West Palm Beach Florida Financial Account Transfer to Living Trust

Description

How to fill out Florida Financial Account Transfer To Living Trust?

We consistently aim to reduce or evade legal complications when engaging with intricate legal or financial issues.

To achieve this, we enlist the help of legal professionals whose services are typically very expensive.

However, not every legal issue is so complicated; many can be handled by ourselves.

US Legal Forms is an online repository of current do-it-yourself legal documents ranging from wills and powers of attorney to articles of incorporation and requests for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it through the My documents tab. The procedure is equally simple if you’re new to the site! You can register for your account in just a few minutes. Ensure to verify if the West Palm Beach Florida Financial Account Transfer to Living Trust aligns with the regulations and laws of your state and region. Additionally, it’s crucial that you review the form’s description (if available), and if you find any inconsistencies with your original intent, seek an alternative template. Once you’ve confirmed that the West Palm Beach Florida Financial Account Transfer to Living Trust suits your case, you can opt for a subscription plan and proceed with payment. You will then be able to download the form in any format that is accessible. With over 24 years in the industry, we have assisted millions by providing customizable, current legal documents. Take full advantage of US Legal Forms now to save time and resources!

- Our platform empowers you to manage your issues independently without requiring a lawyer.

- We provide access to legal form templates that aren't always publicly available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Utilize US Legal Forms any time you need to retrieve and download the West Palm Beach Florida Financial Account Transfer to Living Trust or any other form swiftly and securely.

Form popularity

FAQ

The 5-year rule for trusts refers to the regulations that govern how long assets must be held in a trust before they qualify for certain tax benefits or protections. In particular, this rule is often associated with Medicaid planning, where assets transferred to a trust require a 5-year waiting period. Understanding this rule helps in planning a West Palm Beach Florida Financial Account Transfer to Living Trust effectively, ensuring that you comply with all necessary legal requirements.

To transfer bank accounts into a living trust, first, gather relevant trust documents such as the trust agreement. Then, visit your bank to discuss the transfer process with a representative. They will guide you on completing the necessary paperwork to ensure the bank account is correctly titled under the trust. Engaging in the West Palm Beach Florida Financial Account Transfer to Living Trust ensures that your assets are managed as per your wishes.

Transferring your bank account to your living trust typically starts with notifying your bank of your intentions. You’ll want to provide them with the necessary trust documentation and fill out any required forms. Once the bank processes your request, they will update the account ownership to reflect the trust. This process is crucial for an effective West Palm Beach Florida Financial Account Transfer to Living Trust.

One of the biggest mistakes parents often make when setting up a trust fund is failing to fund the trust adequately. Parents may create a trust but neglect to transfer significant assets into it. This oversight can lead to complications, particularly during the West Palm Beach Florida Financial Account Transfer to Living Trust process. To ensure that your trust works as intended, consider reviewing all your assets and understanding how they can be included.

Deciding whether to put assets in a trust is a personal choice and can depend on your family's unique situation. A West Palm Beach Florida Financial Account Transfer to Living Trust may help your parents manage assets effectively and avoid probate. It’s important to assess their financial goals and family dynamics before making a decision. Consulting with an expert can clarify how a trust will serve their needs best.

Trust funds have their challenges, such as high administrative costs and potential tax implications. If you consider a West Palm Beach Florida Financial Account Transfer to Living Trust, you may also face limitations on how and when beneficiaries can access funds. Lack of flexibility in some trust structures can also frustrate both grantors and beneficiaries, leading to dissatisfaction.

Trusts can be perceived negatively because they might limit access to assets for beneficiaries while the grantor is alive. In a West Palm Beach Florida Financial Account Transfer to Living Trust, if the trust does not provide clear terms, it can lead to family conflicts. Furthermore, some people may misconstrue trusts as tools for the wealthy only, missing the broader benefits they can offer to various financial situations.

When you transfer assets to a trust, you may face some drawbacks. For instance, a West Palm Beach Florida Financial Account Transfer to Living Trust can incur setup and maintenance costs, which may feel burdensome. You also need to ensure that the trust is well-managed to avoid complications in the future. Additionally, if not structured properly, the trust may not achieve the desired tax benefits.

In most cases, putting property into a trust does not trigger reassessment in Florida, especially if the trust is revocable and the owner remains the same. However, transferring property can have various implications depending on the specifics of the trust and the local laws. It's advisable to consult legal professionals or leverage the tools available on the US Legal platform when navigating the West Palm Beach Florida Financial Account Transfer to Living Trust to avoid potential pitfalls.

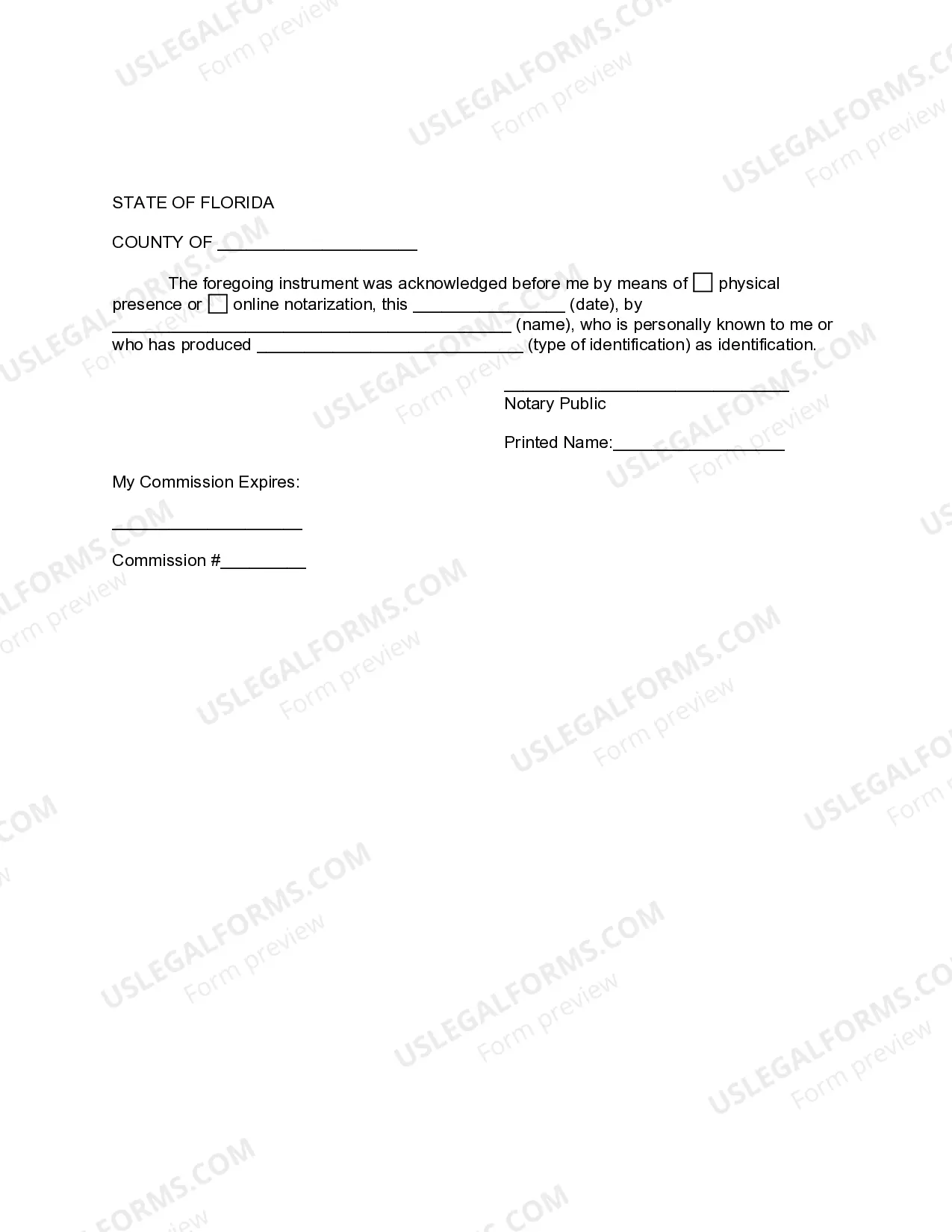

To transfer your property to a living trust in Florida, you start by creating a living trust document that names the trust and beneficiaries. Following this, you must execute a deed that formally transfers the property title to the trust. Using resources like the US Legal platform can streamline the West Palm Beach Florida Financial Account Transfer to Living Trust, ensuring all necessary steps are followed accurately.