Cape Coral Florida Assignment to Living Trust: A Guide to Ensuring Your Estate's Smooth Transition In Cape Coral, Florida, residents have the opportunity to establish a living trust as a smart estate planning tool. A living trust allows individuals to ensure the proper distribution of their assets, both during their lifetimes, and after they pass away. This detailed description aims to provide an overview of Cape Coral Florida Assignment to Living Trust, shedding light on its importance, benefits, and various types available. What is a Living Trust? A living trust is a legal document that allows you (the granter) to transfer assets into a trust for your benefit during your lifetime, but also enables you to control how they are managed and distributed after you're gone. As the granter, you'll appoint yourself as the trustee, maintaining full control over your assets even while they are held in trust. Why Consider Cape Coral Florida Assignment to Living Trust? There are several significant reasons to consider establishing a living trust assignment in Cape Coral, Florida. Firstly, a living trust helps avoid the costly and time-consuming probate process. By having your assets properly titled in the trust, they can pass directly to your chosen beneficiaries upon your passing, bypassing probate court. Furthermore, living trusts provide an added layer of privacy as they do not become public record upon death. Unlike wills, which are subject to public scrutiny, a living trust allows for the discreet transfer of assets, maintaining confidentiality for you and your loved ones. Types of Cape Coral Florida Assignment to Living Trust: 1. Revocable Living Trust: — The most common type of living trust, offering flexibility and control. — You can modify or terminate it during your lifetime. — Assets held in this trust are still subject to estate taxes. 2. Irrevocable Living Trust: — Once established, this trust generally cannot be altered or revoked. — Offers potential tax advantages, as assets placed in this trust are typically excluded from your estate for tax purposes. — Provides protection from creditors and lawsuits. 3. Testamentary Living Trust: — Created through a will and only established after your passing. — Allows for the distribution of assets to be managed by a trustee, often a trusted individual or financial institution. 4. Special Needs Trust: — Designed for beneficiaries with disabilities, ensuring they receive necessary financial support while also allowing them to maintain eligibility for government assistance programs. Final Thoughts: Deciding to establish a Cape Coral Florida Assignment to Living Trust can offer numerous benefits and peace of mind, as it allows for smooth asset transfer, minimizes probate expenses, and ensures privacy. It's essential to consult with an experienced estate planning attorney to understand the specific legal requirements and determine which type of living trust suits your needs best. By taking this proactive step, you can leave a carefully planned legacy for your loved ones while protecting your assets.

Cape Coral Florida Assignment to Living Trust

Category:

State:

Florida

City:

Cape Coral

Control #:

FL-E0178E

Format:

Word;

Rich Text

Instant download

Description

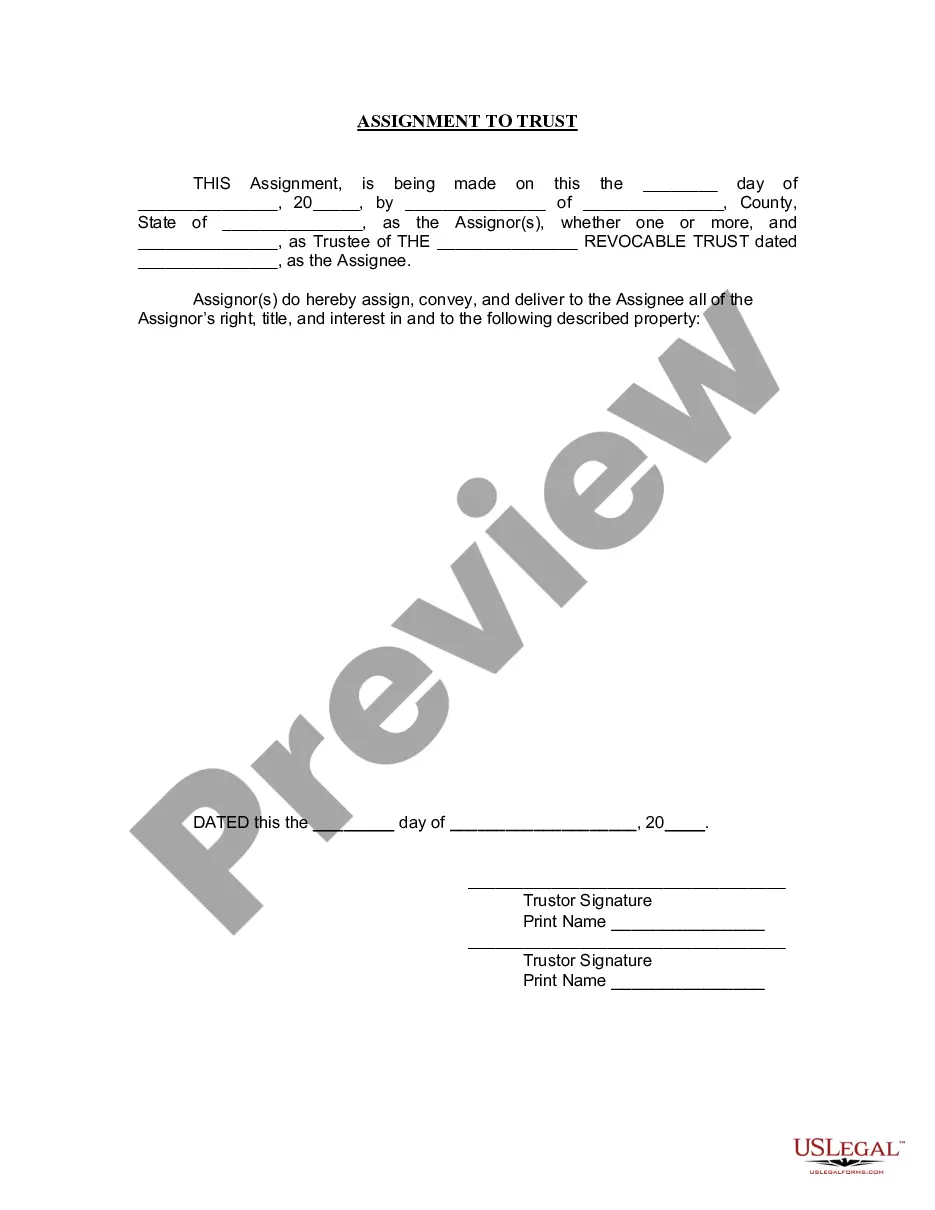

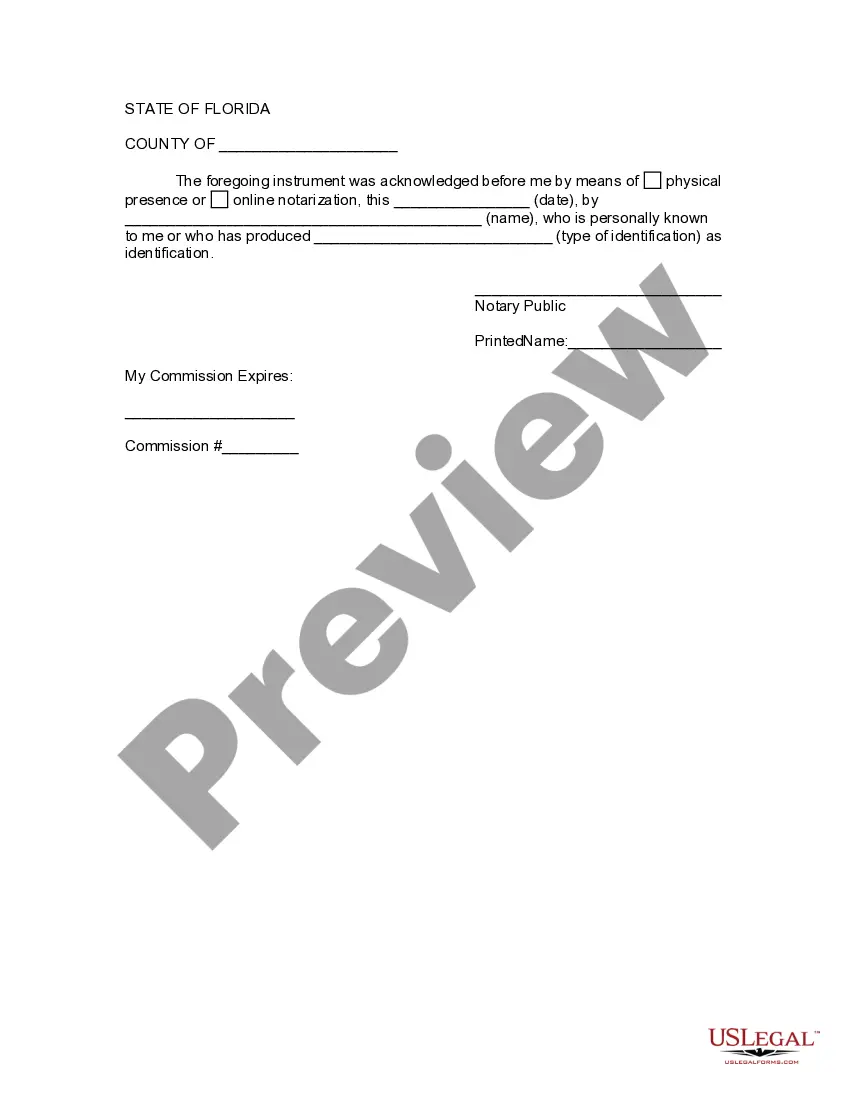

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Cape Coral Florida Assignment to Living Trust: A Guide to Ensuring Your Estate's Smooth Transition In Cape Coral, Florida, residents have the opportunity to establish a living trust as a smart estate planning tool. A living trust allows individuals to ensure the proper distribution of their assets, both during their lifetimes, and after they pass away. This detailed description aims to provide an overview of Cape Coral Florida Assignment to Living Trust, shedding light on its importance, benefits, and various types available. What is a Living Trust? A living trust is a legal document that allows you (the granter) to transfer assets into a trust for your benefit during your lifetime, but also enables you to control how they are managed and distributed after you're gone. As the granter, you'll appoint yourself as the trustee, maintaining full control over your assets even while they are held in trust. Why Consider Cape Coral Florida Assignment to Living Trust? There are several significant reasons to consider establishing a living trust assignment in Cape Coral, Florida. Firstly, a living trust helps avoid the costly and time-consuming probate process. By having your assets properly titled in the trust, they can pass directly to your chosen beneficiaries upon your passing, bypassing probate court. Furthermore, living trusts provide an added layer of privacy as they do not become public record upon death. Unlike wills, which are subject to public scrutiny, a living trust allows for the discreet transfer of assets, maintaining confidentiality for you and your loved ones. Types of Cape Coral Florida Assignment to Living Trust: 1. Revocable Living Trust: — The most common type of living trust, offering flexibility and control. — You can modify or terminate it during your lifetime. — Assets held in this trust are still subject to estate taxes. 2. Irrevocable Living Trust: — Once established, this trust generally cannot be altered or revoked. — Offers potential tax advantages, as assets placed in this trust are typically excluded from your estate for tax purposes. — Provides protection from creditors and lawsuits. 3. Testamentary Living Trust: — Created through a will and only established after your passing. — Allows for the distribution of assets to be managed by a trustee, often a trusted individual or financial institution. 4. Special Needs Trust: — Designed for beneficiaries with disabilities, ensuring they receive necessary financial support while also allowing them to maintain eligibility for government assistance programs. Final Thoughts: Deciding to establish a Cape Coral Florida Assignment to Living Trust can offer numerous benefits and peace of mind, as it allows for smooth asset transfer, minimizes probate expenses, and ensures privacy. It's essential to consult with an experienced estate planning attorney to understand the specific legal requirements and determine which type of living trust suits your needs best. By taking this proactive step, you can leave a carefully planned legacy for your loved ones while protecting your assets.

Free preview

How to fill out Cape Coral Florida Assignment To Living Trust?

If you’ve already used our service before, log in to your account and save the Cape Coral Florida Assignment to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Cape Coral Florida Assignment to Living Trust. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!