Gainesville Florida Assignment to Living Trust: A living trust is a legal document that allows individuals to transfer their assets into a trust while they are still alive. The purpose of this assignment is to ensure a smooth transfer of property upon the granter's death, avoiding the need for probate. In Gainesville, Florida, the Assignment to Living Trust follows the same principles as in other parts of the country. It is a crucial legal instrument designed to assist individuals in managing and distributing their assets effectively, minimize estate taxes, and preserve their privacy. The trust is created during the granter's lifetime and can be altered, amended, or revoked if necessary. Key Benefits of Gainesville Florida Assignment to Living Trust: 1. Avoiding Probate: Perhaps the most significant advantage of a living trust is that it allows for the transfer of assets without undergoing probate. Probate can be a lengthy, expensive, and public process, which can be avoided with a living trust. 2. Privacy: Unlike a will, which becomes part of the public record, a living trust provides a greater level of privacy. The trust document and its provisions remain private, ensuring that the granter's assets, beneficiaries, and distribution plans are kept confidential. 3. Incapacity Planning: A living trust enables the granter to plan for incapacity, ensuring that their affairs are managed efficiently if they become unable to do so themselves. A successor trustee, named in the trust, can step in to handle the granter's financial matters without the need for a court-appointed conservatorship. Different Types of Gainesville Florida Assignment to Living Trust: 1. Revocable Living Trust: This type of trust is the most common and flexible form. It allows the granter to make changes or revoke the trust entirely during their lifetime. The granter can serve as both the trustee and the beneficiary while maintaining full control over the trust assets. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked by the granter once it is established. Once the assets are transferred into an irrevocable trust, the granter relinquishes control, but gains potential estate tax benefits and asset protection. 3. Testamentary Trust: While not technically a living trust, a testamentary trust is created within a will and becomes active upon the granter's death. This type of trust is often used to provide financial support and guidance to minor children or beneficiaries with special needs. In conclusion, the Gainesville Florida Assignment to Living Trust is a valuable legal tool for individuals seeking to streamline the management and distribution of their assets. It offers numerous benefits, such as probate avoidance, increased privacy, and incapacity planning. Depending on the granter's needs and goals, various types of living trusts, including revocable, irrevocable, and testamentary trusts, can be utilized to achieve the desired outcomes.

Gainesville Florida Assignment to Living Trust

Description

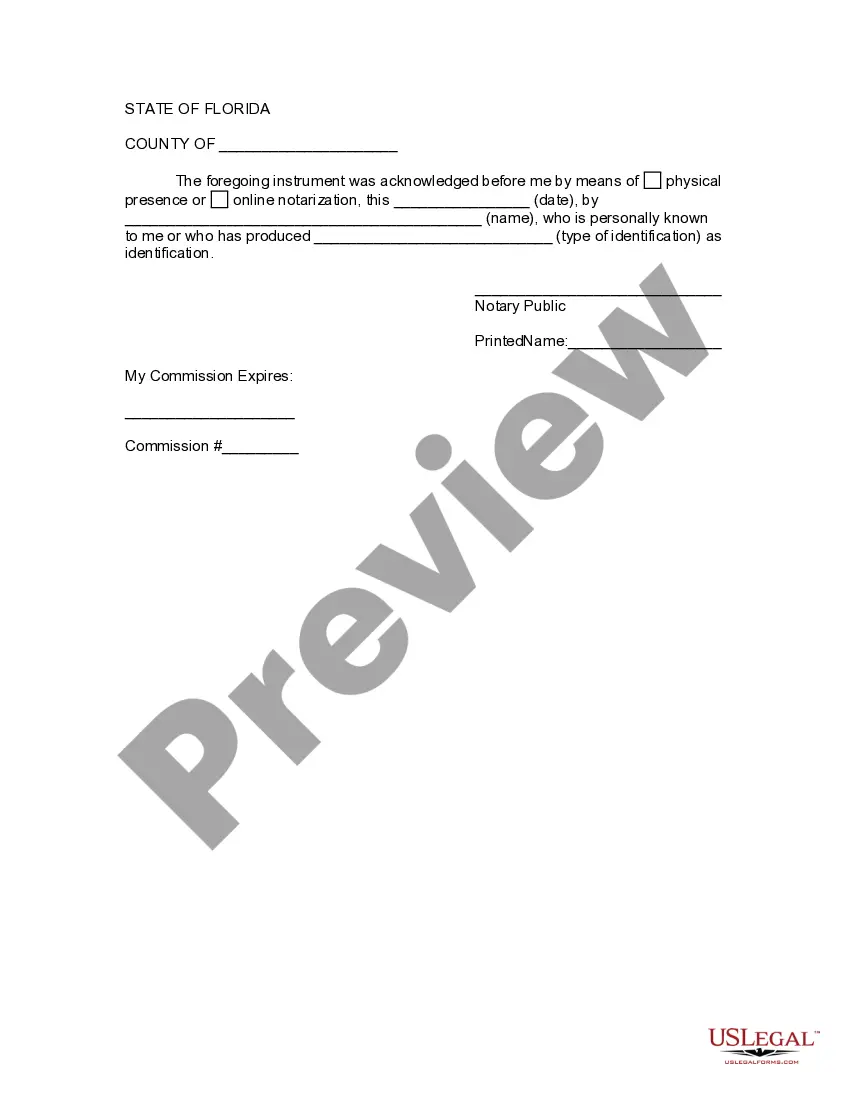

How to fill out Gainesville Florida Assignment To Living Trust?

Take advantage of the US Legal Forms and obtain immediate access to any form sample you need. Our helpful platform with thousands of documents allows you to find and obtain almost any document sample you require. You are able to download, fill, and certify the Gainesville Florida Assignment to Living Trust in just a couple of minutes instead of surfing the Net for hours attempting to find a proper template.

Using our catalog is a superb way to raise the safety of your form submissions. Our professional legal professionals on a regular basis review all the documents to make sure that the templates are appropriate for a particular state and compliant with new acts and regulations.

How do you obtain the Gainesville Florida Assignment to Living Trust? If you already have a subscription, just log in to the account. The Download option will appear on all the samples you view. Additionally, you can find all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Open the page with the form you require. Make sure that it is the template you were looking for: check its headline and description, and take take advantage of the Preview function if it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the saving procedure. Select Buy Now and choose the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the file. Choose the format to obtain the Gainesville Florida Assignment to Living Trust and edit and fill, or sign it for your needs.

US Legal Forms is among the most extensive and reliable template libraries on the web. Our company is always ready to assist you in any legal process, even if it is just downloading the Gainesville Florida Assignment to Living Trust.

Feel free to take advantage of our platform and make your document experience as convenient as possible!