If you own property or assets in Miami-Dade County, Florida and want to establish a living trust, it is important to understand the process of assigning these assets to a living trust. A living trust is a legal document created during your lifetime that allows your assets to be managed and distributed according to your wishes, while also minimizing probate and estate taxes. Let's delve into a detailed description of what a Miami-Dade Florida Assignment to Living Trust entails, including its benefits and available types. A Miami-Dade Florida Assignment to Living Trust is essentially the act of transferring your property and assets located within the jurisdiction of Miami-Dade County to your living trust. The process typically involves preparing and executing a trust agreement or declaration, which designates the trust as the owner of your assets. By effectively transferring ownership, you establish that the assets held in the trust will be managed and distributed according to the terms and conditions outlined in the trust agreement. There are several types of Miami-Dade Florida Assignment to Living Trust that you can consider based on your specific needs and objectives. These include: 1. Revocable Living Trust: A revocable living trust is the most common type of trust utilized by individuals. It allows you to maintain control over your assets during your lifetime and provides flexibility to amend or revoke the trust if circumstances change. With a revocable living trust, the assets are still considered part of your estate for tax and financial purposes. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be easily modified or terminated without the consent of the beneficiaries. It offers potential tax advantages and protection of assets from creditors, making it a popular choice for estate planning and asset protection strategies. 3. Testamentary Living Trust: A testamentary living trust is established through a will and comes into effect upon your death. It allows you to determine how your assets will be distributed and managed after your passing. Unlike a revocable living trust, it does not provide immediate benefits during your lifetime but can be a useful tool for preserving wealth and providing for loved ones. By assigning your Miami-Dade County property and assets to a living trust, you can enjoy several benefits. Firstly, a living trust ensures privacy as it avoids the public probate process, which can expose the details of your estate to the public. Additionally, it allows for a smoother and faster distribution of assets after your passing, minimizing delays and costs associated with probate. Moreover, a living trust can contribute to reducing estate taxes and may provide asset protection from potential creditors. In conclusion, a Miami-Dade Florida Assignment to Living Trust allows you to transfer your property and assets located within the jurisdiction of Miami-Dade County to a living trust. This serves as an efficient estate planning tool, providing control, privacy, and potential tax advantages. Depending on your specific needs, you can choose between revocable, irrevocable, or testamentary living trusts. Consulting with an experienced estate planning attorney in Miami-Dade County is highly recommended ensuring the successful creation and execution of your living trust assignment.

Miami-Dade Florida Assignment to Living Trust

Description

How to fill out Miami-Dade Florida Assignment To Living Trust?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Miami-Dade Florida Assignment to Living Trust gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Miami-Dade Florida Assignment to Living Trust takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

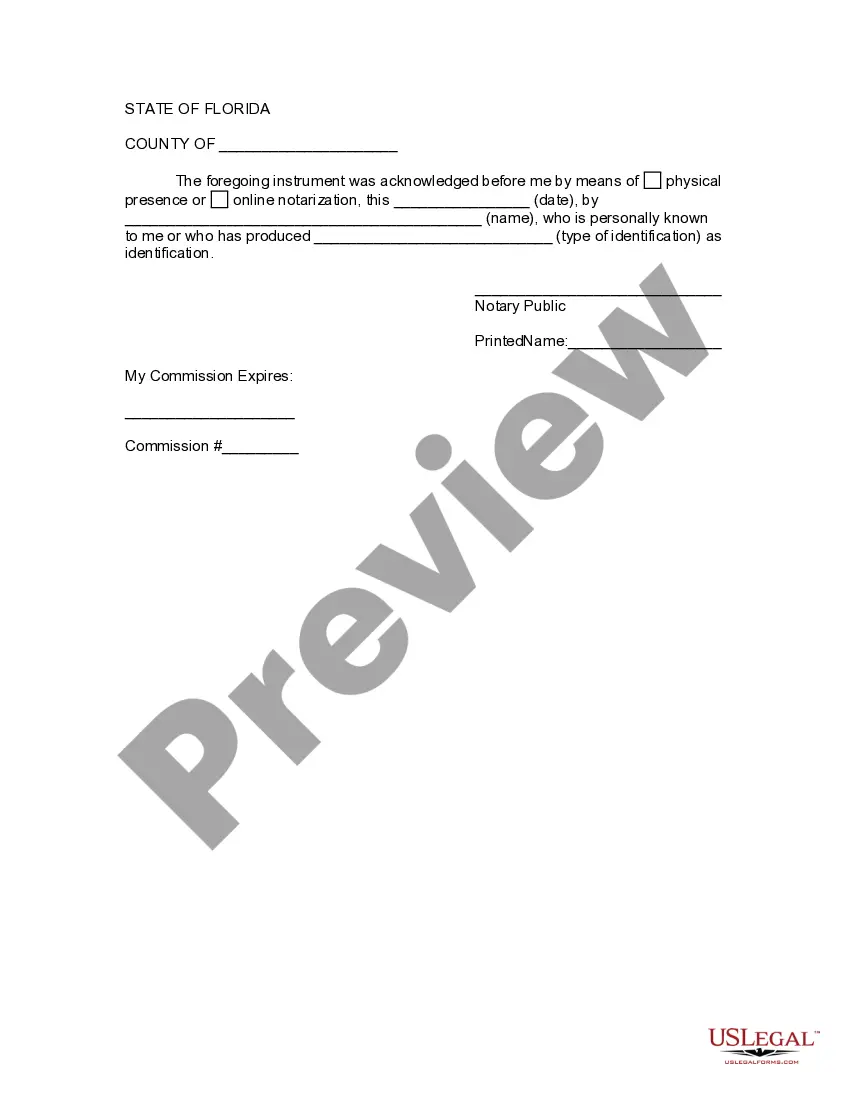

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Miami-Dade Florida Assignment to Living Trust. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!