Orange Florida Assignment to Living Trust is a legal document that transfers ownership of an individual's assets to a trust during their lifetime, typically for the purpose of estate planning and asset protection. This type of trust is created by the owner, referred to as the granter, and involves the transfer of assets to a trustee, who manages and administers the trust according to the granter's instructions. The main objective of an Orange Florida Assignment to Living Trust is to avoid probate, a process that could be time-consuming, expensive, and public. By placing assets into a living trust, the granter ensures a seamless distribution of their assets upon their death, thus avoiding probate court involvement. Additionally, a living trust allows for greater control over the granter's assets both during their lifetime, and after they pass away. There are several types of Orange Florida Assignment to Living Trust: 1. Revocable Living Trust: This is the most common and flexible type of living trust. The granter retains the ability to make changes or terminate the trust during their lifetime. Assets held within a revocable living trust can be easily managed, invested, or distributed according to the granter's wishes. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be modified or revoked once it has been established. The transfer of assets to this type of living trust is permanent. However, an irrevocable living trust offers various benefits, such as estate tax reduction and asset protection from creditors. 3. Testamentary Living Trust: This type of living trust is created through a will, specifying that certain assets should be transferred to the trust upon the granter's death. Unlike revocable or irrevocable living trusts, testamentary trusts do not become effective until the granter passes away. Testamentary living trusts are often used for minor children or beneficiaries who may not be capable of managing their inheritance immediately. Overall, an Orange Florida Assignment to Living Trust provides individuals with an efficient and private means of asset distribution, while granting them control over their assets during their lifetime. It helps to ensure the smooth transition of assets, minimize estate taxes, and protect beneficiaries. Seeking the assistance of an experienced estate planning attorney is highly recommended for the creation and proper structuring of an Orange Florida Assignment to Living Trust.

Orange Florida Assignment to Living Trust

Description

How to fill out Orange Florida Assignment To Living Trust?

Make use of the US Legal Forms and obtain instant access to any form you require. Our beneficial platform with thousands of document templates allows you to find and get almost any document sample you want. You are able to download, complete, and certify the Orange Florida Assignment to Living Trust in a few minutes instead of browsing the web for several hours searching for an appropriate template.

Using our catalog is an excellent way to raise the safety of your form submissions. Our experienced legal professionals on a regular basis check all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and polices.

How can you obtain the Orange Florida Assignment to Living Trust? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. In addition, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instructions below:

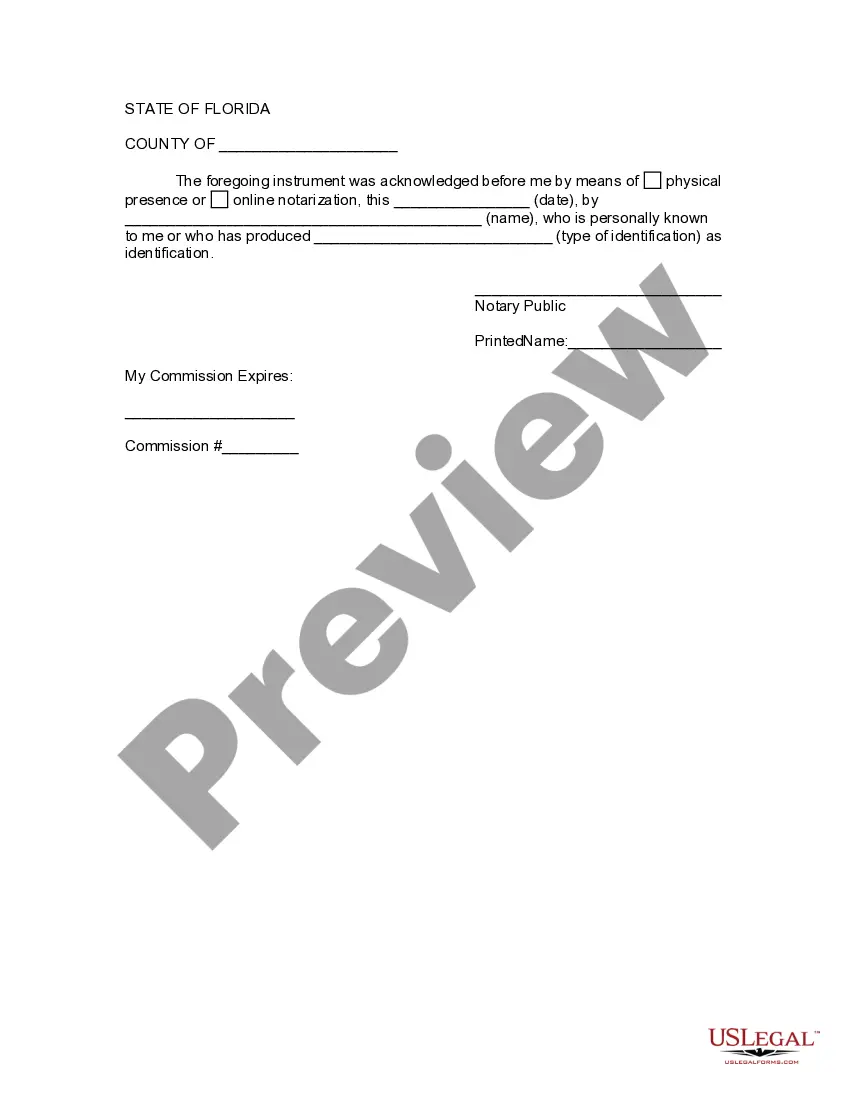

- Open the page with the form you need. Make certain that it is the template you were hoping to find: check its headline and description, and use the Preview feature when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Launch the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order with a credit card or PayPal.

- Download the document. Select the format to obtain the Orange Florida Assignment to Living Trust and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most considerable and reliable template libraries on the web. Our company is always happy to help you in virtually any legal case, even if it is just downloading the Orange Florida Assignment to Living Trust.

Feel free to benefit from our platform and make your document experience as efficient as possible!