The Pompano Beach Florida Assignment to Living Trust is a legal document that allows individuals to transfer their assets, properties, and investments into a trust during their lifetime. This assignment ensures that the trust will hold and distribute these assets according to the wishes of the individual, known as the granter, thereby avoiding probate. A living trust is a widely used estate planning tool, providing numerous benefits such as privacy, asset protection, and ease of distribution. When assigning assets to a living trust in Pompano Beach, Florida, residents have several options available to them, including: 1. Revocable Living Trust: This type of assignment allows the granter to have full control and make changes to the trust during their lifetime. They can add or remove assets, change beneficiaries, or even revoke the trust entirely if they wish to do so. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust assignment cannot be changed or revoked once assets have been transferred. This type of trust offers enhanced asset protection, potential tax benefits, and can be used for charitable giving or Medicaid planning purposes. 3. Testamentary Living Trust: Unlike revocable and irrevocable trusts, a testamentary living trust is not created during the granter's lifetime. Instead, it is established through a will, and its terms are only applicable after the granter's death. This type of assignment allows individuals to outline how their assets will be managed and distributed to beneficiaries. It is crucial to consult with an experienced estate planning attorney in Pompano Beach, Florida, to determine which type of living trust assignment aligns with your specific financial goals, family circumstances, and tax considerations. By assigning assets to a living trust, individuals can ensure their assets and estate are protected, reduce the likelihood of family disputes, and provide for a smooth and efficient transfer of wealth to their chosen beneficiaries.

Pompano Beach Florida Assignment to Living Trust

Category:

State:

Florida

City:

Pompano Beach

Control #:

FL-E0178E

Format:

Word;

Rich Text

Instant download

Description

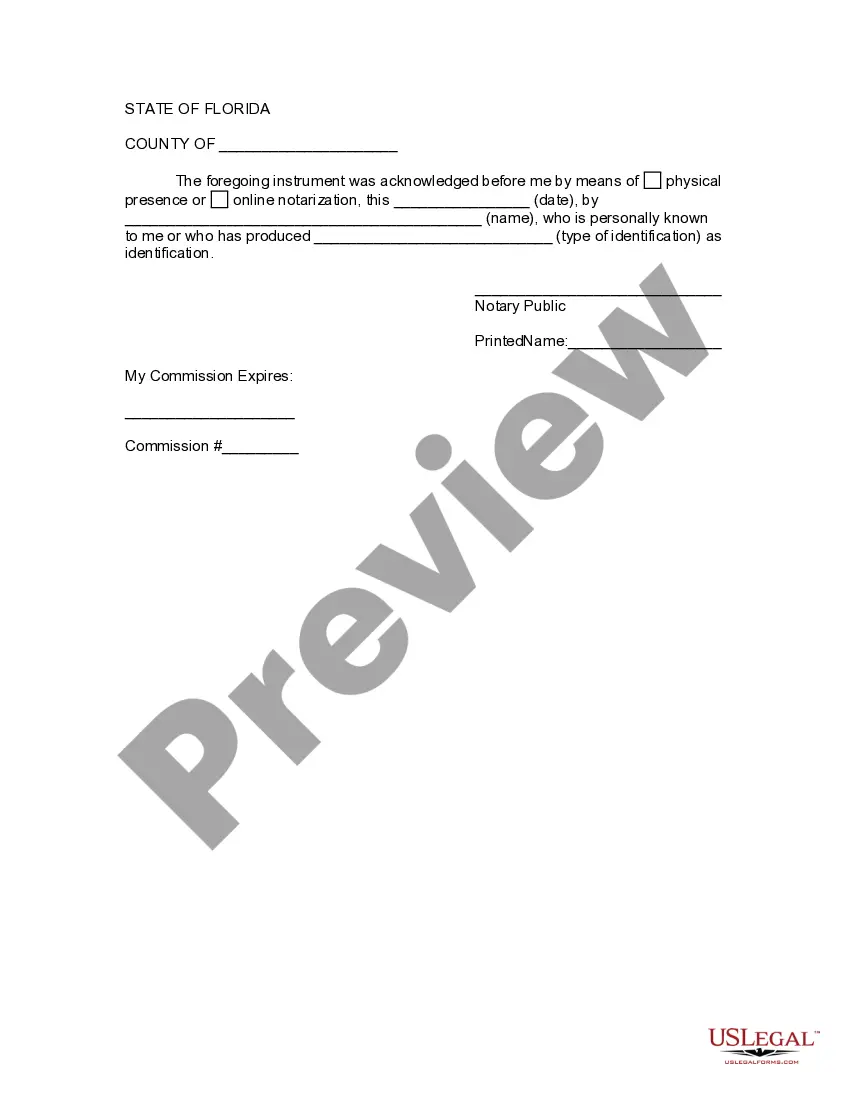

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

The Pompano Beach Florida Assignment to Living Trust is a legal document that allows individuals to transfer their assets, properties, and investments into a trust during their lifetime. This assignment ensures that the trust will hold and distribute these assets according to the wishes of the individual, known as the granter, thereby avoiding probate. A living trust is a widely used estate planning tool, providing numerous benefits such as privacy, asset protection, and ease of distribution. When assigning assets to a living trust in Pompano Beach, Florida, residents have several options available to them, including: 1. Revocable Living Trust: This type of assignment allows the granter to have full control and make changes to the trust during their lifetime. They can add or remove assets, change beneficiaries, or even revoke the trust entirely if they wish to do so. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust assignment cannot be changed or revoked once assets have been transferred. This type of trust offers enhanced asset protection, potential tax benefits, and can be used for charitable giving or Medicaid planning purposes. 3. Testamentary Living Trust: Unlike revocable and irrevocable trusts, a testamentary living trust is not created during the granter's lifetime. Instead, it is established through a will, and its terms are only applicable after the granter's death. This type of assignment allows individuals to outline how their assets will be managed and distributed to beneficiaries. It is crucial to consult with an experienced estate planning attorney in Pompano Beach, Florida, to determine which type of living trust assignment aligns with your specific financial goals, family circumstances, and tax considerations. By assigning assets to a living trust, individuals can ensure their assets and estate are protected, reduce the likelihood of family disputes, and provide for a smooth and efficient transfer of wealth to their chosen beneficiaries.

Free preview

How to fill out Pompano Beach Florida Assignment To Living Trust?

If you’ve already utilized our service before, log in to your account and download the Pompano Beach Florida Assignment to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Pompano Beach Florida Assignment to Living Trust. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!