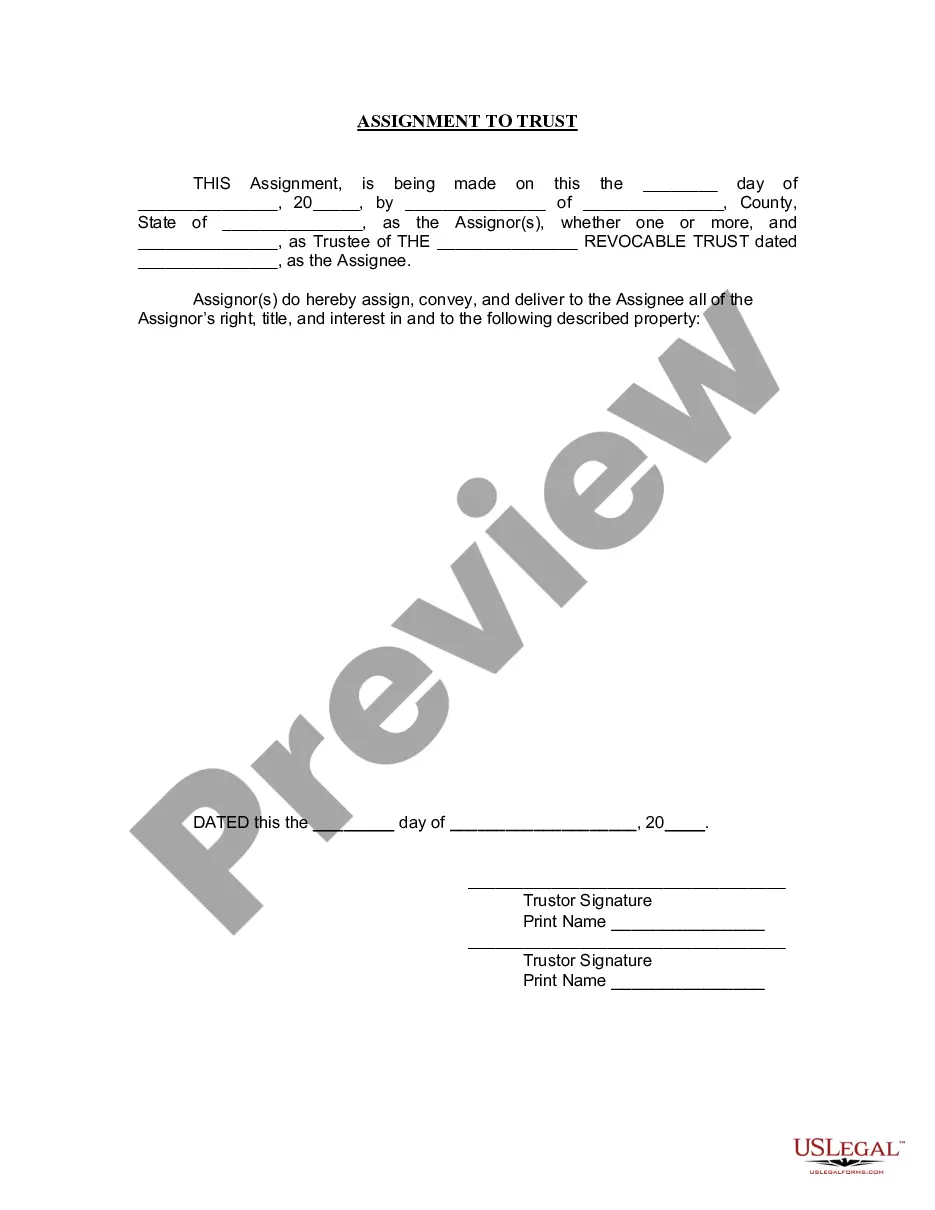

A Tallahassee Florida Assignment to Living Trust is a legal document that outlines the transfer of assets and properties into a living trust located in Tallahassee, Florida. This allows individuals to have control over how their assets are distributed after their death and can provide benefits such as avoiding probate, minimizing estate taxes, and maintaining privacy. The assignment process involves transferring ownership of assets from an individual to the living trust. This includes real estate properties, bank accounts, investments, personal belongings, and other valuable assets. By placing these assets in a living trust, they are managed by a trustee (either the individual themselves or a designated person or entity) for the benefit of the trust's beneficiaries. There are various types of Tallahassee Florida Assignment to Living Trust, including: 1. Revocable Living Trust: This type of trust can be altered or revoked during the individual's lifetime. It provides flexibility and allows the person creating the trust (known as the granter or settler) to maintain control over the assets. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable trust cannot be modified or revoked once established. Assets transferred to this type of trust are considered permanently removed from the granter's estate. 3. Testamentary Living Trust: A testamentary trust is created upon the death of the granter, as specified in their will. This allows assets to be transferred into the trust after the individual passes away. 4. Special Needs Trust: This trust is designed to provide financial support and manage assets for individuals with special needs, ensuring that their eligibility for government benefits is not compromised. 5. Charitable Living Trust: This type of trust allows individuals to leave a portion of their assets to a charity or multiple charities of their choice, providing ongoing support to causes they care about. 6. Family Trust: A family trust is established to benefit family members, allowing for the efficient transfer of assets and the management of financial affairs within the family. 7. Qualified Personnel Residence Trust (PRT): This trust allows individuals to transfer their primary residence or vacation home into a trust while still maintaining the right to reside in the property for a specific period. It can help minimize estate taxes while retaining the use of the property during the granter's lifetime. By engaging in a Tallahassee Florida Assignment to Living Trust, individuals can ensure that their assets are protected and passed on to their chosen beneficiaries in accordance with their wishes. It is crucial to consult with an experienced estate planning attorney in Tallahassee to understand the legal requirements and implications of such assignments.

Tallahassee Florida Assignment to Living Trust

Description

How to fill out Tallahassee Florida Assignment To Living Trust?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Tallahassee Florida Assignment to Living Trust gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Tallahassee Florida Assignment to Living Trust takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Tallahassee Florida Assignment to Living Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!