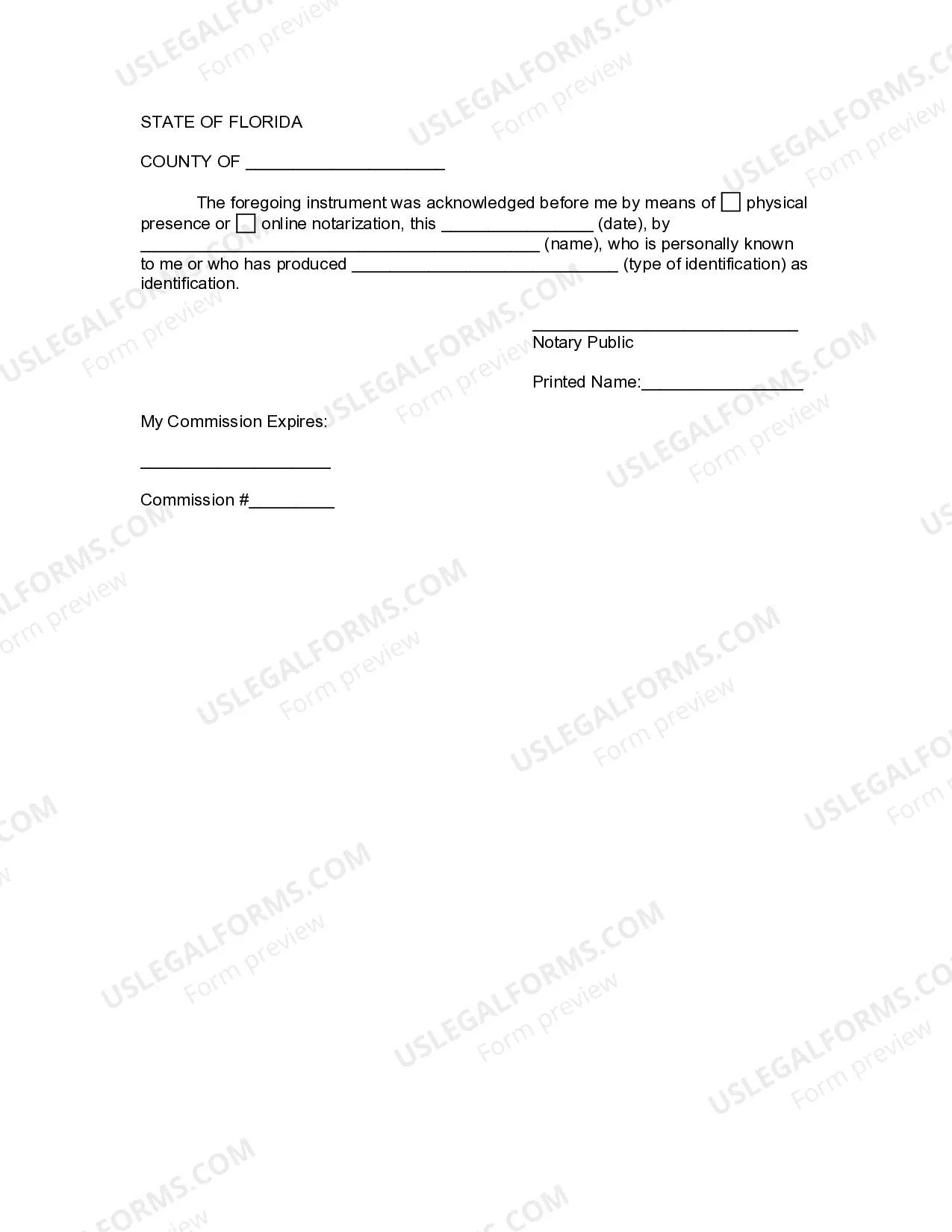

Tallahassee Florida Revocation of Living Trust is a legal process that allows individuals in Tallahassee, Florida, to terminate their existing living trust. A living trust is a widely used estate planning tool that allows individuals to dictate how their assets should be managed and distributed both during their lifetime and after their death. When circumstances change or individuals decide to alter their estate planning strategies, they may opt for revoking their living trust. By revoking their trust, individuals regain control of their assets and have the opportunity to revise their estate plan to better suit their current needs, wishes, and beneficiaries. There are two primary types of Tallahassee Florida Revocation of Living Trust: 1. Voluntary Revocation: This type of revocation occurs when individuals willingly choose to terminate their living trust. It can be done for various reasons, such as a change in family dynamics, the birth of a child, divorce, marriage, asset acquisition or disposition, or simply a desire to modify the provisions of their trust. Voluntary revocations require the trust creator (settler) to follow specific legal procedures to ensure the revocation is valid, such as drafting and signing a formal revocation document in the presence of witnesses or notarization as per Florida law. 2. Involuntary Revocation: Also known as "revocation by operation of law," this type of revocation occurs under certain circumstances outlined by the Florida Statutes section 736.0706. Involuntary revocation occurs automatically without the need for the settler to take any action. Examples of scenarios leading to an involuntary revocation include if the settler gets divorced and their former spouse is the sole beneficiary; if a revocable trust becomes irrevocable due to the settler's incapacity or death, subsequently rendering the trust provisions invalid; or if the trust fails to comply with statutory requirements. Revoking a living trust in Tallahassee should be undertaken with careful consideration and professional guidance, as the process involves legal complexities. Consulting with an experienced attorney familiar with estate planning in Florida is highly advisable to ensure compliance with the specific laws and requirements related to revocations. It is essential to understand the potential tax implications, asset distribution, and ensure the new estate planning documents reflect the settler's goals and circumstances accurately. Overall, the Tallahassee Florida Revocation of Living Trust allows individuals to reassess their estate planning strategies and ensure their assets are distributed according to their current wishes, effectively adapting to life's changing circumstances.

Tallahassee Florida Revocation of Living Trust

Description

How to fill out Tallahassee Florida Revocation Of Living Trust?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Tallahassee Florida Revocation of Living Trust? US Legal Forms is your go-to option.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of specific state and county.

To download the document, you need to log in account, find the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Tallahassee Florida Revocation of Living Trust conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Tallahassee Florida Revocation of Living Trust in any provided file format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours learning about legal paperwork online once and for all.