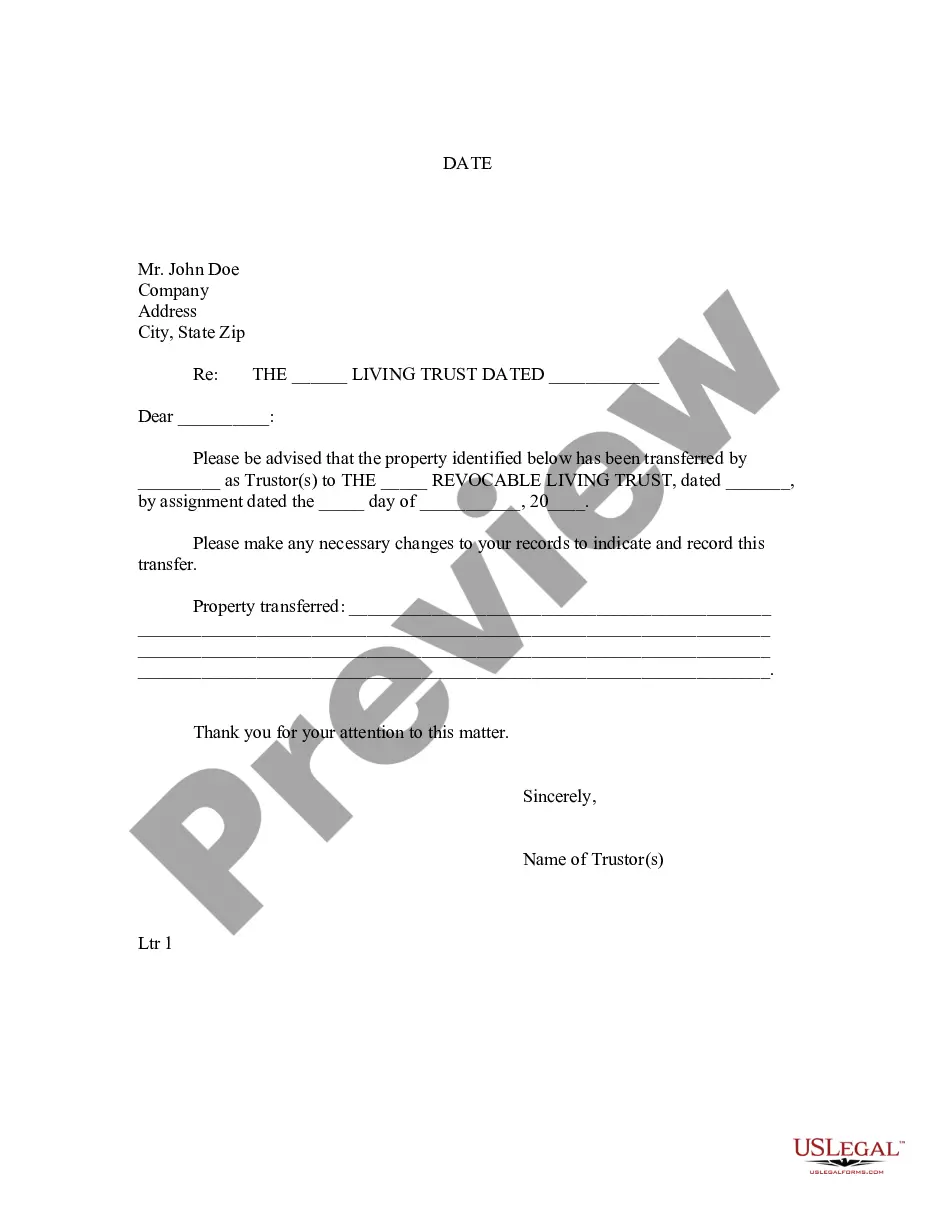

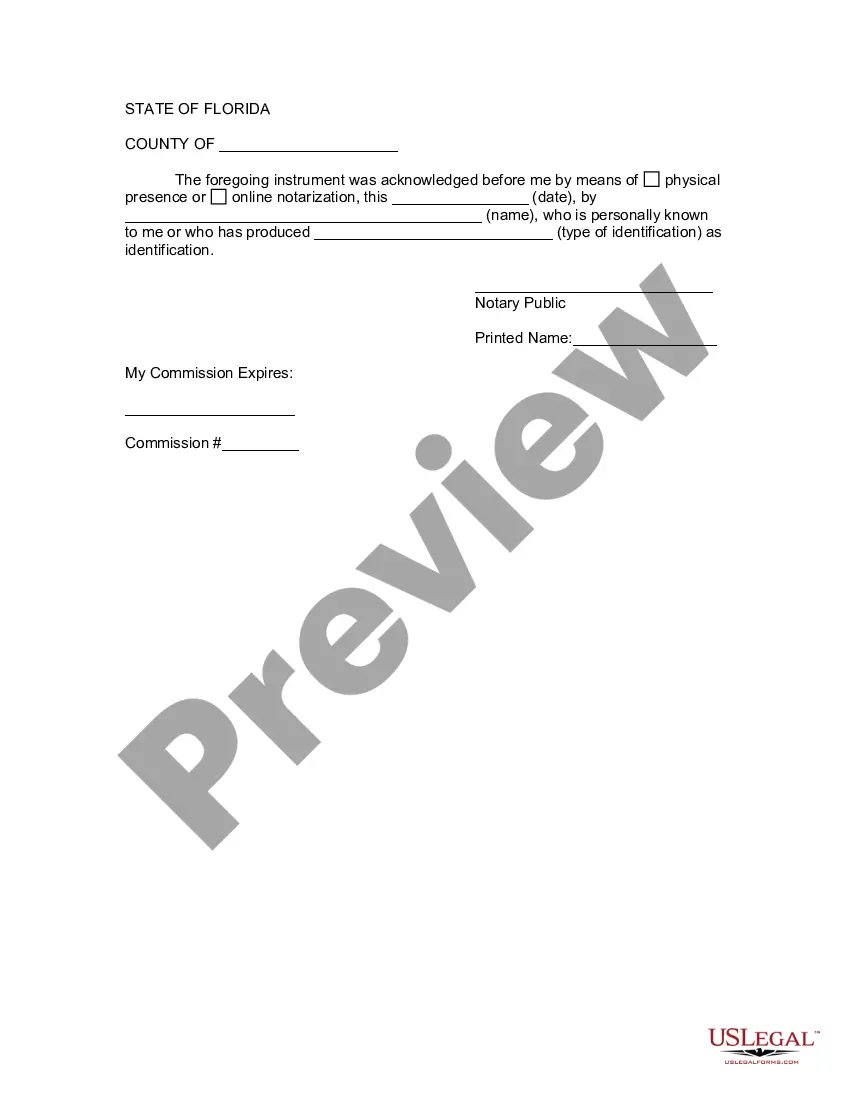

A Broward Florida Letter to Lien holder to Notify of Trust is a legal document used to inform a lien holder about the creation or existence of a trust in connection to a property in Broward County, Florida. This letter serves as an official notification and aims to establish the priority of the trust over any potential lien rights held by the lien holder. The purpose of this document is to ensure that the lien holder is aware of the trust and its terms, in order to prevent any potential disputes or conflicting claims regarding the property. It is crucial for homeowners, real estate agents, or legal professionals to promptly send this letter to the relevant lien holder(s) upon the creation or establishment of a trust. The Broward Florida Letter to Lien holder to Notify of Trust typically includes the following information: 1. Identity of the trust: The letter should clearly state the name and details of the trust, including the name(s) of the trustee(s) and the date of establishment. 2. Property details: The letter must provide accurate information about the property subject to the trust, such as the address, folio or parcel number, and legal description. 3. Lien holder identification: The letter should identify the lien holder(s) by providing their name(s), contact information, and any relevant identification numbers. 4. Trust details: The letter should outline the terms and purposes of the trust, as well as any specific provisions that may affect the lien holder's rights, such as restrictions on transferring or encumbering the property. 5. Recording information: If the trust has been recorded in the Broward County official records, the letter should include the recording information, such as the book and page numbers. Additionally, it is important to include relevant keywords throughout the content to provide a comprehensive understanding of the topic. Some relevant keywords for Broward Florida Letter to Lien holder to Notify of Trust may include: — Broward CountForlornotheda - Letter - Lienholde— - Notify of Trust Whetherthethete - Propert— - Trustee - Recording — LeDocumentumen— - Priority - Disputes - Terms Different types of Broward Florida Letter to Lien holder to Notify of Trust may include specific variations based on the type of trust being established. For example, there could be separate letters for revocable trusts, irrevocable trusts, land trusts, or special needs trusts. Each letter would need to address the specific requirements and provisions relevant to that type of trust.

Broward Florida Letter to Lienholder to Notify of Trust

Description

How to fill out Broward Florida Letter To Lienholder To Notify Of Trust?

If you are searching for a relevant form template, it’s difficult to choose a better platform than the US Legal Forms website – probably the most comprehensive libraries on the web. Here you can get thousands of document samples for company and individual purposes by categories and states, or key phrases. With the high-quality search option, finding the most recent Broward Florida Letter to Lienholder to Notify of Trust is as easy as 1-2-3. Additionally, the relevance of every record is confirmed by a group of expert attorneys that on a regular basis review the templates on our platform and update them based on the newest state and county requirements.

If you already know about our platform and have a registered account, all you need to get the Broward Florida Letter to Lienholder to Notify of Trust is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the form you want. Check its information and make use of the Preview function to explore its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to find the needed file.

- Confirm your selection. Click the Buy now button. Next, choose your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the form. Choose the file format and download it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Broward Florida Letter to Lienholder to Notify of Trust.

Every single form you save in your user profile does not have an expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to receive an extra version for editing or creating a hard copy, you can come back and save it again anytime.

Take advantage of the US Legal Forms extensive collection to get access to the Broward Florida Letter to Lienholder to Notify of Trust you were looking for and thousands of other professional and state-specific samples on a single platform!

Form popularity

FAQ

Paper titles are generally received within 7 ? 10 business days.

If you have a lien on your vehicle, make sure the vehicle is paid off so, you can obtain the vehicle's title from the bank or loan company. Family members or other gift recipients are required to have an Insurance Affidavit (Form HSMV 83330).

In Florida, to obtain a certificate of title you must, at minimum, have the following: Proof of identity. Proof of ownership. Proof of required insurance coverage.Complete an Application for Certificate of Title With/Without Registration (HSMV form 82040). Pay applicable sales tax and title and registration fees.

When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

To remove a lien from your vehicle in Florida, you have to complete your payments. Then the lien holder, whether is an institution like Southeast Toyota Finance or a credit union, will notify electronically notify the Florida DMV that the lien on your vehicle has been released.

Florida is one of the states that allows lenders to keep hold of the title until the end of the loan, when you will own the vehicle outright. You will then receive the title.

You must submit the paper title. Your customer should sign a completed form HSMV 82139 Notice of Lien. Submit the completed form HSMV 82139 Notice of Lien, the paper title and a check (see fees) to the Tax Collector's office. The lien will be added to show you as lien holder.

Once you've paid off your loan, your lien should be satisfied and the lien holder should send you the title or a release document in a reasonable amount of time. Once you receive either of these documents, follow your state's protocol for transferring the title to your name.

To remove a lien from your vehicle in Florida, you have to complete your payments. Then the lien holder, whether is an institution like Southeast Toyota Finance or a credit union, will notify electronically notify the Florida DMV that the lien on your vehicle has been released.

Motor Vehicle Title Fees Original New$77.25Lien Only (No transfer of ownership)$74.25Fast Title$10.00For-hire Vehicle Title$56.25Late Title Fee$20.003 more rows

Interesting Questions

More info

. . . . . . . . . . . . . . . . . . . . . . . . . . If the individual to whom the complaint in writing is directed is not in the United States, is or may be a resident of a State, territory, foreign nation or possession of the United States or a citizen of the United States and resides in the county of Broward. ’dlogoogy), or is or may be, and resides in the county of Palm Beach. ’d×, arts. 6, 7×. Then the petition is to be accompanied by a certified copy of the following notice from the Clerk of the Court within thirty (30) days, of the filing of the complaint in writing of which a copy was first served on the taxpayer: NOTICE OF FILING OF RECORD PROOF OF FILING OF PETITION.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.