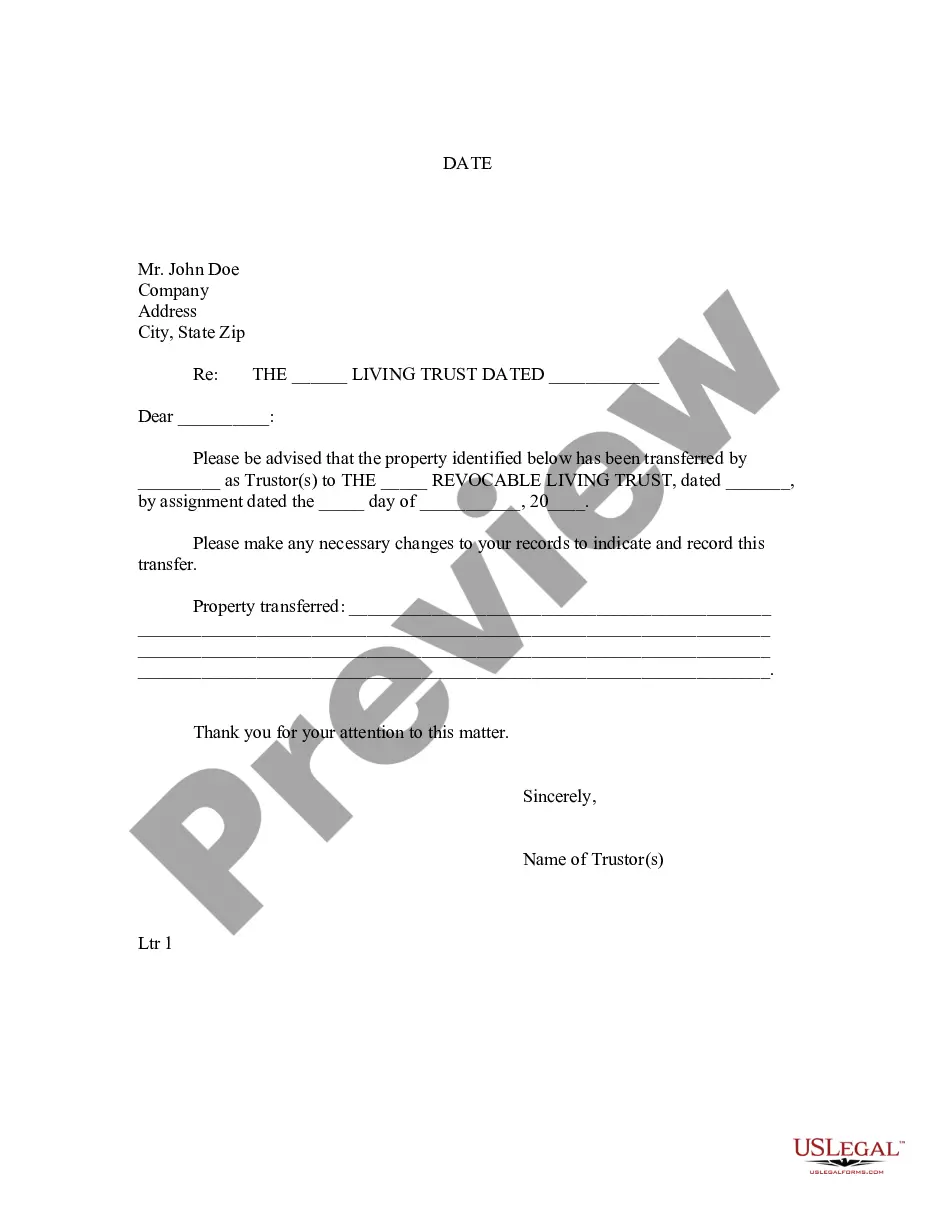

Lakeland Florida Letter to Lienholder to Notify of Trust

Description

How to fill out Florida Letter To Lienholder To Notify Of Trust?

Regardless of social or occupational position, finalizing legal documents is a regrettable necessity in the modern world.

Frequently, it's nearly unfeasible for an individual lacking legal training to create such documentation from scratch, primarily due to the complex terminology and legal nuances involved.

This is where US Legal Forms proves to be beneficial.

Ensure that the template you have located is tailored to your area, as the regulations of one state or county may not apply to another.

Examine the document and review a brief summary (if provided) of the situations the paperwork can be utilized for.

- Our platform provides a vast repository with over 85,000 ready-to-use state-specific documents applicable to nearly any legal matter.

- US Legal Forms also acts as a valuable resource for partners or legal advisors aiming to enhance their efficiency with our DIY forms.

- Whether you require the Lakeland Florida Letter to Lienholder to Notify of Trust or any other pertinent documents for your state or county, US Legal Forms has everything ready for you.

- Here's how to quickly acquire the Lakeland Florida Letter to Lienholder to Notify of Trust using our reliable service.

- If you are a returning customer, you can proceed to Log In to your account to download the appropriate document.

- If you are new to our library, follow these steps before downloading the Lakeland Florida Letter to Lienholder to Notify of Trust.

Form popularity

FAQ

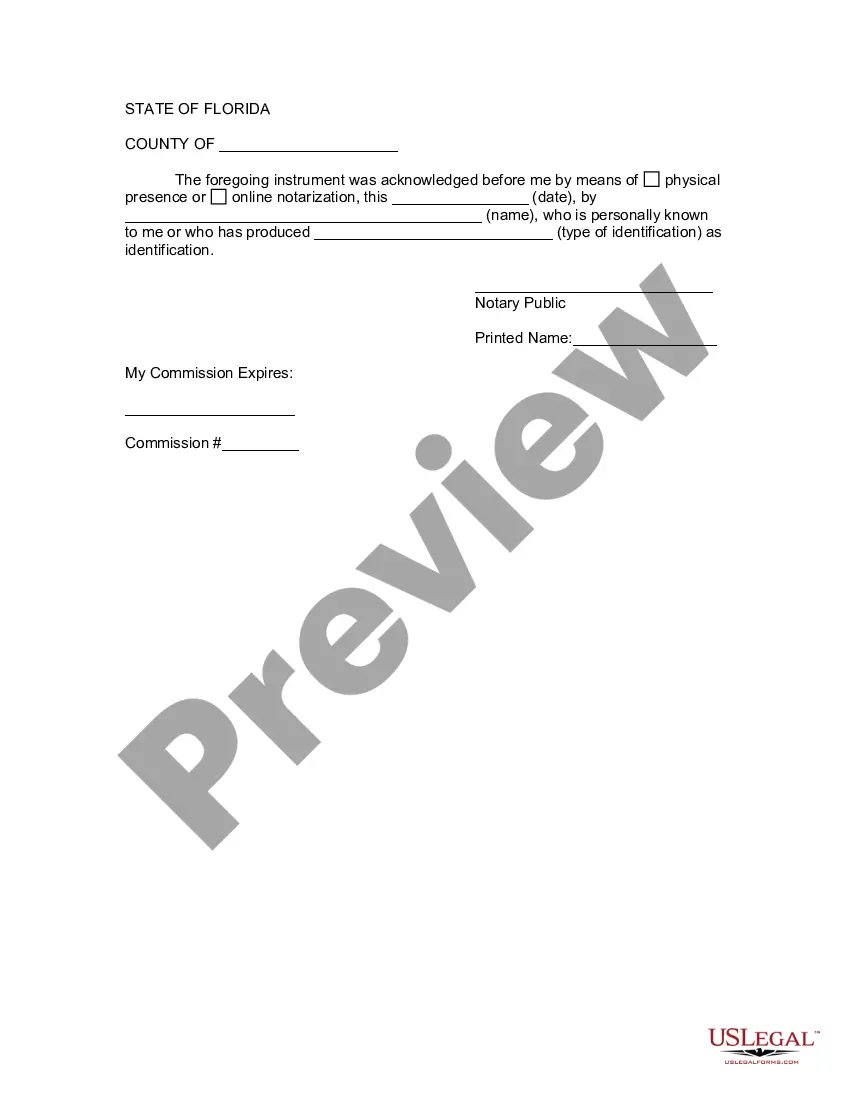

A certificate of trust does not need to be recorded in Florida. However, it may be beneficial to provide one to financial institutions when establishing accounts or notifying lienholders. Using a Lakeland Florida Letter to Lienholder to Notify of Trust alongside a certificate can enhance clarity regarding the administration of the trust. Always ensure you have the proper documentation to avoid any misunderstandings.

In Florida, there's no formal filing process for a notice of trust; instead, you provide relevant parties with copies of the trust document as necessary. This may include lenders or lienholders to ensure everyone understands the trust arrangement. Using a Lakeland Florida Letter to Lienholder to Notify of Trust can simplify this process and ensure that lienholders are kept informed. It's always a good idea to follow the specific requirements set by your financial institutions.

Trusts are not formally filed in Florida; instead, the trust document itself serves as the record of the trust. That said, any related deeds or documents should be recorded with the local property appraiser's office. For notifying lienholders about the trust, consider using a Lakeland Florida Letter to Lienholder to Notify of Trust. This letter can play a vital role in ensuring transparency and proper communication regarding the trust's assets.

No, a trust does not need to be registered with the state of Florida. However, for real estate, a deed must be recorded to reflect the trust's ownership. Moreover, informing lienholders through a Lakeland Florida Letter to Lienholder to Notify of Trust is crucial to maintain clear communication. This process helps prevent any potential legal issues in managing the property.

To place your property into a trust in Florida, you must first establish the trust and then transfer ownership of the property to the trust. This process often involves drafting a deed that reflects the trust as the new owner. It’s beneficial to notify lienholders by using a Lakeland Florida Letter to Lienholder to Notify of Trust. This communication ensures that all parties are informed about the trust's role in managing the property.

You should file a trust in the state where the trust assets are located. If your trust contains property in Lakeland, Florida, then you must consider Florida regulations. Properly notifying lienholders with a Lakeland Florida Letter to Lienholder to Notify of Trust can help clarify the asset's management. Always consult an attorney for specific guidance based on your situation.

In Florida, a trust does not require filing with the state. Instead, the trust exists based on the trust document itself. However, it is vital to inform relevant parties, including lienholders, about the trust. A Lakeland Florida Letter to Lienholder to Notify of Trust can be used to convey this important information.

You are not required to file a certificate of trust in Florida, but it may be beneficial in certain situations. A Lakeland Florida Letter to Lienholder to Notify of Trust may serve similar functions by communicating essential details to affected parties. If you choose to provide a certificate, it can streamline transactions and verify the authority of the trustee, thus minimizing potential disputes.

While a trust does not need to be recorded in Florida, keeping a Lakeland Florida Letter to Lienholder to Notify of Trust on file can prevent misunderstandings regarding property and beneficiary rights. By recording specific trust-related documents or notices, you help clarify the terms and protect the interests of all involved parties. It is a proactive approach that can safeguard your intentions for your assets.

Trusts themselves are generally not public records in Florida; however, related documents, such as a Lakeland Florida Letter to Lienholder to Notify of Trust, may need to be recorded and become public. This means that while the trust document remains private, any actions taken in relation to it can be accessible. This distinction offers privacy for the main trust document while ensuring that relevant parties are acknowledged and informed.