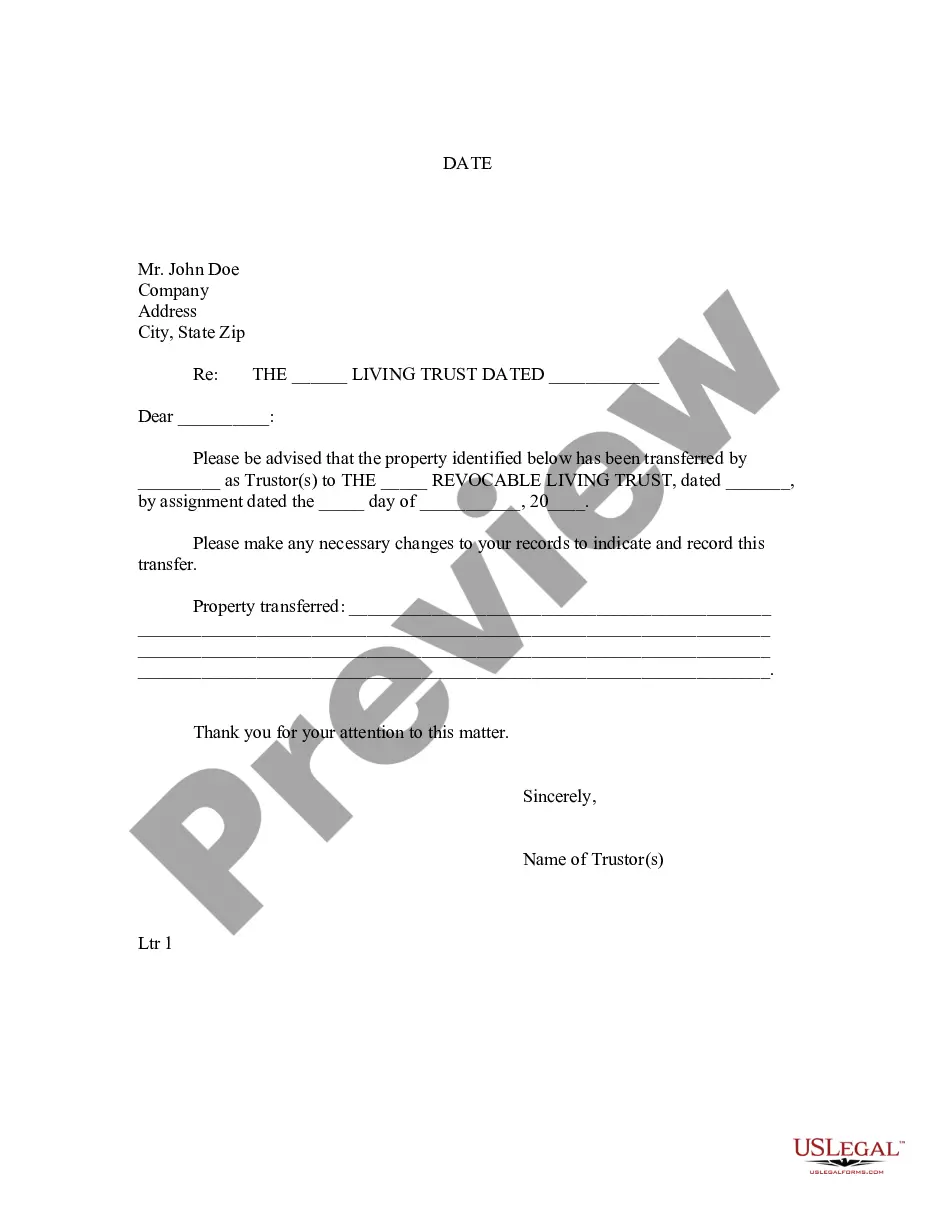

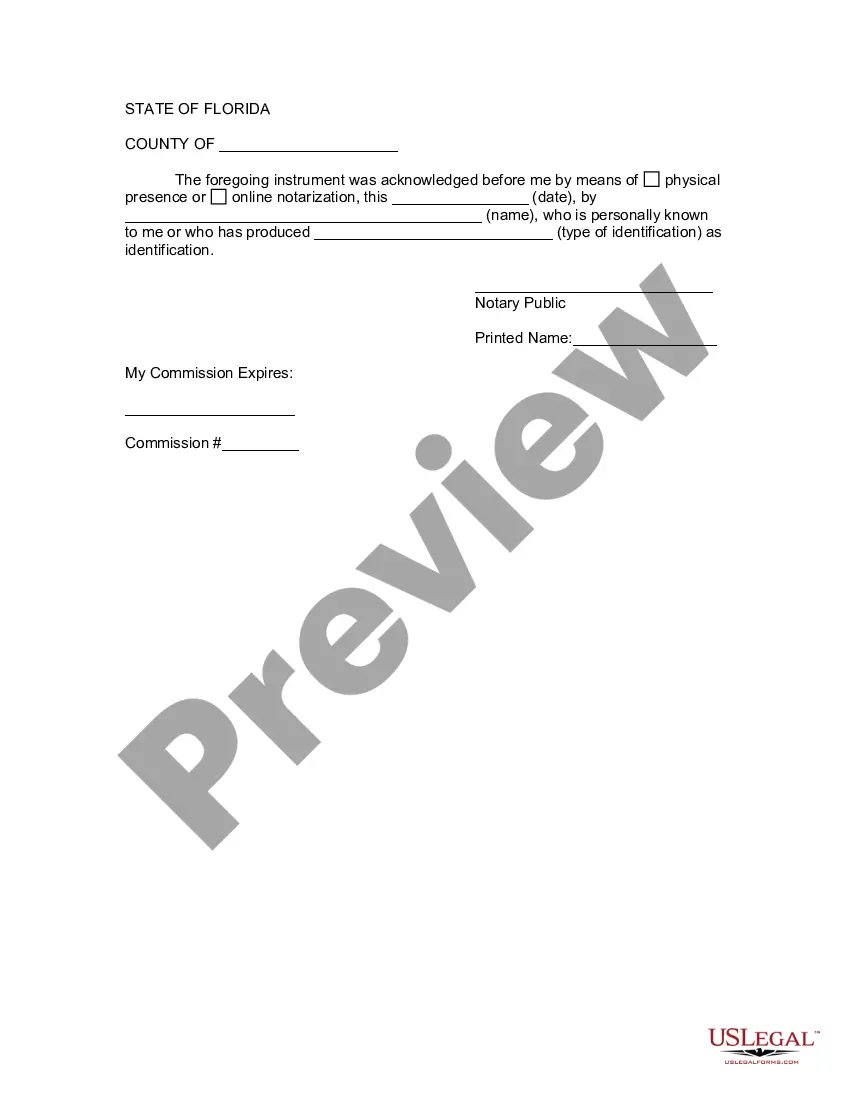

Title: Palm Bay Florida Letter to Lien holder to Notify of Trust — Comprehensive Guide Introduction: In Palm Bay, Florida, individuals or organizations may opt to establish a trust to handle various financial matters or protect their assets. When it comes to notifying the lien holder about a trust, a formal letter should be crafted to inform them of the change in ownership or legal arrangement. This article provides a detailed description of a Palm Bay Florida Letter to Lien holder to Notify of Trust, highlighting its purpose, essential components, and possible variations. I. Purpose of the Letter: The primary purpose of the Palm Bay Florida Letter to Lien holder to Notify of Trust is to officially notify the lien holder about the establishment or amendment of a trust. This letter ensures that the lien holder is aware that the ownership of the property has been transferred to the trust and that the trust is now responsible for fulfilling any outstanding obligations. II. Essential Components of the Letter: 1. Sender's Contact Information: Include your name, address, phone number, email, and any other relevant contact details at the beginning of the letter. 2. Lien holder's Contact Information: Include the lien holder's name, address, and any other necessary contact details. 3. Introduction: Begin the letter with a formal salutation, such as "Dear [Lien holder's Name]." 4. Verification of Trust Existence: Clearly state that you have established a trust and provide its official name and date of creation. 5. Property Details: Specify the property covered under the trust, including its address and any relevant identifiers, such as property or account numbers. 6. Change in Ownership: Clearly state that the ownership of the property has been transferred to the trust and mention the date when this transfer occurred. 7. Assumption of Obligations: Emphasize that the trust will be responsible for fulfilling any financial obligations, including previously existing liens or loans related to the property. 8. Request for Acknowledgment: Kindly ask the lien holder to acknowledge receipt of the letter by signing and returning a copy for your records. 9. Contact Information: Reiterate your contact details and request that the lien holder direct any future correspondence or inquiries regarding the property to you as the trust's representative. 10. Formal Closing: End the letter with a polite closing, such as "Sincerely" or "Best regards," followed by your name and signature. III. Possible Variations: 1. Palm Bay Florida Letter to Lien holder to Amend Trust: In case you need to amend an existing trust arrangement with the lien holder, a similar letter should be written, highlighting the specific changes made and the rationale behind them. 2. Palm Bay Florida Letter to Notify Multiple Lien holders: If there are multiple lien holders associated with the property, individual letters should be sent to each, tailored to their specific circumstances. Conclusion: Mastering the art of drafting a Palm Bay Florida Letter to Lien holder to Notify of Trust is crucial for ensuring a smooth transition of property ownership and fulfilling any obligations associated with the property under the new trust arrangement. By following the essential components and understanding the possible variations, individuals can effectively inform lien holders about the establishment or amendment of a trust in Palm Bay, Florida.

Palm Bay Florida Letter to Lienholder to Notify of Trust

Description

How to fill out Palm Bay Florida Letter To Lienholder To Notify Of Trust?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Palm Bay Florida Letter to Lienholder to Notify of Trust gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Palm Bay Florida Letter to Lienholder to Notify of Trust takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Palm Bay Florida Letter to Lienholder to Notify of Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!