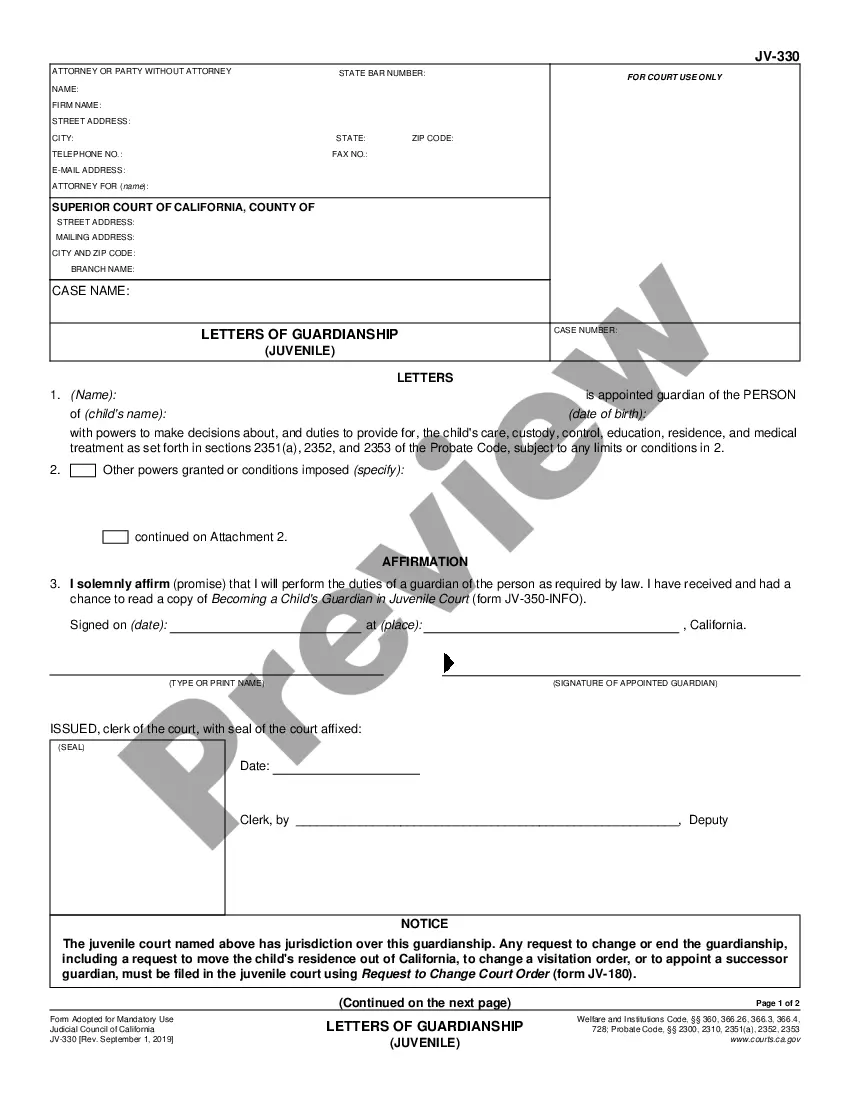

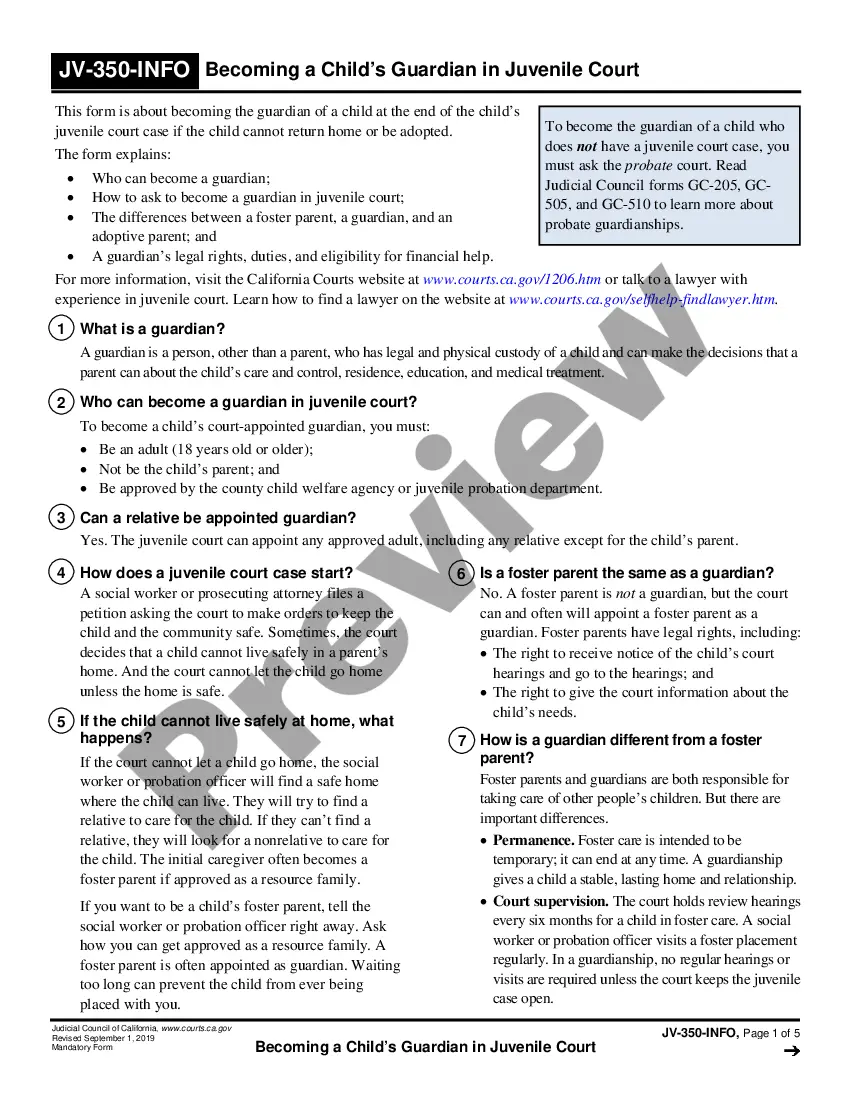

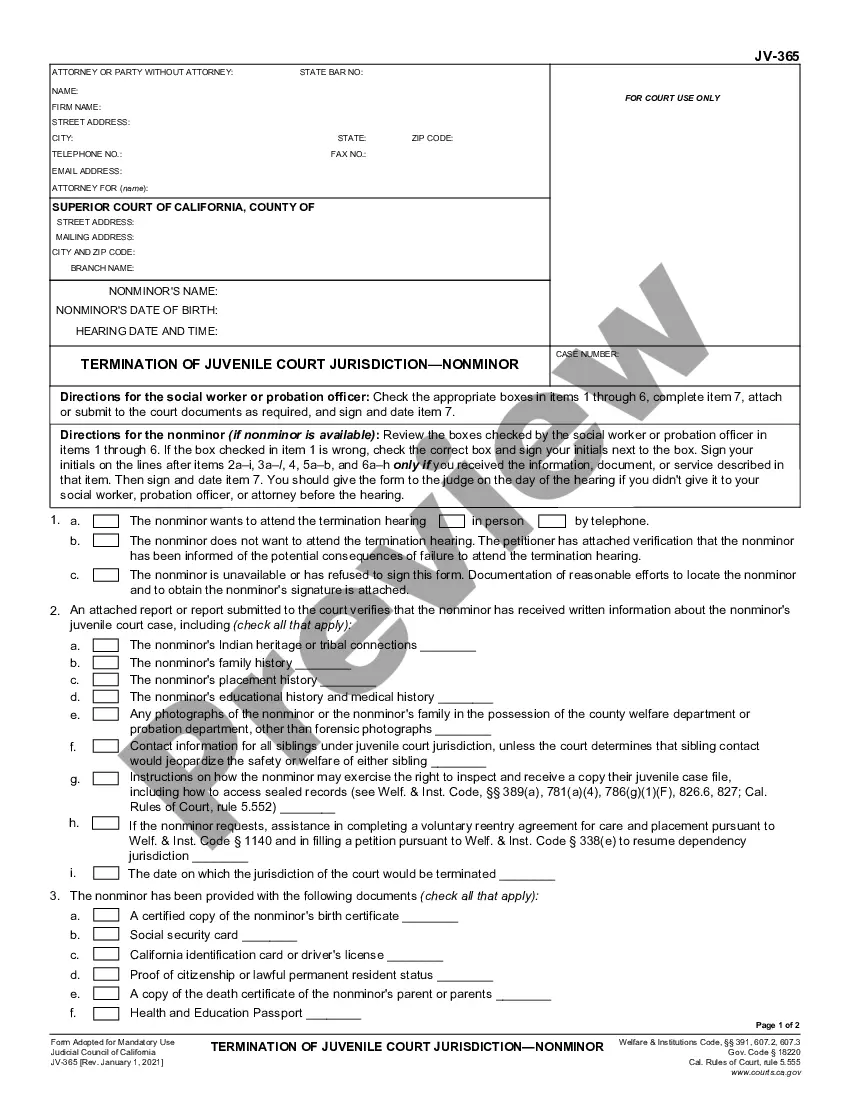

A Jacksonville Florida Mortgage Deed from Individual is a legal document that establishes a framework for the transfer of ownership of a property in Jacksonville, Florida, as collateral against a loan or debt. It serves as evidence of the borrower's agreement to grant the lender a security interest in the property being mortgaged. The Jacksonville Florida Mortgage Deed from Individual includes important details such as the names of the parties involved — the mortgagor (borrower) and the mortgagee (lender), a legal description of the property being mortgaged, and the terms and conditions of the loan. There are various types of Jacksonville Florida Mortgage Deeds from Individual, including: 1. Conventional Mortgage Deed: This is the most common type of mortgage deed, where an individual (the mortgagor) uses their property as collateral to secure a loan from a lender (the mortgagee). 2. Refinance Mortgage Deed: This deed is used when an individual wants to refinance their existing mortgage with a new loan, either to secure better loan terms or to access equity in the property. 3. Second Mortgage Deed: In some cases, individuals may choose to take out a second mortgage on their property. This deed establishes the lender's security interest as a secondary lien behind the primary mortgage. 4. Reverse Mortgage Deed: This type of mortgage is available to homeowners who are aged 62 or older. Instead of making mortgage payments, the lender provides funds to the borrower, who retains ownership of the property until their death, at which point the property is typically sold to repay the loan. The Jacksonville Florida Mortgage Deed from Individual also outlines the repayment terms, including the loan amount, interest rate, repayment schedule, and any additional terms or conditions agreed upon by both parties. Additionally, it may specify the consequences of default, such as foreclosure procedures. Once the Jacksonville Florida Mortgage Deed from Individual is signed and notarized by the parties involved, it is recorded with the county's land records office to provide public notice of the mortgage and protect the lender's interest in the property. Overall, a Jacksonville Florida Mortgage Deed from Individual is a crucial legal document that facilitates the borrowing of funds against a property in Jacksonville, Florida, ensuring the lender's security interest while establishing the terms and conditions of the loan.

Jacksonville Florida Mortgage Deed from Individual

Description

How to fill out Jacksonville Florida Mortgage Deed From Individual?

We always want to minimize or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney services that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Jacksonville Florida Mortgage Deed from Individual or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Jacksonville Florida Mortgage Deed from Individual adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Jacksonville Florida Mortgage Deed from Individual would work for your case, you can select the subscription option and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!