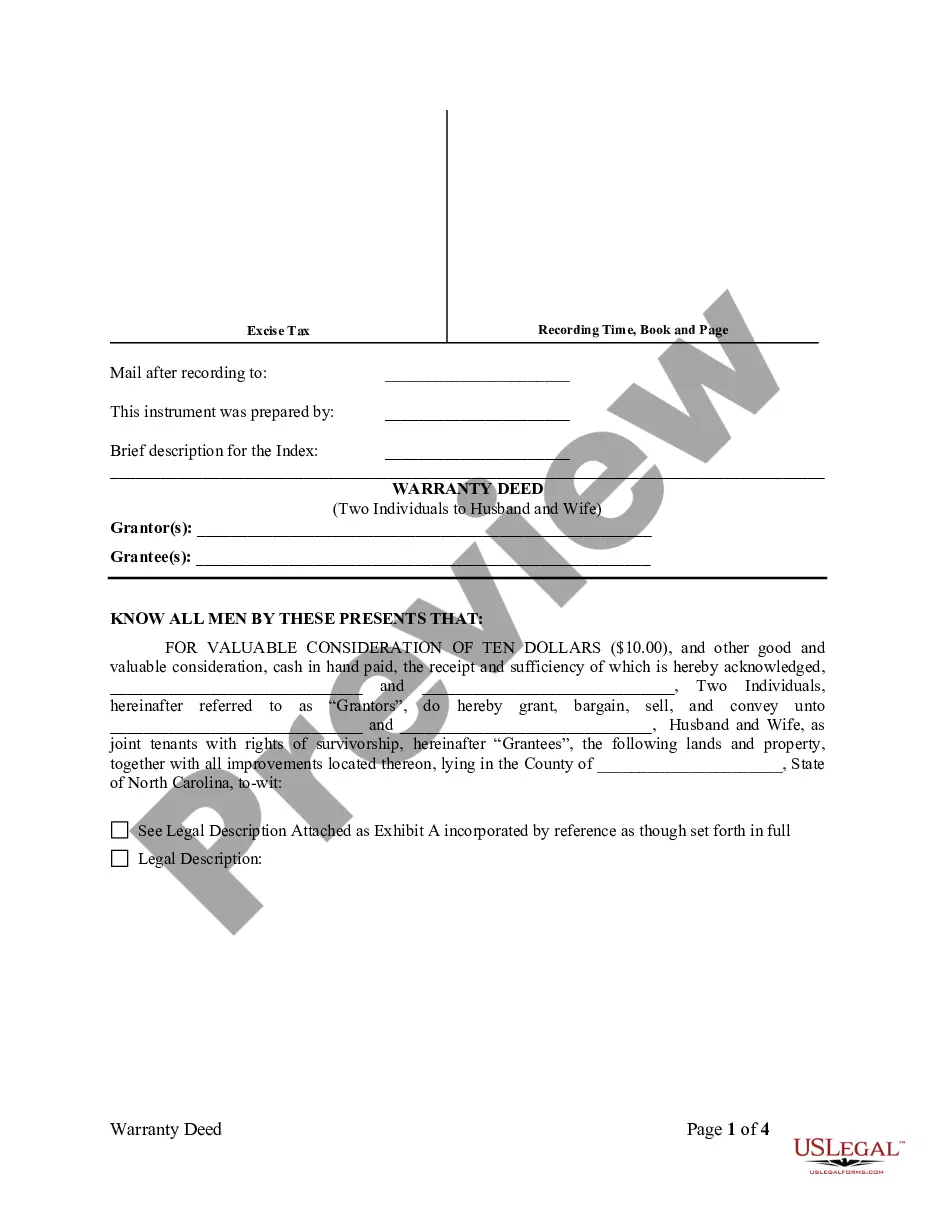

Port St. Lucie Florida Mortgage Deed from Individual is a legal document that outlines the terms and conditions of a mortgage agreement between an individual borrower and a lender in the city of Port St. Lucie, Florida. It serves as confirmation of the borrower's debt and provides the lender with a property interest in the event of default. Keywords: Port St. Lucie, Florida, Mortgage Deed, individual, legal document, terms and conditions, mortgage agreement, borrower, lender, property interest, default. There are a few different types of Port St. Lucie Florida Mortgage Deeds from Individuals: 1. Fixed-Rate Mortgage Deed: This type of mortgage deed specifies a fixed interest rate for the loan term, allowing borrowers to have consistent monthly payments throughout the repayment period. 2. Adjustable-Rate Mortgage (ARM) Deed: An ARM mortgage deed offers an initially low-interest rate for a fixed period, typically 3, 5, 7, or 10 years. After the initial period, the interest rate adjusts periodically based on market conditions. 3. FHA Mortgage Deed: This type of mortgage deed is insured by the Federal Housing Administration (FHA), making it more accessible for individuals with lower credit scores or down payment capabilities. It offers flexible qualification criteria and competitive interest rates. 4. VA Mortgage Deed: VA mortgage deeds are specifically available for eligible veterans, active-duty military personnel, and surviving spouses. These deeds are guaranteed by the Department of Veterans Affairs (VA) and provide favorable terms, including lower interest rates, no down payment, and no mortgage insurance requirement. 5. Jumbo Mortgage Deed: Jumbo mortgage deeds are used for loans exceeding the conforming loan limits set by Fannie Mae and Freddie Mac. In Port St. Lucie, Florida, where real estate prices may be higher, individuals may require this type of mortgage deed when purchasing a high-value property. In conclusion, a Port St. Lucie Florida Mortgage Deed from Individual is a crucial legal document outlining the terms of a mortgage agreement between a borrower and lender. It allows individuals in Port St. Lucie, Florida, to obtain financing for their home purchases, with different types of mortgage deeds available to suit their unique needs and circumstances. Whether it's a fixed-rate, adjustable-rate, FHA, VA, or jumbo mortgage deed, individuals can find the right mortgage product to fulfill their homeownership goals in Port St. Lucie, Florida.

Port St. Lucie Florida Mortgage Deed from Individual

Description

How to fill out Florida Mortgage Deed From Individual?

If you’ve previously availed yourself of our service, Log In to your account and download the Port St. Lucie Florida Mortgage Deed from Individual to your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it in line with your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have lifelong access to every document you’ve purchased: you can access it in your profile within the My documents menu whenever you need to retrieve it again. Utilize the US Legal Forms service to swiftly discover and save any template for your personal or professional requirements!

- Confirm you’ve found the correct document. Browse the description and use the Preview option, if available, to verify if it suits your requirements. If it doesn't fit your needs, use the Search tab above to locate the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process your payment. Input your credit card information or choose the PayPal option to finalize the transaction.

- Obtain your Port St. Lucie Florida Mortgage Deed from Individual. Choose the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

The clerk of court in the middle district of Florida oversees the administrative functions of the court and ensures legal documents are processed. For individuals dealing with property issues or a Port St. Lucie Florida Mortgage Deed from Individual, this office can be a critical point of contact. You can find their contact information on their official website.

The clerk of court in the Eastern District of Missouri is responsible for maintaining court records and facilitating court operations. It is essential for anyone involved in legal proceedings to know who holds this position. If you have questions about how this relates to a Port St. Lucie Florida Mortgage Deed from Individual, consider seeking information through our platform.

You can contact the Hillsborough Clerk of Court through their official website, where you will find their phone number and email addresses. Their office handles many services, including recording deeds and managing court documents. If you need help with a Port St. Lucie Florida Mortgage Deed from Individual, they can provide valuable information.

St. Lucie County falls within the Nineteenth Judicial Circuit of Florida. This district handles various civil and criminal matters for the county. Understanding the court system is essential when dealing with property-related matters like a Port St. Lucie Florida Mortgage Deed from Individual.

To file a quit claim deed in Palm Beach County, you must first prepare the document according to local requirements. After preparing it, you can submit it to the Palm Beach County Clerk's Office for recording. If you need assistance, our platform offers helpful resources on handling a Port St. Lucie Florida Mortgage Deed from Individual, which can also guide you.

Port St. Lucie is located in St. Lucie County, Florida. This area is known for its beautiful landscapes and vibrant community. If you are looking to manage property transactions such as a Port St. Lucie Florida Mortgage Deed from Individual, understanding the local county can simplify your process.

To retrieve a copy of your deed in Broward County, visit the Clerk's Office website for guidance on how to request your document. You may choose to submit your request online, by mail, or visit the office in person. Providing complete property information will streamline your experience. For added ease in managing your Port St. Lucie Florida Mortgage Deed from Individual, explore options available at US Legal Forms.

To obtain a survey of your property in Broward County, you can contact a licensed surveyor who operates in the area. Many surveyors provide services to gather needed property details effectively. You may also check with the Broward County records office for any existing surveys they may have on file related to your Port St. Lucie Florida Mortgage Deed from Individual.

To get a copy of a deed in Broward County, you can request the document through the Broward County Clerk's Office. They offer online, mail, and in-person options for requesting copies. Make sure to provide necessary details about the property to expedite the process. If you require assistance with your Port St. Lucie Florida Mortgage Deed from Individual, consider using US Legal Forms for a guided process.

You can contact Broward County records by visiting their official website, where they provide contact details for their office. Alternatively, you can call their main phone number to speak with a representative directly. Your inquiries about documents related to your Port St. Lucie Florida Mortgage Deed from Individual will receive proper attention.