Cape Coral Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Florida Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

If you are looking for a pertinent document, it's difficult to find a superior source than the US Legal Forms website – likely the most comprehensive collections on the internet.

With this collection, you can obtain thousands of sample documents for business and personal use by categories and regions, or keywords.

With the high-quality search feature, locating the most recent Cape Coral Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Select the file format and download it to your device.

- Moreover, the validity of every document is confirmed by a team of professional attorneys who routinely review the templates on our site and update them according to the latest state and local regulations.

- If you're already aware of our platform and possess an account, all you need to access the Cape Coral Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have the sample open that you desire. Review its description and utilize the Preview feature (if available) to view its content. If it doesn’t fulfill your needs, use the Search bar at the top of the page to find the suitable file.

- Validate your choice. Click on the Buy now button. Then, select the desired pricing plan and enter your details to create an account.

Form popularity

FAQ

An assumption agreement for a mortgage allows a new borrower to take over the existing mortgage obligations from the original borrower. In the context of the Cape Coral Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, this legal process can benefit both parties by providing a smooth transition of mortgage responsibility. The new borrower may gain access to favorable terms while the original mortgagor can release their obligations. For those seeking clarity and assistance, USLegalForms offers comprehensive resources to navigate this agreement effectively.

Assuming a mortgage through a Cape Coral Florida Assumption Agreement of Mortgage and Release of Original Mortgagors can have downsides. One potential issue is inheriting the original borrower's debt, which could include a higher interest rate or unfavorable terms. Additionally, if the assumption is not approved by the lender, the buyer may face difficulties or legal complications, making it crucial to understand the agreement thoroughly.

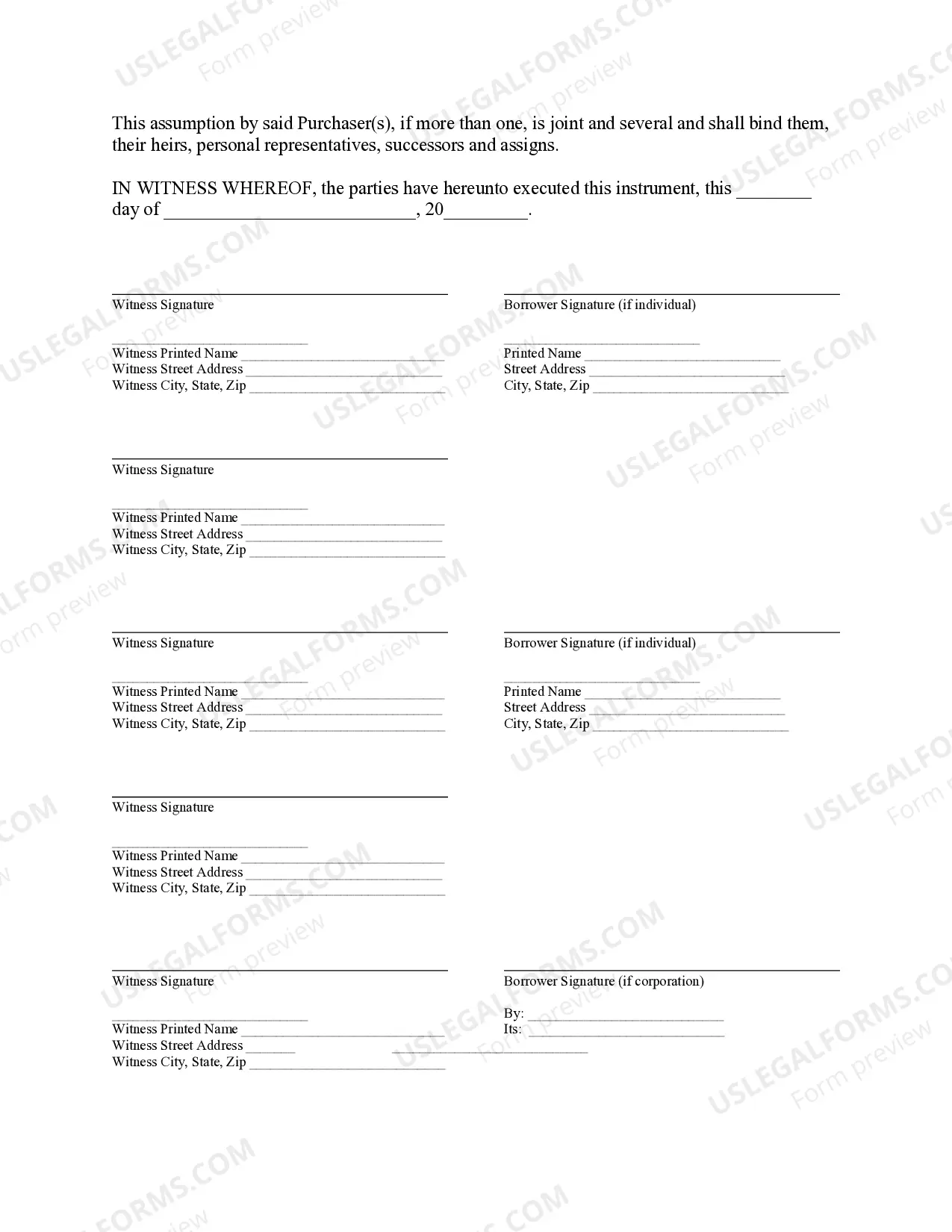

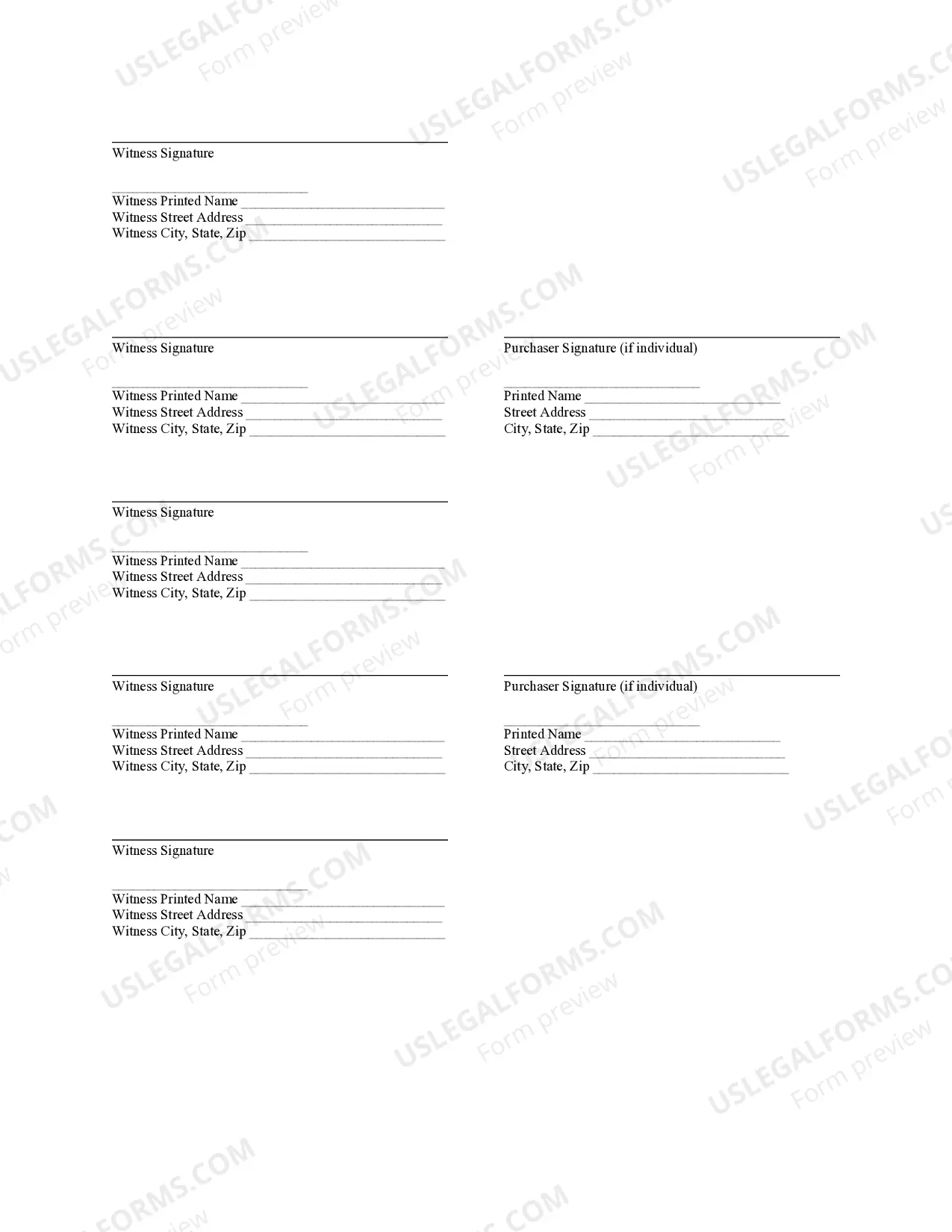

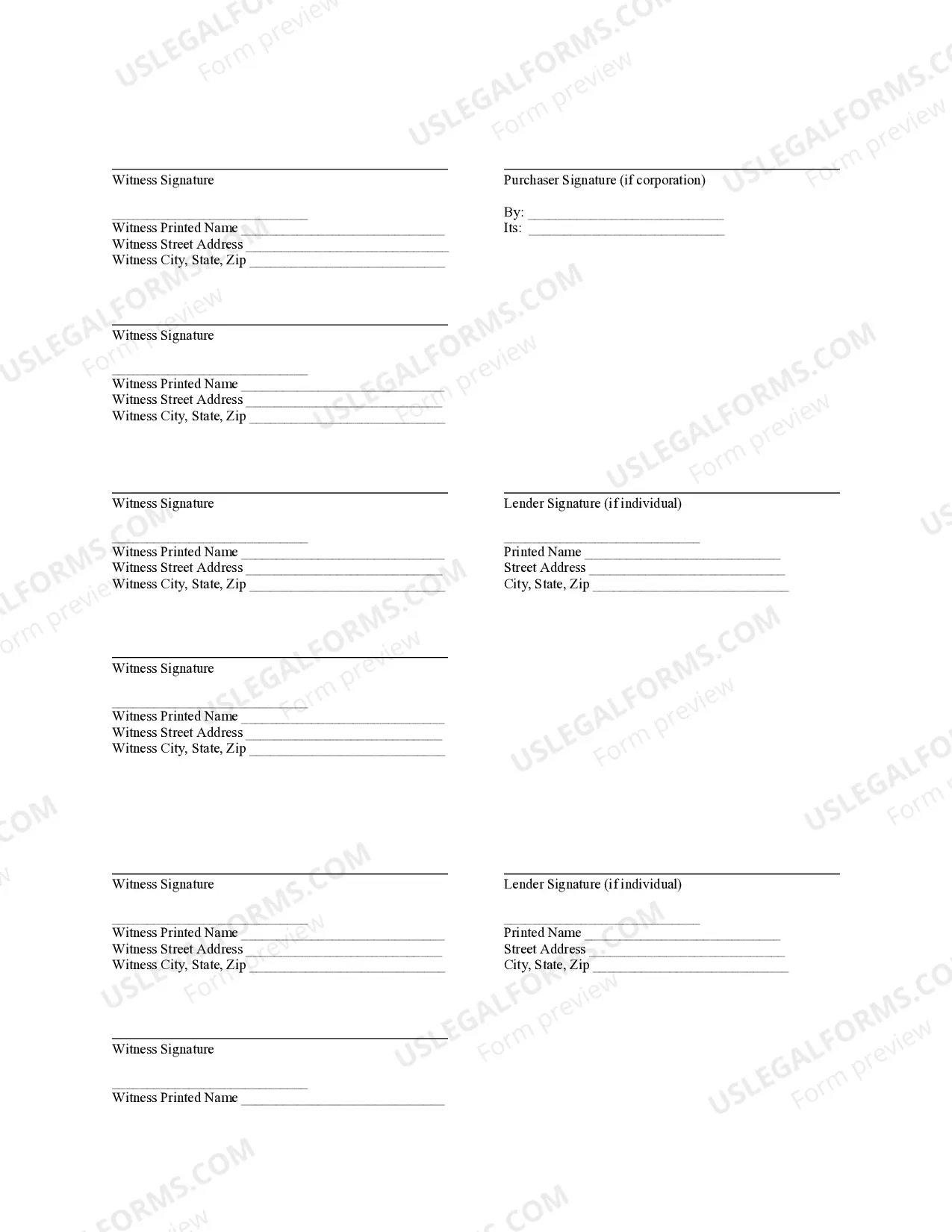

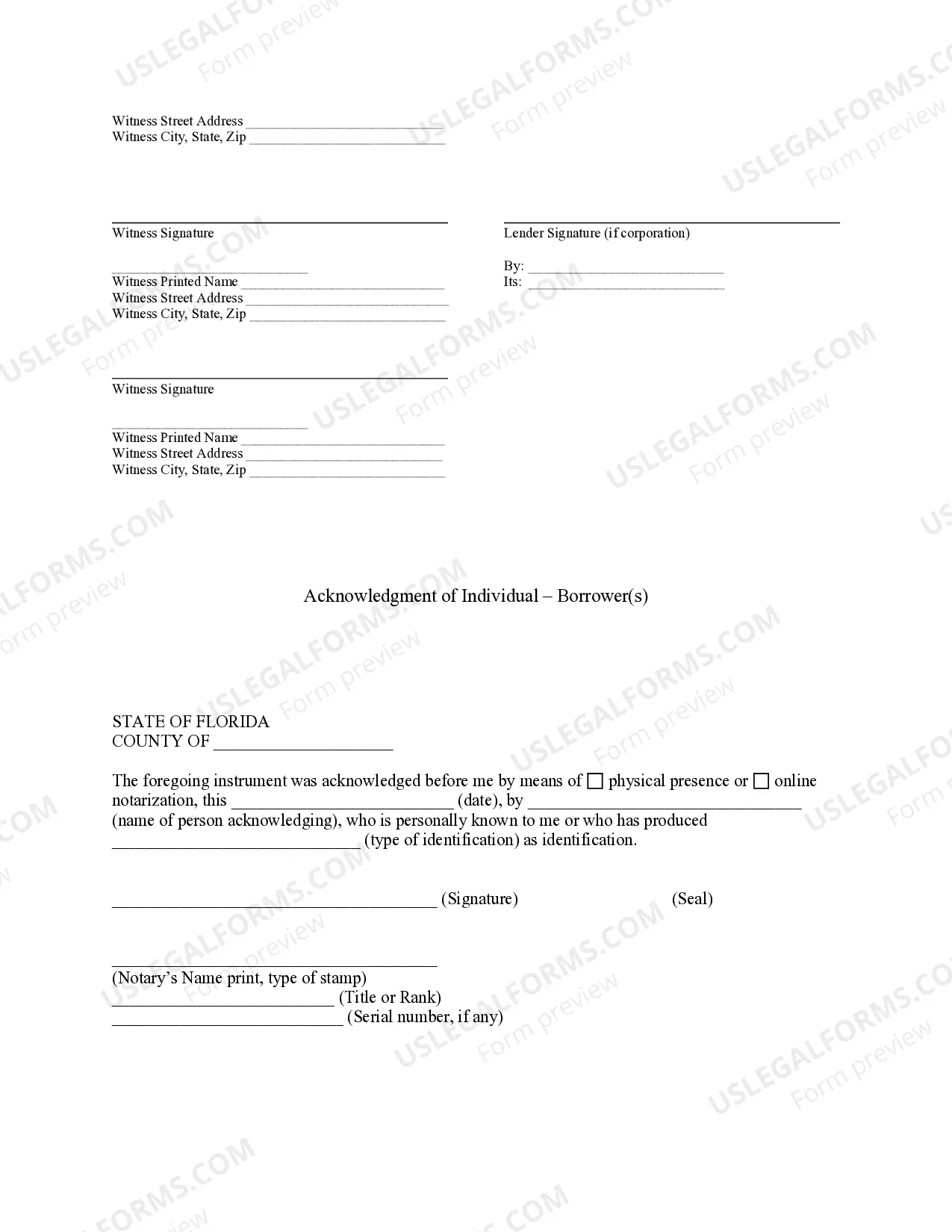

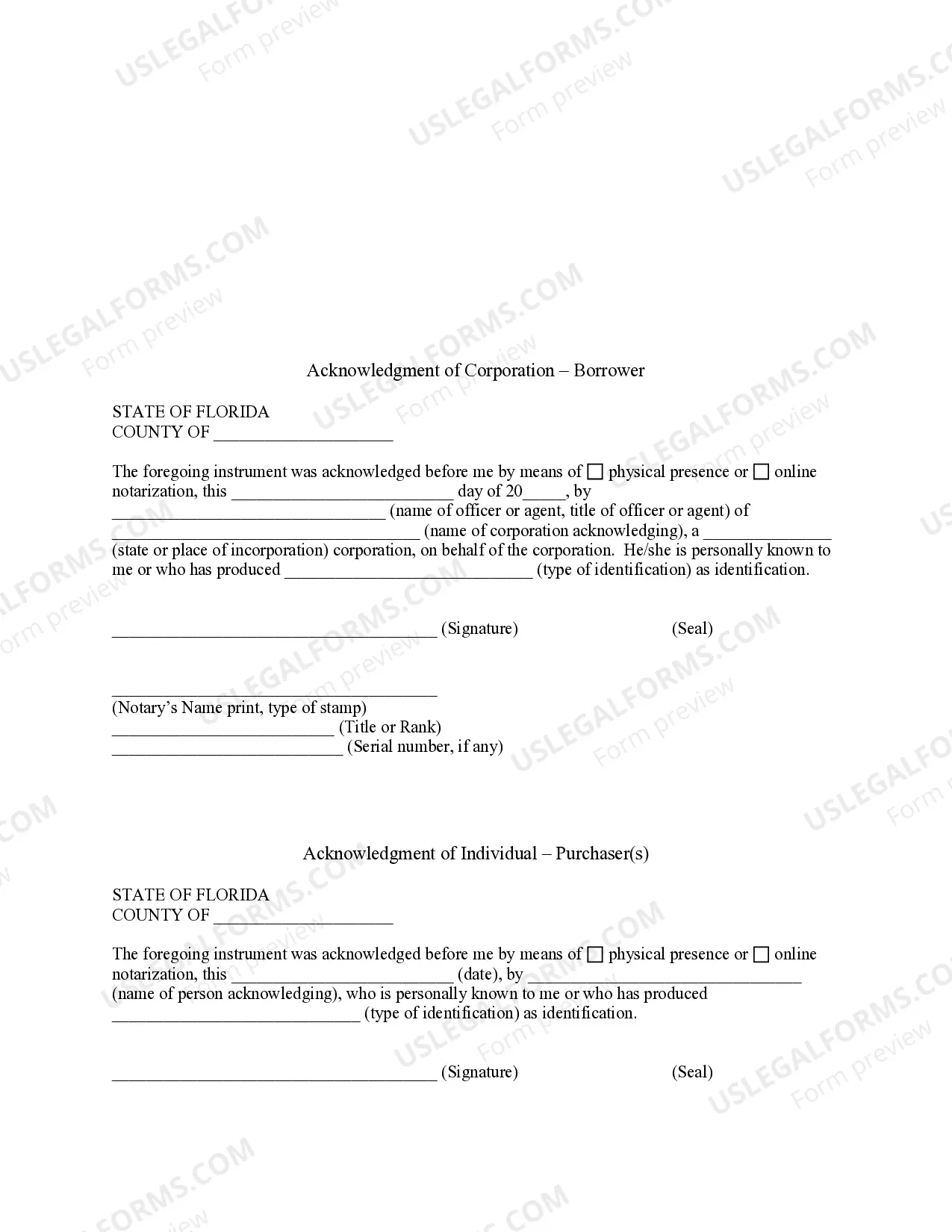

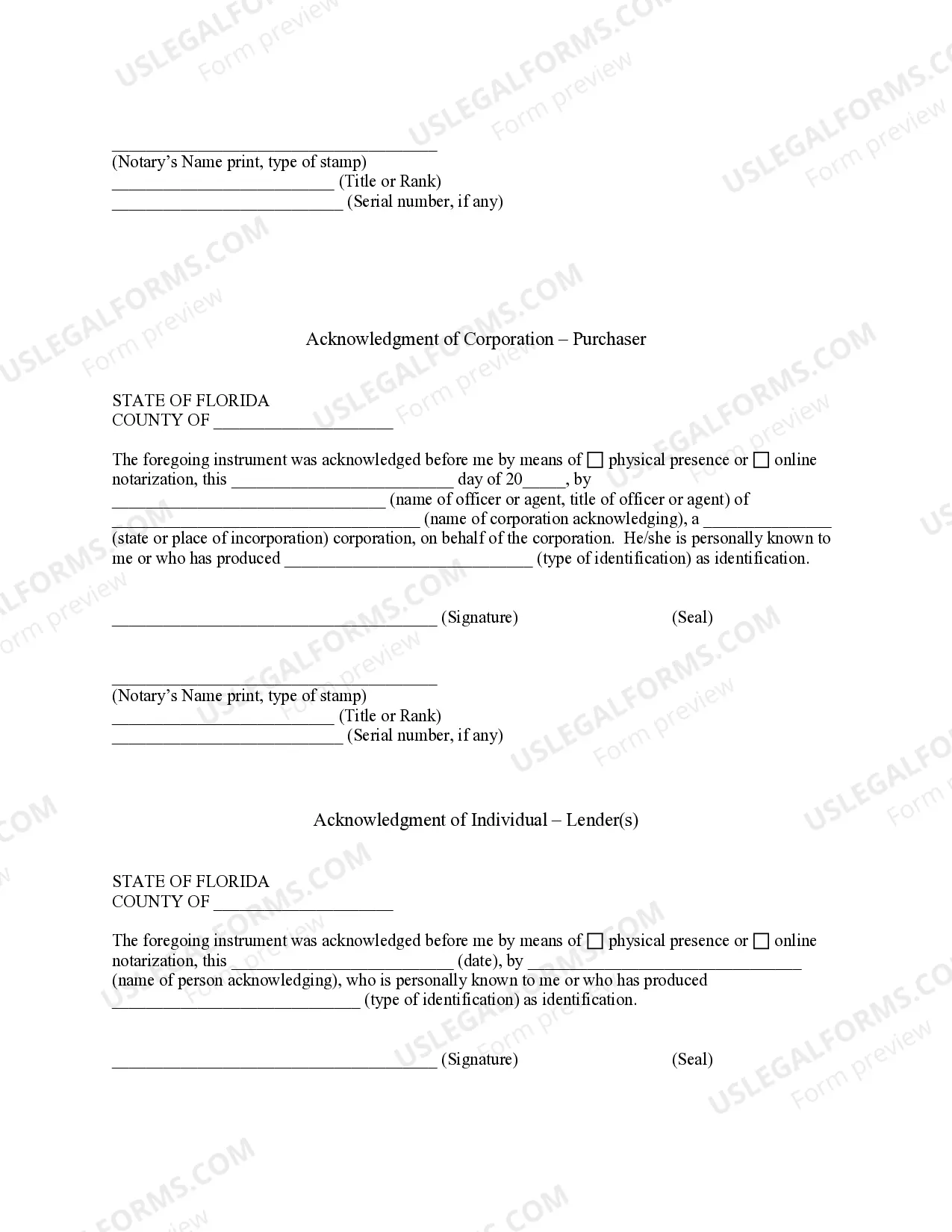

To fill out a Cape Coral Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, start by obtaining the correct template from a trusted source, such as US Legal Forms. Fill in detailed information about the buyer, original borrower, and property. Finally, make sure to include any necessary disclosures or clauses that pertain to the agreement, and ensure all parties sign to finalize the document.

In a Cape Coral Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, both the buyer and the lender must sign the assumption agreement. The original borrower, or mortgagor, may also need to sign to release them from future liability. This agreement is crucial because it confirms the buyer will take over the mortgage payments while ensuring the lender agrees to the change.

On an assumption, the funding fee is 0.5% of the existing mortgage balance and is paid by the new home buyer at closing.

Once the loan is paid off and all the terms of the mortgage are satisfied, a mortgage deed of release is created. Until then, the lender holds the title of the property and after the final payment is made, the title of the property is transferred to the borrower of the mortgage.

Upon receiving your final payment, the lender must execute and file a written, notarized document (typically referred to as a release or satisfaction of mortgage) that acknowledges the mortgage is satisfied or paid in full. They must also file the document with the clerk of the county where your property is located.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

How do I discharge a mortgage? Notify your lender: Reach out to your lender and discuss your plans to release the mortgage with them.Complete and return the Discharge Authority form:Register your discharge and Certificate of Title:

You can transfer a mortgage to another person if the terms of your mortgage say that it is ?assumable.? If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.