The Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that allows a borrower to transfer the responsibility of repaying the existing mortgage to a new party. This agreement is commonly used in real estate transactions, where the original mortgagor wants to transfer the mortgage to a new buyer or borrower who is willing to assume the mortgage. The Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors includes detailed terms and conditions that both parties must agree upon. It outlines the rights and obligations of the original mortgagor, the new borrower, and the lender. The agreement typically includes provisions such as the transfer of ownership, the assumption of the mortgage debt, the release of liability for the original mortgagor, and the terms of repayment. In Hialeah, Florida, there may be different types of Assumption Agreements of Mortgage and Release of Original Mortgagors, depending on the specific circumstances of the transaction. Some common types include: 1. Residential Assumption Agreement: This type of agreement is used when a residential property, such as a house or a condominium, is being transferred to a new buyer or borrower. It typically includes provisions related to the transfer of ownership, escrow accounts, and the assumption of the mortgage payments. 2. Commercial Assumption Agreement: In cases involving commercial properties like office buildings, warehouses, or retail spaces, a Commercial Assumption Agreement may be used. This agreement addresses the unique requirements of commercial transactions, such as lease agreements, zoning restrictions, and potential business-related contingencies. 3. Assumption Agreement with Existing Mortgage Lender: This type of agreement is applicable when the new borrower intends to assume the existing mortgage with the same lender. It may involve negotiating the terms of the mortgage, such as interest rates, repayment periods, or even restructuring the loan based on the financial situation of the new borrower. 4. Assumption Agreement with a Third-Party Lender: In situations where the new borrower intends to assume the mortgage with a different lender, an Assumption Agreement with a Third-Party Lender comes into play. This agreement involves coordinating with both the original lender and the new lender to transfer the mortgage to the new borrower smoothly. Overall, the Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors ensures a legal and documented transfer of mortgage responsibility from the original mortgagor to a new party. It protects the rights and interests of all parties involved and provides a clear framework for the assumption of the mortgage and the release of liability for the original mortgagor.

Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Hialeah Florida Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Do you require a reliable and cost-effective legal forms provider to obtain the Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors? US Legal Forms is your premier choice.

Whether you need a straightforward agreement to establish terms for living together with your partner or a collection of documents to facilitate your separation or divorce in court, we've got you covered. Our platform offers over 85,000 current legal document templates for personal and corporate use.

All templates we provide are not generic but tailored to meet the specific needs of different states and regions.

To acquire the document, you must Log In to your account, find the required template, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased form templates anytime in the My documents section.

You can now establish your account. Then, select the subscription plan and continue to payment. Once the payment is completed, download the Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors in any available format.

You can revisit the website whenever needed and redownload the document at no extra cost. Accessing up-to-date legal forms has never been simpler. Try US Legal Forms today and stop spending your precious time navigating legal documents online once and for all.

- Are you unfamiliar with our platform? No problem.

- You can create an account with ease, but first, ensure you follow these steps.

- Verify if the Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors meets the requirements of your state and locality.

- Review the document's description (if available) to understand its intended purpose and audience.

- Begin your search again if the template doesn’t fit your legal situation.

Form popularity

FAQ

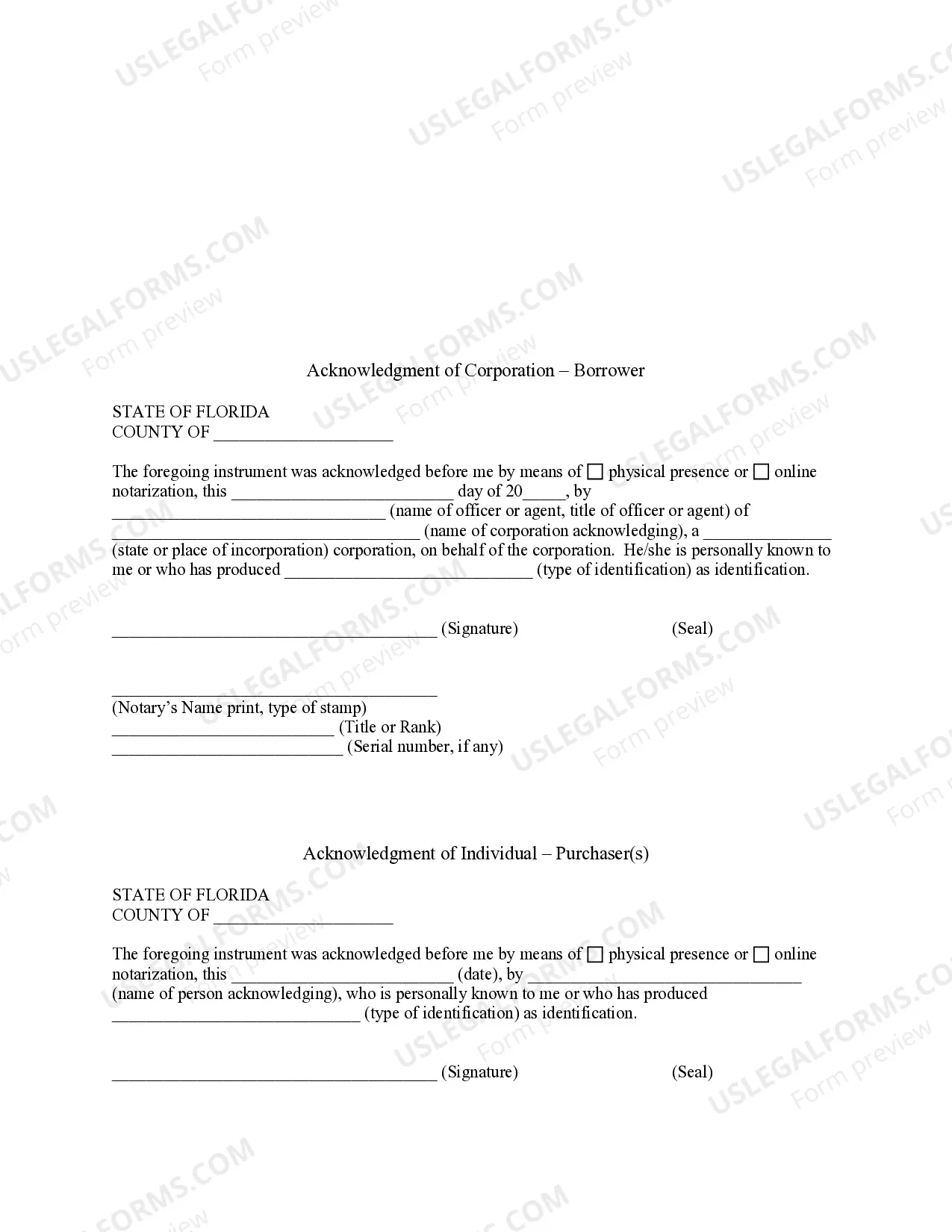

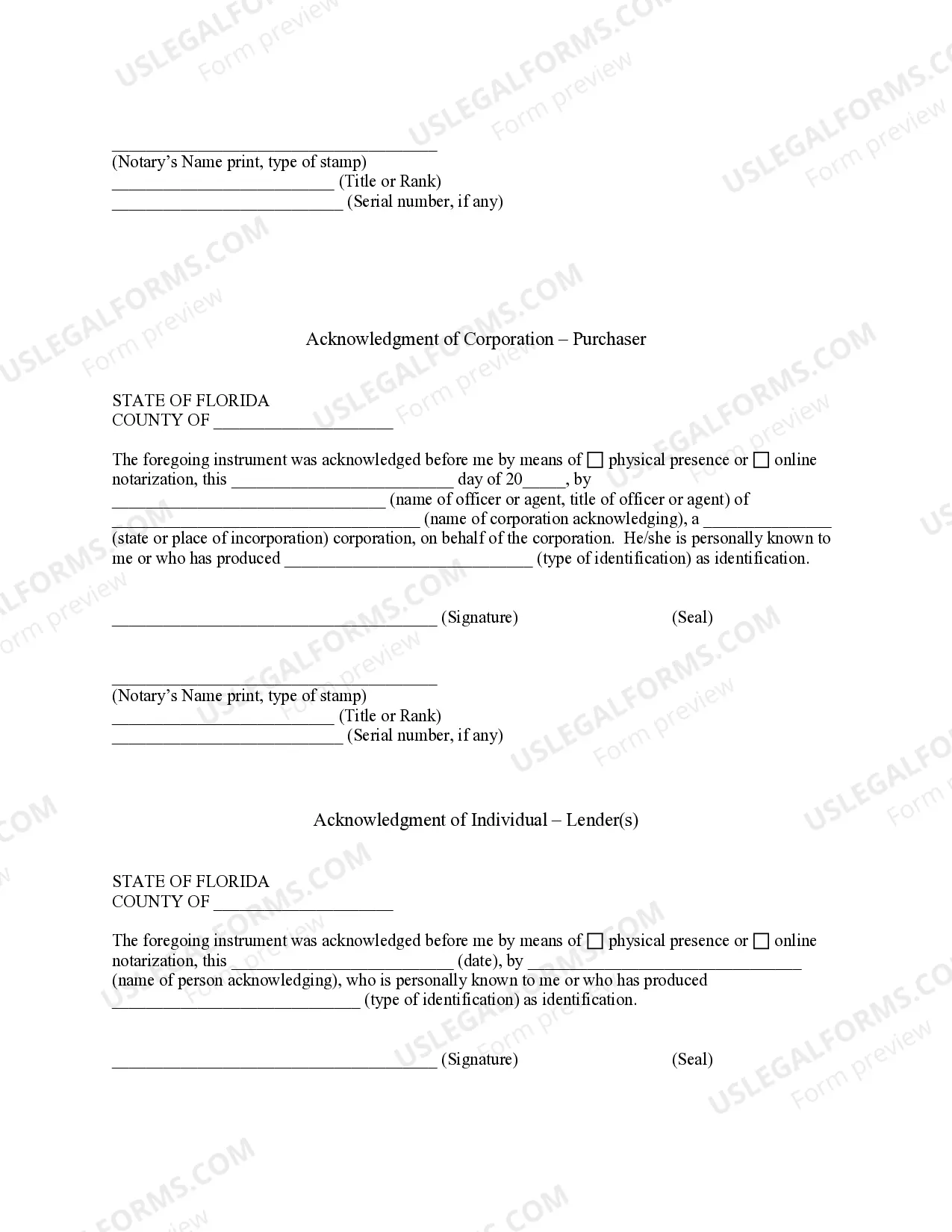

The process of assumption involves a buyer agreeing to take over an existing mortgage from the seller. When you enter into a Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, you ensure that the original borrower is released from further liability. This agreement makes the transaction smoother for both parties by transferring the mortgage responsibility to the new owner. It is advisable to consult with legal professionals to navigate this process effectively.

Mortgages can lead to financial strain if a homeowner struggles to make monthly payments, leading to potential foreclosure. Moreover, the debt can limit a homeowner’s financial flexibility, especially with unexpected expenses. This is a key consideration in the context of the Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, where assumptions can shift this burden between parties.

A mortgage assumption agreement is a legal document that allows a buyer to take over a seller's existing mortgage. This agreement details the terms under which the buyer assumes responsibility for the mortgage payments, as per the Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors. It's important to involve the lender, as their approval is often required for this process.

To file an assumption of mortgage, you should first consult with the lender to seek permission for the mortgage transfer. Once approved, the Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors needs to be completed and signed by all involved parties. After that, submit the signed agreement to the lender and ensure all necessary documentation is in order.

To perform a mortgage release, contact your lender to request the necessary documentation. Once you have the forms, complete and submit them to the appropriate local government office, along with any required fees. Successfully completing a Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors can simplify this process, ensuring that you can move forward with confidence.

The intangible tax on assumption of mortgage in Florida is a state tax charged on the assumption of an existing mortgage, typically calculated based on the amount of the mortgage being assumed. This tax can vary depending on local regulations and the specific details of your agreement. If you are pursuing a Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, it’s crucial to calculate this tax to prevent surprises during the transaction.

A mortgage discharge eliminates the mortgage entirely, releasing the borrower from their obligation. In contrast, a mortgage release only removes specific properties from the mortgage while keeping the remainder intact. When dealing with a Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, knowing this distinction can help you make informed decisions.

A partial release of mortgage in Florida allows a borrower to release a portion of the property from the mortgage obligation while keeping the remaining property under the mortgage. This often occurs during real estate transactions or when a property is sold partially. If you are navigating a Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, understanding this concept is crucial.

The time it takes to release mortgage funds can vary. Typically, lenders take between a few days to several weeks to process the paperwork related to the release of mortgage funds. However, if you have a Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors in place, this may expedite the process.

To discharge your mortgage yourself, you must first contact your lender to obtain the appropriate discharge documents. Once you have these documents, you must complete and file them with the local court or county clerk. After filing, make sure to keep a copy for your records, as this indicates the completion of your Hialeah Florida Assumption Agreement of Mortgage and Release of Original Mortgagors.