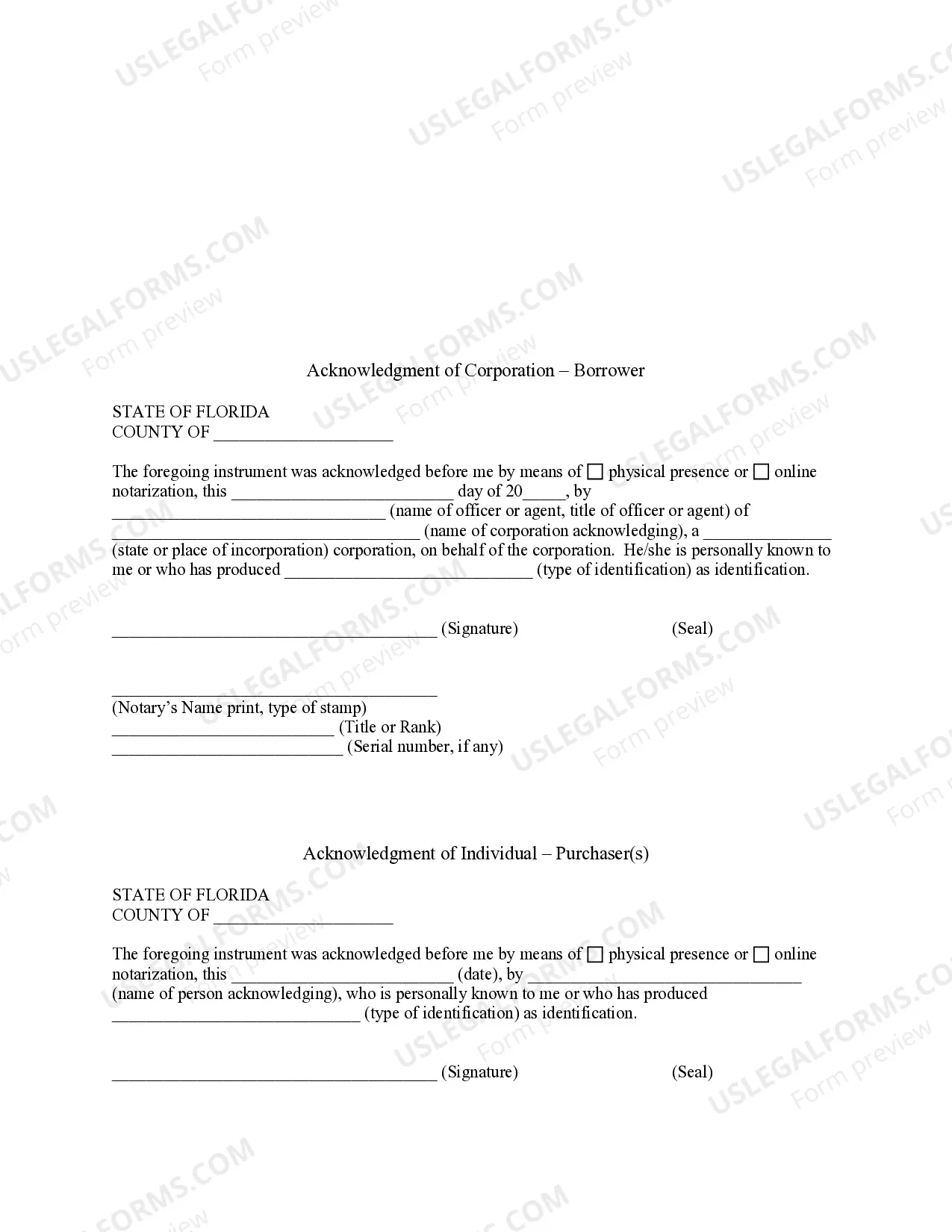

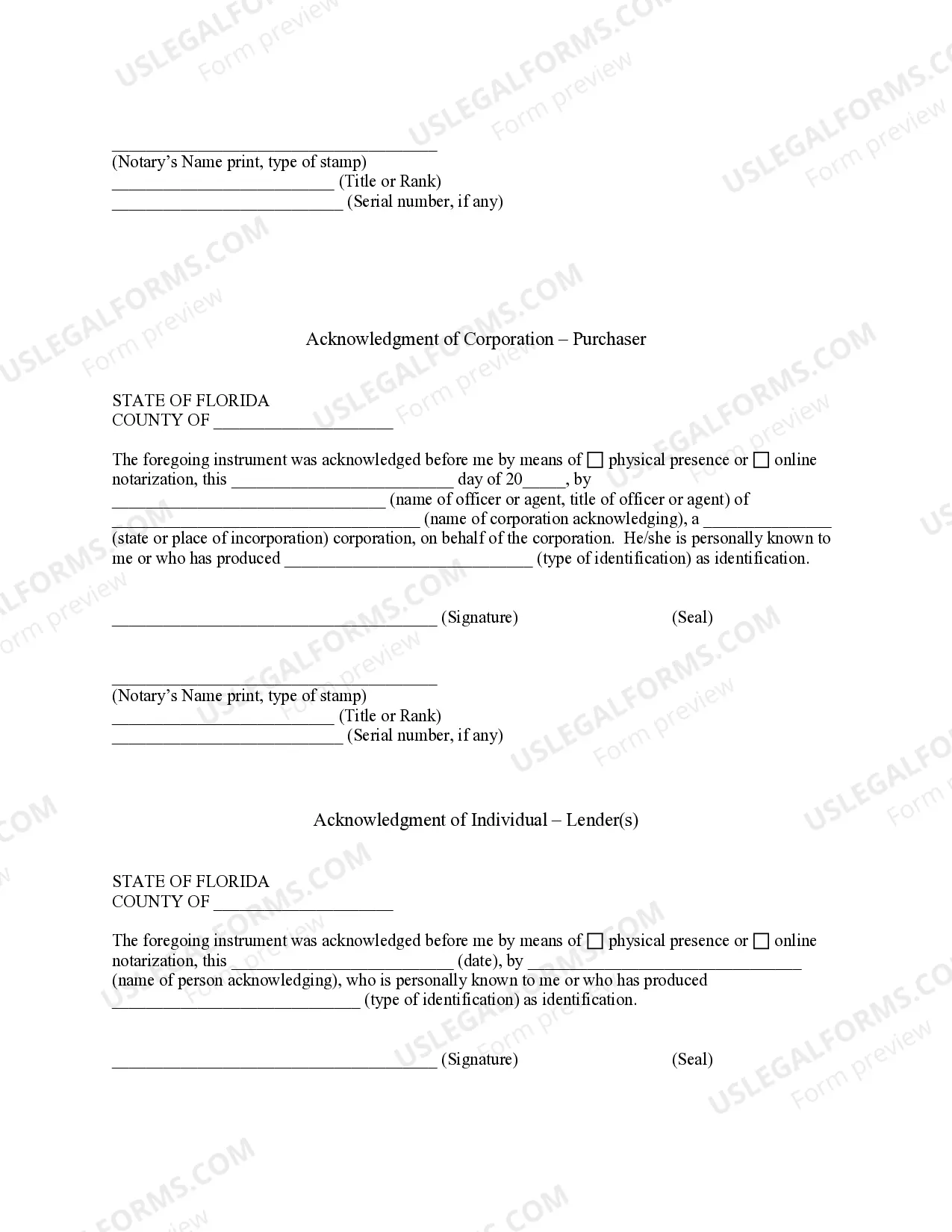

Lakeland Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that entails the transfer of an existing mortgage from the original mortgagors to a new party, known as the assumption. This agreement is typically used when a property owner wishes to transfer their mortgage obligation to another individual or entity. The assumption agreement serves as a legally binding contract between the original mortgagors, the assumption, and the mortgage lender. It outlines the terms and conditions under which the assumption agrees to take on the responsibility of the mortgage, including making timely payments and fulfilling all terms of the original mortgage agreement. In Lakeland, Florida, there are two main types of assumption agreements: 1. Simple Assumption Agreement: This type of agreement involves the transfer of the mortgage without a release of liability for the original mortgagors. In this case, the original mortgagors will remain responsible for the mortgage debt in addition to the assumption. The lender may require a creditworthiness assessment of the assumption to ensure they can assume the mortgage obligation. 2. Release of Original Mortgagors Agreement: This agreement allows the original mortgagors to be released from any further obligations or liabilities associated with the mortgage. The assumption becomes solely responsible for the mortgage debt and takes over all rights and responsibilities outlined in the original mortgage agreement. The Lakeland Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is an important legal document that protects the interests of all parties involved. It ensures a smooth transition of mortgage responsibility and provides clarity regarding the duties and obligations of the assumption. It is crucial for all parties to thoroughly review and understand the terms before signing the agreement to foster a transparent and legally secure transaction.

Lakeland Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Lakeland Florida Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

If you are looking for a valid form template, it’s impossible to find a more convenient place than the US Legal Forms website – probably the most considerable libraries on the internet. With this library, you can get a huge number of document samples for company and personal purposes by types and states, or key phrases. With our high-quality search feature, discovering the most recent Lakeland Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is as elementary as 1-2-3. In addition, the relevance of each record is proved by a team of expert attorneys that on a regular basis review the templates on our website and revise them according to the latest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Lakeland Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have opened the sample you require. Check its information and utilize the Preview function (if available) to see its content. If it doesn’t meet your needs, use the Search option at the top of the screen to find the needed document.

- Confirm your decision. Click the Buy now button. After that, select your preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and download it to your system.

- Make adjustments. Fill out, edit, print, and sign the obtained Lakeland Florida Assumption Agreement of Mortgage and Release of Original Mortgagors.

Each template you save in your user profile does not have an expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to get an extra duplicate for modifying or creating a hard copy, you may come back and save it once again whenever you want.

Take advantage of the US Legal Forms professional collection to gain access to the Lakeland Florida Assumption Agreement of Mortgage and Release of Original Mortgagors you were looking for and a huge number of other professional and state-specific templates on one platform!