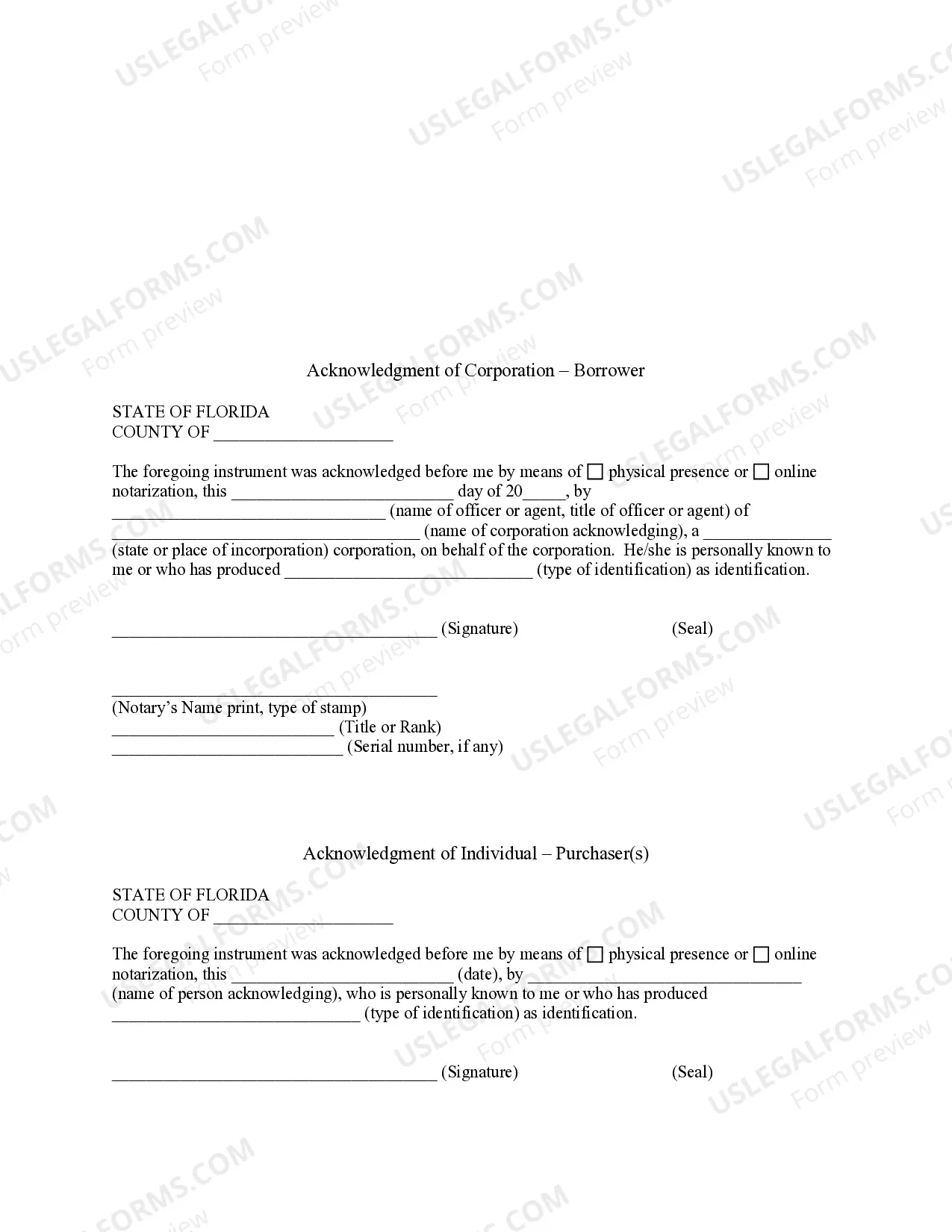

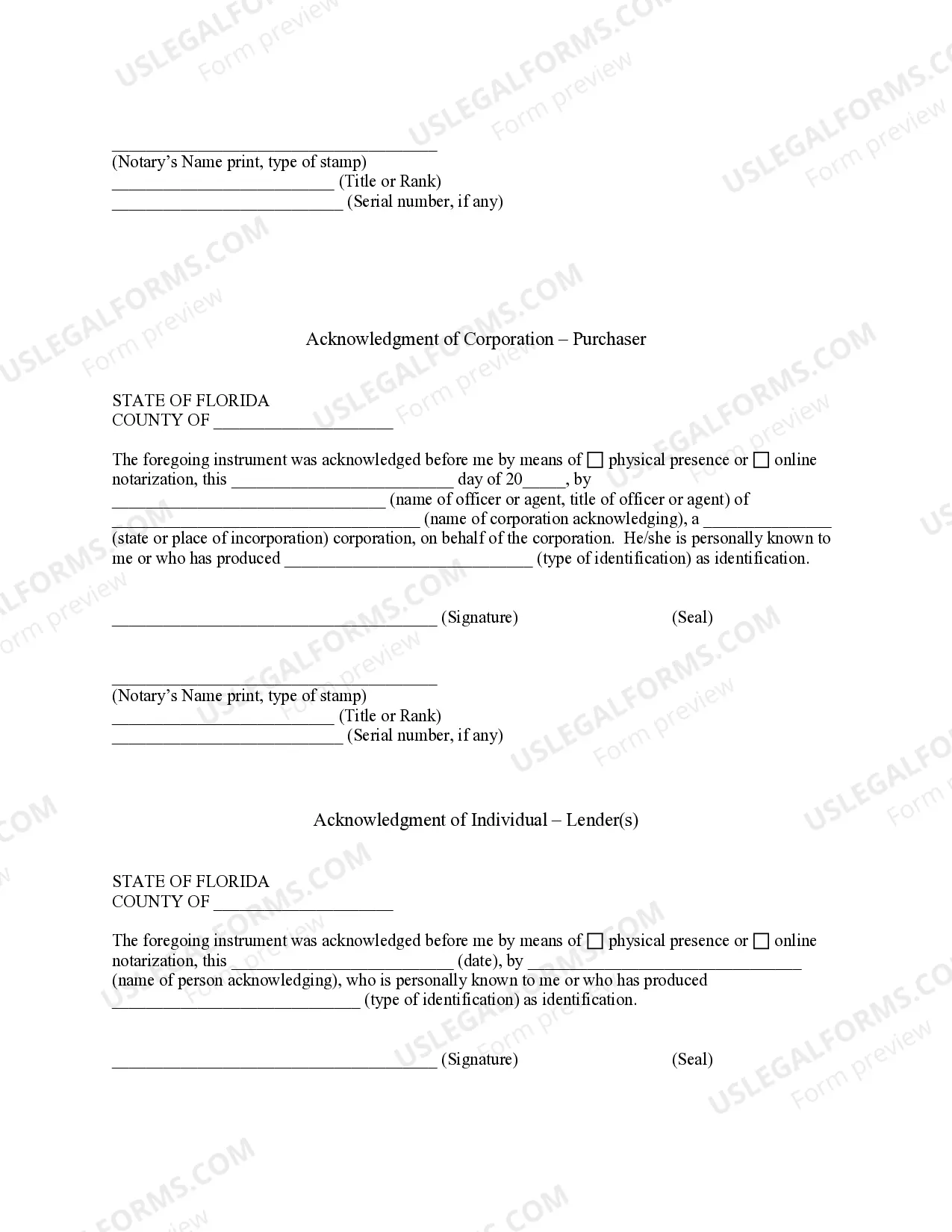

Palm Bay Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the terms and conditions under which a new borrower assumes an existing mortgage loan in Palm Bay, Florida. This agreement is commonly used in situations where the original mortgagors wish to transfer their mortgage obligations to another party. The Assumption Agreement is a legally binding contract that requires the new borrower to assume all the rights and responsibilities of the original mortgage. It applies to various types of properties, including residential homes, commercial buildings, and vacant land within the Palm Bay Area. The Palm Bay Florida Assumption Agreement of Mortgage and Release of Original Mortgagors includes several key components. Firstly, it details the names and contact information of all parties involved, including the original mortgagors, the new borrower, and the mortgage lender. It also defines the mortgage loan terms, such as the principal amount, interest rate, repayment schedule, and any applicable fees. The agreement specifies the conditions for the assumption of the mortgage, including the new borrower's creditworthiness evaluation and their ability to meet the lender's eligibility criteria. Both parties involved must consent to the assumption, and the original mortgagors are typically released from future mortgage obligations once the agreement is executed. There may be variations of Palm Bay Florida Assumption Agreement of Mortgage and Release of Original Mortgagors that cater to specific scenarios. For instance, some agreements could pertain to government-backed mortgages, such as those insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA). In such cases, additional clauses and requirements related to these specific mortgage programs may be incorporated into the agreement. It is crucial for all parties involved to carefully review the terms of the Palm Bay Florida Assumption Agreement of Mortgage and Release of Original Mortgagors before signing it. Seeking legal advice from a qualified professional, such as a real estate attorney or mortgage specialist, is strongly recommended ensuring compliance with local and state regulations.

Palm Bay Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Palm Bay Florida Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Take advantage of the US Legal Forms and get immediate access to any form sample you need. Our beneficial website with a huge number of templates allows you to find and obtain almost any document sample you want. It is possible to export, fill, and certify the Palm Bay Florida Assumption Agreement of Mortgage and Release of Original Mortgagors in just a few minutes instead of browsing the web for hours seeking the right template.

Using our library is a superb strategy to raise the safety of your form filing. Our experienced attorneys on a regular basis review all the documents to make certain that the forms are relevant for a particular region and compliant with new acts and polices.

How can you get the Palm Bay Florida Assumption Agreement of Mortgage and Release of Original Mortgagors? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you view. In addition, you can get all the previously saved records in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Open the page with the form you need. Make sure that it is the template you were hoping to find: verify its name and description, and take take advantage of the Preview function if it is available. Otherwise, utilize the Search field to find the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Save the document. Select the format to get the Palm Bay Florida Assumption Agreement of Mortgage and Release of Original Mortgagors and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy document libraries on the internet. Our company is always ready to help you in virtually any legal process, even if it is just downloading the Palm Bay Florida Assumption Agreement of Mortgage and Release of Original Mortgagors.

Feel free to take advantage of our form catalog and make your document experience as straightforward as possible!