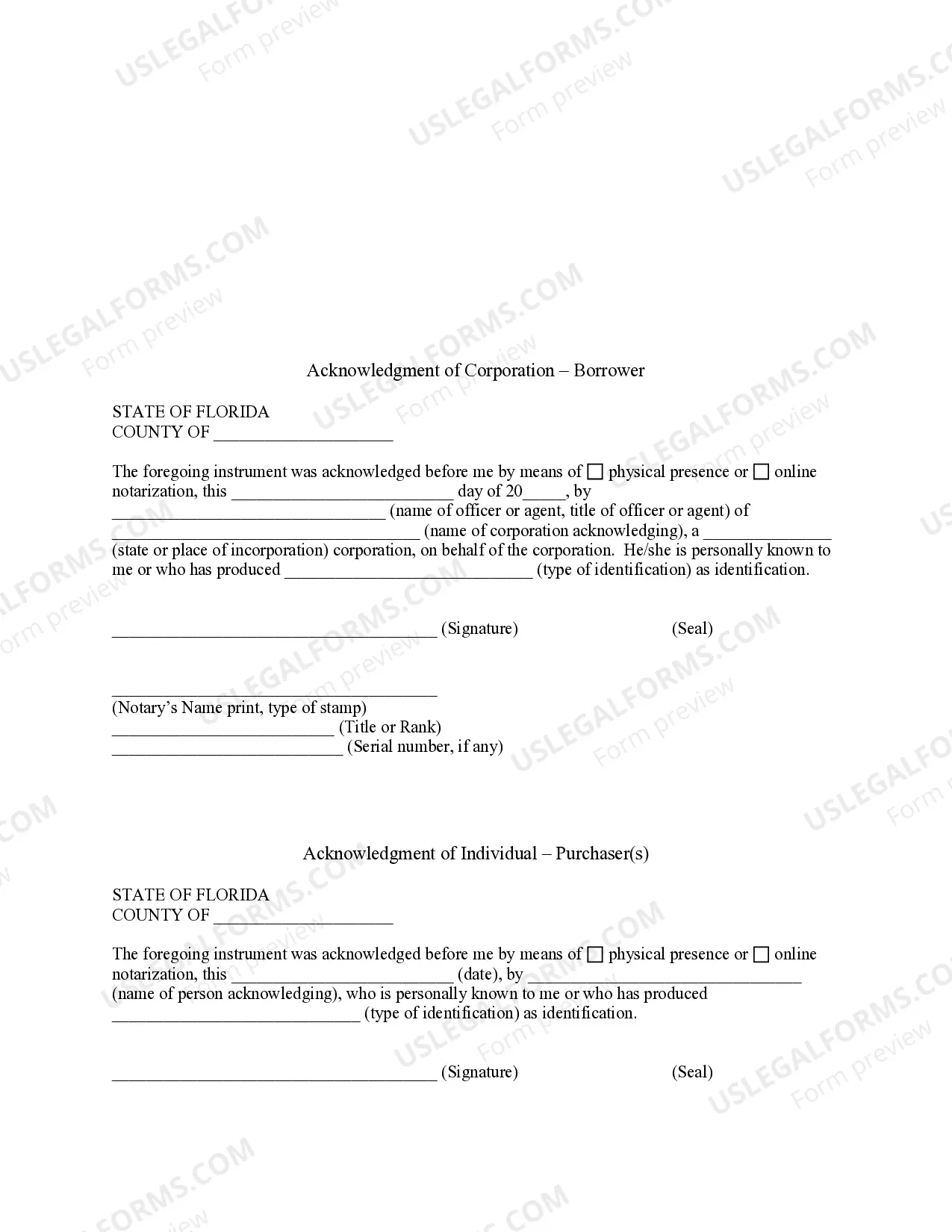

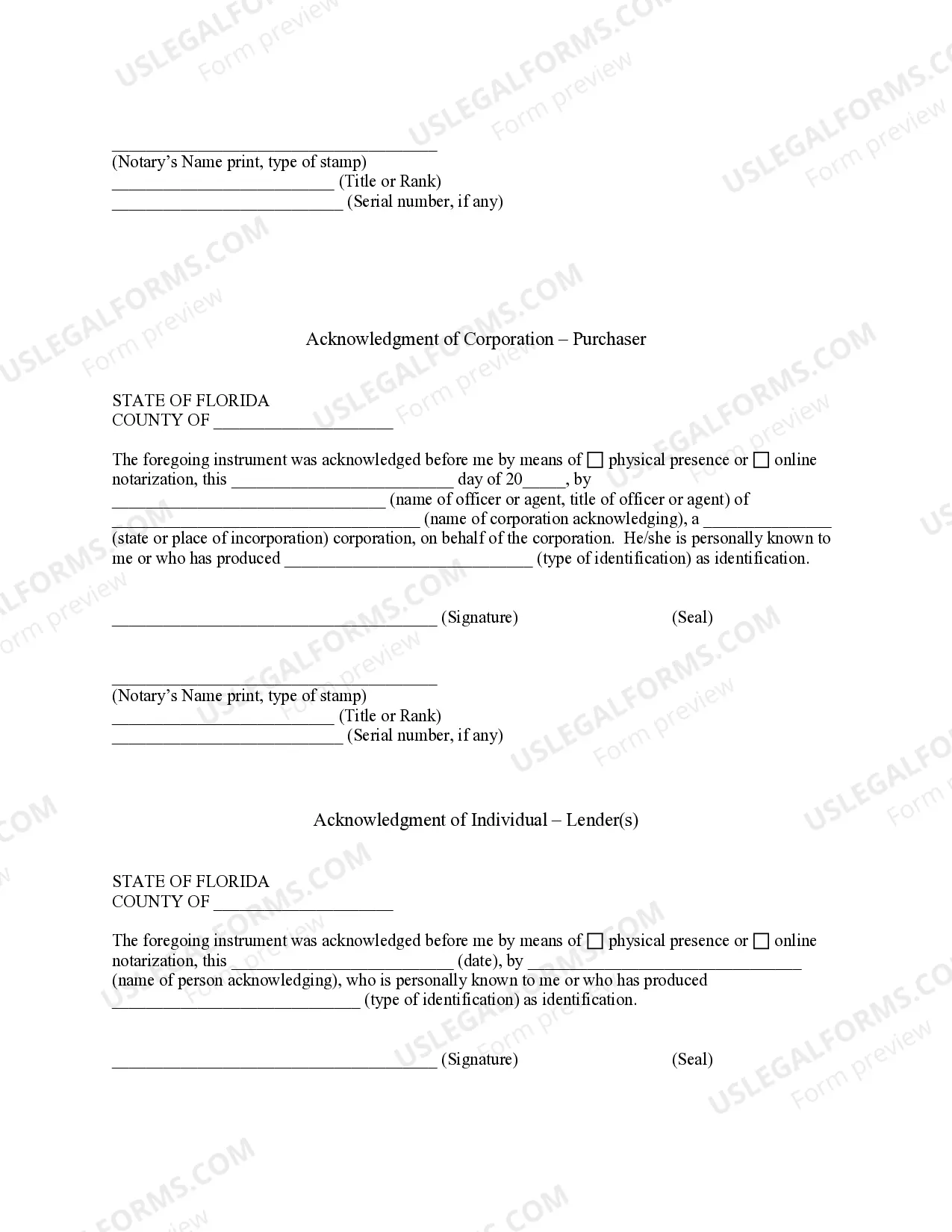

A Palm Beach Florida Assumption Agreement of Mortgage and Release of Original Mortgagors refers to a legal document used in real estate transactions when the existing mortgage on a property is assumed or transferred from the original mortgagor to a new borrower. This agreement outlines the terms and conditions of this transfer, releasing the original mortgagor from any further obligations or liabilities associated with the mortgage. In Palm Beach, Florida, there are different types of Assumption Agreements of Mortgage and Release of Original Mortgagors, namely: 1. Full Assumption: This occurs when a new borrower takes over the existing mortgage and becomes solely responsible for all loan repayments and other associated obligations. Through this agreement, the original mortgagor is released from any further responsibilities towards the mortgage. 2. Partial Assumption: In this case, a new borrower assumes a portion of the original mortgage while the remaining balance continues to be the responsibility of the original mortgagor. This agreement specifies the terms, conditions, and repayment responsibilities for both parties involved. 3. Subject-To Assumption: This type of assumption agreement allows a new borrower to take over the mortgage payments without formally assuming the debt. The original mortgagor remains liable for the loan, and the new borrower essentially takes over the property's ownership and management. This agreement often includes terms outlining the transfer of property title and potential risks associated with the existing mortgage. In all types of Assumption Agreements of Mortgage and Release of Original Mortgagors in Palm Beach, Florida, it is crucial to consult with legal professionals to ensure compliance with local, state, and federal laws. These agreements typically require thorough documentation, including the execution of new promissory notes, the transfer of title, and any necessary approvals from the existing lender. By utilizing a Palm Beach Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, borrowers and sellers can facilitate the transfer of properties while protecting the interests of all parties involved. It is essential to understand the specific terms of the assumption agreement, including the responsibility for mortgage repayments, implications on credit, and any limitations or restrictions related to the property.

Palm Beach Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Palm Beach Florida Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Take advantage of the US Legal Forms and obtain immediate access to any form template you require. Our useful platform with thousands of templates simplifies the way to find and get virtually any document sample you require. You are able to download, fill, and certify the Palm Beach Florida Assumption Agreement of Mortgage and Release of Original Mortgagors in just a couple of minutes instead of browsing the web for hours searching for the right template.

Using our collection is a wonderful strategy to raise the safety of your record submissions. Our experienced attorneys on a regular basis check all the records to make certain that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you obtain the Palm Beach Florida Assumption Agreement of Mortgage and Release of Original Mortgagors? If you have a profile, just log in to the account. The Download option will appear on all the documents you look at. In addition, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions listed below:

- Open the page with the template you require. Make sure that it is the template you were seeking: examine its title and description, and take take advantage of the Preview feature if it is available. Otherwise, use the Search field to find the needed one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Export the document. Pick the format to get the Palm Beach Florida Assumption Agreement of Mortgage and Release of Original Mortgagors and change and fill, or sign it for your needs.

US Legal Forms is one of the most significant and reliable form libraries on the web. We are always ready to help you in virtually any legal process, even if it is just downloading the Palm Beach Florida Assumption Agreement of Mortgage and Release of Original Mortgagors.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!