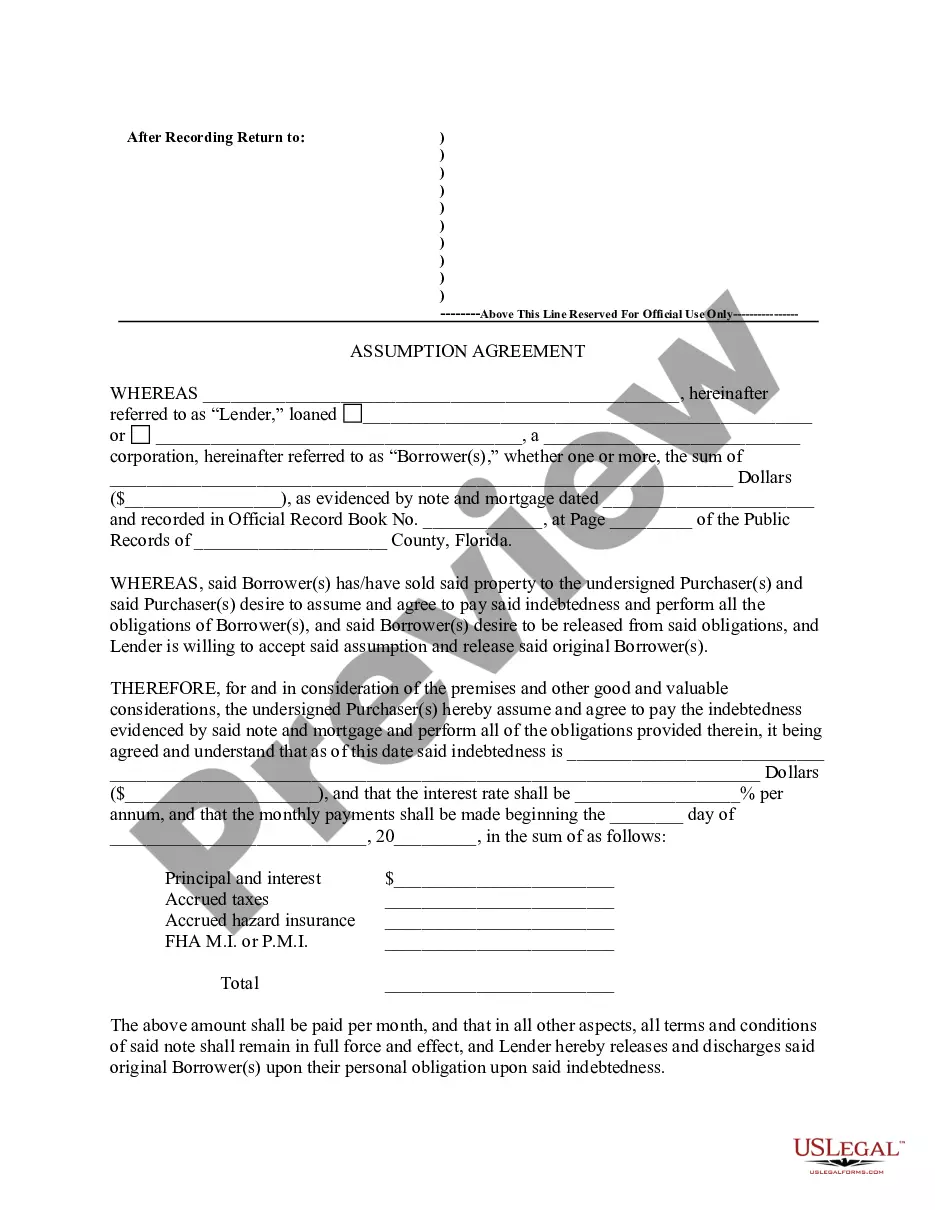

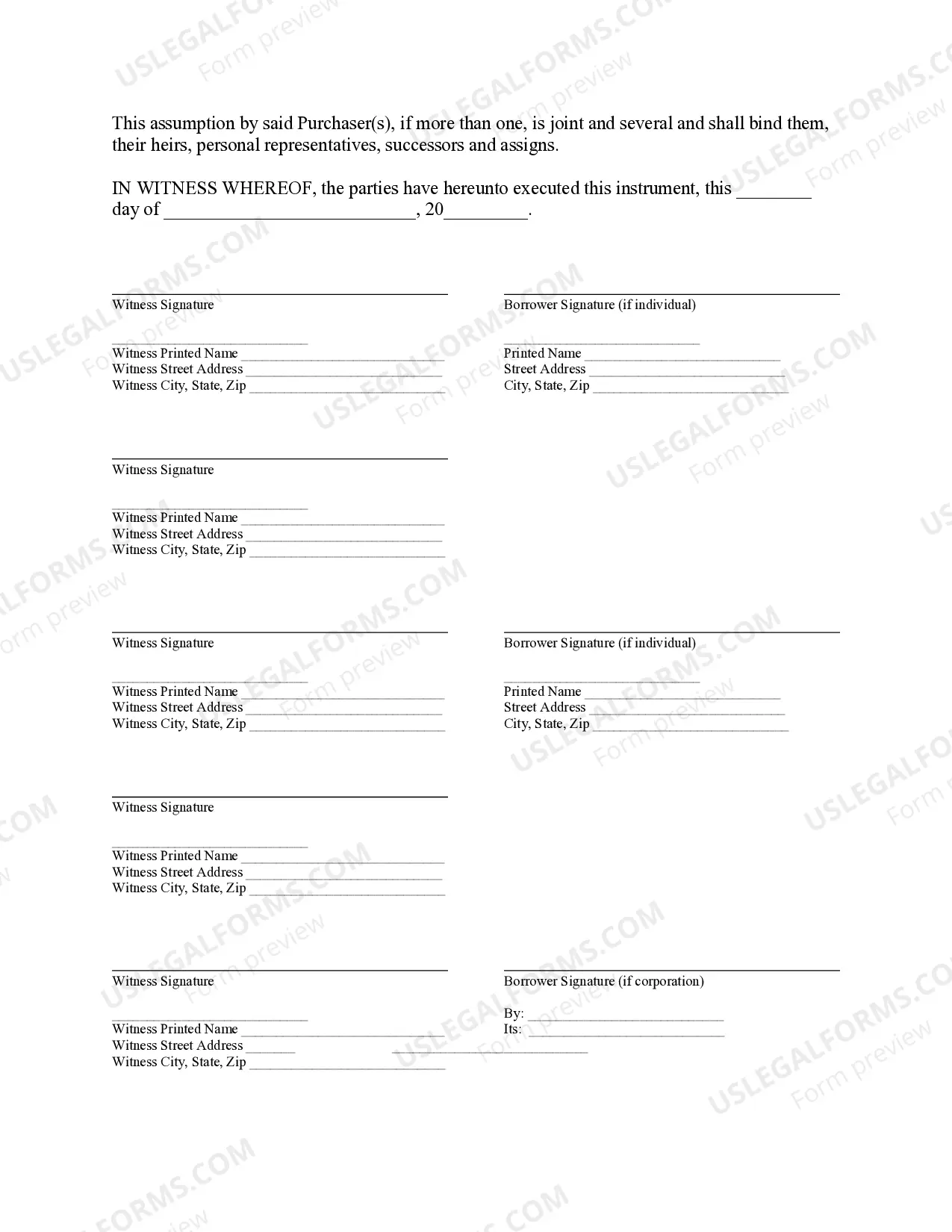

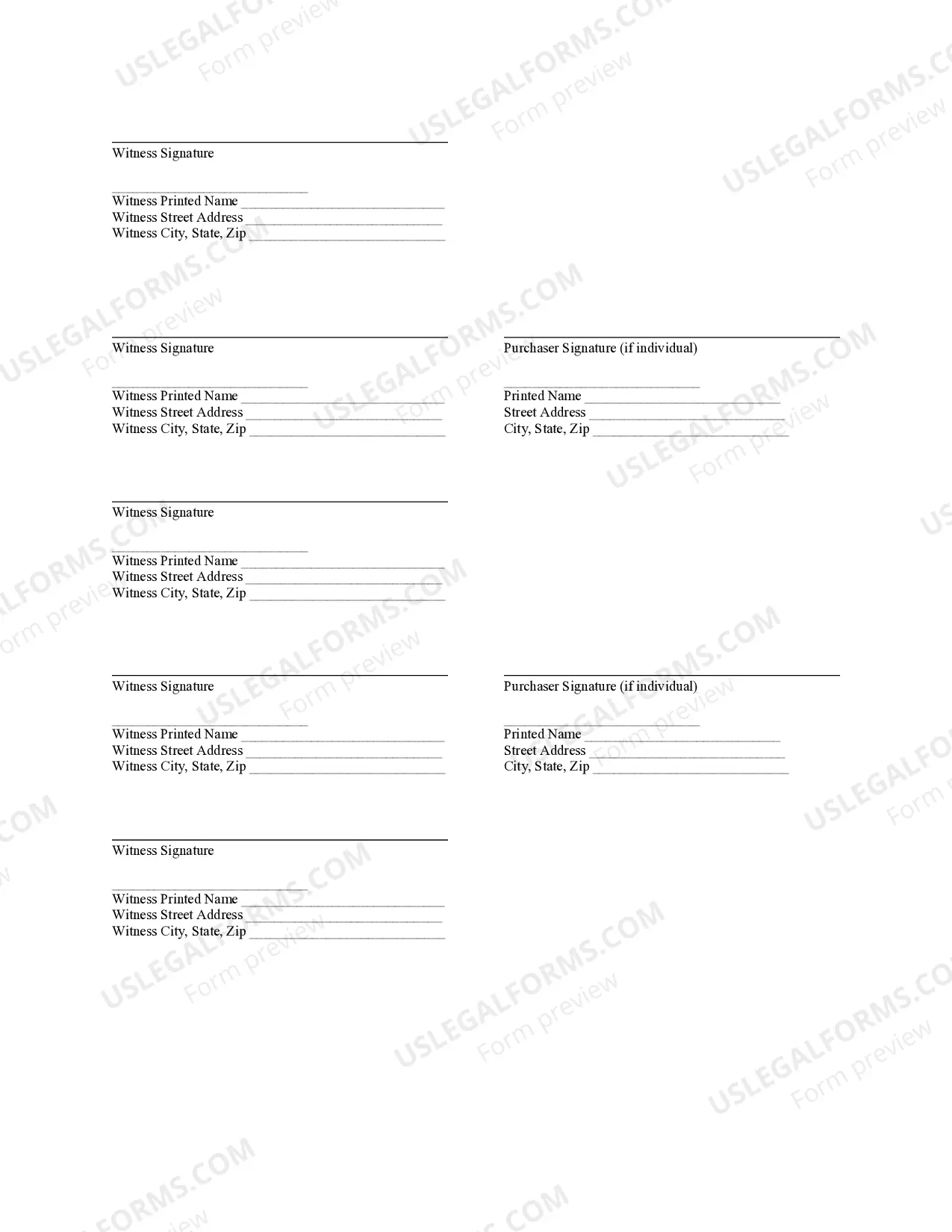

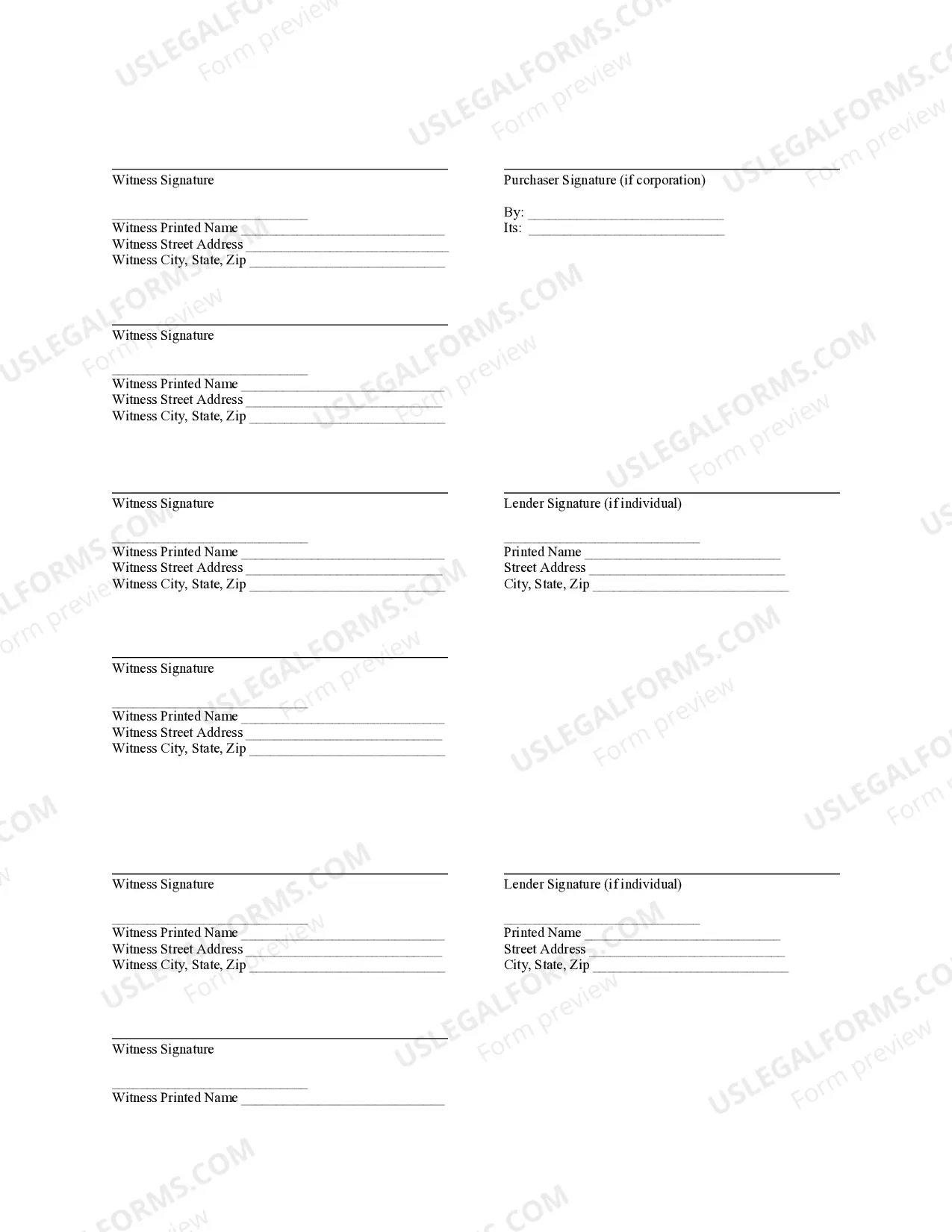

Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the process of transferring an existing mortgage and releasing the original mortgagors from their obligations. In this agreement, the responsibility of mortgage payments and other related obligations is shifted from the original mortgagors to a new party. There are several types of Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, each catering to specific circumstances. 1. Residential Assumption Agreement: This type of agreement is commonly used when a homeowner decides to sell their property, and the purchaser agrees to assume the mortgage. The original mortgagors are then released from their financial obligations, and the new owner becomes responsible for repaying the loan. 2. Commercial Assumption Agreement: In the case of commercial properties, such as office buildings or retail spaces, a commercial assumption agreement may be utilized. This occurs when a business or investor assumes the existing mortgage of a property they are acquiring, allowing the original mortgagors to be released from liability. 3. Assumption Agreement with Lender Approval: Sometimes, lenders may require their approval for an assumption agreement to be valid. In this type of agreement, the new party interested in assuming the mortgage must seek consent from the lender and go through a qualification process to ensure their financial stability. 4. Assumption Agreement without Lender Approval: In situations where the mortgage does not require lender approval for assumption, the parties involved can proceed directly with the agreement, releasing the original mortgagors and transferring the mortgage responsibility to the new party without involving the lender. In the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, key components are addressed, including: — Identification of the involved parties: The agreement clearly identifies the original mortgagors, the new party assuming the mortgage, and the lender. — Mortgage details: The original mortgage terms, including the outstanding balance, interest rate, and repayment schedule are outlined. — Assumption terms: The agreement specifies the terms and conditions of the assumption, such as the new party's responsibility for repayments, whether any down-payment is required, and any changes to the existing mortgage terms. — Release of original mortgagors: Once the assumption is complete, the agreement formalizes the release of the original mortgagors from all current and future obligations related to the mortgage. — Lender's consent (if applicable): If lender approval is required, the agreement may include a provision stating that the assumption is subject to the lender's consent and any additional conditions imposed by the lender. It's important to note that the terms and conditions of the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors may vary depending on the specific circumstances, the type of property involved, and the lender's requirements. It is advisable to consult with a qualified attorney or real estate professional when drafting or reviewing such agreements to ensure all legal considerations are properly addressed.

Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

State:

Florida

City:

Tallahassee

Control #:

FL-ED1014

Format:

Word;

Rich Text

Instant download

Description

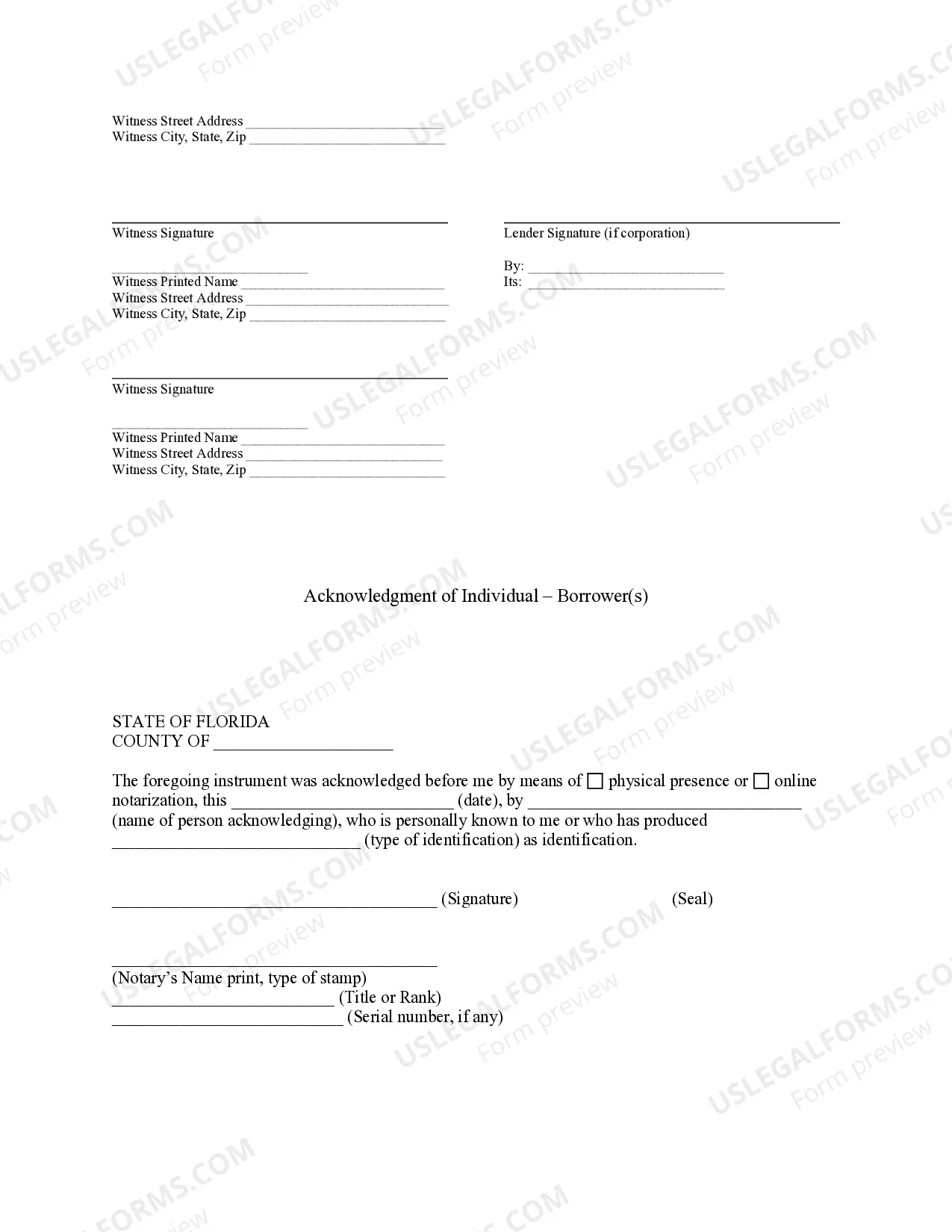

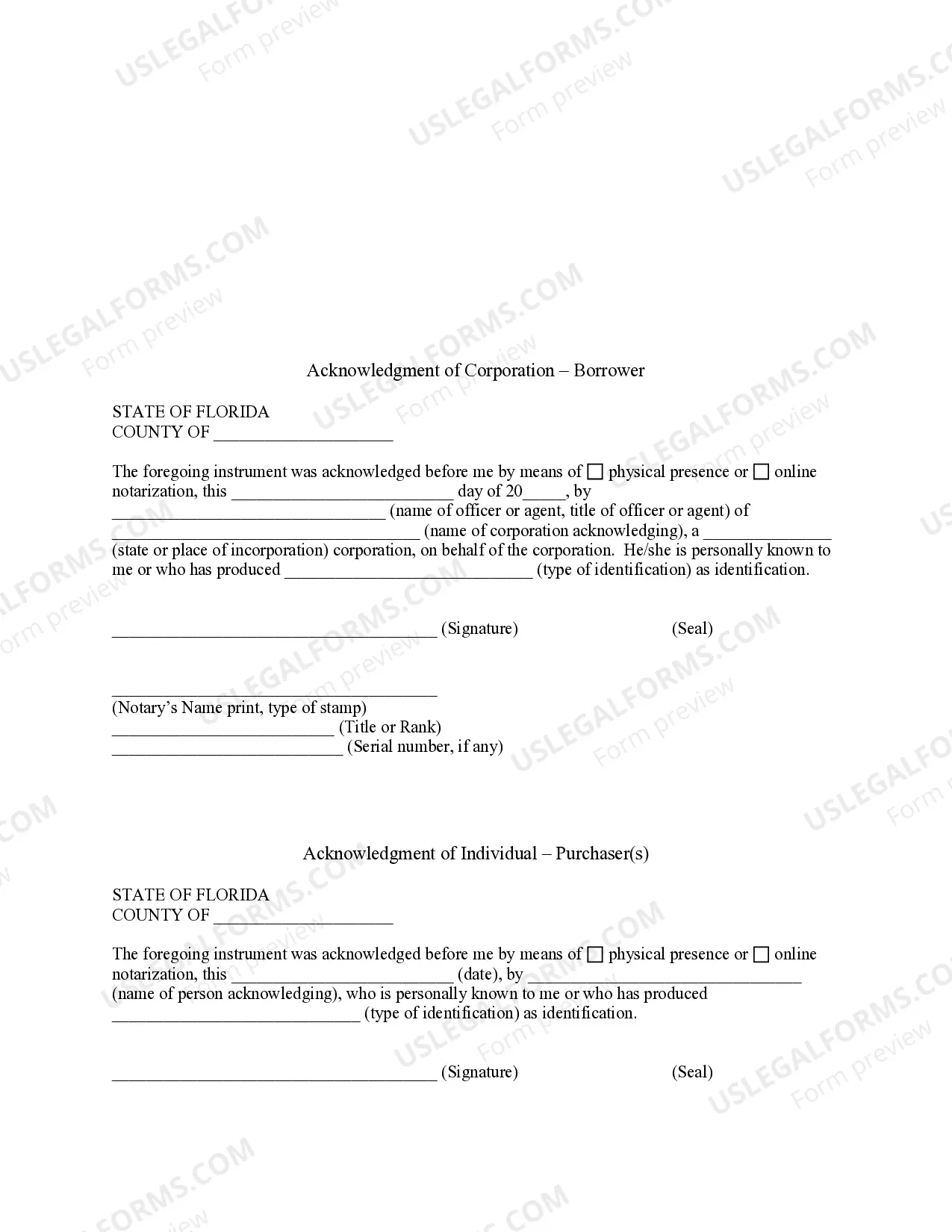

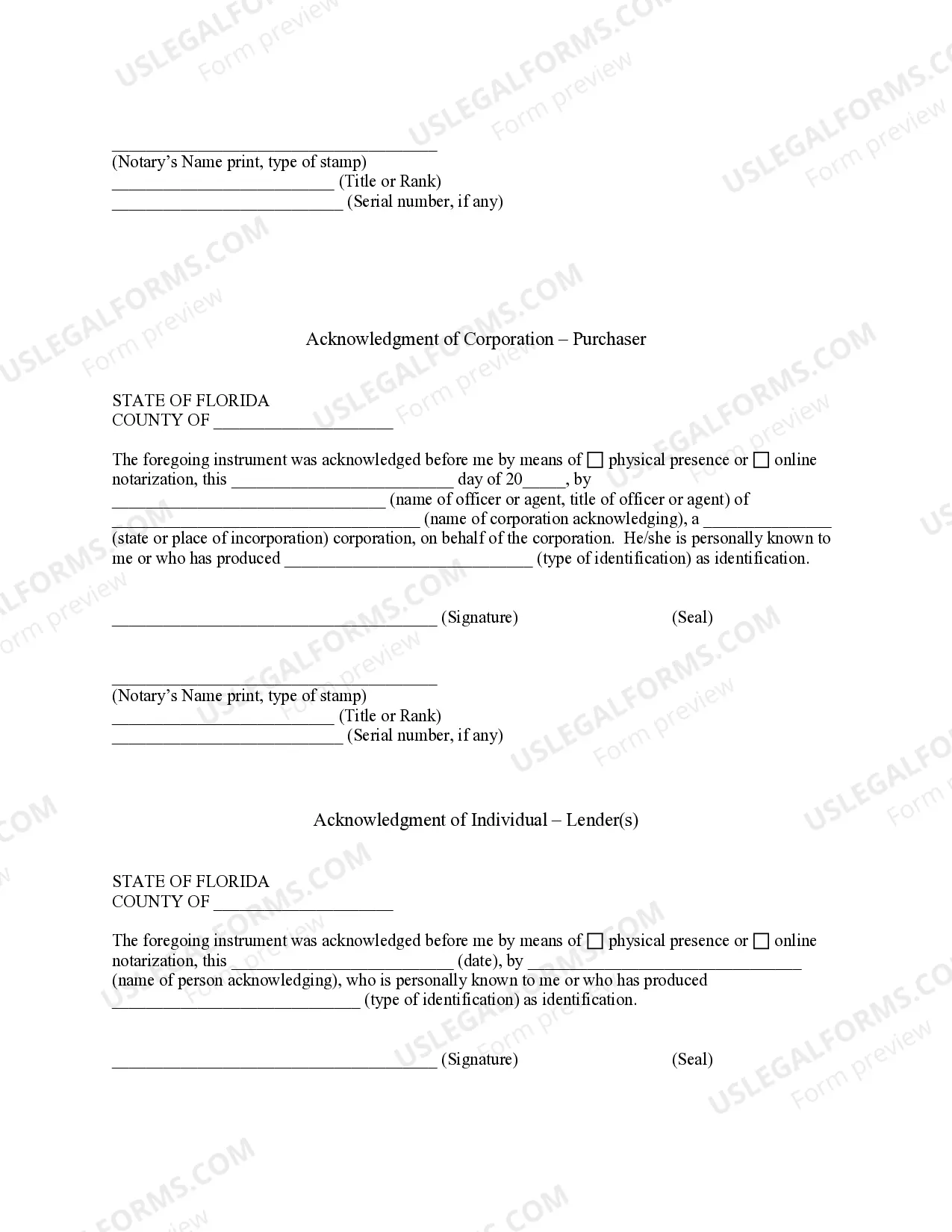

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that outlines the process of transferring an existing mortgage and releasing the original mortgagors from their obligations. In this agreement, the responsibility of mortgage payments and other related obligations is shifted from the original mortgagors to a new party. There are several types of Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, each catering to specific circumstances. 1. Residential Assumption Agreement: This type of agreement is commonly used when a homeowner decides to sell their property, and the purchaser agrees to assume the mortgage. The original mortgagors are then released from their financial obligations, and the new owner becomes responsible for repaying the loan. 2. Commercial Assumption Agreement: In the case of commercial properties, such as office buildings or retail spaces, a commercial assumption agreement may be utilized. This occurs when a business or investor assumes the existing mortgage of a property they are acquiring, allowing the original mortgagors to be released from liability. 3. Assumption Agreement with Lender Approval: Sometimes, lenders may require their approval for an assumption agreement to be valid. In this type of agreement, the new party interested in assuming the mortgage must seek consent from the lender and go through a qualification process to ensure their financial stability. 4. Assumption Agreement without Lender Approval: In situations where the mortgage does not require lender approval for assumption, the parties involved can proceed directly with the agreement, releasing the original mortgagors and transferring the mortgage responsibility to the new party without involving the lender. In the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, key components are addressed, including: — Identification of the involved parties: The agreement clearly identifies the original mortgagors, the new party assuming the mortgage, and the lender. — Mortgage details: The original mortgage terms, including the outstanding balance, interest rate, and repayment schedule are outlined. — Assumption terms: The agreement specifies the terms and conditions of the assumption, such as the new party's responsibility for repayments, whether any down-payment is required, and any changes to the existing mortgage terms. — Release of original mortgagors: Once the assumption is complete, the agreement formalizes the release of the original mortgagors from all current and future obligations related to the mortgage. — Lender's consent (if applicable): If lender approval is required, the agreement may include a provision stating that the assumption is subject to the lender's consent and any additional conditions imposed by the lender. It's important to note that the terms and conditions of the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors may vary depending on the specific circumstances, the type of property involved, and the lender's requirements. It is advisable to consult with a qualified attorney or real estate professional when drafting or reviewing such agreements to ensure all legal considerations are properly addressed.

Free preview

How to fill out Tallahassee Florida Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

If you’ve already utilized our service before, log in to your account and download the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!