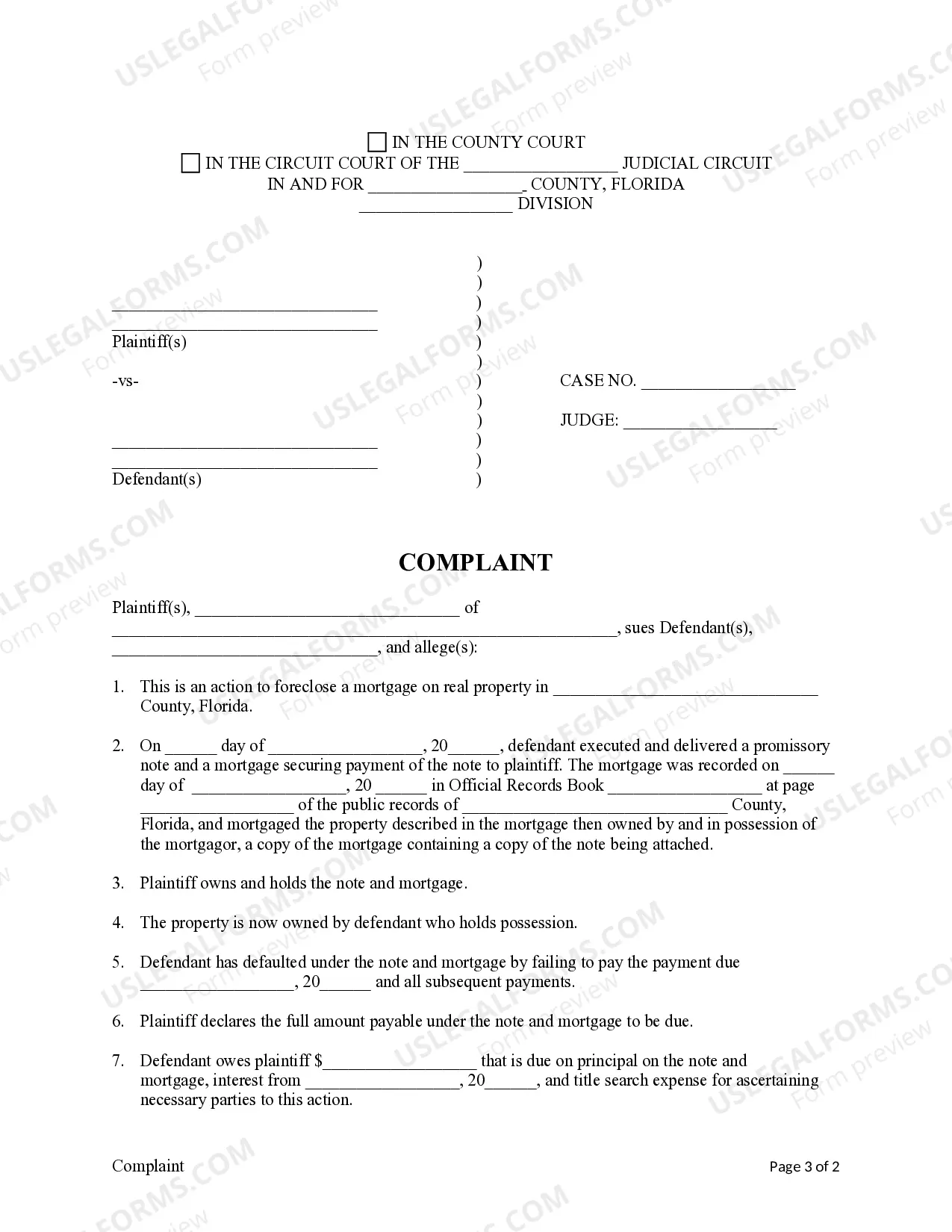

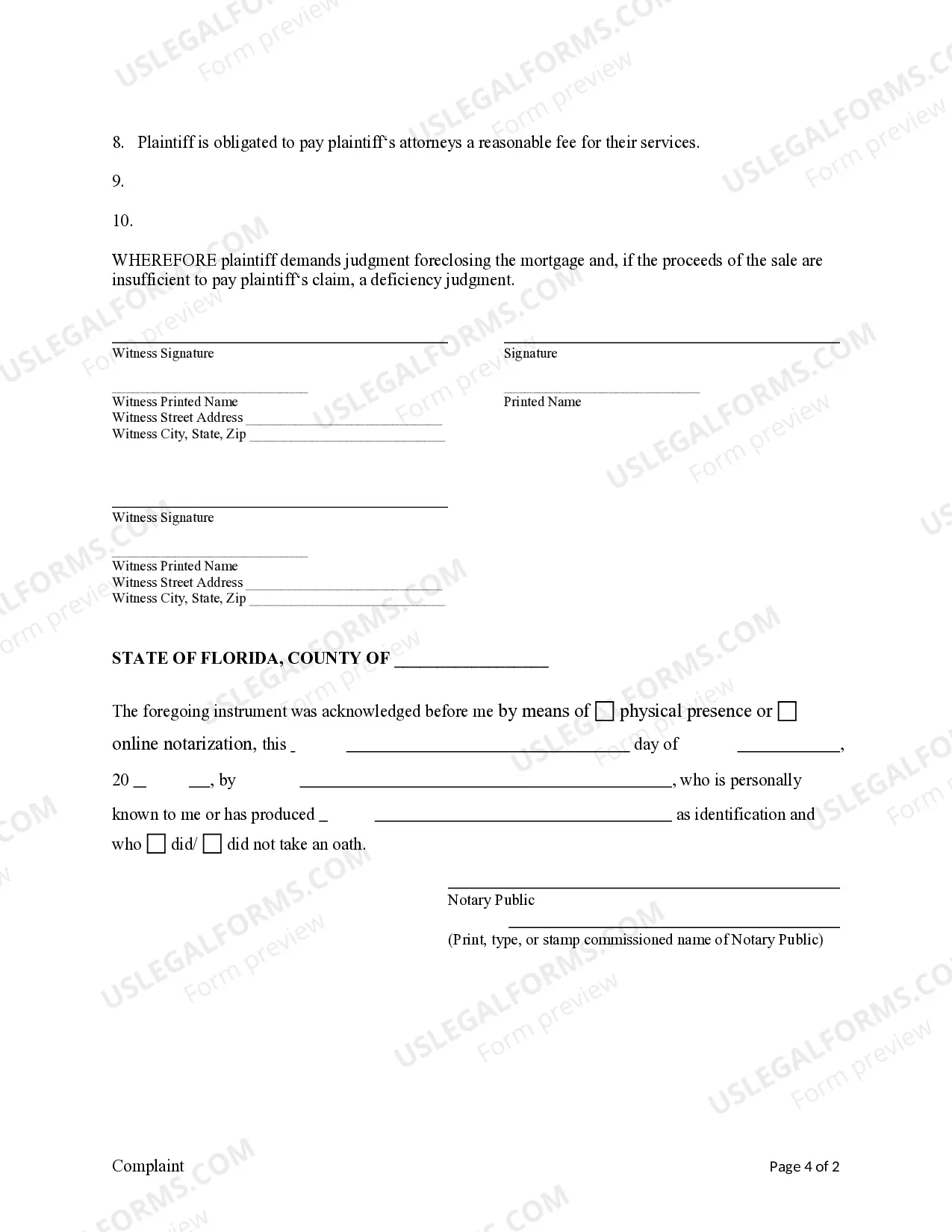

This is a verified complaint as provided for in Florida rules. It is used by a mortgage lender to foreclose on a property.

Fort Lauderdale Florida Complaint for Mortgage Foreclosure

Description

How to fill out Florida Complaint For Mortgage Foreclosure?

We consistently aim to reduce or evade legal repercussions when managing intricate legal or financial matters.

To achieve this, we seek legal counsel services that are often prohibitively expensive.

Nevertheless, not all legal issues are so intricately convoluted.

Many of them can be resolved by us independently.

Make use of US Legal Forms whenever you require to obtain and download the Fort Lauderdale Florida Complaint for Mortgage Foreclosure or any other document swiftly and securely.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our collection empowers you to manage your own affairs without the need for an attorney.

- We offer access to legal document templates that are not always readily available.

- Our templates cater to specific states and regions, greatly easing the search process.

Form popularity

FAQ

In Broward County, foreclosures, including those related to the Fort Lauderdale Florida Complaint for Mortgage Foreclosure, are handled by specific judges assigned to the circuit court. These judges specialize in handling foreclosure cases, ensuring that each situation receives the appropriate legal attention. For individuals seeking assistance, understanding which judge oversees a case can sometimes clarify the process. For comprehensive guidance, you can explore resources on platforms like US Legal Forms, which provide valuable insights and document templates to help navigate these complex proceedings.

Mortgage lenders in Florida are regulated by the Florida Office of Financial Regulation. This office oversees the licensing and operational standards of lenders to protect consumers. Being informed about regulatory bodies can be beneficial while addressing your Fort Lauderdale Florida Complaint for Mortgage Foreclosure.

To file a complaint with the Florida Real Estate Commission, you must complete a complaint form detailing your concerns. This form can typically be found on their official website. By providing clear information regarding the incident, you will enhance their ability to address your concerns, particularly related to your experience with a Fort Lauderdale Florida Complaint for Mortgage Foreclosure.

A notice of intent to foreclose is a formal notification sent by the lender to the borrower, signaling their intention to initiate foreclosure proceedings. This notice outlines the reasons for the action and the next steps the borrower must take. Understanding this notice is vital when dealing with a Fort Lauderdale Florida Complaint for Mortgage Foreclosure.

Foreclosure in Florida can take anywhere from a few months to over a year, depending on various factors like court schedules and responses from the borrower. Delays may occur if the borrower contests the foreclosure. Being aware of the expected timeline can help you prepare for your Fort Lauderdale Florida Complaint for Mortgage Foreclosure.

The foreclosure process in Florida involves several key steps, starting with the filing of a complaint. Following this, the court issues a summons to the borrower, allowing them time to respond. If the case proceeds, the court may issue a final judgment, resulting in a public auction of the property. Each step is crucial for your Fort Lauderdale Florida Complaint for Mortgage Foreclosure.

To foreclose on a mortgage in Florida, the lender must file a complaint in court. This process includes serving the borrower with a summons and allowing them an opportunity to respond. Once the matter is resolved, the courts may grant a final judgment, leading to a sale of the property, particularly relevant to your Fort Lauderdale Florida Complaint for Mortgage Foreclosure.

The Tenant Foreclosure Protection Act safeguards tenants who are living in properties undergoing foreclosure. It ensures that tenants receive notice and have specific rights during the process. Understanding how this act applies to your situation can help you navigate your Fort Lauderdale Florida Complaint for Mortgage Foreclosure effectively.

To file for foreclosure in Florida, you need to begin by preparing a complaint for mortgage foreclosure. This formal document outlines your case and must be submitted to the local court. Ensure you provide all necessary supporting documents, including the mortgage note and any payment history, to strengthen your Fort Lauderdale Florida Complaint for Mortgage Foreclosure.

Mortgage lenders in Florida are overseen by both state and federal regulatory bodies. The Florida Office of Financial Regulation plays a key role at the state level, while entities like the Consumer Financial Protection Bureau provide oversight at the federal level. If you find yourself needing to file a Fort Lauderdale Florida Complaint for Mortgage Foreclosure, these agencies are equipped to assist you in navigating your concerns.