This is a verified complaint as provided for in Florida rules. It is used by a mortgage lender to foreclose on a property.

Tallahassee Florida Complaint for Mortgage Foreclosure

Description

How to fill out Florida Complaint For Mortgage Foreclosure?

If you have previously engaged our service, Log In to your account and store the Tallahassee Florida Complaint for Mortgage Foreclosure on your device by selecting the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have indefinite access to every document you have purchased: you can locate it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or business needs!

- Confirm you’ve located the correct document. Review the description and use the Preview option, if available, to verify it satisfies your requirements. If it doesn’t suit you, make use of the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Tallahassee Florida Complaint for Mortgage Foreclosure. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or use professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

If you are facing wrongful foreclosure in Florida, it is crucial to seek assistance promptly. You can contact a local attorney who specializes in mortgage foreclosure issues. Additionally, organizations like JustAnswer provide valuable resources to assist you in navigating your situation. Remember, addressing a Tallahassee Florida Complaint for Mortgage Foreclosure requires knowledge of local laws, so getting expert help is essential.

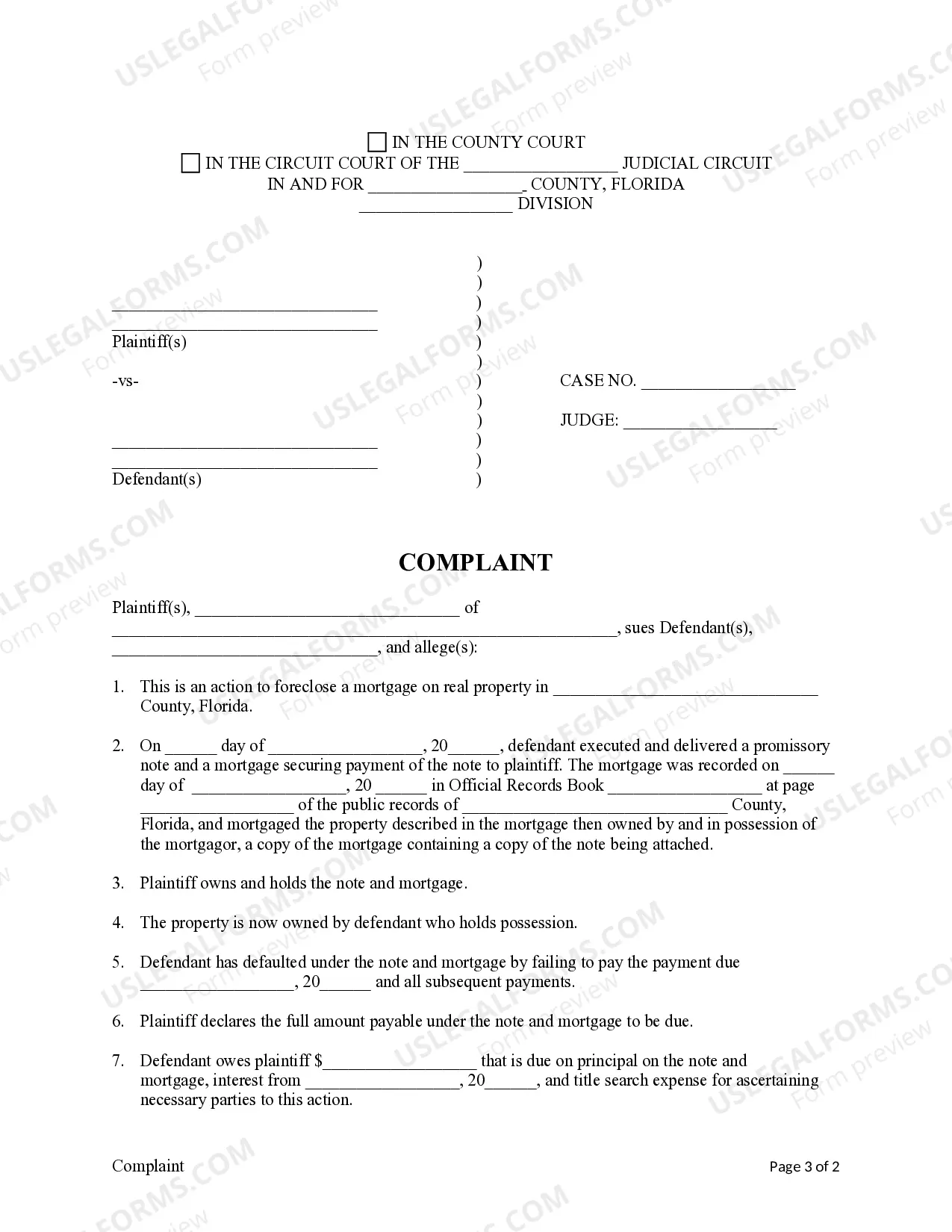

In Florida, foreclosures are typically handled by the Circuit Court. Each county, including those in Tallahassee, has its own Circuit Court designated to manage these cases. If you're filing a Tallahassee Florida Complaint for Mortgage Foreclosure, you'll need to submit your complaint to the appropriate Circuit Court in your county. Understanding this can help streamline your process and ensure you follow the correct procedures.

The Tenant Foreclosure Protection Act in Florida provides certain protections for tenants living in properties undergoing foreclosure. This law ensures that tenants receive notice of foreclosure actions and outlines their rights during the process. Being aware of these protections is crucial for anyone involved in a Tallahassee Florida Complaint for Mortgage Foreclosure to safeguard their living situation.

The foreclosure process in Florida involves several key steps, starting with the lender filing a complaint and the court issuing a summons. Next, the borrower can respond to the complaint, potentially leading to mediation. Finally, if the case proceeds, the court may issue a judgment of foreclosure, culminating in a public auction. Knowing these steps helps you navigate your Tallahassee Florida Complaint for Mortgage Foreclosure more effectively.

In Florida, the statute of limitations for mortgage foreclosure is five years from the date of the borrower's default. After this period, lenders can lose the right to foreclose on the property. It’s important to keep this timeframe in mind when considering a Tallahassee Florida Complaint for Mortgage Foreclosure, as it can significantly affect your case.

A notice of intent to foreclose is a document that a lender sends to the borrower before initiating foreclosure proceedings. This notice informs the borrower of the default and provides a specific timeframe to rectify the situation. Understanding this notice is vital when preparing a Tallahassee Florida Complaint for Mortgage Foreclosure.

To file a complaint against a mortgage company in Florida, start by gathering your documentation, including evidence of misconduct or violations. You can then submit your complaint to the Florida Department of Financial Services or the appropriate regulatory agency. For an organized approach, consider using resources like USLegalForms to guide you in creating your Tallahassee Florida Complaint for Mortgage Foreclosure.

To file a Tallahassee Florida Complaint for Mortgage Foreclosure, you need to include essential documents such as the original mortgage agreement, proof of default, and the promissory note. Additionally, you should provide documentation that verifies the property is under mortgage. Make sure to follow the local court rules, as they can vary by jurisdiction.