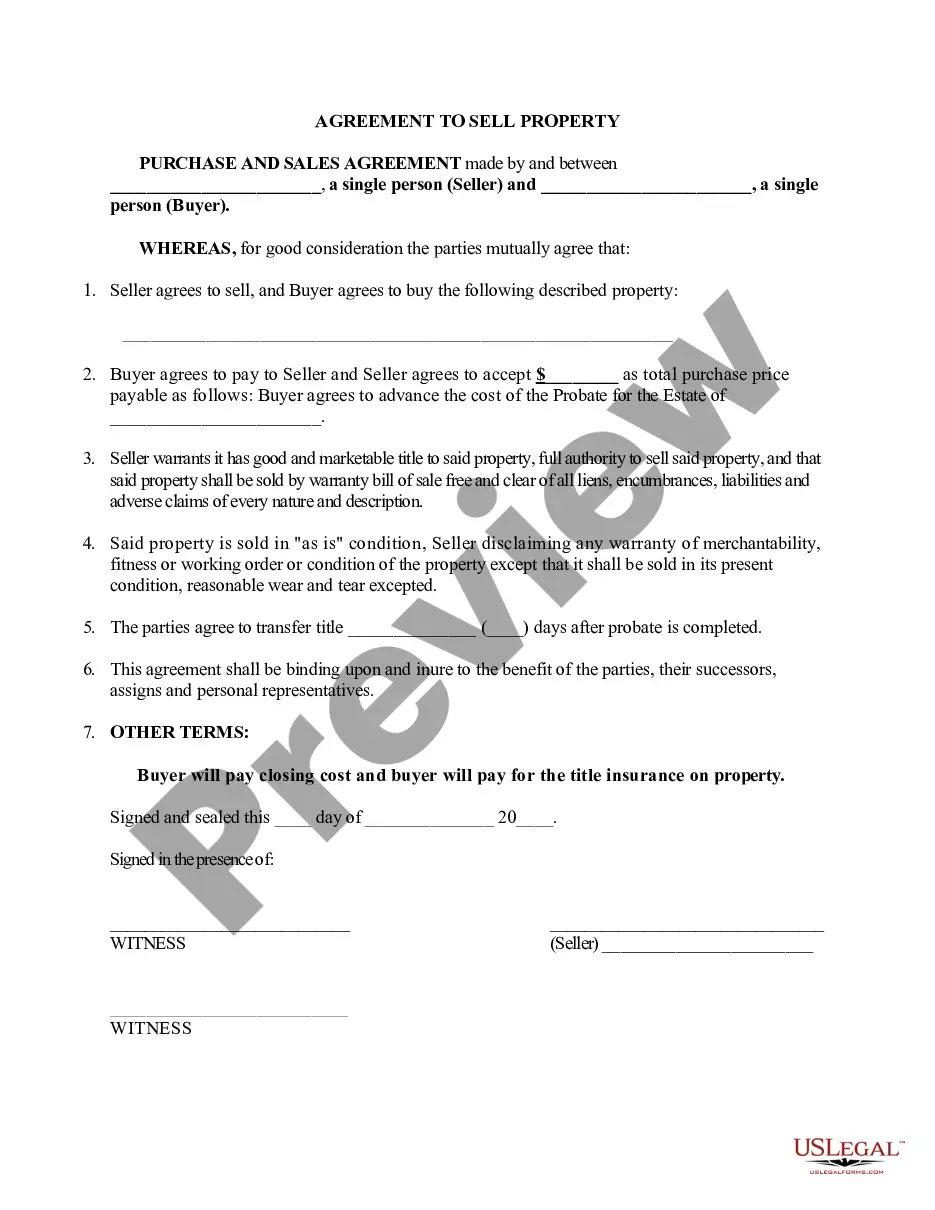

The Miramar Florida Agreement to Sell Property is a legally binding document that outlines the terms and conditions for the sale of a property in the city of Miramar, Florida. This agreement is crucial for both the seller and the buyer as it protects their rights and interests throughout the transaction process. To give you a comprehensive understanding, let's delve into the key components of a typical Miramar Florida Agreement to Sell Property: 1. Parties Involved: The agreement identifies the parties involved in the transaction, namely the seller (current property owner) and the buyer (prospective purchaser). It includes their legal names, addresses, and contact information. 2. Property Details: This section outlines all relevant details about the property being sold, such as its address, legal description, and any specific characteristics or amenities. 3. Purchase Price and Payment Terms: The agreement specifies the agreed-upon purchase price for the property and the method of payment. It may detail whether the payment will be made in cash, through financing, or a combination of both. Additionally, it may outline any specific terms for the down payment and the schedule for future payments. 4. Closing Date and Contingencies: The agreement states the anticipated closing date, which is the date when the ownership of the property is transferred from the seller to the buyer. It may also include contingency clauses, such as the buyer's ability to secure financing or conduct a successful inspection before the closing date. 5. Disclosures and Representations: Both parties are required to disclose any pertinent information about the property, such as known defects or legal issues. This section ensures transparency and protects both parties from future disputes. 6. Title Examination and Insurance: The agreement may specify that the seller must provide a clear and marketable title to the property, free from any liens or encumbrances. It may also outline the buyer's option to obtain title insurance, which protects against any unforeseen title defects. Types of Miramar Florida Agreement to Sell Property: While there may not be specific types of Miramar Florida Agreement to Sell Property, different variations can exist based on factors such as the property's intended use (residential, commercial, etc.), whether the property is part of a condominium or homeowners association, or if the transaction involves additional complexities such as seller financing or lease-purchase arrangements. However, regardless of the specific type, the core elements mentioned above will typically be present in any agreement to sell property in Miramar, Florida. In summary, the Miramar Florida Agreement to Sell Property is a vital legal document that sets forth the terms and conditions for the sale of a property in Miramar, Florida. It protects the rights and interests of both the seller and the buyer and ensures a smooth and transparent transaction process.

Miramar Florida Agreement to Sell Property

Description

How to fill out Miramar Florida Agreement To Sell Property?

Do you require a reliable and economical provider of legal forms to obtain the Miramar Florida Agreement to Sell Property? US Legal Forms is your ideal solution.

Whether you need a simple contract to establish guidelines for living together with your spouse or a set of documents to facilitate your divorce process in court, we've got you covered. Our site features over 85,000 current legal document templates for personal and business use. All templates we provide are not standard and tailored to meet the demands of specific states and regions.

To retrieve the document, you must Log In to your account, locate the necessary template, and click the Download button beside it. Remember that you can access your previously acquired document templates at any time from the My documents section.

Is this your first visit to our platform? No problem. You can create an account with ease, but beforehand, ensure you do the following.

Now you can set up your account. Then choose your subscription plan and proceed to payment. After the payment is finalized, download the Miramar Florida Agreement to Sell Property in any available format. You can return to the site at any time and re-download the document without any cost.

Acquiring current legal forms has never been easier. Try US Legal Forms today, and say goodbye to spending your precious time researching legal documents online.

- Determine if the Miramar Florida Agreement to Sell Property aligns with the laws of your state and locality.

- Review the form’s description (if present) to understand who and what the document is designed for.

- Re-initiate the search if the template does not fit your particular circumstances.

Form popularity

FAQ

Selling your house in Florida without a realtor is entirely feasible. This allows for greater control over the sales process and eliminates commission costs. Using the Miramar Florida Agreement to Sell Property can simplify your tasks, guiding you through legal requirements. This approach enables you to effectively manage negotiations and secure a satisfactory deal.

Yes, you can sell property in Florida without a Realtor. Many homeowners choose to take on this responsibility to save on commissions. Utilizing resources like the Miramar Florida Agreement to Sell Property can help streamline the process. It provides a structured format to deal with legalities, ensuring that your sale is efficient and compliant.

In Florida, selling real estate typically requires a license. However, unlicensed persons can occasionally sell their own property without a license. To navigate this process effectively, they can use the Miramar Florida Agreement to Sell Property, which ensures that all legal requirements are met. By having a solid agreement, individuals can protect themselves while selling their properties.

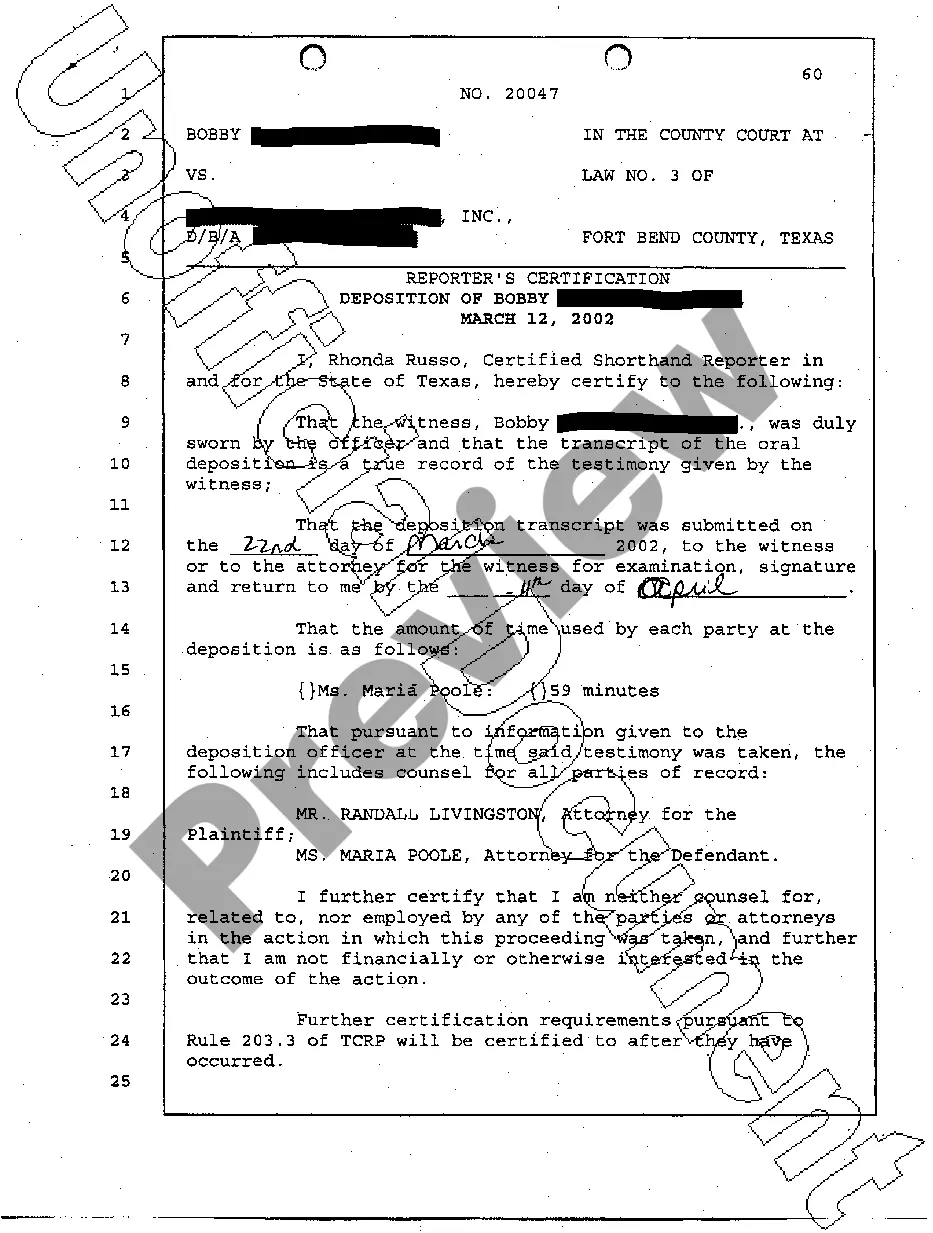

Yes, a personal representative can sell property in Florida. This individual is often appointed through a will or by the court in the case of an intestate estate. It's important to follow the guidelines set by the court and ensure compliance with the Miramar Florida Agreement to Sell Property. By using such an agreement, the representative can facilitate a smoother transaction, protecting the interests of the estate.

You do not need a lawyer to sell property in Florida, but having one can provide peace of mind. A legal professional can assist you in drafting the Miramar Florida Agreement to Sell Property and navigating any complex legalities. Without their guidance, you may encounter challenges that could delay your sale.

In Florida, real estate contracts can be prepared by a licensed attorney or a real estate agent. If you are managing your sale independently, you will be responsible for drafting the Miramar Florida Agreement to Sell Property. Using platforms like US Legal Forms can simplify this process, offering customizable templates that meet Florida's legal requirements.

When selling your house without a realtor, you will need several important documents, including a property deed and the Miramar Florida Agreement to Sell Property. You may also require a title search report and any disclosures mandated by law. Collecting all necessary paperwork ahead of time will streamline your selling process.

To sell your property in Florida without a realtor, you can list it yourself using online platforms or local classifieds. Additionally, preparing an effective Miramar Florida Agreement to Sell Property and ensuring you comply with all local regulations is vital. By taking this approach, you can save on commission fees and have full control over the sale.

While it is not legally required to hire an attorney to sell your house in Florida, it is highly recommended. An attorney can provide valuable guidance throughout the process and ensure the Miramar Florida Agreement to Sell Property is correctly drafted. Their expertise can help you avoid common pitfalls and legal complications.

Yes, sellers in Florida typically incur closing costs when completing the sale of their property. These costs can include title insurance, transfer taxes, and settlement fees. When preparing your Miramar Florida Agreement to Sell Property, it is essential to factor in these expenses so you can plan your finances appropriately.