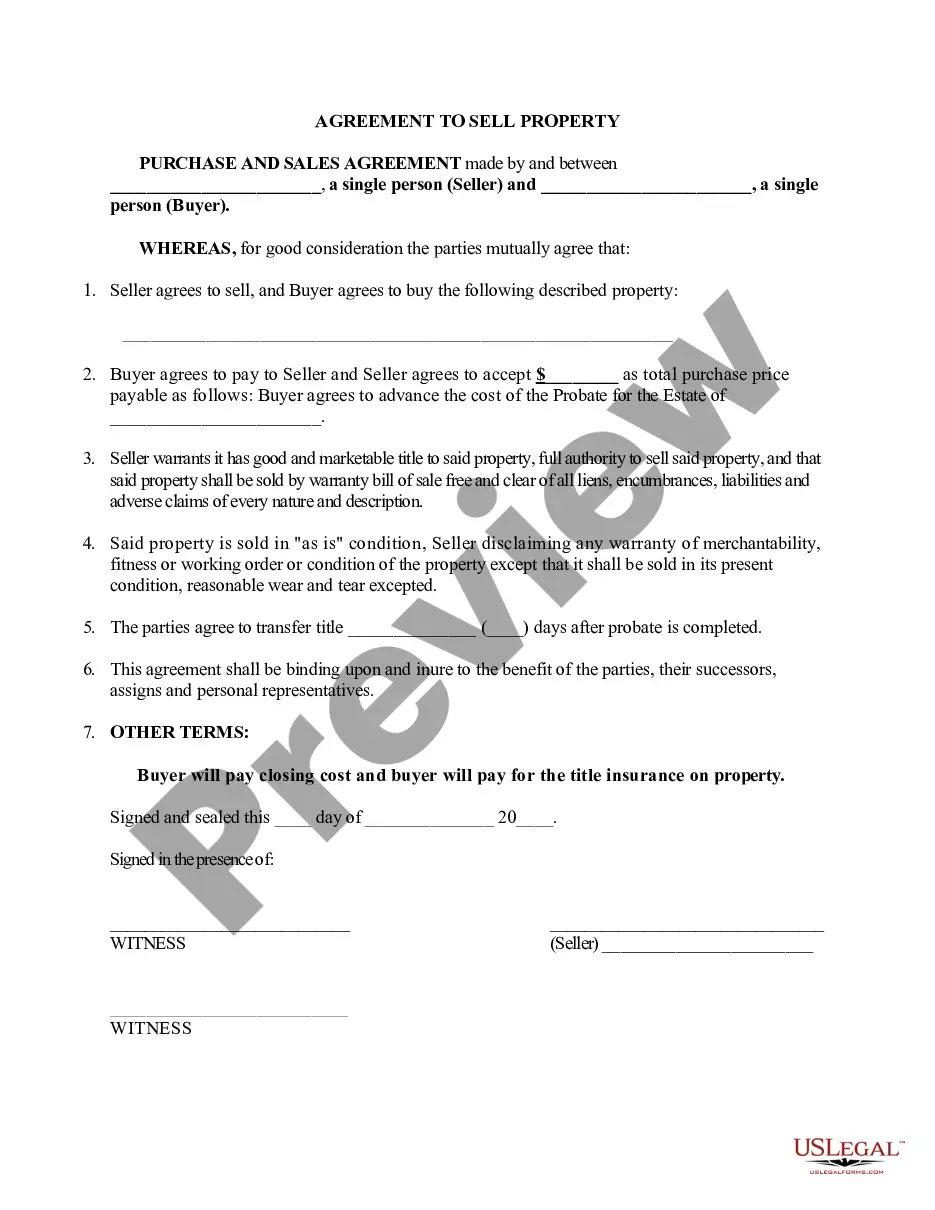

The Pompano Beach Florida Agreement to Sell Property is a legal document that outlines the terms and conditions of a property sale transaction in Pompano Beach, Florida. It serves as a legally binding agreement between the seller and the buyer, establishing their rights, responsibilities, and obligations throughout the sale process. This agreement typically includes essential details such as the full names and addresses of both parties involved, the description and address of the property being sold, the purchase price, and the deposit amount. Additionally, it outlines the payment terms, financing arrangements, and any contingencies that might be included, such as property inspections or mortgage approvals. There are a few different types of Pompano Beach Florida Agreements to Sell Property, each varying based on the specific circumstances of the sale: 1. Standard Agreement to Sell Property: This is the most common type of agreement used for regular property sales. It covers all the essential aspects of the transaction, ensuring clarity and protection for both parties. 2. Agreement to Sell Property with Financing: This type of agreement is applicable when the buyer requires financing to purchase the property. It includes additional clauses and details regarding mortgage arrangements, down payments, interest rates, and repayment terms. 3. Agreement to Sell Property with Contingencies: This type of agreement is utilized when certain conditions must be met for the sale to proceed. These conditions can include the satisfactory completion of property inspections, obtaining necessary permits, or the seller securing suitable housing before moving out. 4. Agreement to Sell Property for Cash: In cases where the buyer plans to purchase the property outright with cash, this type of agreement is employed. It typically skips the financing and mortgage-related clauses found in other agreements. 5. Agreement to Sell Property with Seller Financing: This type of agreement is used when the seller provides financing to the buyer, acting as the mortgage holder. The terms of this agreement include the interest rate, payment schedule, and consequences of default. It is essential to consult with a real estate attorney or a qualified professional to ensure that the Agreement to Sell Property complies with local laws, regulations, and specific requirements in Pompano Beach, Florida. This document safeguards both parties involved, helping facilitate a smooth and legally sound property sale transaction.

Pompano Beach Florida Agreement to Sell Property

Description

How to fill out Pompano Beach Florida Agreement To Sell Property?

Are you looking for a reliable and inexpensive legal forms supplier to get the Pompano Beach Florida Agreement to Sell Property? US Legal Forms is your go-to solution.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Pompano Beach Florida Agreement to Sell Property conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the form is good for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Pompano Beach Florida Agreement to Sell Property in any provided file format. You can return to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal paperwork online once and for all.