Broward Affidavit of No Florida Estate Tax Due is a legal document that individuals or representatives of an estate in Broward County, Florida may need to submit in order to prove that no estate tax is due on the property they are handling. This affidavit serves as a declaration to the Broward County Property Appraiser's Office that the estate in question does not owe any Florida estate tax. The Broward Affidavit of No Florida Estate Tax Due is applicable when the total value of the decedent's estate falls below the required threshold for estate taxation in Florida. In this case, it is important to understand the specific types of affidavits that may be necessary, depending on the circumstances: 1. Broward Affidavit of No Florida Estate Tax Due for Intestate (No Will) Estates: — This affidavit is utilized when the deceased person had no valid will during their lifetime, and the estate administration process is guided by Florida's intestate succession laws. 2. Broward Affidavit of No Florida Estate Tax Due for Testate (With Will) Estates: — This affidavit is relevant when the decedent had a legally recognized will at the time of their death, which outlines how their assets and property should be distributed. 3. Broward Affidavit of No Florida Estate Tax Due for Small Estates: — In certain situations, estates with a lower total value, often referred to as "small estates," may qualify for simplified probate proceedings. This affidavit is used to declare that no estate tax is owed on such small estates. It is important to note that the specific requirements and procedures for completing and filing the Broward Affidavit of No Florida Estate Tax Due may vary, depending on the circumstances of the estate and the rules and regulations set by the Broward County Property Appraiser's Office. In summary, the Broward Affidavit of No Florida Estate Tax Due is a crucial document that helps estate representatives affirm that no estate tax is owed on the properties they are managing. It is essential to understand the specific type of affidavit required, whether it pertains to intestate or testate estates, as well as the threshold for qualifying as a small estate.

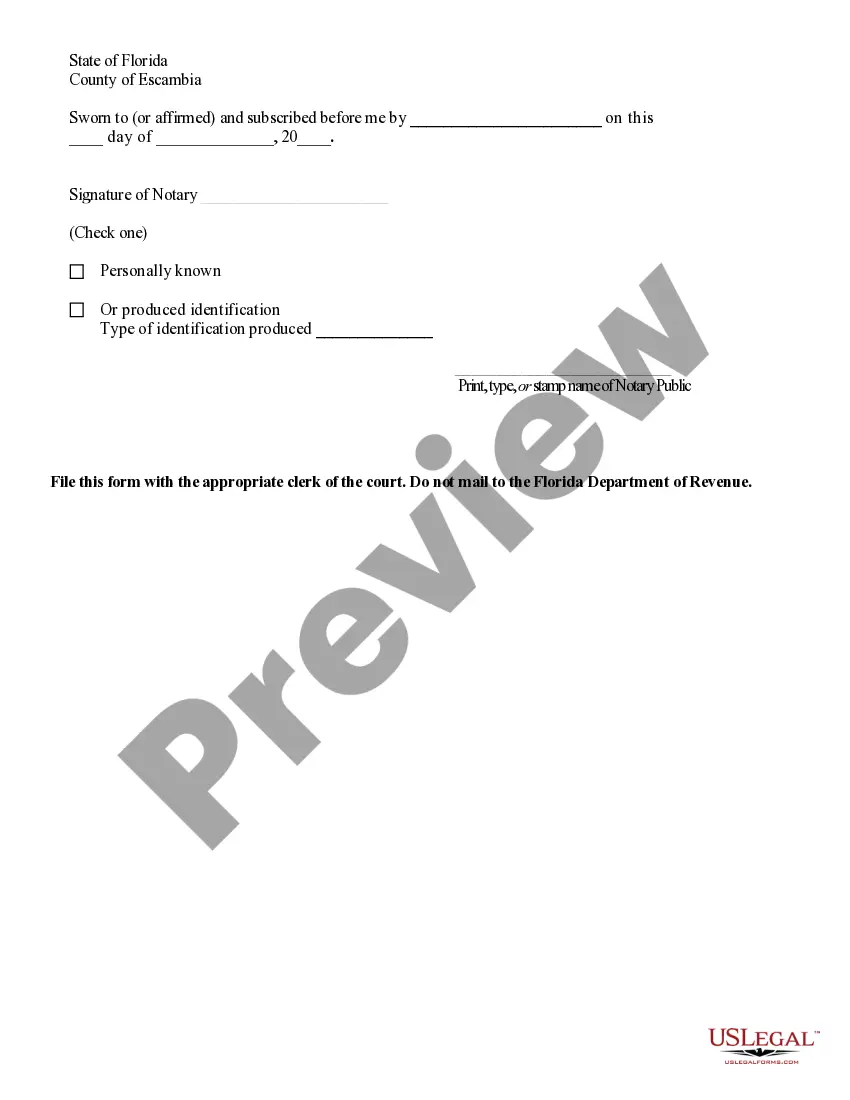

Broward Affidavit of No Florida Estate Tax Due

Description

How to fill out Broward Affidavit Of No Florida Estate Tax Due?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for attorney solutions that, usually, are extremely costly. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Broward Affidavit of No Florida Estate Tax Due or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Broward Affidavit of No Florida Estate Tax Due complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Broward Affidavit of No Florida Estate Tax Due is proper for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!