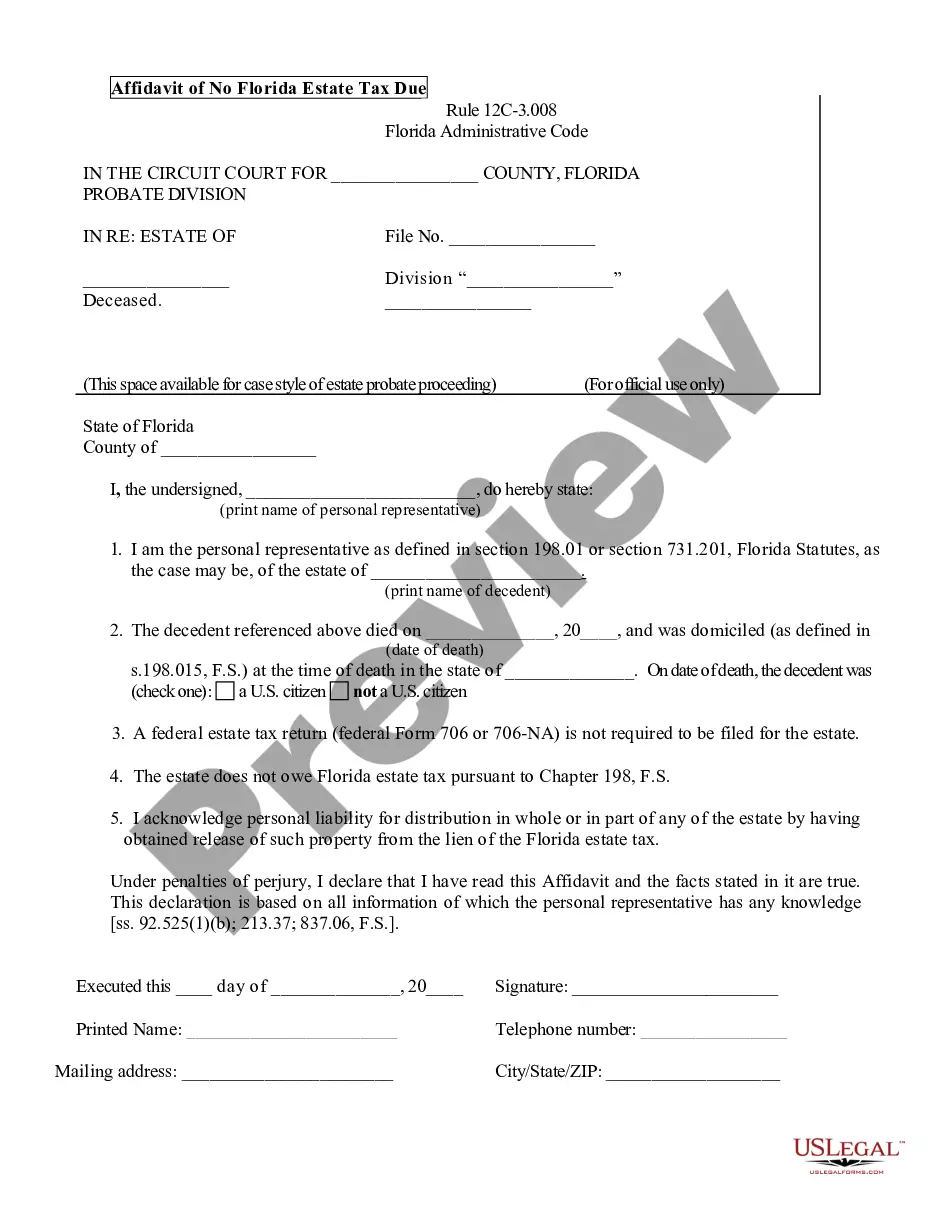

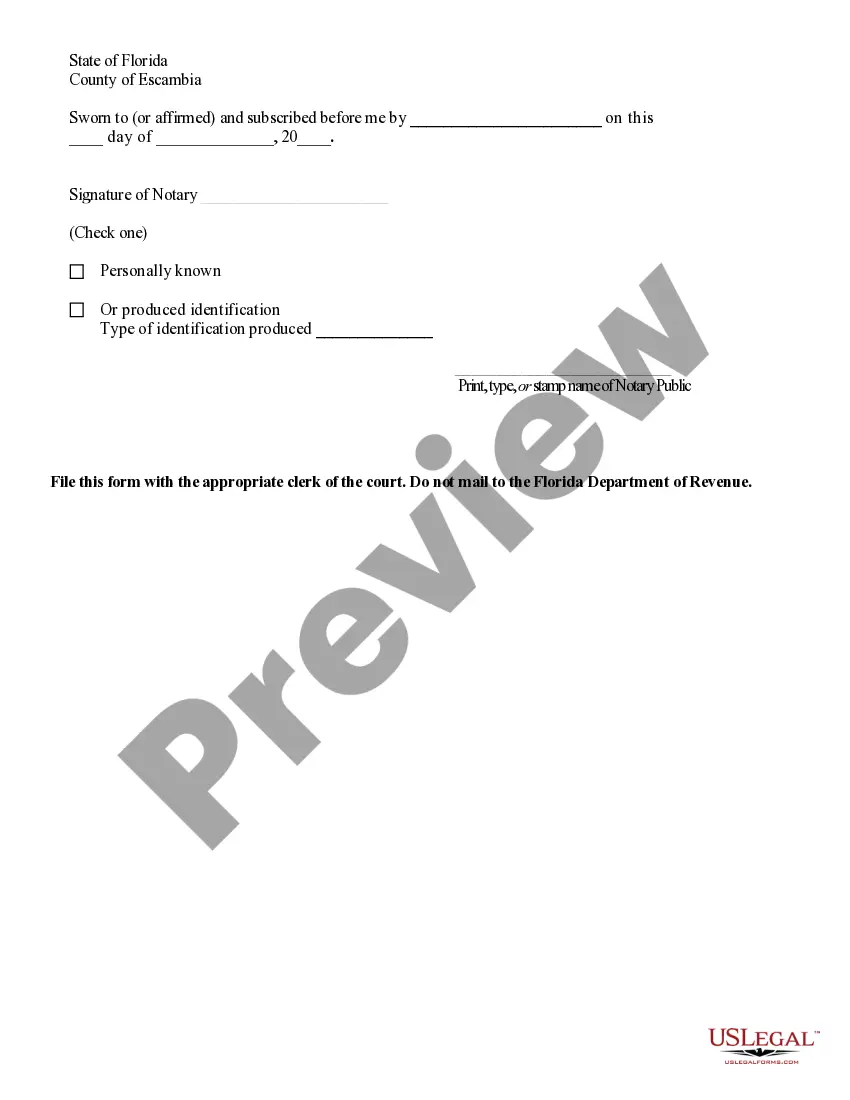

The Coral Springs Affidavit of No Florida Estate Tax Due is a legal document that serves as evidence to confirm that no estate tax is owed on a deceased person's estate in the city of Coral Springs, Florida. This affidavit eliminates the need to file a Florida estate tax return and provides relief from potential penalties and interest related to estate tax liabilities. Keywords: Coral Springs, Affidavit of No Florida Estate Tax Due, estate tax, legal document, deceased person, relief, penalties, interest, liabilities. Types of Coral Springs Affidavit of No Florida Estate Tax Due: 1. Individual Estate Affidavit: This type of affidavit is applicable when an individual's estate is below the taxable threshold, exempting it from Florida estate tax obligations. It requires the executor or personal representative of the estate to provide detailed information regarding the deceased person's assets, debts, liabilities, and other relevant financial information. Keywords: Individual Estate Affidavit, taxable threshold, executor, personal representative, assets, debts, liabilities. 2. Spousal Estate Affidavit: When the deceased person's surviving spouse inherits the entire estate, this affidavit can be used to assert that the estate is not subject to Florida estate tax laws. The surviving spouse needs to complete and file this affidavit, along with necessary supporting documents, to establish the absence of estate tax due. Keywords: Spousal Estate Affidavit, surviving spouse, inheritance, supporting documents, absence of estate tax, Florida estate tax laws. 3. Small Estate Affidavit: If the total value of the deceased person's estate falls within the Small Estate threshold defined by Florida law, this type of affidavit can be utilized. The Small Estate threshold specifies the maximum value of assets that qualify for exemption from estate tax. The affidavit must provide a comprehensive list of the estate's assets, liabilities, and beneficiaries. Keywords: Small Estate Affidavit, estate value, Small Estate threshold, exemption, assets, liabilities, beneficiaries. 4. Exempt Estate Affidavit: This affidavit is applicable when the estate consists solely of exempt assets, such as certain types of retirement accounts, life insurance proceeds, or properties owned by a surviving spouse. By providing supporting documentation, the individual can establish that the estate does not meet the criteria for Florida estate tax, relieving them from tax liabilities. Keywords: Exempt Estate Affidavit, exempt assets, retirement accounts, life insurance proceeds, surviving spouse, supporting documentation, tax liabilities. It is crucial to consult with a legal professional or estate tax specialist to determine the specific type of Coral Springs Affidavit of No Florida Estate Tax Due that best suits your circumstances and to ensure compliance with relevant laws and regulations.

Coral Springs Affidavit of No Florida Estate Tax Due

Description

How to fill out Coral Springs Affidavit Of No Florida Estate Tax Due?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Coral Springs Affidavit of No Florida Estate Tax Due becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Coral Springs Affidavit of No Florida Estate Tax Due takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Coral Springs Affidavit of No Florida Estate Tax Due. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!