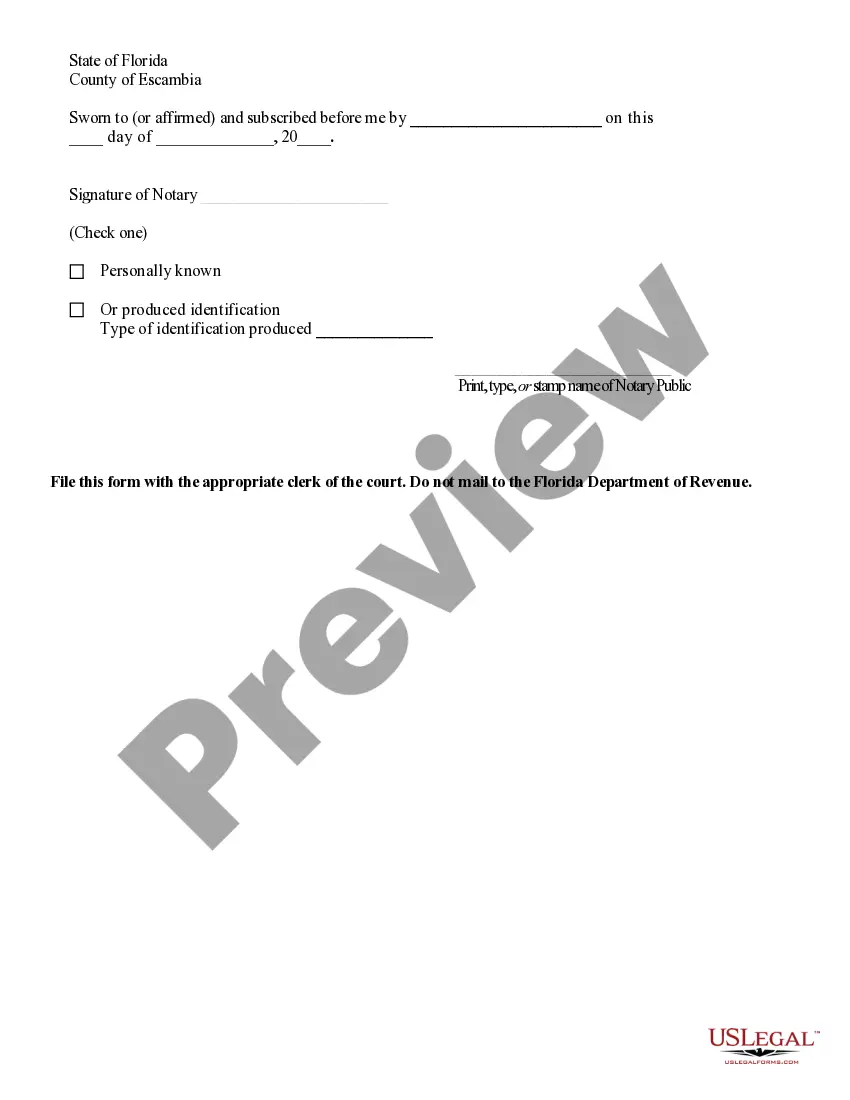

Gainesville Affidavit of No Florida Estate Tax Due is a legal document that plays a crucial role in the estate settlement process. This affidavit is filed in the state of Florida to declare that the estate of a deceased individual is exempt from Florida estate tax. It certifies that no estate tax is due or that the estate has met all the tax obligations required by the state law. The Gainesville Affidavit of No Florida Estate Tax Due is typically filed by the personal representative or executor of the estate. It provides detailed information regarding the deceased person's assets, debts, and other financial liabilities. This document ensures that the estate tax matters have been duly addressed and that the estate can be distributed to the beneficiaries without any further tax-related obligations. Keywords: Gainesville, Affidavit of No Florida Estate Tax Due, estate settlement, legal document, Florida estate tax, exempt, tax obligations, personal representative, executor, deceased person's assets, debts, financial liabilities, estate tax matters, beneficiaries. Different types of Gainesville Affidavit of No Florida Estate Tax Due: 1. Simple Affidavit of No Florida Estate Tax Due: This type of affidavit is used when the estate is exempted from Florida estate tax due to its value falling below the tax threshold set by the state. 2. Affidavit of Florida Estate Tax Paid: This type of affidavit is utilized when the estate has already paid the required Florida estate tax according to the state law. It serves as proof that all tax obligations have been duly fulfilled. 3. Affidavit of No Florida Estate Tax Due with Pending Probate: This affidavit is filed when the estate has no outstanding Florida estate tax due, but the probate process is still ongoing. It ensures that the estate tax matters are appropriately addressed, allowing the probate proceedings to proceed smoothly. 4. Affidavit of No Florida Estate Tax Due for Homestead Property: This specific affidavit is used when the estate mainly consists of homestead property, and it declares that no Florida estate tax is applicable to the homestead property due to its exemption under state laws. Remember to consult with legal professionals or estate planning experts to ensure proper understanding and execution of the Gainesville Affidavit of No Florida Estate Tax Due specific to your situation.

Gainesville Affidavit of No Florida Estate Tax Due

Description

How to fill out Gainesville Affidavit Of No Florida Estate Tax Due?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we apply for legal services that, usually, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Gainesville Affidavit of No Florida Estate Tax Due or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Gainesville Affidavit of No Florida Estate Tax Due complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Gainesville Affidavit of No Florida Estate Tax Due would work for your case, you can select the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!