The Hialeah Affidavit of No Florida Estate Tax Due is a legal document that certifies the absence of any outstanding estate tax liabilities in the state of Florida. This affidavit is crucial in the process of estate administration and helps in determining whether the deceased individual's estate owes any estate taxes. The purpose of the Hialeah Affidavit of No Florida Estate Tax Due is to provide a declaration, supported by relevant financial information, that no taxes are owed to the state of Florida. This affidavit must be filled out accurately and submitted to the appropriate authorities within the required timeframe. There are different types of Hialeah Affidavits of No Florida Estate Tax Due, including: 1. Personal Representative's Affidavit: This type of affidavit is filed by the personal representative or executor of the estate. It outlines the deceased individual's assets, debts, and any potential tax liabilities. 2. Beneficiary's Affidavit: This affidavit is filed by a beneficiary of the estate. It certifies that the beneficiary has received their distribution from the estate and confirms that no estate tax is due. 3. Surviving Spouse's Affidavit: In cases where the surviving spouse is the sole beneficiary and the value of the estate falls below the estate tax exemption limit, a surviving spouse's affidavit may be filed. This affidavit confirms that no estate tax is due based on the spousal exemption. When preparing a Hialeah Affidavit of No Florida Estate Tax Due, it is important to include relevant keywords to ensure the document is correctly understood by all parties involved. Some keywords that can be used include: — Florida estate tax law— - Hialeah Affidavit — No estate tax liabilit— - Estate administration — Estate tax exemptio— - Personal representative/executor — Financiainformationio— - Distribution of assets — Beneficiarconfirmationio— - Surviving spouse exemption By using these keywords effectively, the description of the Hialeah Affidavit of No Florida Estate Tax Due will be more accurate and relevant. It is essential to consult with a legal professional for guidance on how to properly prepare and file this affidavit based on the specific circumstances of the estate.

Hialeah Affidavit of No Florida Estate Tax Due

Description

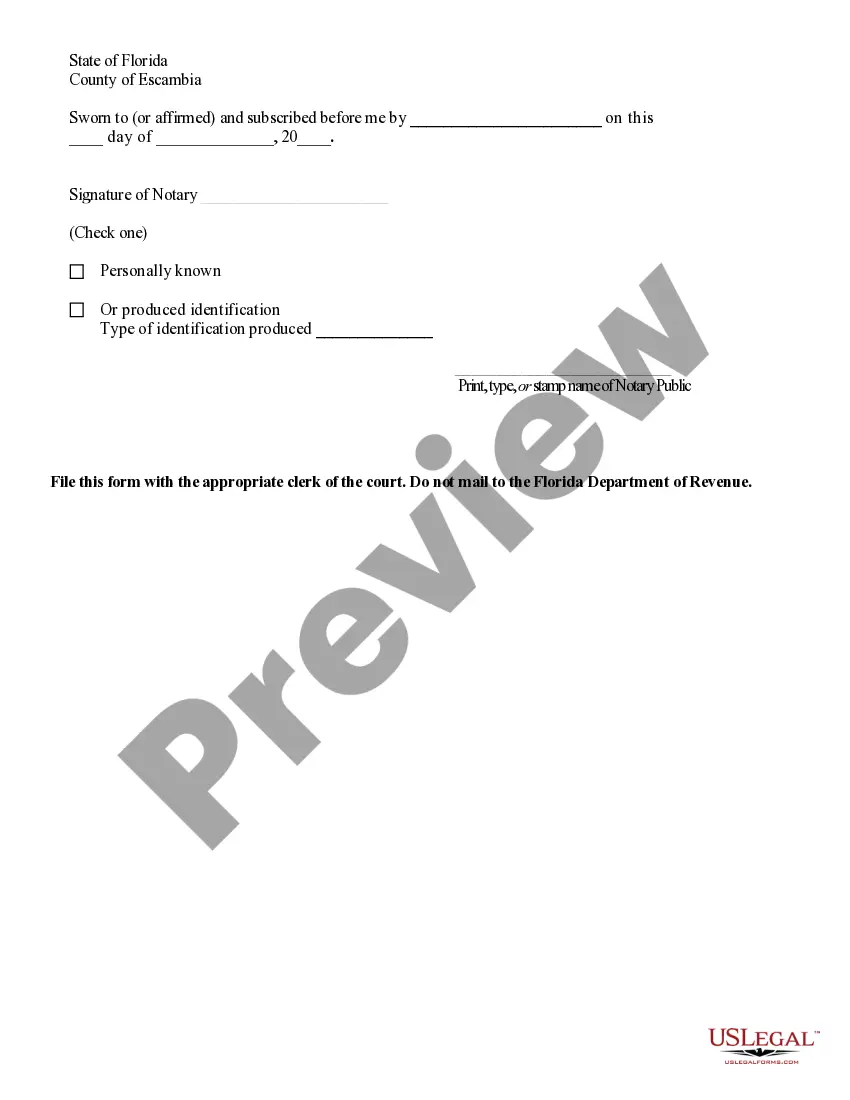

How to fill out Hialeah Affidavit Of No Florida Estate Tax Due?

Take advantage of the US Legal Forms and have immediate access to any form you need. Our beneficial platform with thousands of templates makes it simple to find and get virtually any document sample you will need. It is possible to save, complete, and sign the Hialeah Affidavit of No Florida Estate Tax Due in just a few minutes instead of surfing the Net for hours attempting to find an appropriate template.

Using our collection is an excellent strategy to improve the safety of your document filing. Our professional attorneys regularly review all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and polices.

How do you get the Hialeah Affidavit of No Florida Estate Tax Due? If you already have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. In addition, you can find all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction below:

- Find the template you require. Make sure that it is the template you were looking for: examine its headline and description, and make use of the Preview function when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the saving procedure. Select Buy Now and select the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Export the file. Select the format to obtain the Hialeah Affidavit of No Florida Estate Tax Due and change and complete, or sign it according to your requirements.

US Legal Forms is among the most considerable and reliable document libraries on the web. Our company is always happy to assist you in any legal procedure, even if it is just downloading the Hialeah Affidavit of No Florida Estate Tax Due.

Feel free to make the most of our platform and make your document experience as efficient as possible!