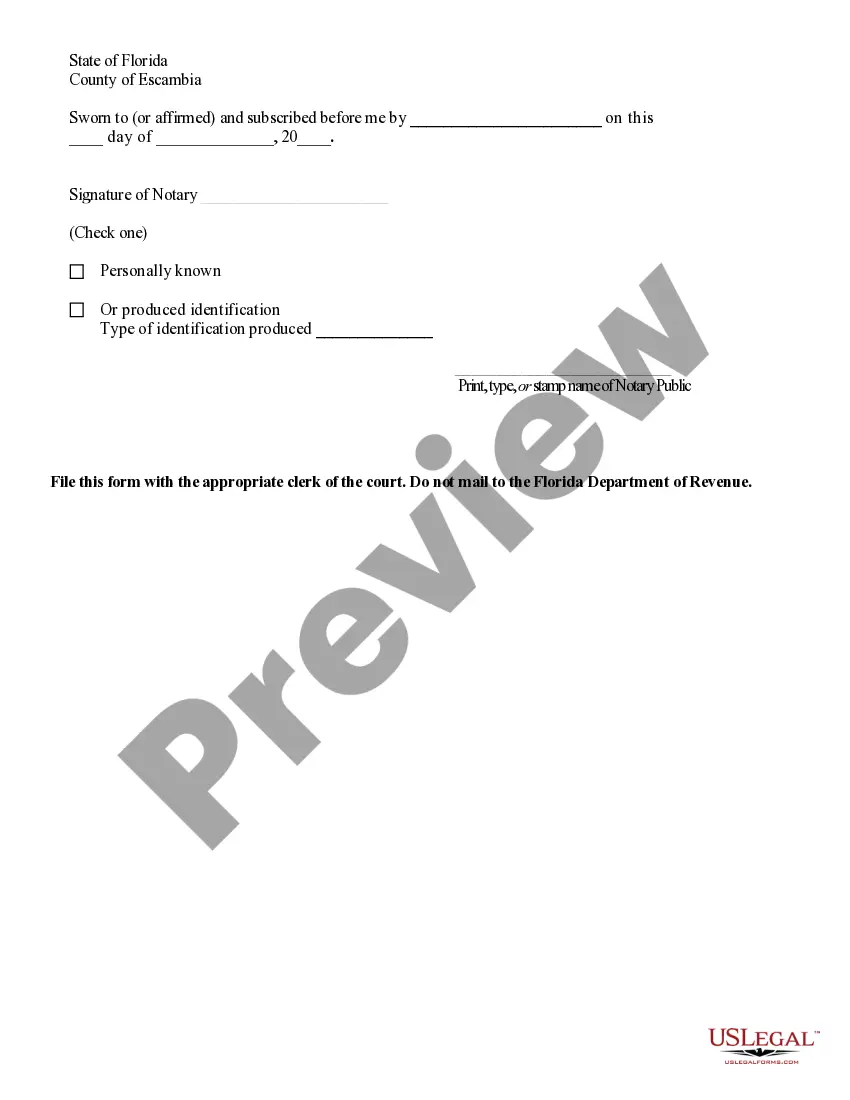

Miami-Dade Affidavit of No Florida Estate Tax Due is a legal document that is required to be filed when an individual, executor, or personal representative is seeking to prove that no Florida estate tax is due for a decedent's estate in Miami-Dade County. This affidavit serves as evidence that no tax liability exists and is crucial to avoid delays and complications regarding the distribution of assets. The purpose of the Miami-Dade Affidavit of No Florida Estate Tax Due is to provide a declaration, under penalty of perjury, that the estate does not meet the threshold for Florida estate tax liability. It certifies that the total value of the estate, including both real and personal property, does not exceed the exemption limit set by the state. By filing this affidavit, the personal representative or executor attests that all necessary deductions, such as funeral expenses, administration fees, debts, mortgages, and other allowable exemptions, have been properly accounted for in determining the net taxable value of the estate. While there is primarily one type of Miami-Dade Affidavit of No Florida Estate Tax Due, it may be necessary to differentiate it from other similar affidavits related to estate taxes. These include the Federal Estate Tax Return, which is filed with the Internal Revenue Service (IRS) to report and pay any federal estate taxes due, and the Affidavit of No Florida Estate Tax Due filed with the county in which the decedent resided to exempt the estate from taxation at the state level. Completing the Miami-Dade Affidavit of No Florida Estate Tax Due involves providing detailed information about the decedent's estate, including their full legal name, date of death, Social Security Number, the estimated value of assets, and a list of all beneficiaries. Supporting documentation must also be attached, such as appraisals, bank statements, and other relevant financial records. It is crucial to ensure accuracy and compliance when filling out the Miami-Dade Affidavit of No Florida Estate Tax Due, as any errors or incomplete information may lead to the imposition of penalties or delays in the probate process. Seeking guidance from an experienced estate attorney is highly recommended navigating the complexities of this legal document and ensure a smooth administration of the estate.

Miami-Dade Affidavit of No Florida Estate Tax Due

Description

How to fill out Miami-Dade Affidavit Of No Florida Estate Tax Due?

We always strive to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for legal services that, usually, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Miami-Dade Affidavit of No Florida Estate Tax Due or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Miami-Dade Affidavit of No Florida Estate Tax Due adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Miami-Dade Affidavit of No Florida Estate Tax Due would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!