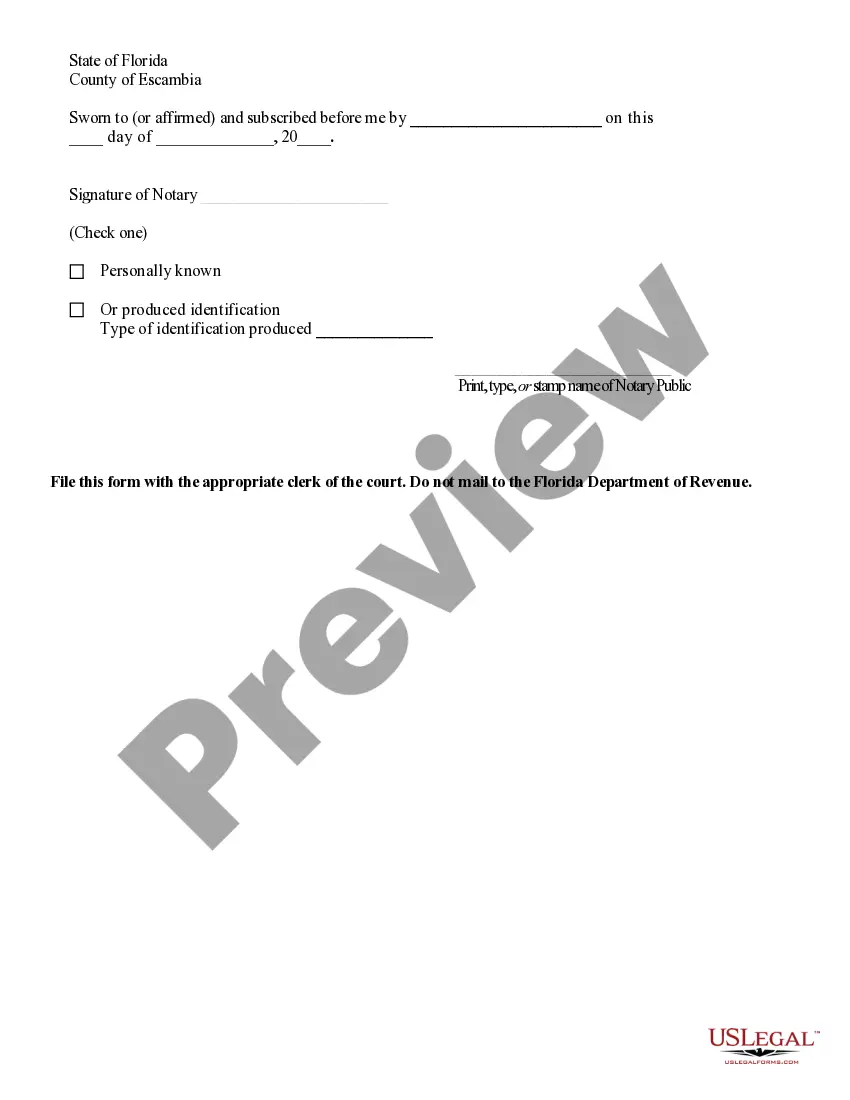

The Miami Gardens Affidavit of No Florida Estate Tax Due is a legal document that certifies that no estate tax is owed to the state of Florida regarding a deceased individual's estate in Miami Gardens. This affidavit is crucial in the probate process as it provides proof to the authorities that all necessary taxes have been paid or that the estate is exempt from taxation. Keywords: — Miami Gardens: Refers to the specific location where the affidavit is applicable, ensuring accuracy and jurisdiction. — Affidavit of No Florida Estate Tax Due: The main document in question, declaring no estate tax obligations to the state of Florida. — Estate Tax: The tax levied on the transfer of a deceased person's estate to their heirs or beneficiaries. — Probate Process: The legal procedure involving the administration and distribution of a deceased person's estate. — Authorities: Refers to the state tax department or agency responsible for assessing and collecting estate taxes. — Taxes Paid: Confirming that all necessary estate taxes have been settled, ensuring compliance with tax regulations. — Exemptions: Circumstances where an estate is not subject to estate taxes, such as when the estate's value falls below a certain threshold. Different Types of Miami Gardens Affidavit of No Florida Estate Tax Due: 1. Basic Affidavit: This standard type of affidavit is used when there are no outstanding estate tax obligations in Miami Gardens. 2. Exemption Affidavit: Specifically designed to demonstrate that the estate is exempt from paying Florida estate taxes due to certain qualifying factors, such as a low estate value or specific exemptions outlined by state laws. 3. Amended Affidavit: Used when there is a need to update or revise the previously submitted affidavit. This includes cases where new information regarding estate taxes becomes available or when errors in the initial affidavit are discovered. Overall, the Miami Gardens Affidavit of No Florida Estate Tax Due plays a crucial role in the probate process by verifying the payment or exemption of estate taxes. It is essential to ensure the accurate completion of this document to comply with Florida state laws and facilitate the timely distribution of the deceased's assets.

Affidavit Of No Estate Tax Due

Description

How to fill out Miami Gardens Affidavit Of No Florida Estate Tax Due?

We always want to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney services that, usually, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Miami Gardens Affidavit of No Florida Estate Tax Due or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Miami Gardens Affidavit of No Florida Estate Tax Due adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Miami Gardens Affidavit of No Florida Estate Tax Due is suitable for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!