The Miramar Affidavit of No Florida Estate Tax Due is a legal document used in the state of Florida to attest that no estate tax is owed on the deceased person's estate. This affidavit is required to be filed with the Florida Department of Revenue for the purpose of finalizing estate administration and ensuring compliance with state tax laws. The Miramar Affidavit of No Florida Estate Tax Due serves as proof that no estate tax is applicable to a specific estate. It includes essential details such as the deceased person's name, date of death, and social security number. Additionally, it must state whether the estate is subject to federal estate tax or has already filed federal estate tax returns. By filing this affidavit, the executor or personal representative of the estate formally declares that no Florida estate tax is due or that the estate meets the requirements for exemption from taxation. This document is necessary to obtain the necessary clearances for transferring estate assets, such as real estate, bank accounts, or investment funds. Different types of Miramar Affidavits of No Florida Estate Tax Due may be associated with specific circumstances. For example: 1. General Miramar Affidavit of No Florida Estate Tax Due: This type of affidavit is typically used when the estate does not meet the thresholds for estate tax liability, regardless of exemptions. 2. Exemption-Specific Miramar Affidavit of No Florida Estate Tax Due: In certain cases, an estate might fall under specific exemptions, such as the spousal exemption or agricultural exemption. Depending on the scenario, an affidavit tailored to the exemption may be required. The Miramar Affidavit of No Florida Estate Tax Due is a crucial document that ensures compliance with state tax regulations and facilitates the smooth transfer of the deceased person's assets to beneficiaries. Executors or personal representatives should consult with an attorney or tax professional to determine the specific requirements and best course of action for their particular estate.

Miramar Affidavit of No Florida Estate Tax Due

Description

How to fill out Miramar Affidavit Of No Florida Estate Tax Due?

Make use of the US Legal Forms and have immediate access to any form sample you require. Our beneficial website with a huge number of documents simplifies the way to find and obtain almost any document sample you require. You are able to download, fill, and sign the Miramar Affidavit of No Florida Estate Tax Due in just a couple of minutes instead of surfing the Net for many hours looking for an appropriate template.

Using our collection is a superb strategy to improve the safety of your record filing. Our experienced lawyers regularly review all the documents to make certain that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you obtain the Miramar Affidavit of No Florida Estate Tax Due? If you already have a subscription, just log in to the account. The Download option will be enabled on all the samples you look at. Additionally, you can get all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, follow the instruction below:

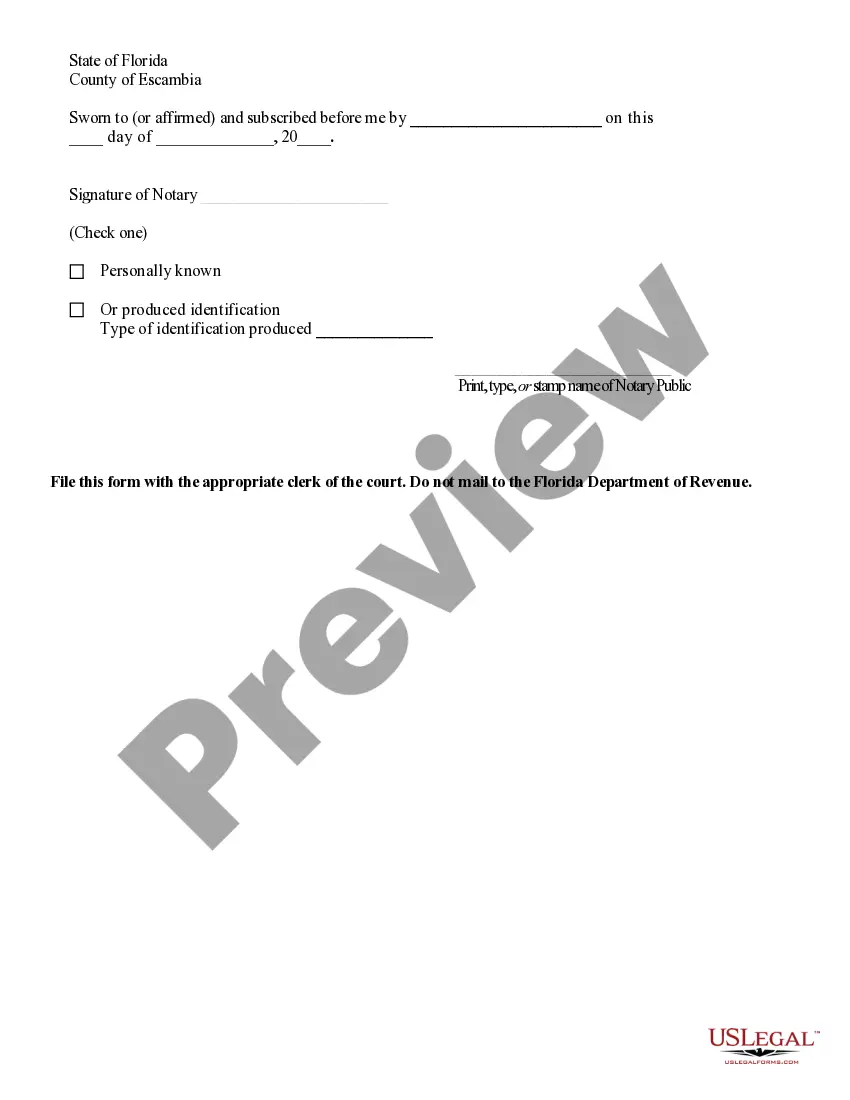

- Open the page with the template you need. Make sure that it is the template you were seeking: examine its name and description, and make use of the Preview function when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you like. Then, sign up for an account and process your order with a credit card or PayPal.

- Save the document. Indicate the format to obtain the Miramar Affidavit of No Florida Estate Tax Due and change and fill, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable document libraries on the web. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the Miramar Affidavit of No Florida Estate Tax Due.

Feel free to take advantage of our form catalog and make your document experience as efficient as possible!