The Pembroke Pines Affidavit of No Florida Estate Tax Due is a legal document that is used to declare that no estate tax is due on a deceased person's estate in Pembroke Pines, Florida. This affidavit is essential for individuals who are handling the administration of an estate and need to provide evidence that no estate tax is owed to the state. When a person passes away, their estate may be subject to various taxes, including the Florida Estate Tax. However, if the estate falls below a certain threshold, no estate tax is due. In Pembroke Pines, this threshold is currently set at $5.7 million, in accordance with state laws. The Pembroke Pines Affidavit of No Florida Estate Tax Due must be completed and filed with the appropriate governmental agency, such as the Florida Department of Revenue, to confirm that the estate does not exceed the taxable limit. It is crucial to submit this affidavit promptly to avoid any penalties or disputes in the future. There are several types of Pembroke Pines Affidavit of No Florida Estate Tax Due that may be relevant, depending on the specific circumstances of the estate: 1. Individual Affidavit: This form is used when a person is administering the estate as an individual, rather than as a representative of a corporate entity or trust. 2. Corporate Affidavit: When the estate is being administered by a corporation, this form should be filled out and submitted. 3. Trustee Affidavit: If the estate is being handled by a trustee, this affidavit should be completed in compliance with the specific requirements for trust administration. To complete the Pembroke Pines Affidavit of No Florida Estate Tax Due, the administrator must gather relevant information about the deceased person's assets, liabilities, and beneficiaries. This includes details about real estate, bank accounts, investments, personal property, and any outstanding debts or obligations. The affidavit should accurately represent the estate's financial status to ensure compliance with Florida estate tax laws. It is important to note that the Pembroke Pines Affidavit of No Florida Estate Tax Due may require additional supporting documents, such as a complete inventory of the estate's assets, certified copies of the deceased person's death certificate, and any relevant tax returns. This documentation helps validate the information provided in the affidavit and substantiates the claim that no estate tax is due. In conclusion, the Pembroke Pines Affidavit of No Florida Estate Tax Due is a crucial legal document used to confirm that no estate tax is owed on a deceased person's estate in Pembroke Pines. By accurately completing and submitting this affidavit, administrators can ensure compliance with state tax laws and avoid potential penalties.

Pembroke Pines Affidavit of No Florida Estate Tax Due

Description

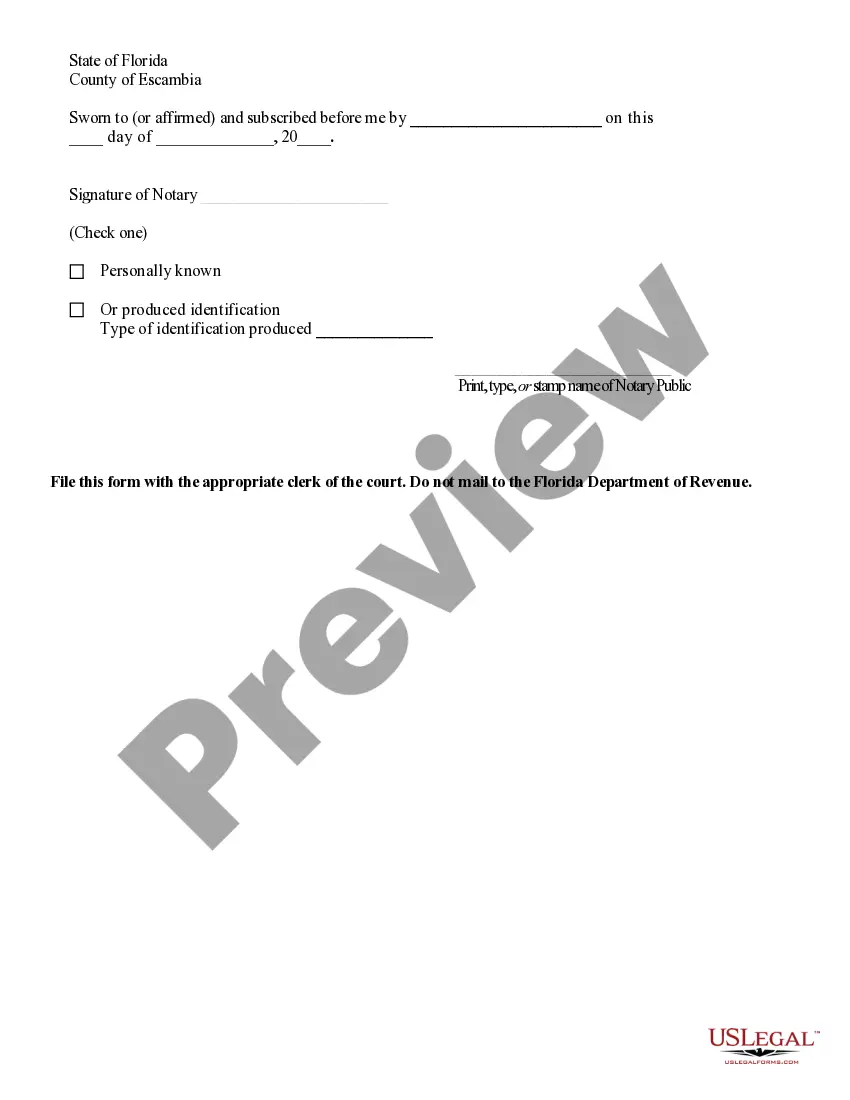

How to fill out Pembroke Pines Affidavit Of No Florida Estate Tax Due?

Take advantage of the US Legal Forms and have immediate access to any form sample you require. Our helpful website with a large number of documents allows you to find and get virtually any document sample you will need. It is possible to save, complete, and certify the Pembroke Pines Affidavit of No Florida Estate Tax Due in just a few minutes instead of browsing the web for several hours looking for the right template.

Using our collection is a superb way to improve the safety of your form filing. Our experienced attorneys regularly check all the documents to make sure that the templates are relevant for a particular region and compliant with new acts and regulations.

How can you obtain the Pembroke Pines Affidavit of No Florida Estate Tax Due? If you have a profile, just log in to the account. The Download button will appear on all the samples you look at. Moreover, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, follow the instruction listed below:

- Open the page with the form you require. Make certain that it is the form you were seeking: examine its headline and description, and utilize the Preview feature when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Pick the format to obtain the Pembroke Pines Affidavit of No Florida Estate Tax Due and edit and complete, or sign it according to your requirements.

US Legal Forms is among the most significant and trustworthy document libraries on the web. Our company is always happy to help you in virtually any legal process, even if it is just downloading the Pembroke Pines Affidavit of No Florida Estate Tax Due.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!