The West Palm Beach Affidavit of No Florida Estate Tax Due is a legal document used in the state of Florida when an individual or entity is filing for an exemption from paying estate taxes. This affidavit is required to be filed with the Palm Beach County Clerk's Office and provides proof that the estate is not subject to any Florida estate tax obligations. Keywords: West Palm Beach, Affidavit of No Florida Estate Tax Due, legal document, Florida, exemption, estate taxes, Palm Beach County Clerk's Office, proof, obligations. There are no different types of West Palm Beach Affidavit of No Florida Estate Tax Due. However, it is important to note that there may be other types of affidavits related to estate taxes depending on the circumstances, such as an Affidavit of Estate Tax Payment if taxes are due, or an Affidavit of Waiver of Florida Estate Tax if the estate meets certain criteria for exemption. Regardless of the specific type, the West Palm Beach Affidavit of No Florida Estate Tax Due serves as a crucial tool for individuals and entities dealing with estates in the area. This legal document ensures compliance with Florida estate tax laws and provides evidence that no taxes are owed to the state. When completing the West Palm Beach Affidavit of No Florida Estate Tax Due, it is essential to accurately and comprehensively provide the required information. The affidavit typically requires details concerning the deceased person's identity, including their full legal name, social security number, and date of death. Additionally, it is necessary to outline the estate's assets and their estimated values at the time of the individual's passing. The affidavit may request information on real estate properties, bank accounts, investments, vehicles, personal belongings, and any other assets that were part of the estate. Furthermore, the affidavit may require information about any outstanding debts and liabilities of the deceased person. This might include mortgages, loans, credit card debts, or other financial obligations that need to be accounted for when determining the net value of the estate. In the West Palm Beach Affidavit of No Florida Estate Tax Due, it is crucial to include supporting documentation, such as bank statements, property appraisals, or financial statements, to substantiate the information provided. Additionally, the affidavit typically requires the signature of the person filing it, certifying the accuracy of the information presented. By completing and filing the West Palm Beach Affidavit of No Florida Estate Tax Due with the Palm Beach County Clerk's Office, individuals and entities can fulfill their legal obligation and demonstrate that the estate is not subject to Florida estate tax. This document plays an essential role in estate planning, ensuring that the deceased person's assets are accurately accounted for and any potential tax liabilities are appropriately addressed and resolved.

West Palm Beach Affidavit of No Florida Estate Tax Due

Category:

State:

Florida

City:

West Palm Beach

Control #:

FL-LR012

Format:

Word;

Rich Text

Instant download

Description

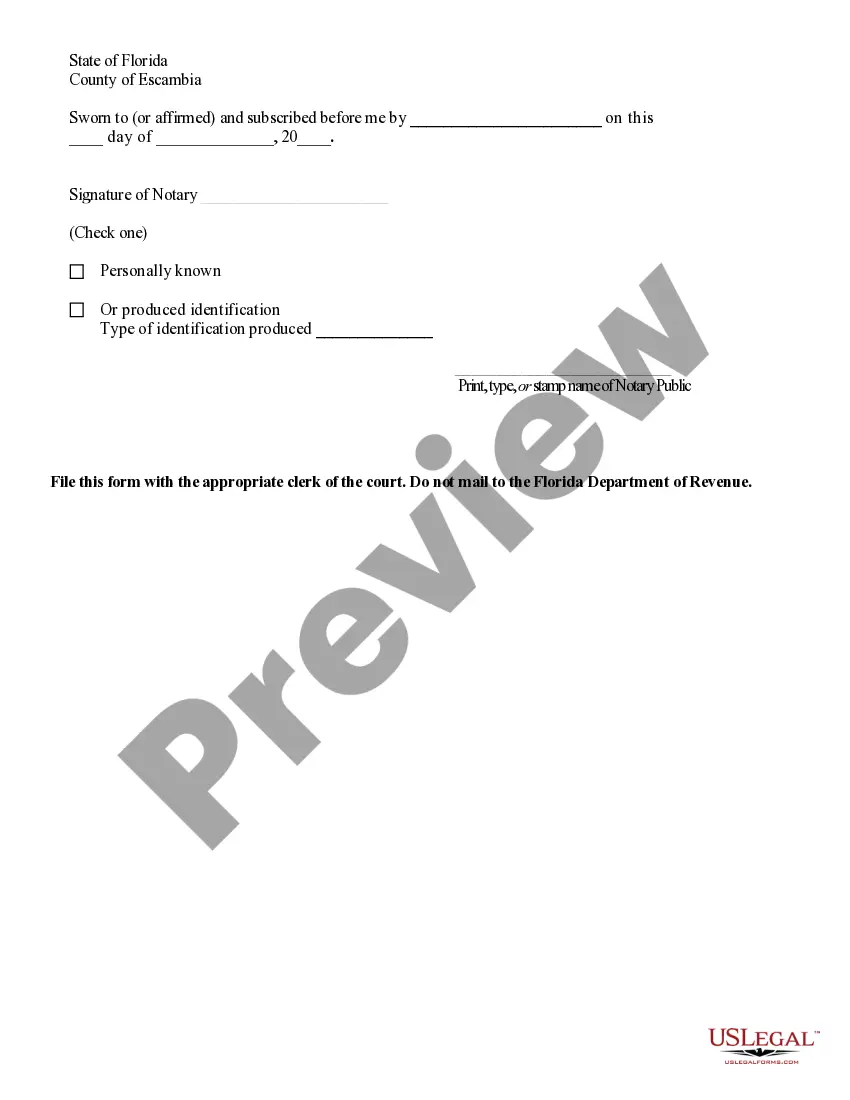

This form is used in an estate probate proceeding as a sworn statement that no estate tax is due on a property.

The West Palm Beach Affidavit of No Florida Estate Tax Due is a legal document used in the state of Florida when an individual or entity is filing for an exemption from paying estate taxes. This affidavit is required to be filed with the Palm Beach County Clerk's Office and provides proof that the estate is not subject to any Florida estate tax obligations. Keywords: West Palm Beach, Affidavit of No Florida Estate Tax Due, legal document, Florida, exemption, estate taxes, Palm Beach County Clerk's Office, proof, obligations. There are no different types of West Palm Beach Affidavit of No Florida Estate Tax Due. However, it is important to note that there may be other types of affidavits related to estate taxes depending on the circumstances, such as an Affidavit of Estate Tax Payment if taxes are due, or an Affidavit of Waiver of Florida Estate Tax if the estate meets certain criteria for exemption. Regardless of the specific type, the West Palm Beach Affidavit of No Florida Estate Tax Due serves as a crucial tool for individuals and entities dealing with estates in the area. This legal document ensures compliance with Florida estate tax laws and provides evidence that no taxes are owed to the state. When completing the West Palm Beach Affidavit of No Florida Estate Tax Due, it is essential to accurately and comprehensively provide the required information. The affidavit typically requires details concerning the deceased person's identity, including their full legal name, social security number, and date of death. Additionally, it is necessary to outline the estate's assets and their estimated values at the time of the individual's passing. The affidavit may request information on real estate properties, bank accounts, investments, vehicles, personal belongings, and any other assets that were part of the estate. Furthermore, the affidavit may require information about any outstanding debts and liabilities of the deceased person. This might include mortgages, loans, credit card debts, or other financial obligations that need to be accounted for when determining the net value of the estate. In the West Palm Beach Affidavit of No Florida Estate Tax Due, it is crucial to include supporting documentation, such as bank statements, property appraisals, or financial statements, to substantiate the information provided. Additionally, the affidavit typically requires the signature of the person filing it, certifying the accuracy of the information presented. By completing and filing the West Palm Beach Affidavit of No Florida Estate Tax Due with the Palm Beach County Clerk's Office, individuals and entities can fulfill their legal obligation and demonstrate that the estate is not subject to Florida estate tax. This document plays an essential role in estate planning, ensuring that the deceased person's assets are accurately accounted for and any potential tax liabilities are appropriately addressed and resolved.

Free preview

How to fill out West Palm Beach Affidavit Of No Florida Estate Tax Due?

If you’ve already utilized our service before, log in to your account and download the West Palm Beach Affidavit of No Florida Estate Tax Due on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your West Palm Beach Affidavit of No Florida Estate Tax Due. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!