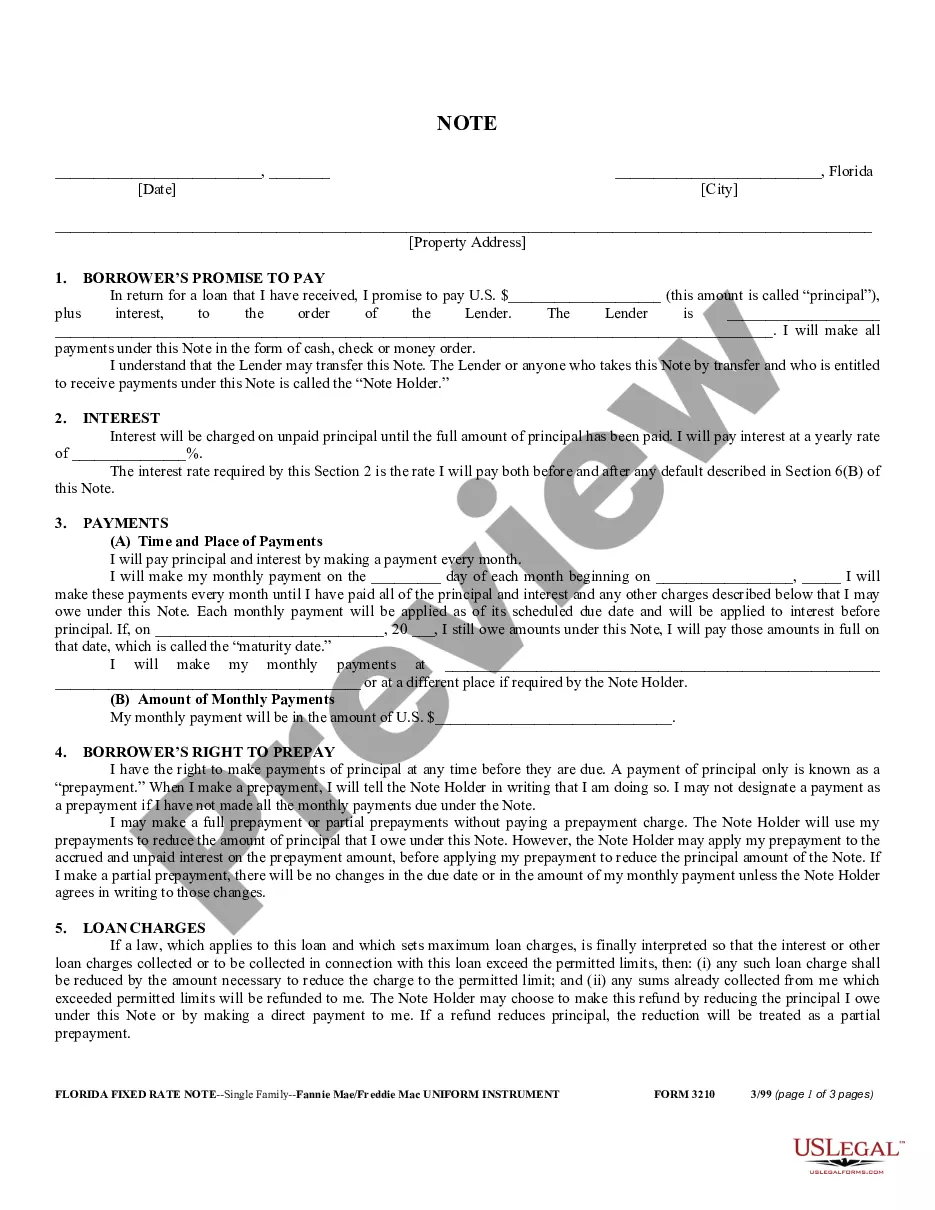

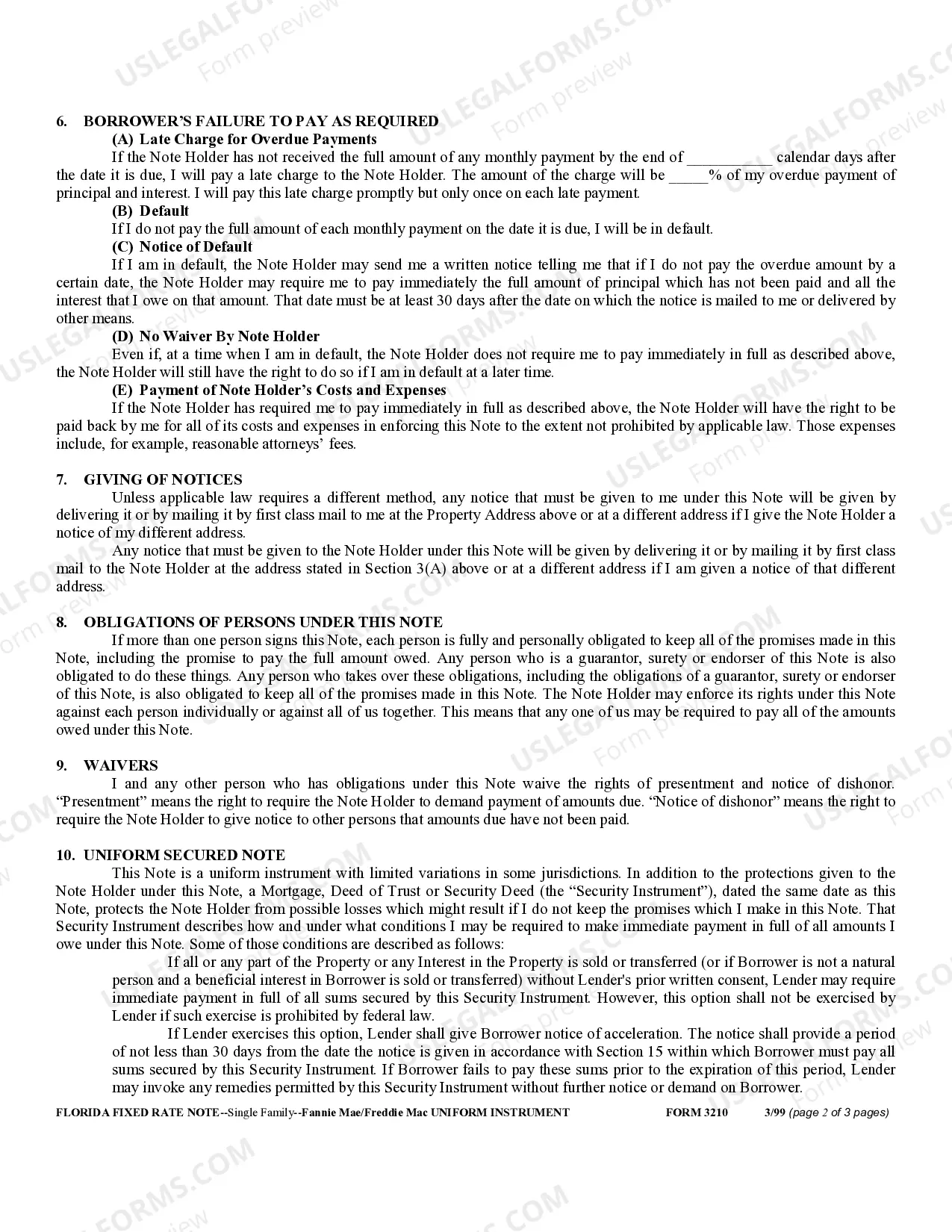

A Jacksonville Florida Secured Promissory Note refers to a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower based in Jacksonville, Florida. This financial instrument provides a binding agreement regarding the amount borrowed, interest rate, repayment schedule, and any applicable fees or penalties. The key aspect that sets a secured promissory note apart is the inclusion of collateral. In Jacksonville, lenders often require borrowers to offer some form of collateral, such as property, vehicles, stocks, or other assets, to secure the loan. This collateral provides lenders with a sense of security in case the borrower fails to repay the loan as agreed upon. The terms and conditions of a Jacksonville Florida Secured Promissory Note may vary depending on the specific agreement between the lender and borrower. However, typical components of this document include: 1. Loan Amount: The principal amount of money lent to the borrower, which is typically specified in both numeric and written forms. 2. Interest Rate: The percentage charged on the loan amount as interest, usually expressed as an annual rate. 3. Repayment Schedule: The agreed-upon timeline for repaying the loan, including the number of installments and their specific due dates. This can be monthly, quarterly, or annually. 4. Collateral Description: This section outlines the collateral being offered by the borrower, providing details such as type, location, condition, and appraisal value. 5. Default and Acceleration: The consequences of default, such as late payment penalties, increased interest rates, or the lender's right to accelerate the loan and demand immediate repayment. 6. Governing Law: As the note is specific to Jacksonville, Florida, it references the laws and regulations applicable within the state. 7. Signatures: The note must be signed by both the lender and borrower, indicating their agreement and commitment to the terms outlined. Different types of Jacksonville Florida Secured Promissory Notes may exist based on the nature of the loan. Some common variations include: 1. Real Estate Secured Promissory Note: This type of note involves collateral in the form of real estate property, such as a house or land. 2. Vehicle Secured Promissory Note: Here, the collateral offered by the borrower is a vehicle, which could be a car, boat, or motorcycle. 3. Stock Secured Promissory Note: In this case, the borrower pledges stocks or shares as collateral for the loan. These variations may have specific terms and conditions related to the nature of the chosen collateral and legal requirements applicable within Jacksonville, Florida. In conclusion, a Jacksonville Florida Secured Promissory Note is a legal document that establishes the terms and conditions of a loan agreement, including collateral provisions, between a lender and a borrower in Jacksonville, Florida. The specific type of secured note varies based on the nature of the collateral being pledged by the borrower.

Jacksonville Florida Secured Promissory Note

Category:

State:

Florida

City:

Jacksonville

Control #:

FL-NOTE-1

Format:

Word;

Rich Text

Instant download

Description

This is a Promissory Note for your state. The promissory note is secured, with a fixed interest rate, and contains a provision for installment payments.

A Jacksonville Florida Secured Promissory Note refers to a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower based in Jacksonville, Florida. This financial instrument provides a binding agreement regarding the amount borrowed, interest rate, repayment schedule, and any applicable fees or penalties. The key aspect that sets a secured promissory note apart is the inclusion of collateral. In Jacksonville, lenders often require borrowers to offer some form of collateral, such as property, vehicles, stocks, or other assets, to secure the loan. This collateral provides lenders with a sense of security in case the borrower fails to repay the loan as agreed upon. The terms and conditions of a Jacksonville Florida Secured Promissory Note may vary depending on the specific agreement between the lender and borrower. However, typical components of this document include: 1. Loan Amount: The principal amount of money lent to the borrower, which is typically specified in both numeric and written forms. 2. Interest Rate: The percentage charged on the loan amount as interest, usually expressed as an annual rate. 3. Repayment Schedule: The agreed-upon timeline for repaying the loan, including the number of installments and their specific due dates. This can be monthly, quarterly, or annually. 4. Collateral Description: This section outlines the collateral being offered by the borrower, providing details such as type, location, condition, and appraisal value. 5. Default and Acceleration: The consequences of default, such as late payment penalties, increased interest rates, or the lender's right to accelerate the loan and demand immediate repayment. 6. Governing Law: As the note is specific to Jacksonville, Florida, it references the laws and regulations applicable within the state. 7. Signatures: The note must be signed by both the lender and borrower, indicating their agreement and commitment to the terms outlined. Different types of Jacksonville Florida Secured Promissory Notes may exist based on the nature of the loan. Some common variations include: 1. Real Estate Secured Promissory Note: This type of note involves collateral in the form of real estate property, such as a house or land. 2. Vehicle Secured Promissory Note: Here, the collateral offered by the borrower is a vehicle, which could be a car, boat, or motorcycle. 3. Stock Secured Promissory Note: In this case, the borrower pledges stocks or shares as collateral for the loan. These variations may have specific terms and conditions related to the nature of the chosen collateral and legal requirements applicable within Jacksonville, Florida. In conclusion, a Jacksonville Florida Secured Promissory Note is a legal document that establishes the terms and conditions of a loan agreement, including collateral provisions, between a lender and a borrower in Jacksonville, Florida. The specific type of secured note varies based on the nature of the collateral being pledged by the borrower.

Free preview

How to fill out Jacksonville Florida Secured Promissory Note?

If you’ve already used our service before, log in to your account and save the Jacksonville Florida Secured Promissory Note on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Jacksonville Florida Secured Promissory Note. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!