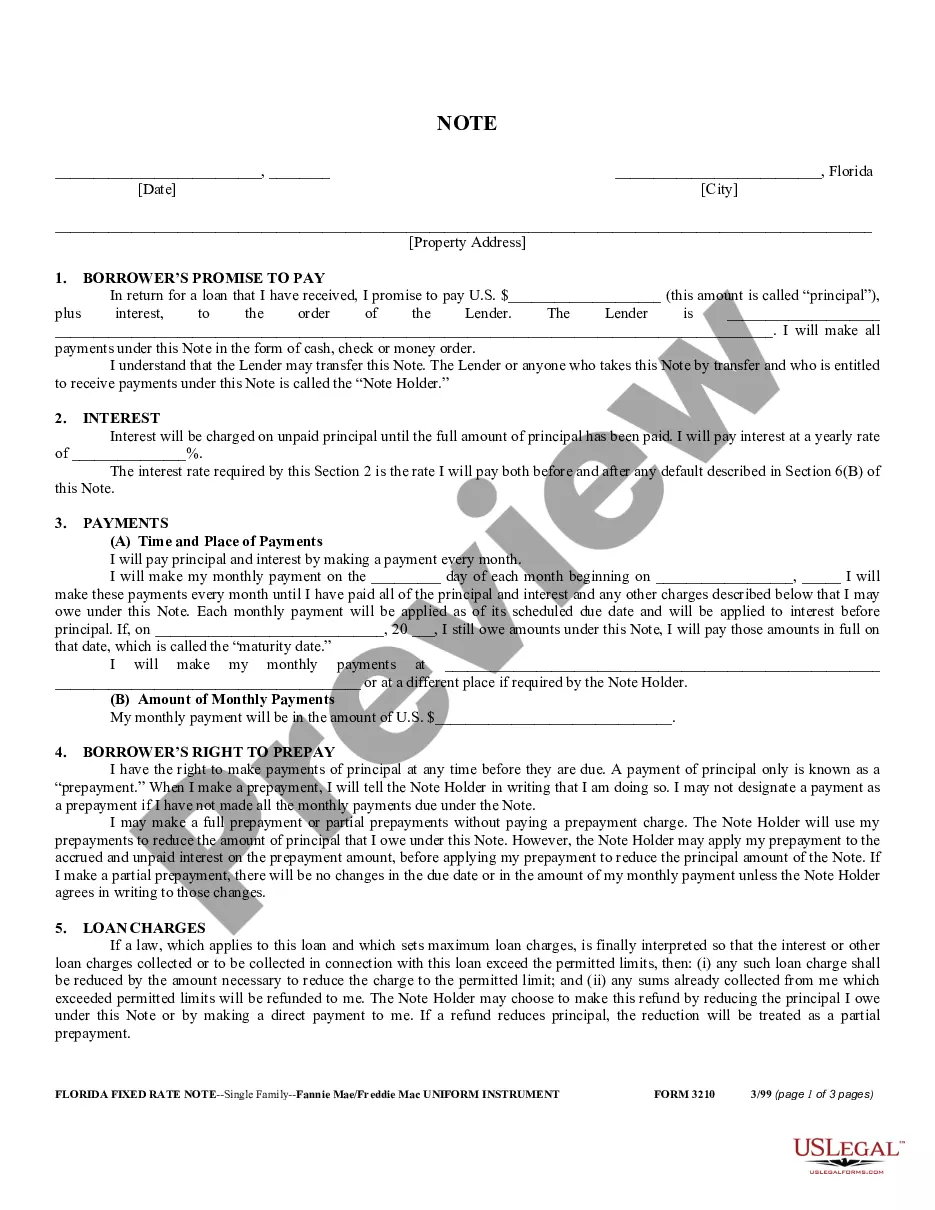

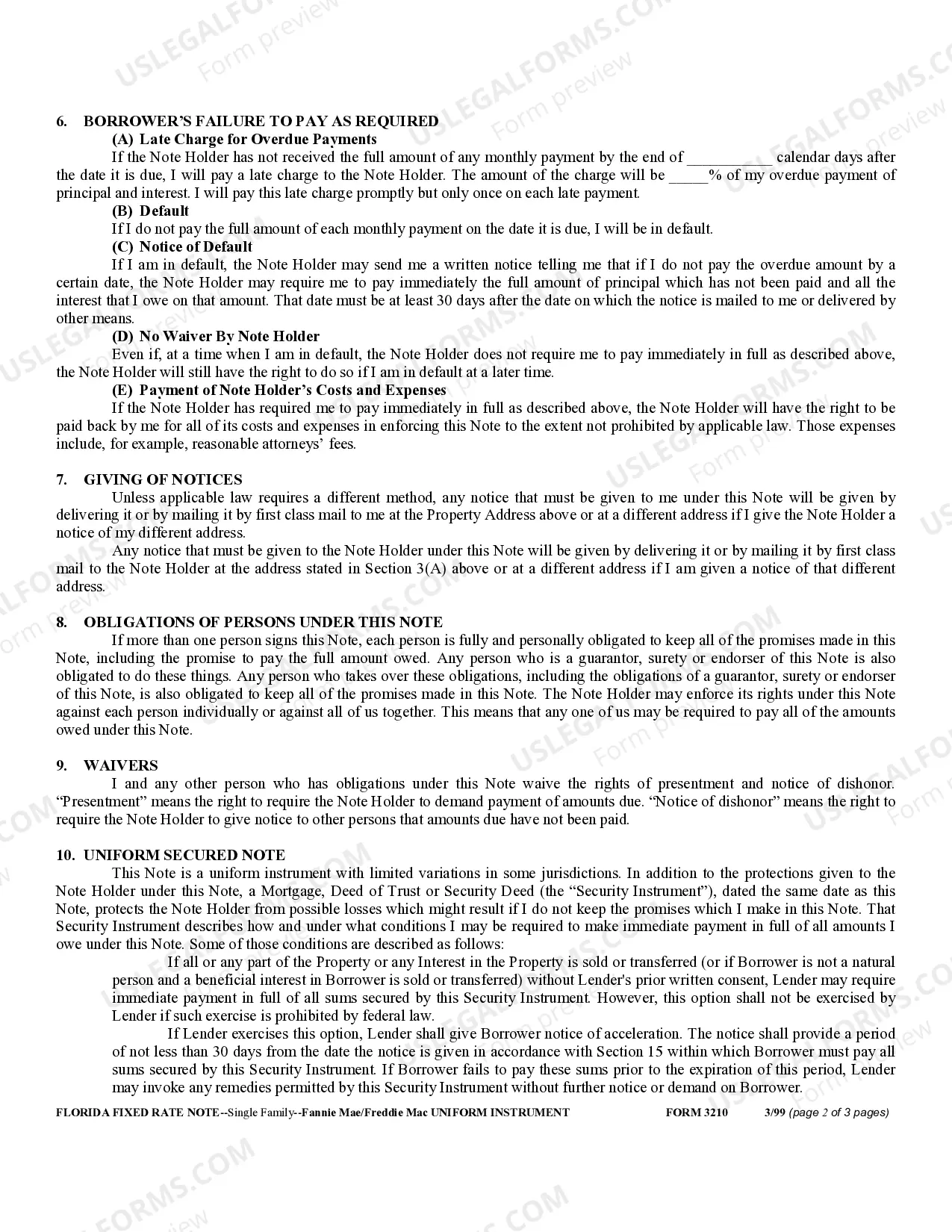

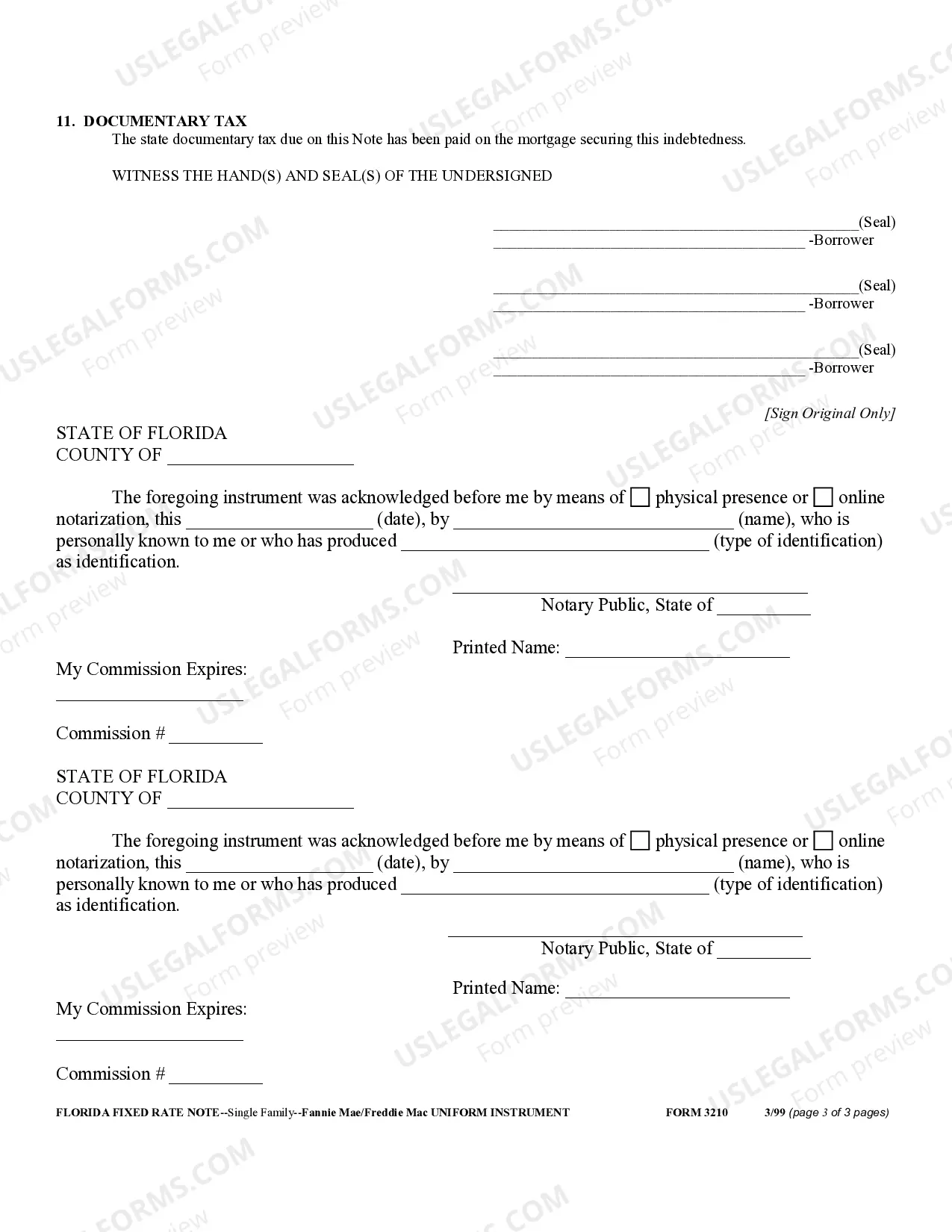

A Miami Gardens Florida Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between two parties, where one party acts as the lender and the other as the borrower. This note serves as proof of the loan and provides security to the lender by using a specific asset as collateral. By incorporating relevant keywords, let's create content that fully explains the topic: Keywords: Miami Gardens Florida, Secured Promissory Note, loan agreement, lender, borrower, legal document, collateral. Description: A Miami Gardens Florida Secured Promissory Note is a legally binding document that establishes the terms and conditions of a loan agreement in Miami Gardens, Florida. In this arrangement, one party acts as the lender, providing a specific amount of money, and the other as the borrower, who agrees to repay the loan over time. What distinguishes a Secured Promissory Note from an unsecured loan is the inclusion of collateral. Collateral refers to a valuable asset, which the borrower offers as security to the lender in case of default or non-repayment. If the borrower fails to fulfill their repayment obligations, the lender has the right to seize the collateral and recover the outstanding amount through its sale. Several types of Secured Promissory Notes are commonly used in Miami Gardens, Florida, each with its unique characteristics and related keywords: 1. Real Estate Secured Promissory Note: This type of note is utilized when the borrower pledges a real property, such as a house or land, as collateral. It safeguards the lender's interest in allowing foreclosure or sale of the property to recover the loan amount. 2. Vehicle Secured Promissory Note: In cases where the loan is specifically for buying a vehicle, this note is employed. The borrower offers the financed vehicle as collateral, granting the lender the right to repossess and sell it in case of default. 3. Business Asset Secured Promissory Note: When a business borrows money, it may use its assets, such as inventory, equipment, or accounts receivable, as collateral to secure the loan. This type of note allows the lender to seize and liquidate these assets to recover their funds. 4. Personal Property Secured Promissory Note: Here, the borrower offers personal belongings, such as jewelry, artwork, or valuable collectibles, as collateral. The lender can sell these assets to retrieve the loaned amount if the borrower fails to repay. By utilizing a Miami Gardens Florida Secured Promissory Note, both parties can establish a clear understanding of their rights and obligations regarding the loan. This legal document provides security to the lender, granting them the assurance that if repayment issues arise, they have a specified asset to fall back on. Note: It is crucial to consult with a legal professional when drafting or entering into any loan agreement to ensure compliance with applicable laws and regulations.

Miami Gardens Florida Secured Promissory Note

Description

How to fill out Miami Gardens Florida Secured Promissory Note?

Take advantage of the US Legal Forms and have immediate access to any form you need. Our beneficial platform with thousands of documents makes it easy to find and get virtually any document sample you need. It is possible to save, complete, and certify the Miami Gardens Florida Secured Promissory Note in just a matter of minutes instead of browsing the web for hours seeking the right template.

Using our collection is a wonderful way to increase the safety of your document filing. Our experienced lawyers regularly check all the documents to ensure that the forms are appropriate for a particular state and compliant with new laws and polices.

How do you get the Miami Gardens Florida Secured Promissory Note? If you have a profile, just log in to the account. The Download option will appear on all the documents you look at. In addition, you can get all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Open the page with the form you need. Make sure that it is the form you were seeking: examine its name and description, and use the Preview option when it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Save the file. Select the format to get the Miami Gardens Florida Secured Promissory Note and change and complete, or sign it according to your requirements.

US Legal Forms is probably the most considerable and reliable template libraries on the internet. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the Miami Gardens Florida Secured Promissory Note.

Feel free to benefit from our platform and make your document experience as efficient as possible!