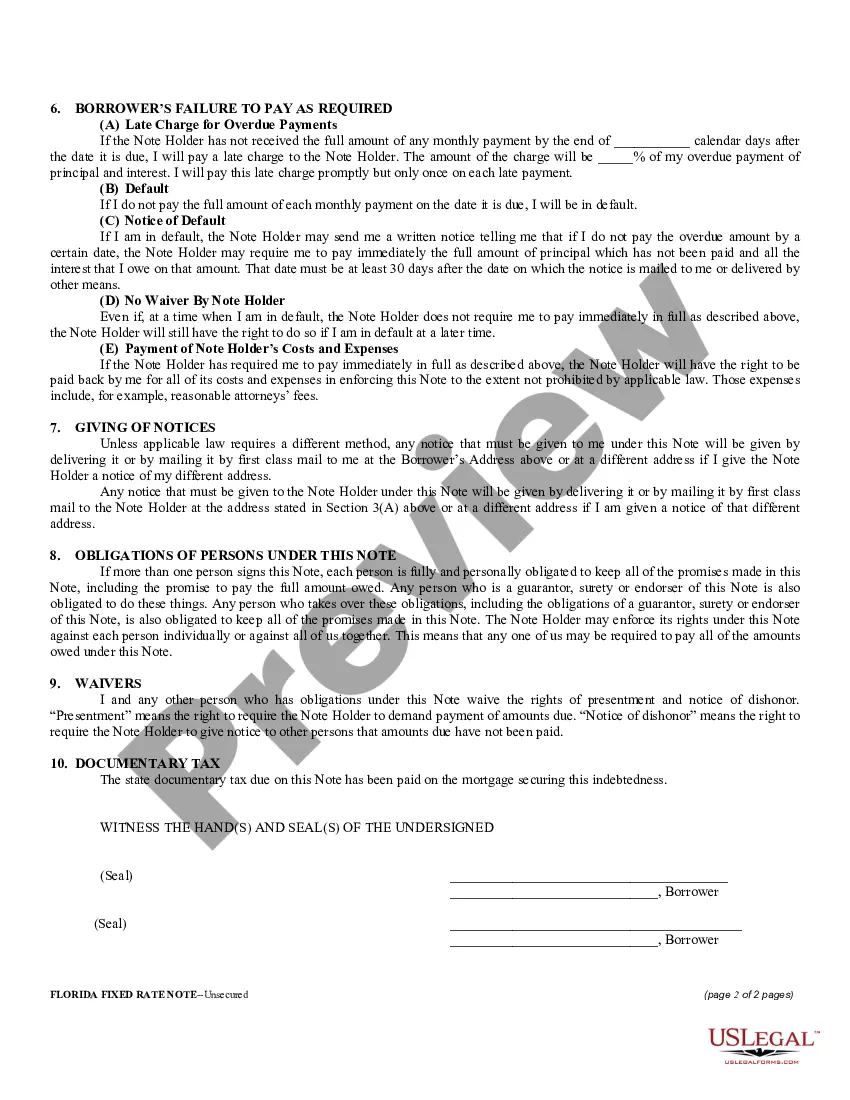

Broward County, Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower within Broward County, Florida. This promissory note is specifically designed for unsecured loans where no collateral is provided by the borrower. The Broward Florida Unsecured Installment Payment Promissory Note for Fixed Rate is used when the parties involved wish to document the specifics of the loan, including the principal amount, interest rate, repayment schedule, and any additional terms and conditions applicable to the loan agreement. This note helps ensure that both the lender and the borrower are on the same page regarding their obligations and responsibilities. Keywords: Broward County, Florida, Unsecured Installment Payment Promissory Note, Fixed Rate, loan agreement, collateral, principal amount, interest rate, repayment schedule, terms and conditions. There might not be specific variations of the Broward Florida Unsecured Installment Payment Promissory Note for Fixed Rate based on Broward County, as the primary focus is on the unsecured format and fixed rate. However, there can be variations or modifications in the note based on individual lenders or borrower preferences, which may involve changes in terms or additional clauses. It is always advisable to consult with legal professionals or financial advisors to tailor the document to the specific needs of the parties involved. In conclusion, the Broward Florida Unsecured Installment Payment Promissory Note for Fixed Rate is an essential legal document that establishes the framework for an unsecured loan within Broward County, Florida. By clearly defining the terms, borrowers and lenders can have a clear understanding of their responsibilities, ensuring a smooth loan repayment process.

Broward Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Broward Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

Take advantage of the US Legal Forms and have immediate access to any form you want. Our beneficial website with a large number of templates makes it easy to find and get virtually any document sample you require. It is possible to save, complete, and certify the Broward Florida Unsecured Installment Payment Promissory Note for Fixed Rate in a couple of minutes instead of browsing the web for several hours looking for a proper template.

Using our catalog is a superb strategy to improve the safety of your document submissions. Our experienced legal professionals regularly check all the documents to make sure that the templates are appropriate for a particular region and compliant with new laws and regulations.

How do you get the Broward Florida Unsecured Installment Payment Promissory Note for Fixed Rate? If you already have a profile, just log in to the account. The Download option will appear on all the samples you view. Moreover, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, follow the instruction below:

- Find the form you require. Make sure that it is the template you were looking for: verify its headline and description, and make use of the Preview function when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the document. Select the format to obtain the Broward Florida Unsecured Installment Payment Promissory Note for Fixed Rate and change and complete, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy document libraries on the web. We are always ready to help you in virtually any legal case, even if it is just downloading the Broward Florida Unsecured Installment Payment Promissory Note for Fixed Rate.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!