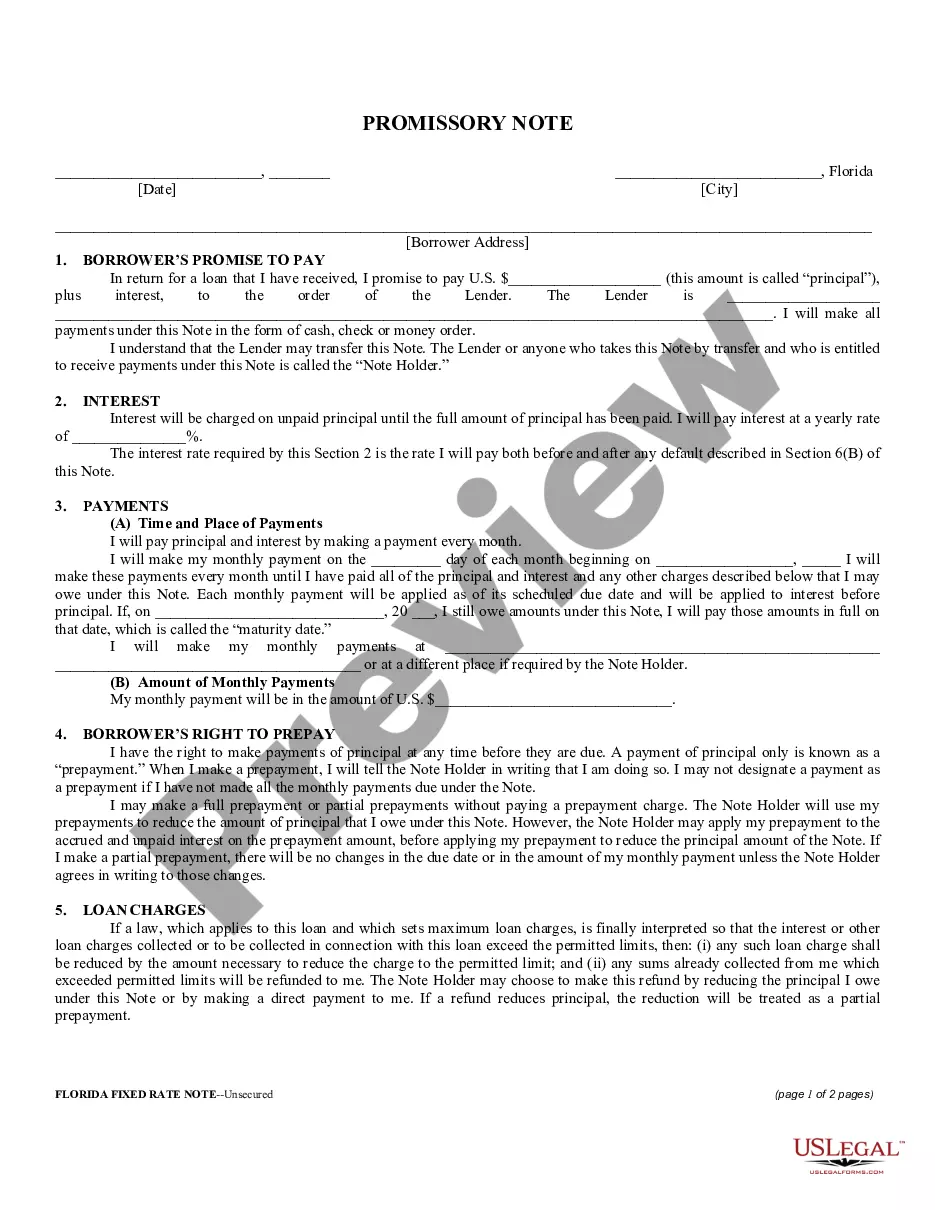

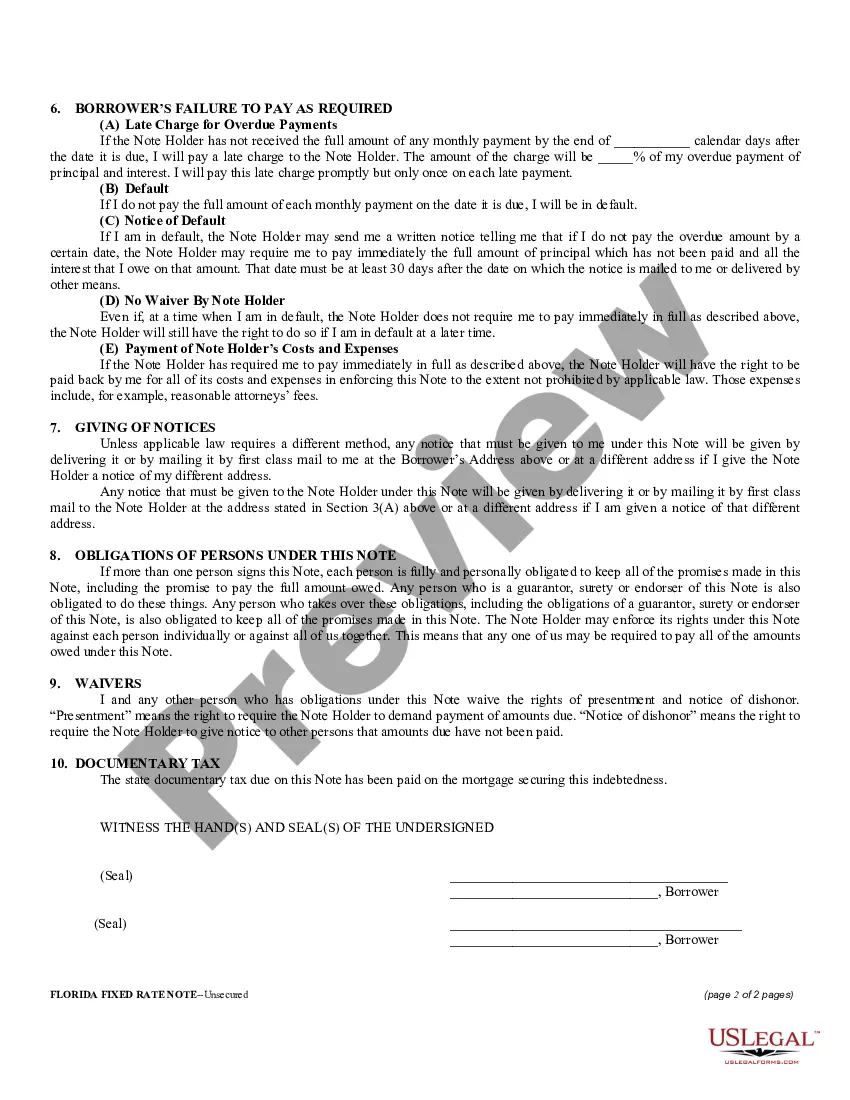

A Jacksonville, Florida unsecured installment payment promissory note for a fixed rate is a legal document that outlines the borrowing and repayment terms between a lender and a borrower in Jacksonville, Florida. This type of promissory note is used when the borrower is seeking a loan but does not offer any collateral to secure it. The note typically contains important information such as the names and contact details of both the lender and borrower, the principal amount being borrowed, the interest rate that is fixed for the duration of the loan, the repayment schedule, and any additional fees or charges that may be applicable. It is a legally binding agreement that both parties must adhere to. The repayment of the loan in this type of promissory note is structured into equal installment payments over a specific period of time. The borrower is obligated to make these payments regularly on the agreed-upon dates until the loan is fully repaid. The fixed interest rate ensures that the borrower knows exactly how much they need to repay each month, providing stability and predictability. It is worth noting that there may be variations or different types of unsecured installment payment promissory notes in Jacksonville, Florida. Some common variations include: 1. Balloon payment promissory note: This type of promissory note allows the borrower to make regular installment payments, but with a large final payment called a "balloon payment" due at the end of the loan term. This final payment is typically larger than the regular installments and is intended to cover the remaining loan balance. 2. Interest-only promissory note: In this type of promissory note, the borrower is only required to make interest payments for a specific period, usually at the beginning of the loan term. The principal amount remains unpaid during this period and is paid back in installments afterwards. 3. Variable rate promissory note: Unlike the fixed rate promissory note, the interest rate in this type of note is subject to change over the duration of the loan. The interest rate is often tied to a specific financial index, such as the prime rate, which means it can increase or decrease based on market conditions. In conclusion, a Jacksonville, Florida unsecured installment payment promissory note for a fixed rate is a legal agreement between a lender and borrower that outlines the terms of a loan with no collateral. It provides details such as the principal amount, fixed interest rate, repayment schedule, and any fees involved. Different variations may include balloon payment, interest-only, or variable-rate promissory notes.

Jacksonville Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

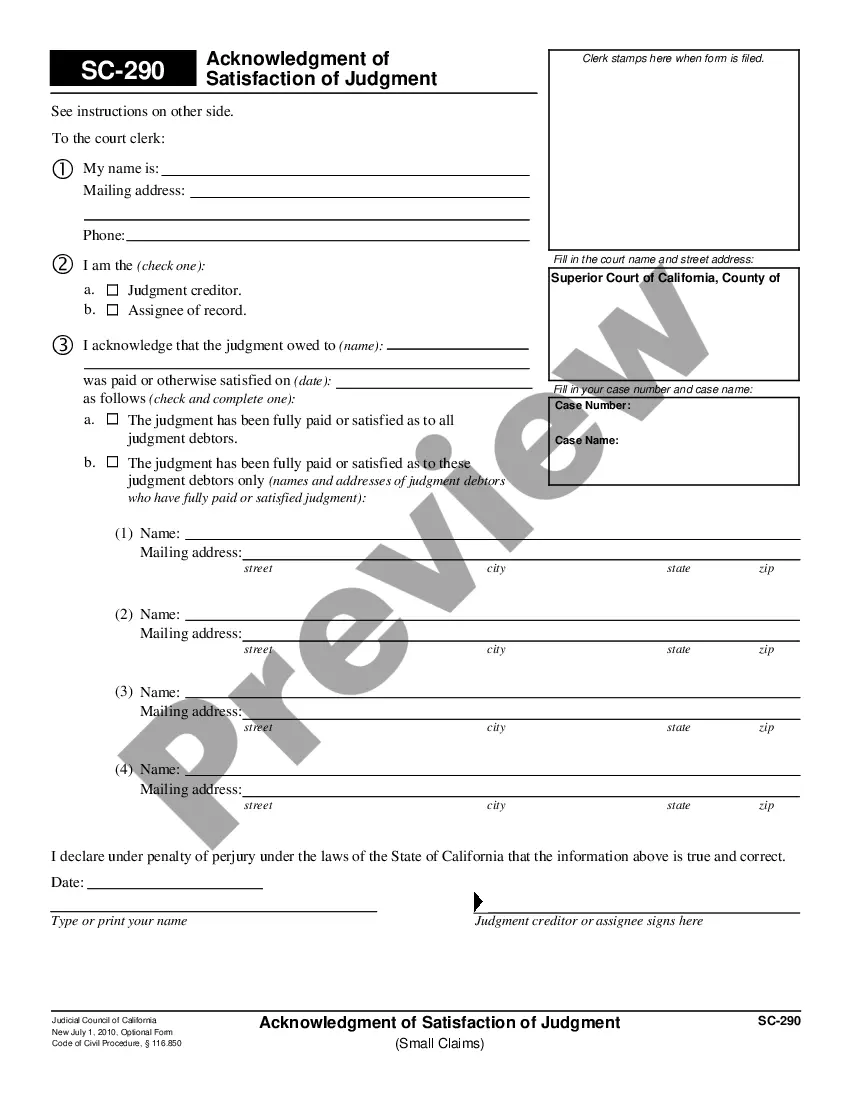

How to fill out Jacksonville Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Jacksonville Florida Unsecured Installment Payment Promissory Note for Fixed Rate becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Jacksonville Florida Unsecured Installment Payment Promissory Note for Fixed Rate takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Jacksonville Florida Unsecured Installment Payment Promissory Note for Fixed Rate. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!