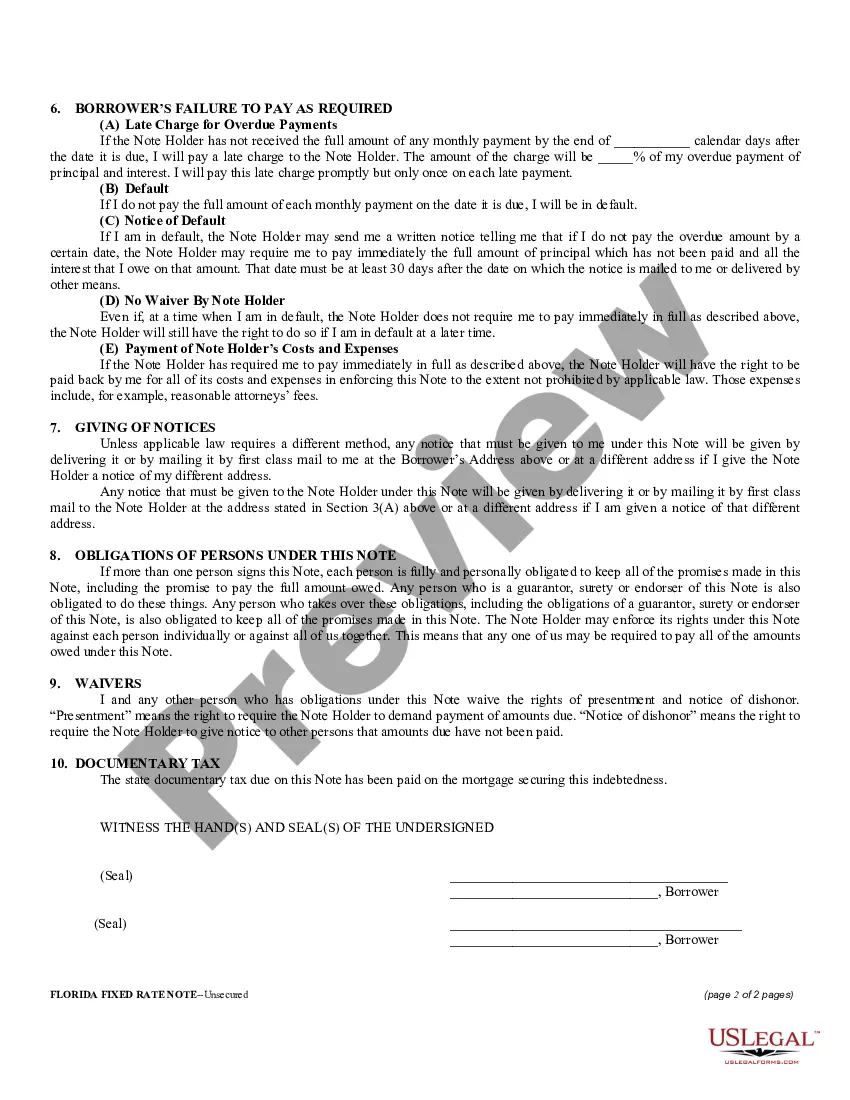

A Lakeland Florida unsecured installment payment promissory note for fixed rate is a legal document that outlines the terms and conditions under which a borrower agrees to repay borrowed money to a lender over a specified period of time with regular, consistent payments. This type of promissory note is widely used in Lakeland, Florida, and serves as a legally binding contract between the borrower and the lender. Keywords: Lakeland Florida, unsecured installment payment promissory note, fixed rate. The Lakeland Florida unsecured installment payment promissory note for fixed rate can be categorized into different types based on various factors such as duration, interest rate, and repayment terms. Some commonly known types include: 1. Short-term unsecured installment payment promissory note: This type of promissory note typically has a duration of less than one year and is used for smaller loan amounts. The interest rate is fixed, meaning it remains constant throughout the repayment period. 2. Long-term unsecured installment payment promissory note: With a duration of more than one year, this type of promissory note is suitable for larger loan amounts. The fixed interest rate provides stability to both the borrower and the lender. 3. Personal unsecured installment payment promissory note: This type of promissory note is used for personal loans between individuals or acquaintances. It does not require collateral, such as property or assets, to secure the loan. 4. Business unsecured installment payment promissory note: Designed for business purposes, this promissory note facilitates borrowing money for business needs without any collateral. It allows businesses to access funds quickly and efficiently. 5. Educational unsecured installment payment promissory note: This type of promissory note is commonly used for student loans. It helps students finance their education and outlines the repayment terms and conditions, including the fixed interest rate. The Lakeland Florida unsecured installment payment promissory note for fixed rate is a critical legal instrument that protects both parties involved in a loan agreement. It specifies important details such as the loan amount, repayment schedule, interest rate, late payment penalties, and any additional provisions agreed upon by the borrower and lender. It is recommended to consult legal professionals before entering into any financial agreements to ensure compliance with local laws and regulations in Lakeland, Florida.

Lakeland Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Lakeland Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

Take advantage of the US Legal Forms and obtain immediate access to any form template you want. Our helpful platform with thousands of documents makes it easy to find and get virtually any document sample you will need. You can save, fill, and certify the Lakeland Florida Unsecured Installment Payment Promissory Note for Fixed Rate in a couple of minutes instead of surfing the Net for many hours looking for the right template.

Using our collection is a great strategy to increase the safety of your record filing. Our professional legal professionals on a regular basis check all the documents to ensure that the templates are appropriate for a particular state and compliant with new laws and regulations.

How can you get the Lakeland Florida Unsecured Installment Payment Promissory Note for Fixed Rate? If you already have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Furthermore, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions listed below:

- Find the template you require. Make certain that it is the template you were looking for: check its headline and description, and make use of the Preview option if it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the saving procedure. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Select the format to obtain the Lakeland Florida Unsecured Installment Payment Promissory Note for Fixed Rate and revise and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable template libraries on the internet. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Lakeland Florida Unsecured Installment Payment Promissory Note for Fixed Rate.

Feel free to benefit from our service and make your document experience as convenient as possible!