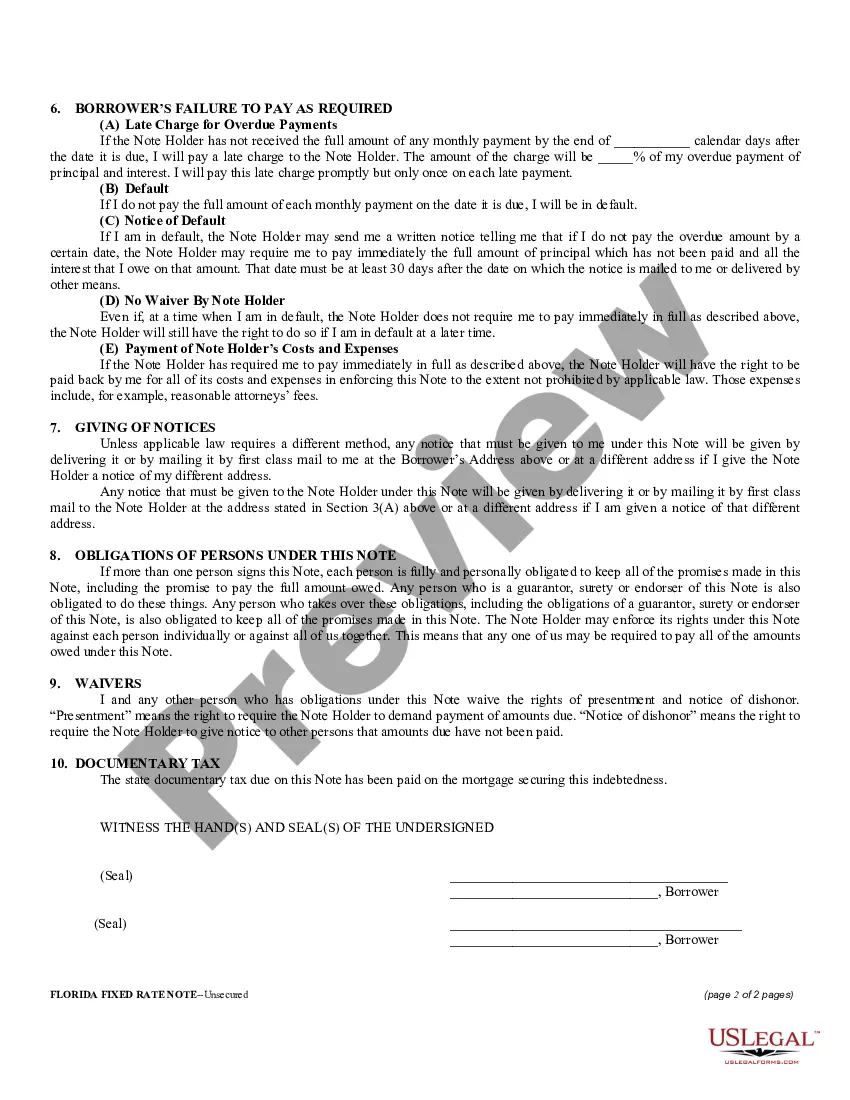

Miami-Dade Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions for a loan agreement between a lender and a borrower in the Miami-Dade County area of Florida. This promissory note specifies the repayment terms, interest rate, and other vital details of the loan agreement. The Miami-Dade Florida Unsecured Installment Payment Promissory Note for Fixed Rate is designed for borrowers who need to borrow funds for personal or business purposes but do not have collateral to secure the loan. It provides a structured repayment plan to help borrowers manage their debt obligations responsibly. Key elements of the Miami-Dade Florida Unsecured Installment Payment Promissory Note for Fixed Rate includes: 1. Parties Involved: The promissory note clearly identifies the lender (often an individual or a lending institution) and the borrower. Their names, addresses, and contact information are mentioned to establish a legal agreement. 2. Loan Amount and Purpose: The promissory note specifies the exact amount of money borrowed by the borrower. It also outlines the purpose of the loan, whether it is for financing education, purchasing a vehicle, starting a business, or any other valid reason. 3. Repayment Terms: The note defines the repayment terms, including the number of installments and the amount due for each payment. It may also highlight the due dates, grace periods, and any late payment penalties or fees associated with missed payments. 4. Interest Rate: This document outlines the fixed interest rate that applies to the loan. The term "Fixed Rate" indicates that the interest remains constant throughout the loan duration, allowing the borrower to plan their repayments more effectively. 5. Default and Remedies: The promissory note includes a detailed section describing the consequences of default by the borrower. It may mention the lender's right to accelerate the loan, demanding immediate full payment, and the remedies available to the lender in case of non-payment or breach of contract. Different types of the Miami-Dade Florida Unsecured Installment Payment Promissory Note for Fixed Rate may include variations in the terms and conditions based on the specific needs of the borrower or lender. Some variations may be influenced by loan duration, special repayment provisions, or other circumstances agreed upon by both parties. In conclusion, the Miami-Dade Florida Unsecured Installment Payment Promissory Note for Fixed Rate serves as an essential legal document for establishing a loan agreement between a lender and a borrower. It provides clarity and protection for both parties involved, ensuring that the loan is repaid in full and on time.

Miami-Dade Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Miami-Dade Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

Do you need a reliable and affordable legal forms supplier to get the Miami-Dade Florida Unsecured Installment Payment Promissory Note for Fixed Rate? US Legal Forms is your go-to option.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and county.

To download the document, you need to log in account, locate the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Miami-Dade Florida Unsecured Installment Payment Promissory Note for Fixed Rate conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is good for.

- Restart the search in case the form isn’t good for your specific scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Miami-Dade Florida Unsecured Installment Payment Promissory Note for Fixed Rate in any provided file format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time researching legal paperwork online for good.