Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

If you have previously utilized our service, sign in to your account and store the Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate on your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it in accordance with your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your file.

You enjoy continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to use it again. Leverage the US Legal Forms service to effortlessly locate and save any template for your individual or business needs!

- Ensure you have found the correct document. Review the description and utilize the Preview option, if available, to verify it satisfies your requirements. If it does not suit your needs, use the Search tab above to discover the suitable one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or choose the PayPal option to finalize the purchase.

- Acquire your Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate. Select the file format for your document and store it to your device.

- Complete your example. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

In Florida, you typically do not need to file a promissory note with a public office unless it is part of a secured transaction. However, it is wise to keep a copy for your records and possibly provide one to a third party for safekeeping. Should you need assistance, uslegalforms can help you create and organize your Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate properly.

You can find your mortgage promissory note in your closing documents, which are often kept by your lender or in your personal records. If you used a Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate via US Legal Forms, you can simply log into your account to access a copy. In any case, reaching out to your lender can provide you further assistance in locating the document.

You can find a promissory note for a mortgage at various sources, including banks, credit unions, and online legal platforms. A Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate can also be created using US Legal Forms, which provides customizable templates to suit your needs. This platform makes it easier to obtain the accurate documentation you need.

Yes, a promissory note is generally enforceable in Florida, provided it meets certain legal requirements such as being in writing and signed by the borrower. When you create a Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate, you ensure that it adheres to the state's regulations, making it a solid legal agreement. If you have questions about enforcing a note, consider seeking advice from a legal professional.

Yes, you can create your own promissory note. However, it is crucial to ensure that it includes all necessary legal elements to be enforceable. Using templates from US Legal Forms allows you to create a valid Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate while ensuring compliance with Florida laws.

To make a promissory note for payment, start by drafting the essential information such as the amount, interest rate, and payment schedule. Be clear and concise in your writing to avoid confusion. You can also take advantage of US Legal Forms' resources to generate a compliant Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate quickly and efficiently.

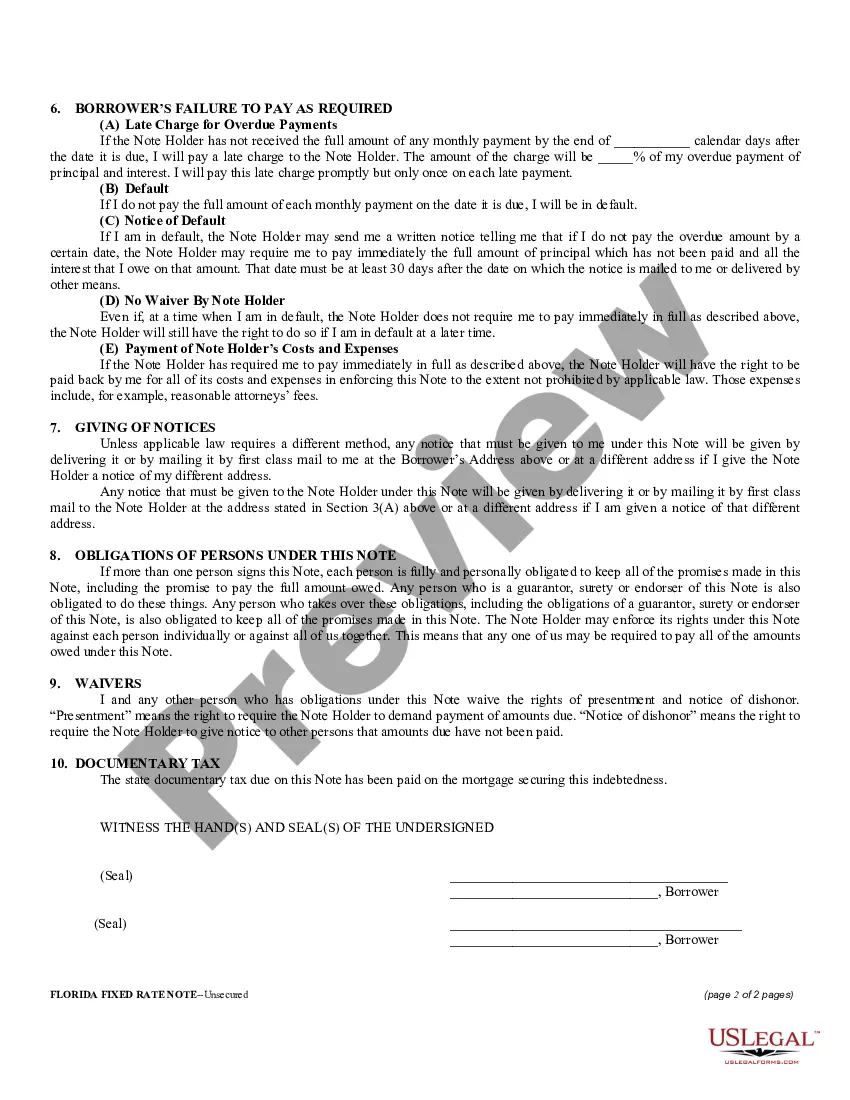

In Florida, a promissory note must include certain key elements such as the names of the parties, the amount borrowed, the interest rate, and the repayment schedule. It should be signed by the borrower to confirm agreement. For a properly structured Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate, using templates from US Legal Forms can simplify the process.

You can obtain a promissory note for your mortgage through various sources. One effective method is to use online platforms like US Legal Forms, which offer customizable templates. This ensures you get a Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate that meets your specific needs.

A promissory note may be deemed invalid if it contains errors, such as missing signatures or unclear terms. Additionally, if a party lacks the legal capacity to enter into the agreement, this could also invalidate the note. To enhance the legitimacy of your agreement, consider drafting a Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate using a trusted legal resource.

A promissory note may be declared invalid in Florida if it does not meet specific legal standards, such as lacking the necessary signatures or being improperly executed. Moreover, if the terms are ambiguous or contradictory, courts might refuse to enforce the note. Using a reliable template for a Miramar Florida Unsecured Installment Payment Promissory Note for Fixed Rate can help you avoid mistakes and ensure the document's validity.