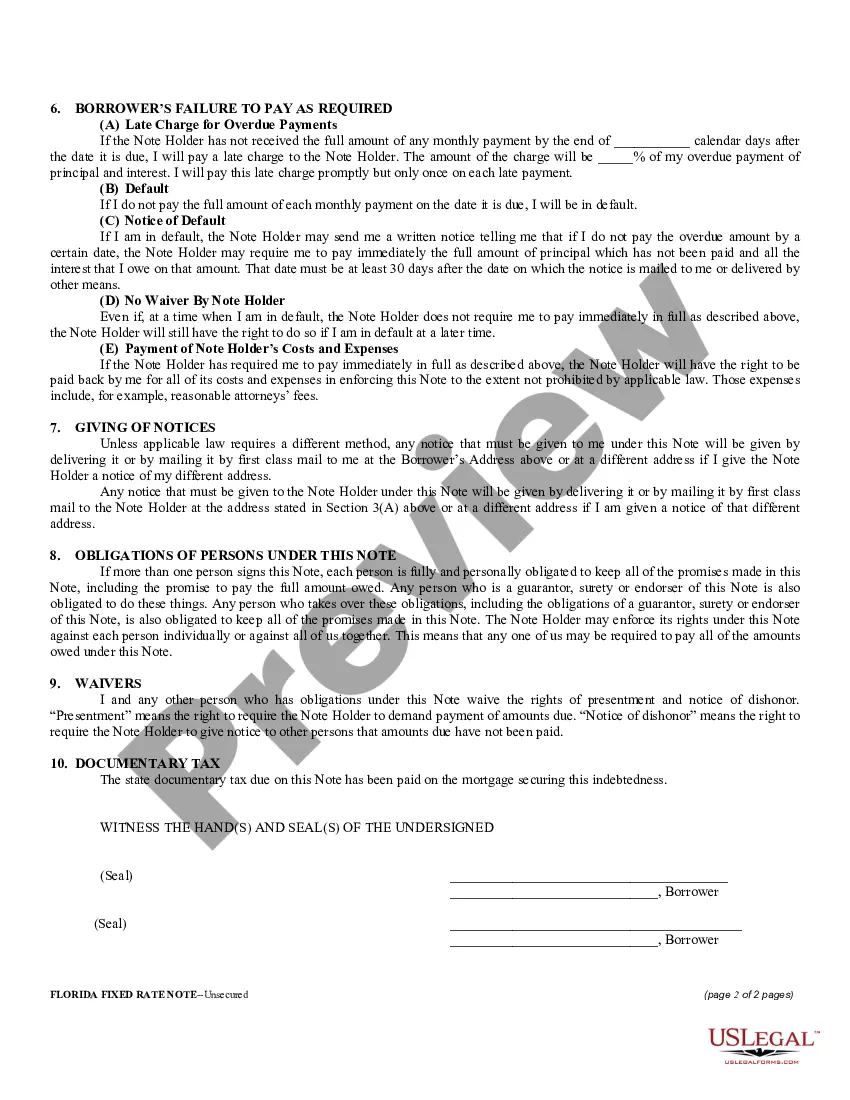

The Orange Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document used to establish a formal agreement between a lender and a borrower in Orange, Florida. This promissory note serves as evidence of a loan transaction and outlines the terms and conditions of repayment. Keywords: Orange Florida, unsecured, installment, payment, promissory note, fixed rate. This promissory note is specifically designed for borrowers in Orange, Florida, who are seeking a loan without providing collateral. It is an unsecured promissory note, meaning that the lender relies solely on the borrower's creditworthiness and promise to repay the loan. The promissory note is structured as an installment payment agreement, which means that the borrower will repay the loan in equal periodic payments over a specified duration. The frequency of payments (e.g., monthly, quarterly) and the installment amount are predetermined and included in the note. One of the crucial elements of this promissory note is the fixed rate of interest. It ensures that the interest rate charged on the loan remains constant throughout the repayment period. This provides stability and predictability for both the lender and the borrower. Different types of Orange Florida Unsecured Installment Payment Promissory Notes for Fixed Rate may exist based on the specific details and terms negotiated between the parties involved. Some variations may include: 1. Short-term Unsecured Installment Payment Promissory Note: This type of promissory note could have a relatively short repayment period, typically spanning a year or less. It is suitable for smaller loan amounts or urgent financial needs. 2. Long-term Unsecured Installment Payment Promissory Note: This type of promissory note is used for loans with longer repayment terms, often extending beyond a year. It allows borrowers to spread out the payments over an extended period. 3. Large Sum Unsecured Installment Payment Promissory Note: This variation is commonly used for significant loan amounts. It may involve more comprehensive terms and conditions due to the higher financial stakes. 4. Unsecured Installment Payment Promissory Note for Individuals: This promissory note is tailored specifically for loans contracted between private individuals, rather than involving financial institutions or businesses. It is important to note that the specific terms and conditions, such as interest rate, payment frequency, and repayment duration, should be clearly stated in the promissory note, along with any additional terms agreed upon by both parties. This ensures mutual understanding and minimizes potential conflicts or misunderstandings.

Orange Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Orange Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any law background to create such papers from scratch, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform provides a massive collection with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Orange Florida Unsecured Installment Payment Promissory Note for Fixed Rate or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Orange Florida Unsecured Installment Payment Promissory Note for Fixed Rate in minutes employing our reliable platform. If you are presently a subscriber, you can go ahead and log in to your account to download the appropriate form.

However, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Orange Florida Unsecured Installment Payment Promissory Note for Fixed Rate:

- Be sure the form you have chosen is good for your area because the regulations of one state or area do not work for another state or area.

- Review the document and go through a brief outline (if available) of scenarios the paper can be used for.

- In case the form you picked doesn’t meet your requirements, you can start again and look for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your login information or create one from scratch.

- Select the payment gateway and proceed to download the Orange Florida Unsecured Installment Payment Promissory Note for Fixed Rate once the payment is completed.

You’re all set! Now you can go ahead and print out the document or complete it online. If you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.