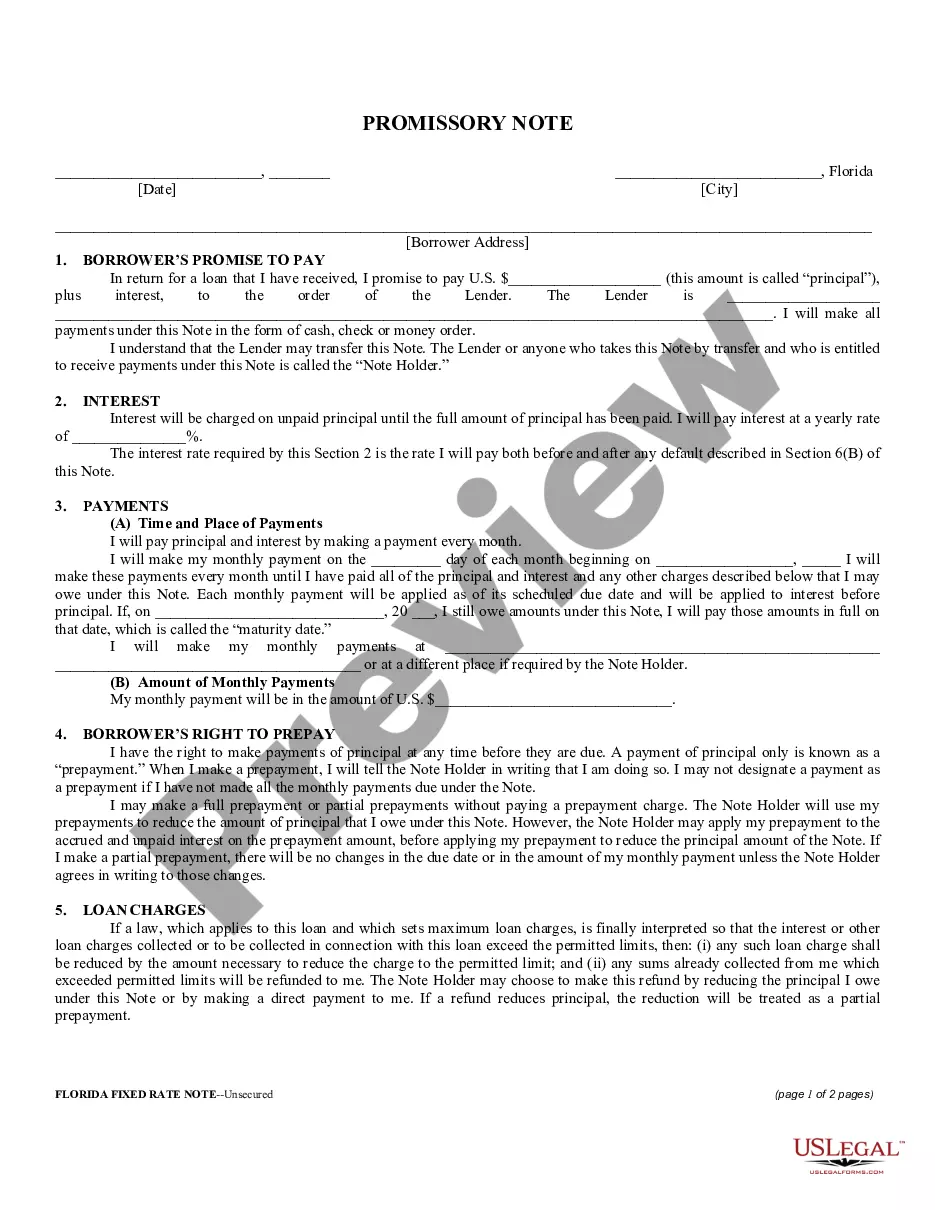

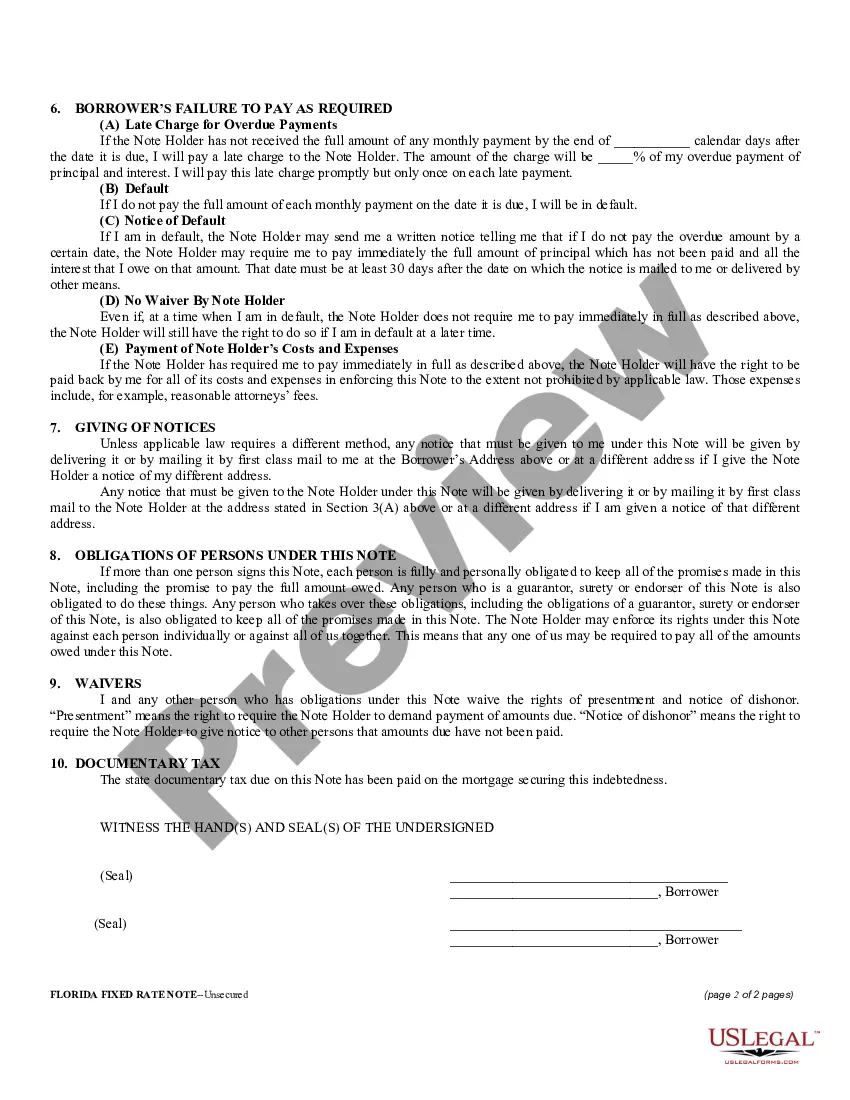

A Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is specific to Palm Beach, Florida, and is used for loans that do not require collateral or security. The Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate serves as a written agreement that details the loan amount, interest rate, repayment schedule, and other essential aspects of the loan. This document provides clarity and protection for both parties involved in the loan transaction. The fixed rate aspect of the promissory note indicates that the interest rate charged on the loan remains constant throughout the repayment period. This offers stability and predictability to the borrower, as they know the exact amount of interest they will be required to pay each month. Key terms and provisions commonly included in a Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate may include: 1. Loan Amount: Clearly specifies the principal amount being borrowed. 2. Interest Rate: States the fixed interest rate charged on the loan, typically expressed as an annual percentage rate (APR). 3. Repayment Schedule: Outlines the installment plan, including the frequency (monthly, bi-monthly, etc.) and the due date for each payment. 4. Late Payment Penalties: Describes the additional charges or penalties that may be imposed if the borrower fails to make the installment payments on time. 5. Prepayment Terms: Determines whether the loan can be repaid in full before the designated maturity date and whether any prepayment penalties or fees will be applicable. 6. Default Terms: Specifies the consequences if the borrower defaults on the loan, such as acceleration of the full balance or legal action. There might be different variations or types of Palm Beach Florida Unsecured Installment Payment Promissory Notes for Fixed Rate, depending on the specific requirements of lenders or borrowers. These may include: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for loans between individuals, such as friends or family members. 2. Business Loan Promissory Note: Designed for loans between businesses, this promissory note includes specific details related to the borrowing company and may include provisions regarding loan purposes or future financing. 3. Student Loan Promissory Note: A specialized promissory note used for educational loans, often ensuring deferred payments until after graduation or providing extended repayment options. In conclusion, a Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial legal document used in loan transactions within Palm Beach, Florida. It outlines all the relevant terms and conditions of the loan, providing clarity and protection for both lender and borrower.

Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Category:

State:

Florida

County:

Palm Beach

Control #:

FL-NOTE-2

Format:

Word;

Rich Text

Instant download

Description

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

A Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is specific to Palm Beach, Florida, and is used for loans that do not require collateral or security. The Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate serves as a written agreement that details the loan amount, interest rate, repayment schedule, and other essential aspects of the loan. This document provides clarity and protection for both parties involved in the loan transaction. The fixed rate aspect of the promissory note indicates that the interest rate charged on the loan remains constant throughout the repayment period. This offers stability and predictability to the borrower, as they know the exact amount of interest they will be required to pay each month. Key terms and provisions commonly included in a Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate may include: 1. Loan Amount: Clearly specifies the principal amount being borrowed. 2. Interest Rate: States the fixed interest rate charged on the loan, typically expressed as an annual percentage rate (APR). 3. Repayment Schedule: Outlines the installment plan, including the frequency (monthly, bi-monthly, etc.) and the due date for each payment. 4. Late Payment Penalties: Describes the additional charges or penalties that may be imposed if the borrower fails to make the installment payments on time. 5. Prepayment Terms: Determines whether the loan can be repaid in full before the designated maturity date and whether any prepayment penalties or fees will be applicable. 6. Default Terms: Specifies the consequences if the borrower defaults on the loan, such as acceleration of the full balance or legal action. There might be different variations or types of Palm Beach Florida Unsecured Installment Payment Promissory Notes for Fixed Rate, depending on the specific requirements of lenders or borrowers. These may include: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for loans between individuals, such as friends or family members. 2. Business Loan Promissory Note: Designed for loans between businesses, this promissory note includes specific details related to the borrowing company and may include provisions regarding loan purposes or future financing. 3. Student Loan Promissory Note: A specialized promissory note used for educational loans, often ensuring deferred payments until after graduation or providing extended repayment options. In conclusion, a Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial legal document used in loan transactions within Palm Beach, Florida. It outlines all the relevant terms and conditions of the loan, providing clarity and protection for both lender and borrower.

Free preview

How to fill out Palm Beach Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

If you’ve already utilized our service before, log in to your account and download the Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Palm Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!