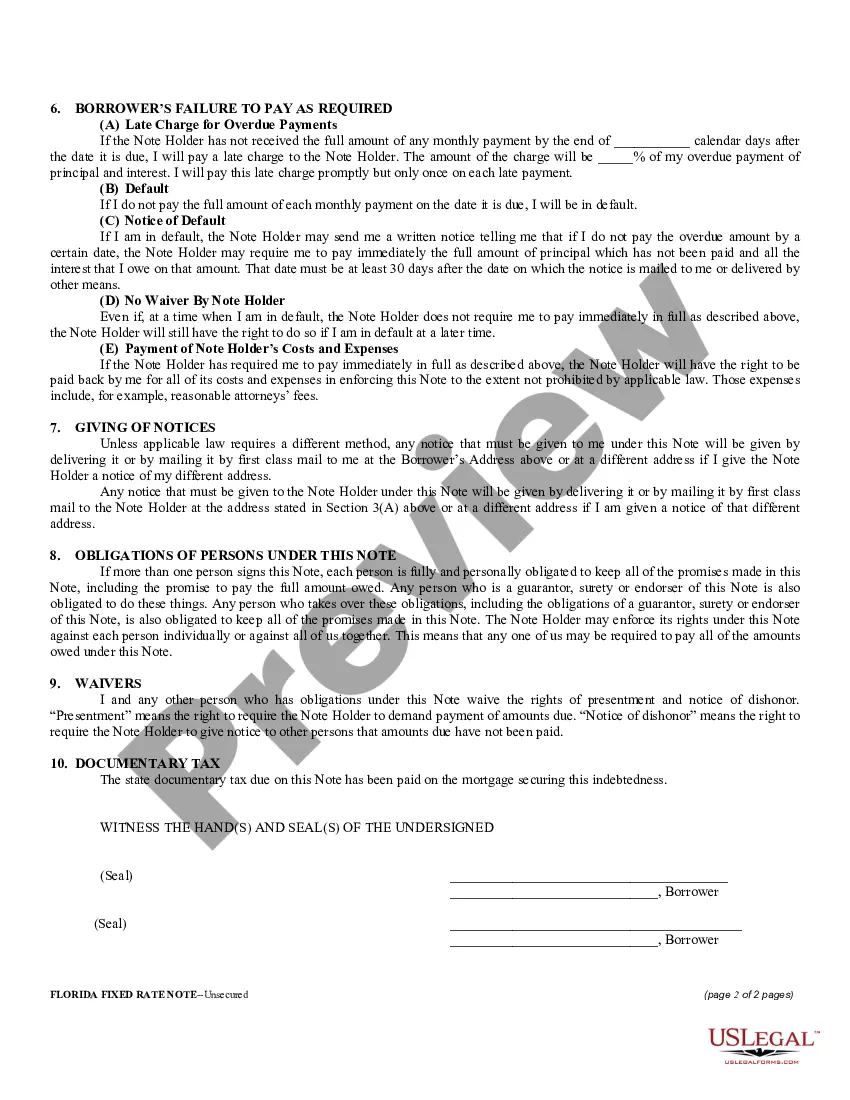

A Pembroke Pines Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is commonly used in Pembroke Pines, Florida, for loans that require regular installment payments at a fixed interest rate. It provides a clear understanding of the loan agreement, ensuring both parties are aware of their obligations and rights. The promissory note typically includes the following key elements: 1. Parties involved: It identifies the lender (the individual, organization, or financial institution providing the loan) and the borrower (the individual or entity receiving the loan). 2. Loan amount: It specifies the principal amount being lent to the borrower. 3. Interest rate: It states the fixed rate at which interest will accrue on the loan. 4. Installment payments: It details the schedule and frequency of payments the borrower must make to repay the loan. 5. Repayment terms: It outlines the duration of the loan and any grace periods, if applicable. 6. Late payment penalties: It specifies any additional charges or penalties imposed on the borrower for failing to make timely payments. 7. Default and remedies: It outlines the consequences if the borrower fails to fulfill their obligations under the promissory note, including the lender's rights to seek legal recourse. 8. Governing law: It states the jurisdiction that will govern the interpretation and enforcement of the promissory note. In Pembroke Pines, Florida, there may be variations or specific types of Unsecured Installment Payment Promissory Notes for Fixed Rate, including: 1. Personal Unsecured Installment Payment Promissory Note for Fixed Rate: This type of promissory note is used for personal loans between individuals, friends, or family members, where no collateral is required to secure the loan. 2. Business Unsecured Installment Payment Promissory Note for Fixed Rate: This promissory note is tailored for business-related loans, ensuring that both parties understand the terms and obligations regarding repayment. 3. Student Unsecured Installment Payment Promissory Note for Fixed Rate: Commonly used for educational purposes, this promissory note enables students to avail themselves of loans to finance their education without the need for collateral. When entering into a Pembroke Pines Florida Unsecured Installment Payment Promissory Note for Fixed Rate, it is crucial for both parties to consult with legal professionals to ensure compliance with relevant laws and regulations. Additionally, borrowers should thoroughly review and understand the terms before signing the promissory note to avoid any misunderstandings or potential legal issues in the future.

Pembroke Pines Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Pembroke Pines Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

Make use of the US Legal Forms and have instant access to any form you need. Our helpful platform with thousands of documents allows you to find and obtain virtually any document sample you require. You can download, complete, and certify the Pembroke Pines Florida Unsecured Installment Payment Promissory Note for Fixed Rate in just a couple of minutes instead of browsing the web for many hours trying to find an appropriate template.

Utilizing our catalog is a superb strategy to raise the safety of your form submissions. Our experienced lawyers regularly check all the records to make sure that the templates are relevant for a particular state and compliant with new acts and polices.

How can you obtain the Pembroke Pines Florida Unsecured Installment Payment Promissory Note for Fixed Rate? If you already have a profile, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions listed below:

- Find the template you require. Make sure that it is the form you were looking for: examine its headline and description, and make use of the Preview feature when it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading process. Select Buy Now and select the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Export the file. Indicate the format to get the Pembroke Pines Florida Unsecured Installment Payment Promissory Note for Fixed Rate and change and complete, or sign it for your needs.

US Legal Forms is probably the most significant and reliable document libraries on the internet. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Pembroke Pines Florida Unsecured Installment Payment Promissory Note for Fixed Rate.

Feel free to take advantage of our service and make your document experience as convenient as possible!