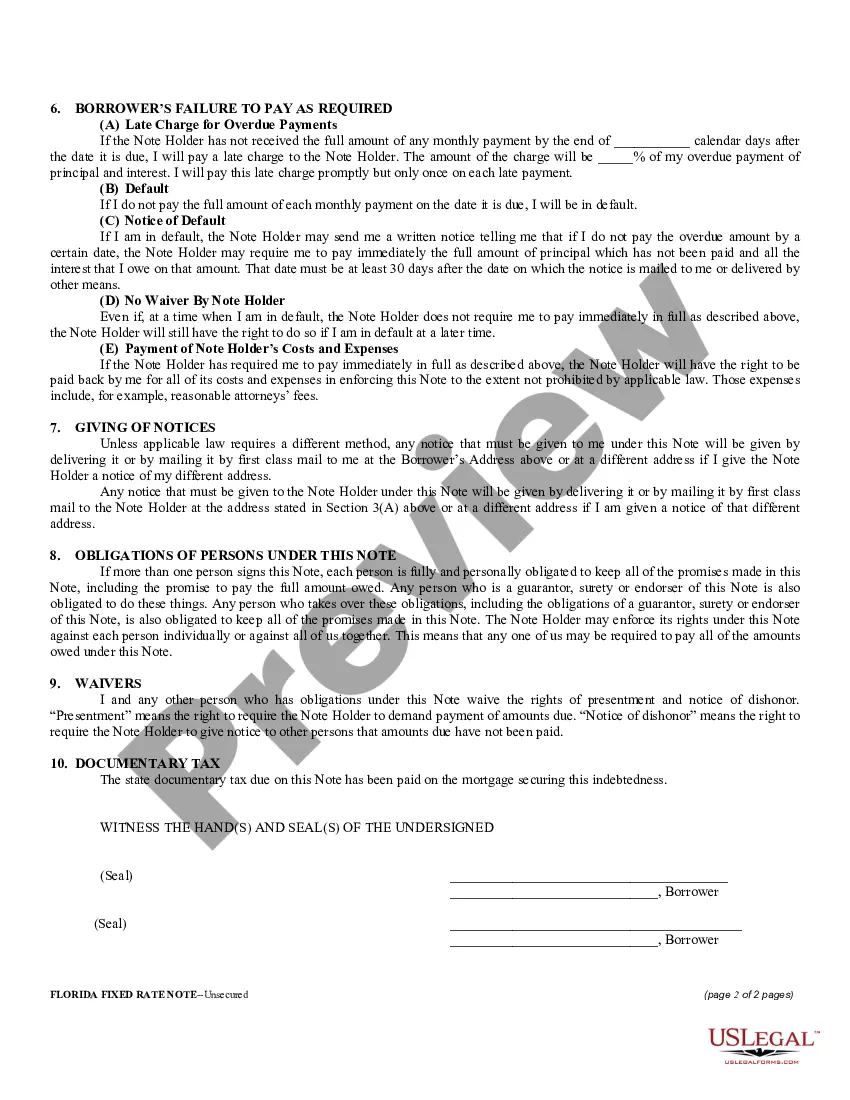

A Pompano Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Pompano Beach, Florida. This type of promissory note is specifically designed for unsecured loans, meaning that the borrower does not provide any collateral to secure the loan. The main purpose of a Pompano Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate is to establish a comprehensive understanding of the loan's repayment details and protect the rights of both parties involved. Typically, this promissory note includes the loan amount, interest rate, repayment schedule, and any applicable late fees or penalties. There are various types of Pompano Beach Florida Unsecured Installment Payment Promissory Notes for Fixed Rate, each tailored to specific loan arrangements. Some common types may include: 1. Personal Loan Promissory Note: A promissory note used for personal loans obtained for various purposes such as home improvement, debt consolidation, or personal expenses. 2. Student Loan Promissory Note: This type of promissory note is utilized for educational loans, typically issued by private lenders to finance the borrower's college or university tuition. 3. Small Business Loan Promissory Note: A promissory note specific to small businesses, often obtained to fund start-up costs, expansion plans, or working capital needs. These loans are usually extended by banks or alternative lenders to support entrepreneurial ventures. 4. Medical Loan Promissory Note: This promissory note is designed for borrowers seeking financial assistance to cover medical expenses, including surgical procedures, dental work, or specialized treatments not fully covered by insurance. Regardless of the type of Pompano Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate, it is crucial for both the lender and the borrower to fully comprehend the terms and obligations stipulated in the agreement. Seeking legal advice or consulting with a financial professional is always recommended ensuring all legal requirements are met and to avoid any potential disputes or misunderstandings.

Pompano Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Pompano Beach Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are searching for a relevant form, it’s difficult to find a better service than the US Legal Forms site – probably the most extensive online libraries. With this library, you can find thousands of document samples for business and individual purposes by types and states, or keywords. With the high-quality search feature, getting the newest Pompano Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate is as easy as 1-2-3. Moreover, the relevance of each document is proved by a team of skilled lawyers that on a regular basis review the templates on our platform and update them based on the newest state and county regulations.

If you already know about our platform and have an account, all you need to receive the Pompano Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate is to log in to your profile and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the form you require. Look at its explanation and make use of the Preview function to check its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to find the appropriate record.

- Affirm your decision. Click the Buy now option. Following that, select the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the form. Indicate the format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the obtained Pompano Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate.

Every form you add to your profile has no expiration date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you want to get an additional version for enhancing or creating a hard copy, feel free to come back and export it once again anytime.

Take advantage of the US Legal Forms extensive library to get access to the Pompano Beach Florida Unsecured Installment Payment Promissory Note for Fixed Rate you were looking for and thousands of other professional and state-specific templates in a single place!