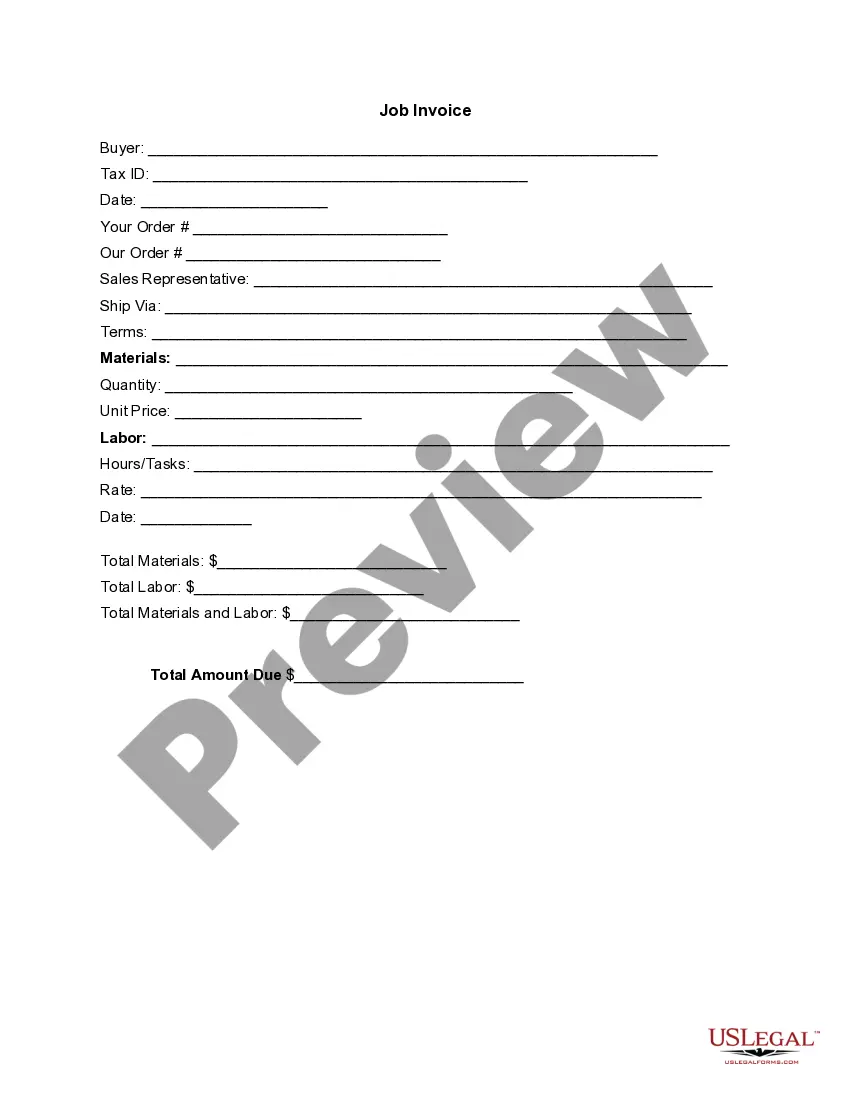

A Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Port St. Lucie, Florida. This type of promissory note is specifically designed for loans that require regular and equal payments over a specific period of time. The promissory note serves as evidence of the loan and establishes the borrower's promise to repay the loan in fixed installments, comprising both principal and interest, until the entire balance is fully settled. It is an unsecured note, meaning that it does not require collateral to secure the loan. This places a higher level of trust in the borrower's intention and ability to repay the loan. The key elements typically included in a Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate are: 1. Parties involved: The promissory note identifies the lender, often referred to as the "Payee," and the borrower, known as the "Maker." Their names, addresses, and contact information are included for legal identification purposes. 2. Loan amount and interest rate: The promissory note clearly states the principal amount borrowed by the borrower and the fixed interest rate that will be applied to the outstanding balance throughout the life of the loan. The interest rate is usually expressed as an annual percentage rate (APR). 3. Repayment terms: This section states the repayment schedule, including the frequency and amount of installment payments. It outlines the due dates, whether monthly or any other agreed-upon interval, providing clarity on when payments are expected. Additionally, it specifies the exact address where payments should be sent. 4. Late fees and penalties: To ensure timely payments, the promissory note may specify the consequences of late payments. It may outline a late fee or penalty that will be imposed if the borrower fails to make payments on time, encouraging prompt payments and discouraging defaults. 5. Prepayment provisions: Some promissory notes may contain clauses allowing the borrower to pay off the loan early without incurring any prepayment penalties, while others may include a provision for a prepayment penalty if the borrower decides to pay off the loan before the predetermined term. Different types or variations of Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate may include: 1. Simple Fixed Rate Promissory Note: This is the basic type of promissory note with a fixed interest rate and equal installment payments over a specified period of time. 2. Balloon Promissory Note: This variation involves smaller installment payments over the term of the loan, with a lump sum (balloon payment) due at the end. 3. Renewable Promissory Note: This allows for the loan to be renewed or extended upon its maturity if mutually agreed upon by both parties. 4. Acceleration Promissory Note: This type allows the lender to demand full repayment of the outstanding loan balance if the borrower defaults on any of the installment payments or breaches any terms of the note. It is crucial for both the lender and borrower to carefully review and understand the terms of the Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate before signing. Seeking legal advice may be beneficial to ensure compliance with state laws and protection of both parties' interests.

Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Port St. Lucie Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

Do you require a reliable and budget-friendly provider of legal documents to obtain the Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate? US Legal Forms is your ideal option.

Whether you need a simple agreement to establish guidelines for living with your partner or a set of documents to advance your separation or divorce through the legal system, we have you secured. Our platform boasts over 85,000 current legal document templates for individual and business use. All the templates we provide are not generic and are tailored based on the specific requirements of your state and county.

To acquire the form, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Kindly note that you can download your previously bought form templates at any time from the My documents section.

Are you visiting our website for the first time? No problem. You can create an account with great ease, but before doing that, please ensure to follow these steps.

Now you can register your account. Subsequently, choose the subscription option and continue to payment. After completing the payment, download the Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate in any available file format. You can return to the website at any time and redownload the form without incurring any additional costs.

Obtaining current legal documents has never been simpler. Give US Legal Forms a try today, and say goodbye to spending hours understanding legal paperwork online.

- Verify that the Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate complies with the regulations of your state and locality.

- Review the specifics of the form (if available) to determine who it applies to and what it is suitable for.

- Repeat your search if the template does not fit your particular situation.

Form popularity

FAQ

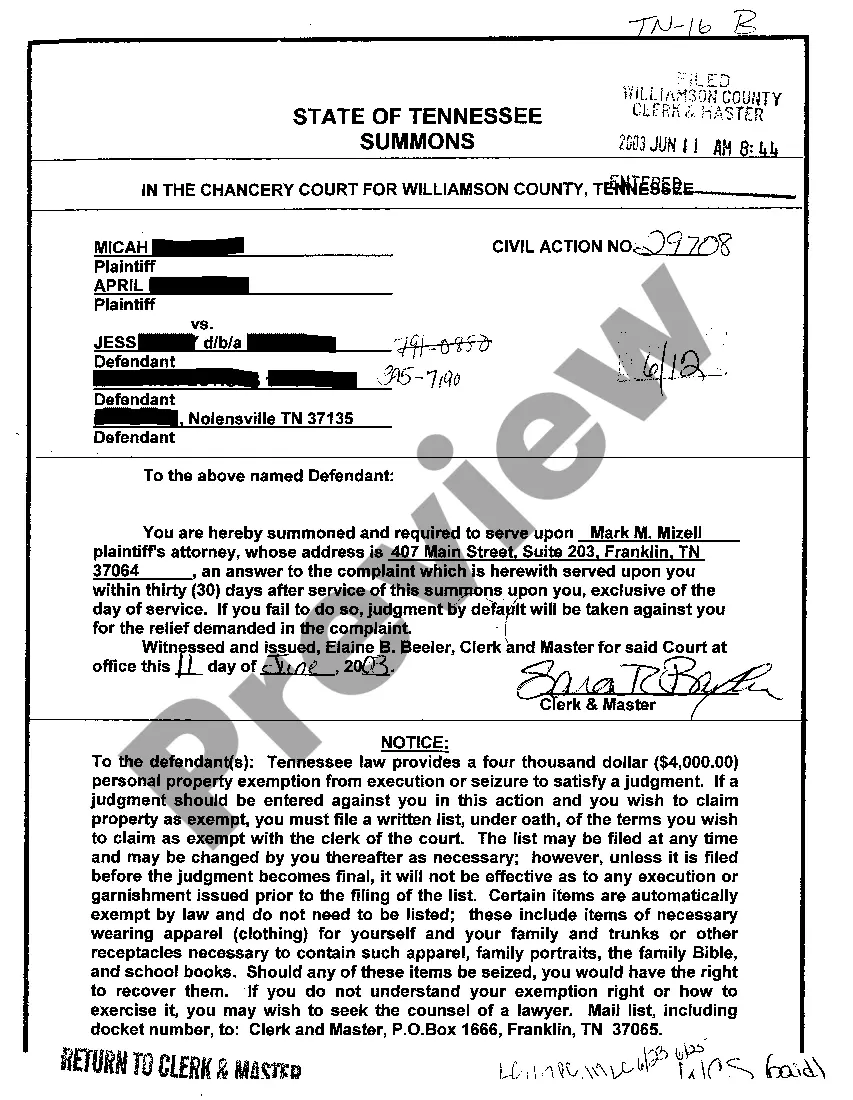

In Florida, a promissory note can be deemed invalid if it lacks clear terms, such as the principal amount, interest rate, and repayment schedule. Additionally, failure to include signatures from all parties involved, including a witness or notary, may also render the note unenforceable. It's essential to ensure your Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate meets these legal requirements for validity. Using a reliable platform like uslegalforms can help you create a compliant promissory note that protects your interests.

You can obtain a promissory note from various sources including legal websites, financial institutions, or by creating one yourself. Numerous online platforms provide templates specifically tailored for Port St. Lucie Florida Unsecured Installment Payment Promissory Notes for Fixed Rate. Using a trusted service like USLegalForms can help you access accurate and legally sound templates.

Promissory notes, including the Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate, can be found through various channels. Many legal websites provide templates or downloadable documents suited for your needs. Additionally, platforms like USLegalForms are great resources for finding compliant and customizable promissory notes.

Yes, a promissory note is generally enforceable in Florida as long as it meets specific legal requirements. These requirements include clear terms relating to the amount, repayment timeline, and any applicable interest. Utilizing a Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate can provide a structured approach to ensure enforceability in Florida.

The key difference lies in collateral. A secured promissory note is tied to specific assets, providing the lender with security if the borrower fails to repay. In contrast, an unsecured promissory note, like the Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate, does not have such backing, placing greater risk on the lender while offering more flexibility to the borrower.

An unsecured note signifies that it is not backed by any specific collateral. If the borrower defaults, the lender cannot claim any particular asset to recover the lost funds. This is vital to understand when dealing with a Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate, as it informs both parties of their rights and obligations without collateral security.

To prove a breach of a promissory note in Florida, one must demonstrate that a valid note existed, the borrower failed to make required payments, and that the lender suffered damages due to this breach. These elements are crucial when dealing with documents such as the Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate. Knowing these can aid in effectively managing your agreement.

The duration of a promissory note in Florida is typically specified within the note itself; it can extend to several years. However, if no terms are set, Florida's statutes may imply a default duration. It's important to outline this duration clearly in your Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate to avoid confusion.

In Florida, it is not a legal requirement for promissory notes to be witnessed. However, having a witness can provide additional protection and clarity, particularly with documents like the Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate. Consider this option depending on the level of security you desire.

To fill out a promissory note, like a Port St. Lucie Florida Unsecured Installment Payment Promissory Note for Fixed Rate, begin with the names and contact details of both parties involved. Clearly outline the principal amount, interest rate, repayment schedule, and any late fees. Ensuring this information is accurate protects all parties and reinforces the document's validity.