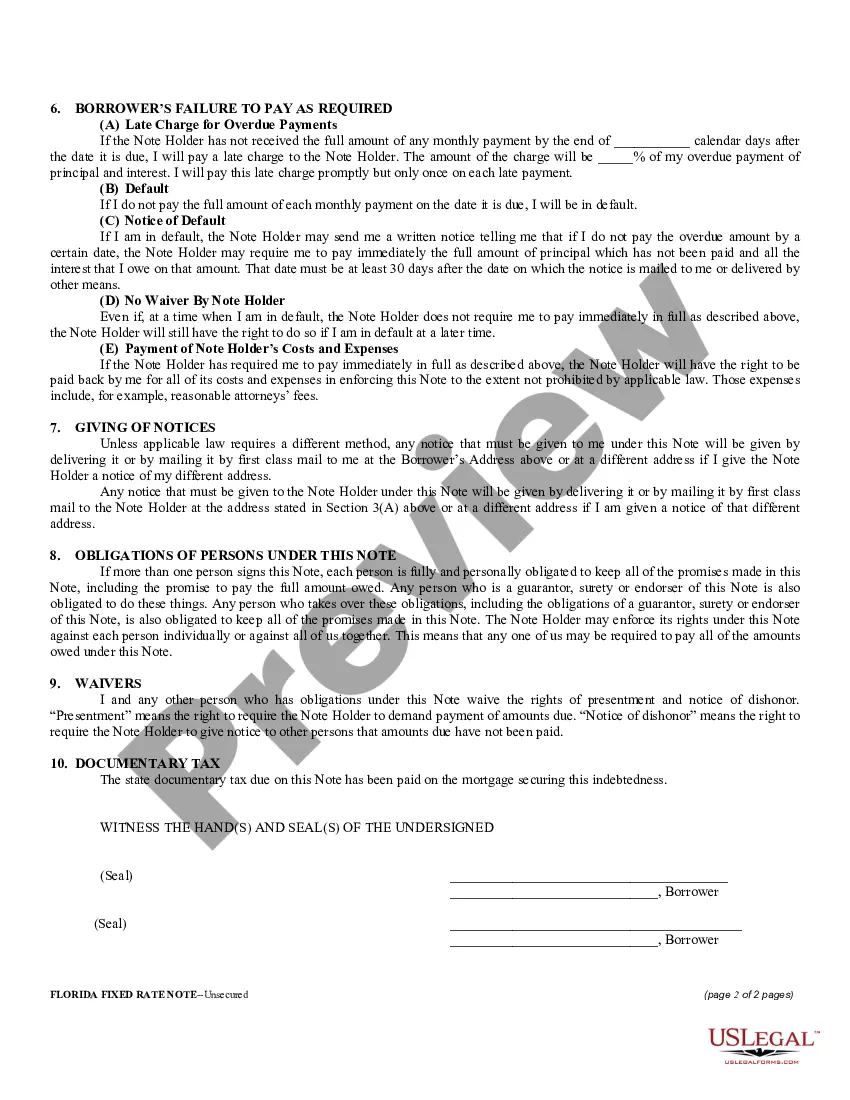

A Tallahassee Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Tallahassee, Florida. This note is often used when a borrower needs to obtain a loan for personal or business purposes and agrees to make regular installment payments over a predetermined period. The purpose of this promissory note is to establish the borrower's commitment to repay the loan and provide clarity on the repayment schedule, interest rate, and other important details. By signing this note, both parties acknowledge their responsibilities and rights as described in the agreement. In Tallahassee, Florida, there may be variations of the Unsecured Installment Payment Promissory Note for Fixed Rate, each catering to specific circumstances and requirements. Some of these variations may include: 1. Tallahassee Florida Unsecured Installment Payment Promissory Note for Personal Loan: This note is designed for personal loans between individuals, such as friends or family members, where no collateral is involved. 2. Tallahassee Florida Unsecured Installment Payment Promissory Note for Business Loan: This note is used when a business needs financing, with no collateral provided, and agrees to repay the loan through fixed installments. 3. Tallahassee Florida Unsecured Installment Payment Promissory Note for Student Loan: This note is specific to educational loans where a student borrows funds to support their academic pursuits and agrees to make regular payments after graduation. 4. Tallahassee Florida Unsecured Installment Payment Promissory Note for Medical Loan: This note pertains to loans taken out for medical expenses, allowing borrowers to repay the borrowed funds in fixed installments. Key elements that should be included in a Tallahassee Florida Unsecured Installment Payment Promissory Note for Fixed Rate: 1. Loan amount: Specify the exact amount borrowed by the borrower from the lender. 2. Interest rate: Clearly state the fixed interest rate that will be applied to the loan. For instance, 5% per annum. 3. Repayment schedule: Outline the installment amounts, due dates, and the duration of the repayment period. For example, monthly installments of $200 due on the 1st of each month for a duration of 24 months. 4. Late payment penalties: Address the consequences of late or missed payments and outline any additional charges or penalties that may be incurred. 5. Default and remedies: Explain the actions that may be taken by the lender if the borrower fails to fulfill the terms of the note, including potential legal action or debt collection efforts. 6. Governing law: Specify that the note is governed by the laws of Tallahassee, Florida, establishing jurisdiction and legal recourse. It is crucial to consult with a legal professional or financial advisor to draft a Tallahassee Florida Unsecured Installment Payment Promissory Note for Fixed Rate that adheres to the specific requirements and ensures its legality and enforceability.

Tallahassee Florida Unsecured Installment Payment Promissory Note for Fixed Rate

Category:

State:

Florida

City:

Tallahassee

Control #:

FL-NOTE-2

Format:

Word;

Rich Text

Instant download

Description

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

A Tallahassee Florida Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Tallahassee, Florida. This note is often used when a borrower needs to obtain a loan for personal or business purposes and agrees to make regular installment payments over a predetermined period. The purpose of this promissory note is to establish the borrower's commitment to repay the loan and provide clarity on the repayment schedule, interest rate, and other important details. By signing this note, both parties acknowledge their responsibilities and rights as described in the agreement. In Tallahassee, Florida, there may be variations of the Unsecured Installment Payment Promissory Note for Fixed Rate, each catering to specific circumstances and requirements. Some of these variations may include: 1. Tallahassee Florida Unsecured Installment Payment Promissory Note for Personal Loan: This note is designed for personal loans between individuals, such as friends or family members, where no collateral is involved. 2. Tallahassee Florida Unsecured Installment Payment Promissory Note for Business Loan: This note is used when a business needs financing, with no collateral provided, and agrees to repay the loan through fixed installments. 3. Tallahassee Florida Unsecured Installment Payment Promissory Note for Student Loan: This note is specific to educational loans where a student borrows funds to support their academic pursuits and agrees to make regular payments after graduation. 4. Tallahassee Florida Unsecured Installment Payment Promissory Note for Medical Loan: This note pertains to loans taken out for medical expenses, allowing borrowers to repay the borrowed funds in fixed installments. Key elements that should be included in a Tallahassee Florida Unsecured Installment Payment Promissory Note for Fixed Rate: 1. Loan amount: Specify the exact amount borrowed by the borrower from the lender. 2. Interest rate: Clearly state the fixed interest rate that will be applied to the loan. For instance, 5% per annum. 3. Repayment schedule: Outline the installment amounts, due dates, and the duration of the repayment period. For example, monthly installments of $200 due on the 1st of each month for a duration of 24 months. 4. Late payment penalties: Address the consequences of late or missed payments and outline any additional charges or penalties that may be incurred. 5. Default and remedies: Explain the actions that may be taken by the lender if the borrower fails to fulfill the terms of the note, including potential legal action or debt collection efforts. 6. Governing law: Specify that the note is governed by the laws of Tallahassee, Florida, establishing jurisdiction and legal recourse. It is crucial to consult with a legal professional or financial advisor to draft a Tallahassee Florida Unsecured Installment Payment Promissory Note for Fixed Rate that adheres to the specific requirements and ensures its legality and enforceability.

Free preview

How to fill out Tallahassee Florida Unsecured Installment Payment Promissory Note For Fixed Rate?

If you’ve already utilized our service before, log in to your account and download the Tallahassee Florida Unsecured Installment Payment Promissory Note for Fixed Rate on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Tallahassee Florida Unsecured Installment Payment Promissory Note for Fixed Rate. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!