A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. In Coral Springs, Florida, a promissory note is an essential instrument utilized in various financial transactions. It serves as evidence of a debt and ensures that both parties involved comprehend and agree upon the loan terms. Here is a detailed description of Coral Springs Florida Promissory Note, including different types: 1. Secured Promissory Note: This type of promissory note requires the borrower to provide collateral, such as real estate or personal property, to secure the loan. If the borrower fails to repay the loan, the lender has the right to seize the collateral to recover their investment. 2. Unsecured Promissory Note: Unlike the secured promissory note, this type does not require any collateral. Instead, the borrower's creditworthiness and financial history are the determining factors for granting the loan. In the case of default, the lender might face challenges in recovering the borrowed amount. 3. Demand Promissory Note: Also known as "payable on demand," this promissory note enables the lender to request repayment of the loan at any time the lender wishes. This type provides flexibility to the lender, giving them the choice to call for full payment or negotiate a revised repayment plan. 4. Installment Promissory Note: This note divides the loan amount into predetermined installments, making it more convenient for the borrower to repay the debt over a set period. Each installment includes both principal and interest portions, allowing clear expectations for both parties involved. 5. Balloon Promissory Note: A balloon payment is incorporated into this type of note, requiring the borrower to make regular payments over a specific period, with a significant final payment at the end. This note is beneficial for borrowers who anticipate a substantial inflow of funds before the payment maturity date. 6. Convertible Promissory Note: This unique type of promissory note allows the debt to be converted into equity in the borrower's company. This note is often used in start-up ventures, providing the lender with a potential ownership stake in the company as an alternative form of repayment. Coral Springs, Florida, recognizes the importance of promissory notes in facilitating financial transactions. These documents serve not only as evidence of a loan agreement but also as protective measures for both the borrower and the lender. Understanding the various types of promissory notes available in Coral Springs ensures that borrowers select the appropriate document that best suits their financial needs and preferences.

Coral Springs Florida Promissory Note

Description

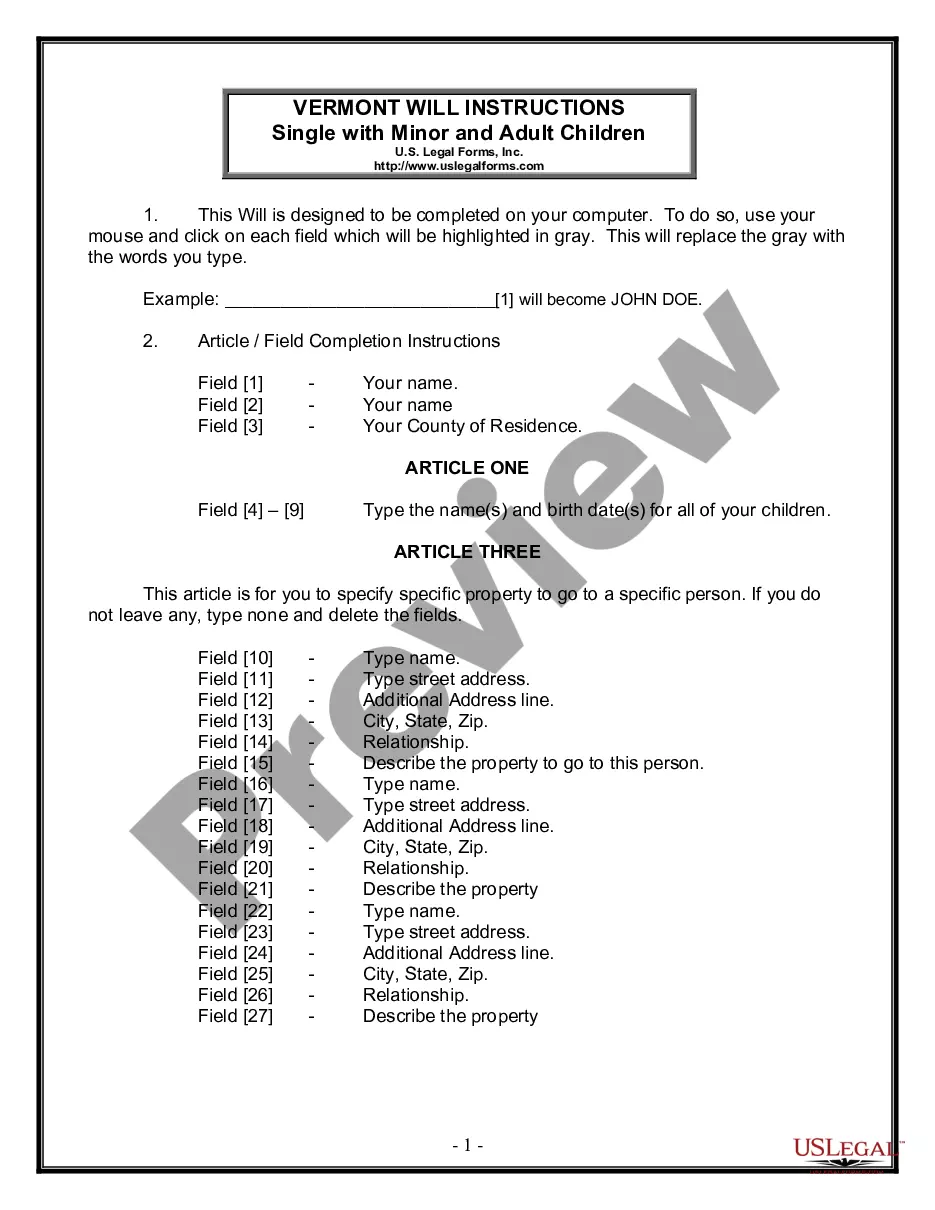

How to fill out Coral Springs Florida Promissory Note?

If you have previously made use of our service, sign in to your account and retrieve the Coral Springs Florida Promissory Note on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents menu whenever you wish to use it again. Make the most of the US Legal Forms service to efficiently find and save any template for your personal or professional requirements!

- Ensure you’ve found the correct document. Review the description and utilize the Preview option, if available, to verify if it aligns with your requirements. If it doesn’t fit your needs, use the Search tab above to discover the right one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and make a payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Obtain your Coral Springs Florida Promissory Note. Choose the file format for your document and save it to your device.

- Complete your document. Print it out or take advantage of professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

A promissory note is enforceable in Coral Springs, Florida, when it adheres to the legal requirements set by state law. This includes having clear terms, proper signatures, and being executed voluntarily. If a note meets these criteria, a creditor can take legal action to collect the debt owed. For proper creation and enforcement, USLegalForms offers valuable templates and insights.

In Coral Springs, Florida, a breach of promissory note occurs when the borrower fails to make payments as agreed. Key elements include the existence of a valid note, non-payment or late payment, and proper notice to the borrower. Establishing these factors ensures that the lender can pursue legal remedies. USLegalForms provides resources to help you understand your rights in such situations.

For a Coral Springs Florida Promissory Note to be valid, it must include essential elements such as the amount due, interest rate, payment schedule, and signatures from both parties. Clear terms that outline the rights and responsibilities of both the lender and borrower are necessary. A properly drafted note increases its enforceability in case of a dispute. Consider using USLegalForms for guidance.

One disadvantage of a promissory note is that it may require legal enforcement if the borrower defaults. This can lead to lengthy and costly legal proceedings. Moreover, if not properly drafted, a Coral Springs Florida promissory note might lack enforceability, leading to potential losses for the lender.

For a promissory note to be valid, it must contain essential components like a clear agreement between parties, a definite amount, and the borrower's signature. In Coral Springs Florida promissory notes, having a clear understanding of the repayment terms is also crucial. Without these elements, the note may not be enforceable.

In Florida, a promissory note must be written and signed by the borrower. It should include the principal amount, interest rate, repayment schedule, and any relevant terms. To ensure compliance with Florida law regarding Coral Springs Florida promissory notes, consulting a legal professional is advisable.

A promissory note generally requires several key elements to be valid, including the names of both the borrower and lender, the principal amount, the interest rate, and the terms of repayment. For a Coral Springs Florida promissory note, it is essential to have these details clearly outlined to avoid disputes. Additionally, signatures from both parties are typically necessary.

Yes, banks can sell promissory notes, especially to investors looking for secured debts. In Coral Springs, Florida, promissory notes may be available through various financial institutions. However, the process often depends on the bank's policies and the specifics of the note.

A Florida promissory note does not need to be notarized to have legal standing. Still, having your Coral Springs Florida promissory note notarized can be advantageous for protecting your rights and clarifying agreement terms. It is a simple step that can provide peace of mind for both the lender and the borrower.

In Florida, promissory notes do not legally require notarization to be valid. However, notarizing your Coral Springs Florida promissory note can enhance its enforceability and protect against potential disputes. Notary services can add a level of assurance for both parties involved.