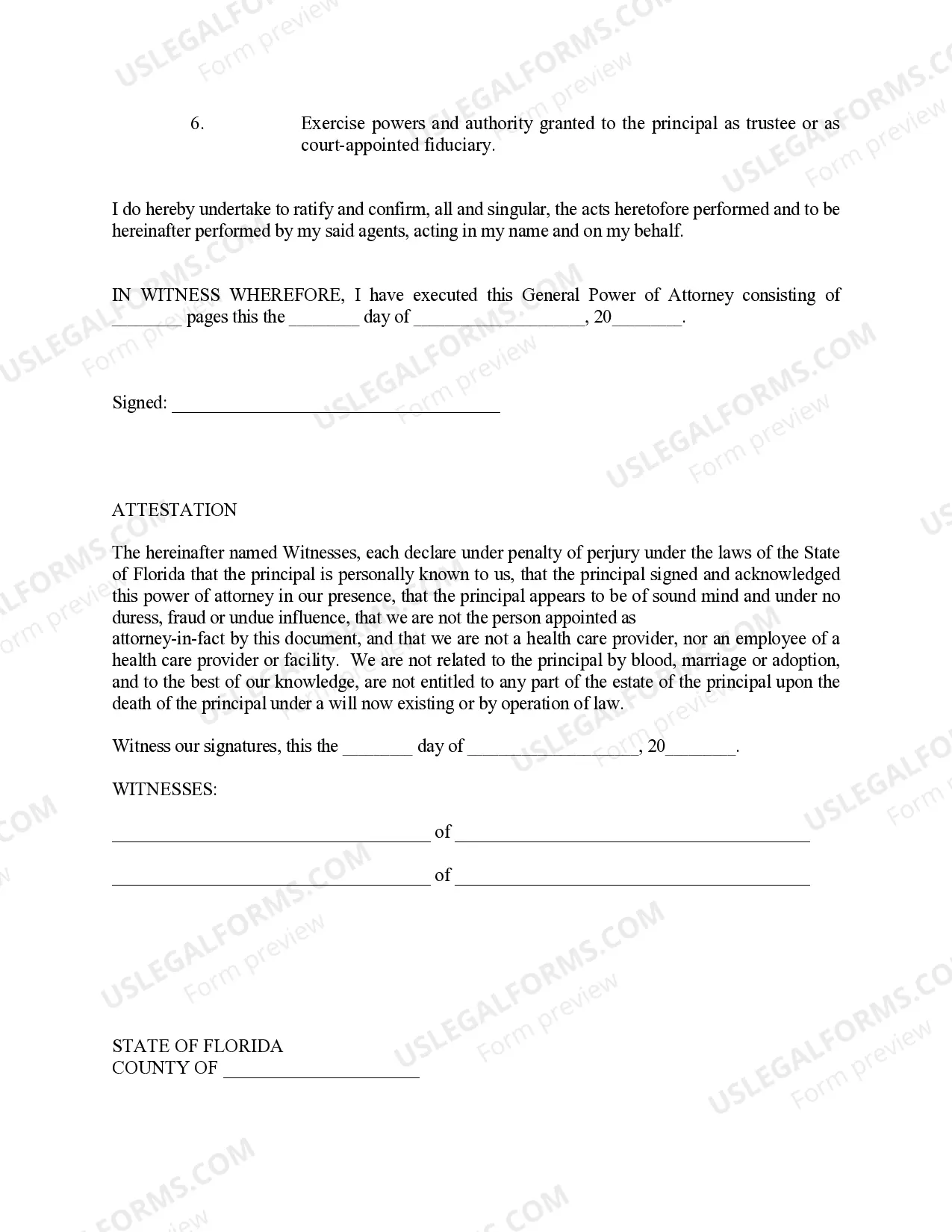

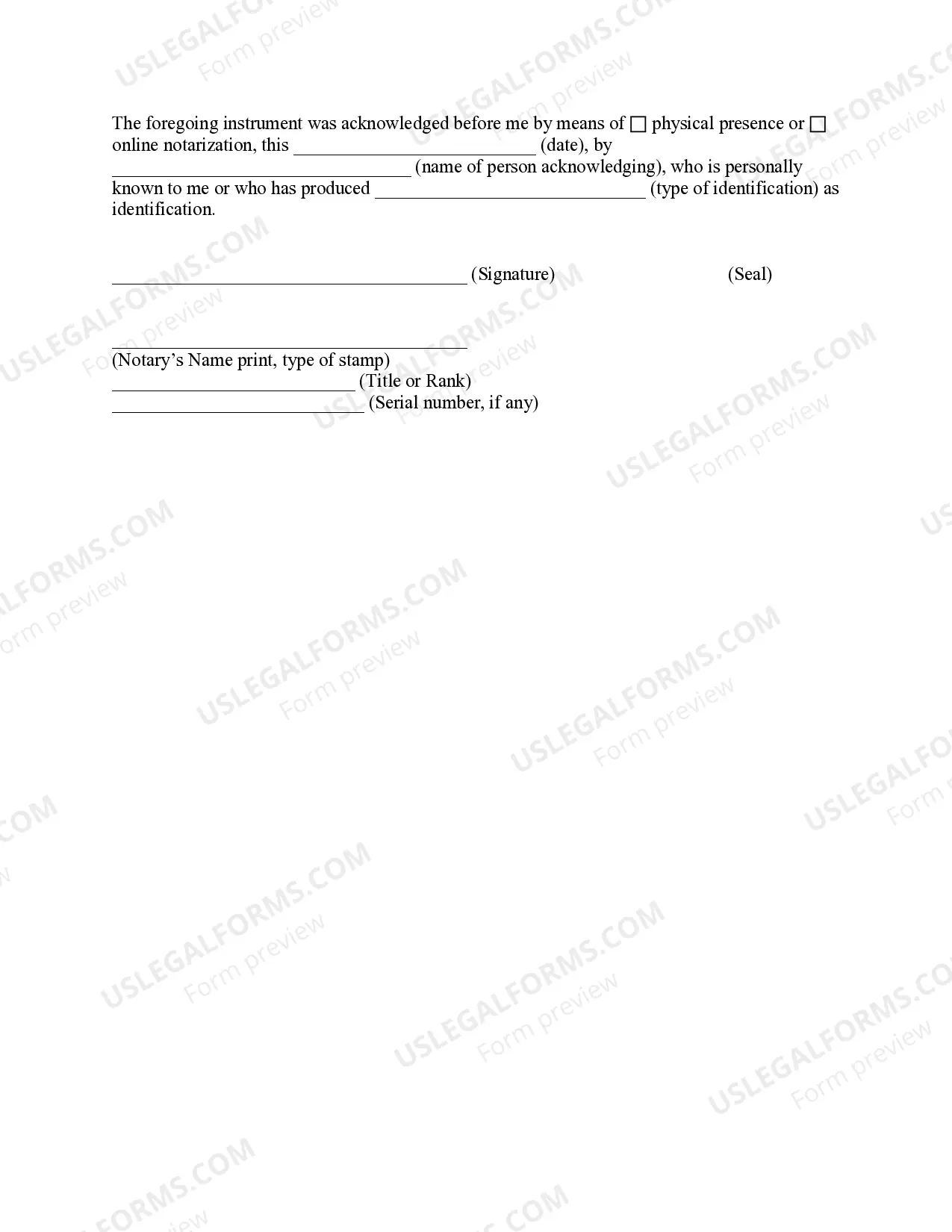

A Palm Beach Florida General Power of Attorney — Finances anPropertyrt— - Nondurable is a legal document that grants broad authority to an appointed individual, known as the agent or attorney-in-fact, to handle financial and property-related matters on behalf of the principal. This power of attorney remains in effect only while the principal is mentally competent and can be revoked or terminated at any time. The purpose of this document is to ensure that the principal's financial affairs and property management can continue smoothly in the event of their absence, incapacity, or inability to make decisions. By appointing a trusted agent, the principal can have peace of mind knowing that their financial matters will be taken care of as per their instructions. Under the Palm Beach Florida General Power of Attorney — Finances anPropertyrt— - Nondurable, the agent may have various responsibilities and powers, including: 1. Managing bank accounts: The agent can access and manage the principal's bank accounts, including making deposits, withdrawals, and transfers. 2. Paying bills and expenses: The agent can handle the payment of monthly bills, mortgage payments, insurance premiums, taxes, and other financial obligations. 3. Real estate transactions: The agent can buy, sell, or lease the principal's real estate properties, sign contracts or agreements related to the properties, and handle any necessary paperwork. 4. Stock and investment management: The agent can manage the principal's stock portfolios, investment accounts, and make investment decisions on their behalf. 5. Legal and tax matters: The agent can engage legal counsel, file tax returns, and handle any legal or tax-related matters on behalf of the principal. 6. Operating business affairs: If the principal owns a business, the agent can manage its operations, enter into contracts, and make financial decisions regarding the business. There may be variations or specific types of Palm Beach Florida General Power of Attorney — Finances anPropertyrt— - Nondurable, such as: 1. Limited Power of Attorney: Grants the agent authority over specific financial or property matters, rather than broad powers. 2. Springing Power of Attorney: Becomes effective only when a specific event or condition triggers its activation, often the incapacity of the principal. 3. Co-Agents Power of Attorney: Allows multiple agents to act simultaneously, sharing the responsibilities under the power of attorney. 4. Special Power of Attorney: Provides authority to the agent to handle specific financial or property matters for a limited duration. Creating a Palm Beach Florida General Power of Attorney — Finances anPropertyrt— - Nondurable is an important step in estate planning and ensuring the smooth management of financial affairs in case of incapacity. It is recommended to consult with an attorney experienced in Florida estate planning laws to ensure the document meets all legal requirements and adequately reflects the principal's wishes.

Palm Beach Florida General Power of Attorney - Finances and Property - Nondurable

Description

How to fill out Palm Beach Florida General Power Of Attorney - Finances And Property - Nondurable?

If you are looking for a relevant form template, it’s extremely hard to find a better platform than the US Legal Forms website – one of the most extensive libraries on the web. Here you can get a large number of document samples for organization and personal purposes by types and regions, or key phrases. With the high-quality search function, finding the latest Palm Beach Florida General Power of Attorney - Finances and Property - Nondurable is as elementary as 1-2-3. Additionally, the relevance of each document is confirmed by a team of expert lawyers that on a regular basis review the templates on our website and revise them in accordance with the most recent state and county demands.

If you already know about our platform and have an account, all you should do to get the Palm Beach Florida General Power of Attorney - Finances and Property - Nondurable is to log in to your profile and click the Download option.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the form you need. Look at its explanation and use the Preview function to see its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the appropriate record.

- Confirm your choice. Click the Buy now option. Next, choose your preferred pricing plan and provide credentials to register an account.

- Process the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Choose the file format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Palm Beach Florida General Power of Attorney - Finances and Property - Nondurable.

Every form you add to your profile has no expiry date and is yours forever. It is possible to access them via the My Forms menu, so if you want to get an extra copy for enhancing or creating a hard copy, you may return and export it once more at any moment.

Make use of the US Legal Forms professional collection to gain access to the Palm Beach Florida General Power of Attorney - Finances and Property - Nondurable you were seeking and a large number of other professional and state-specific templates on a single platform!