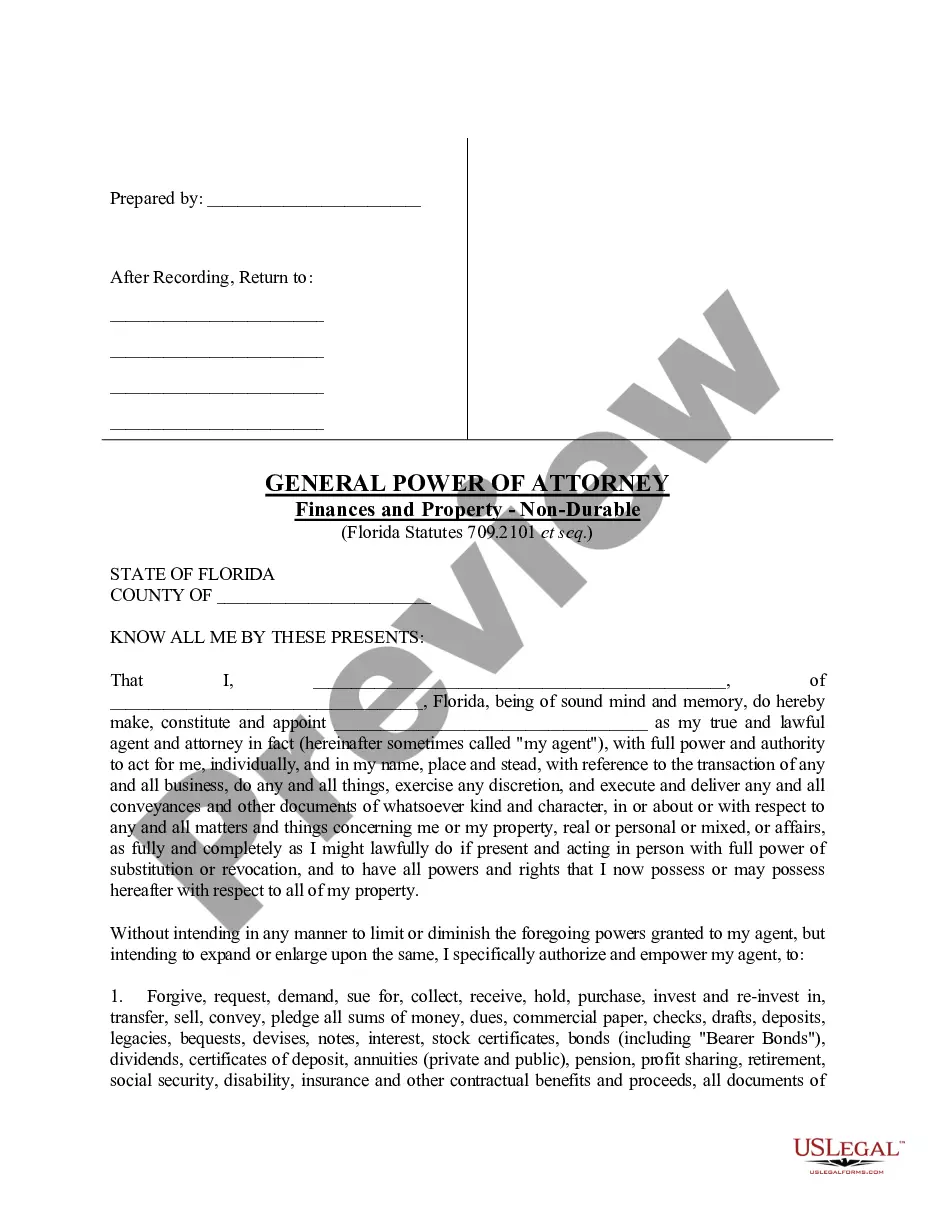

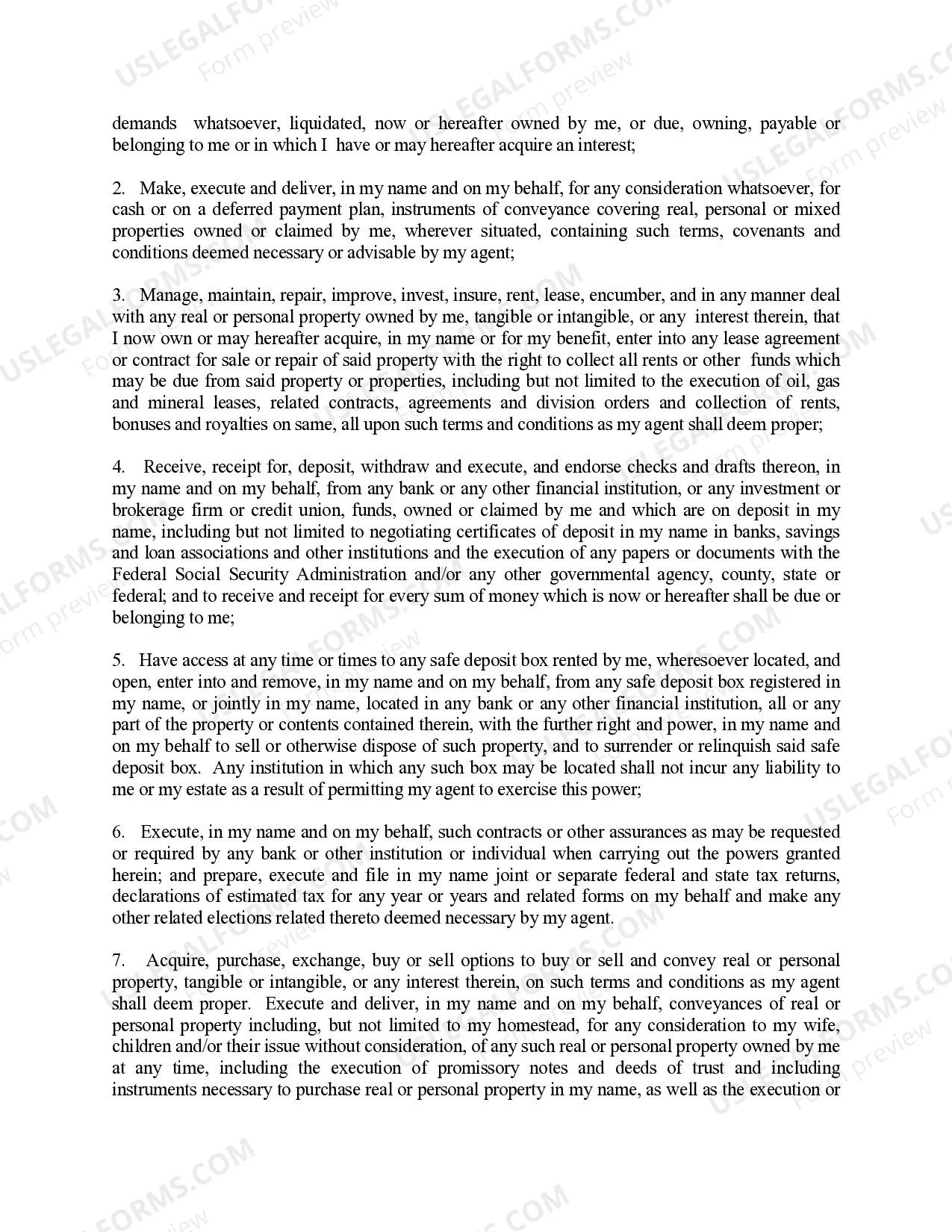

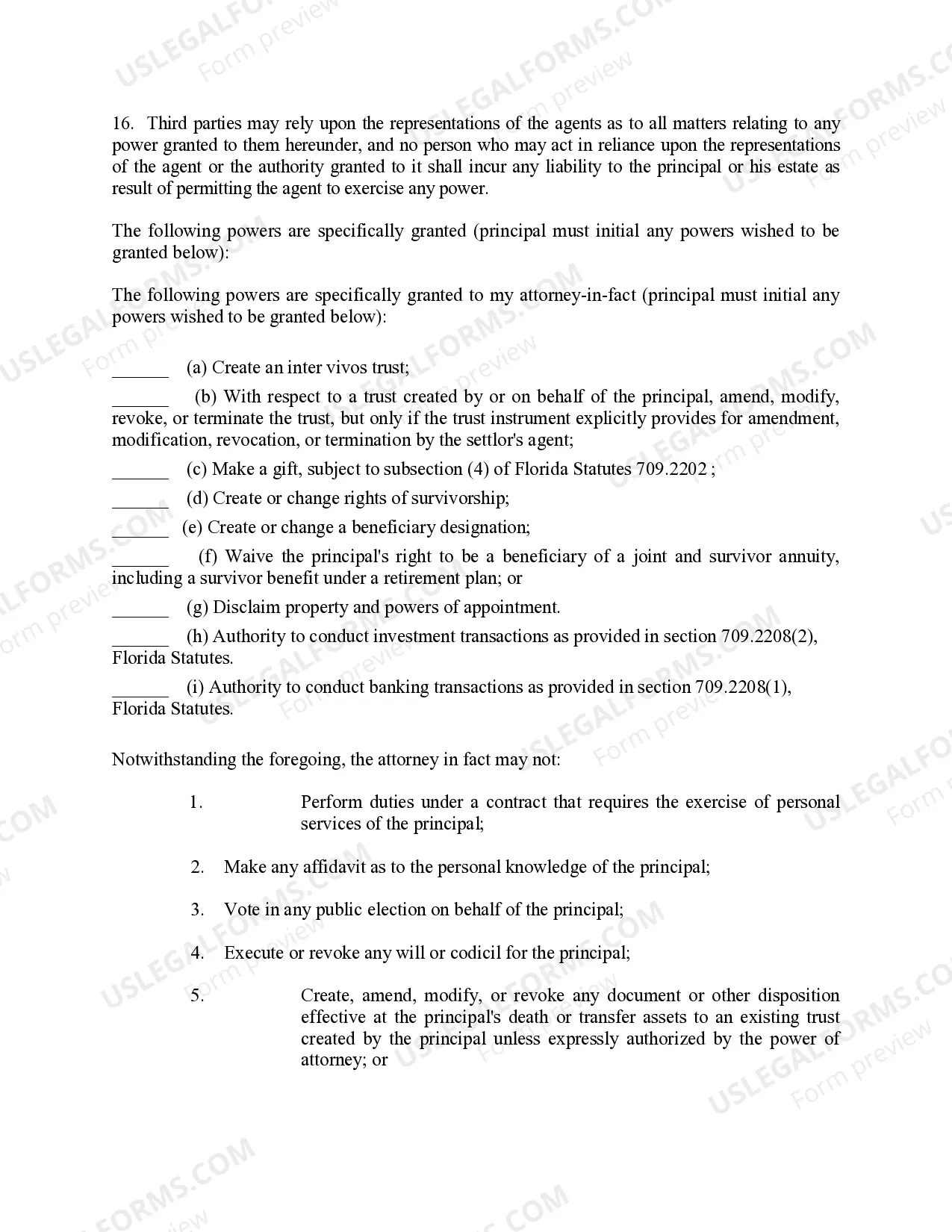

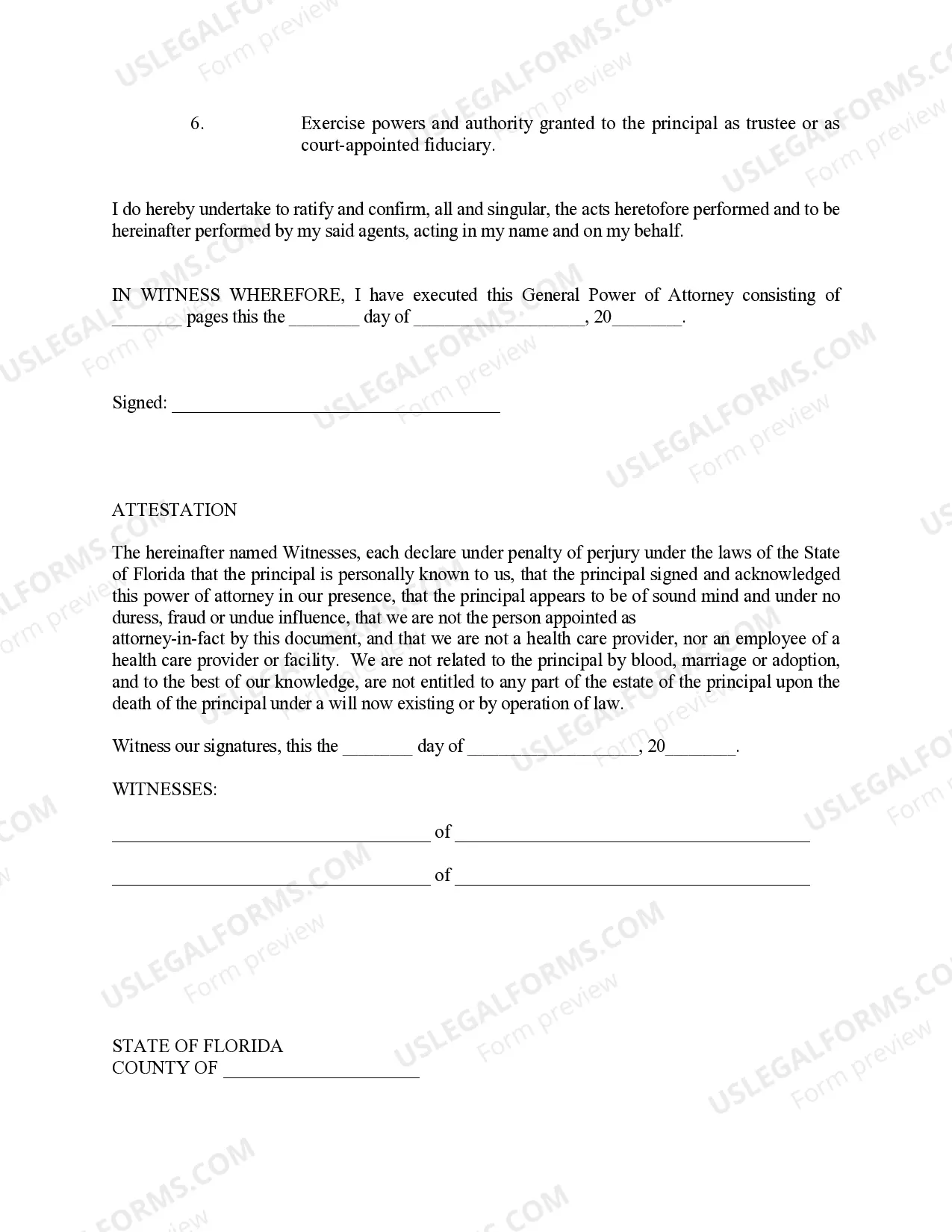

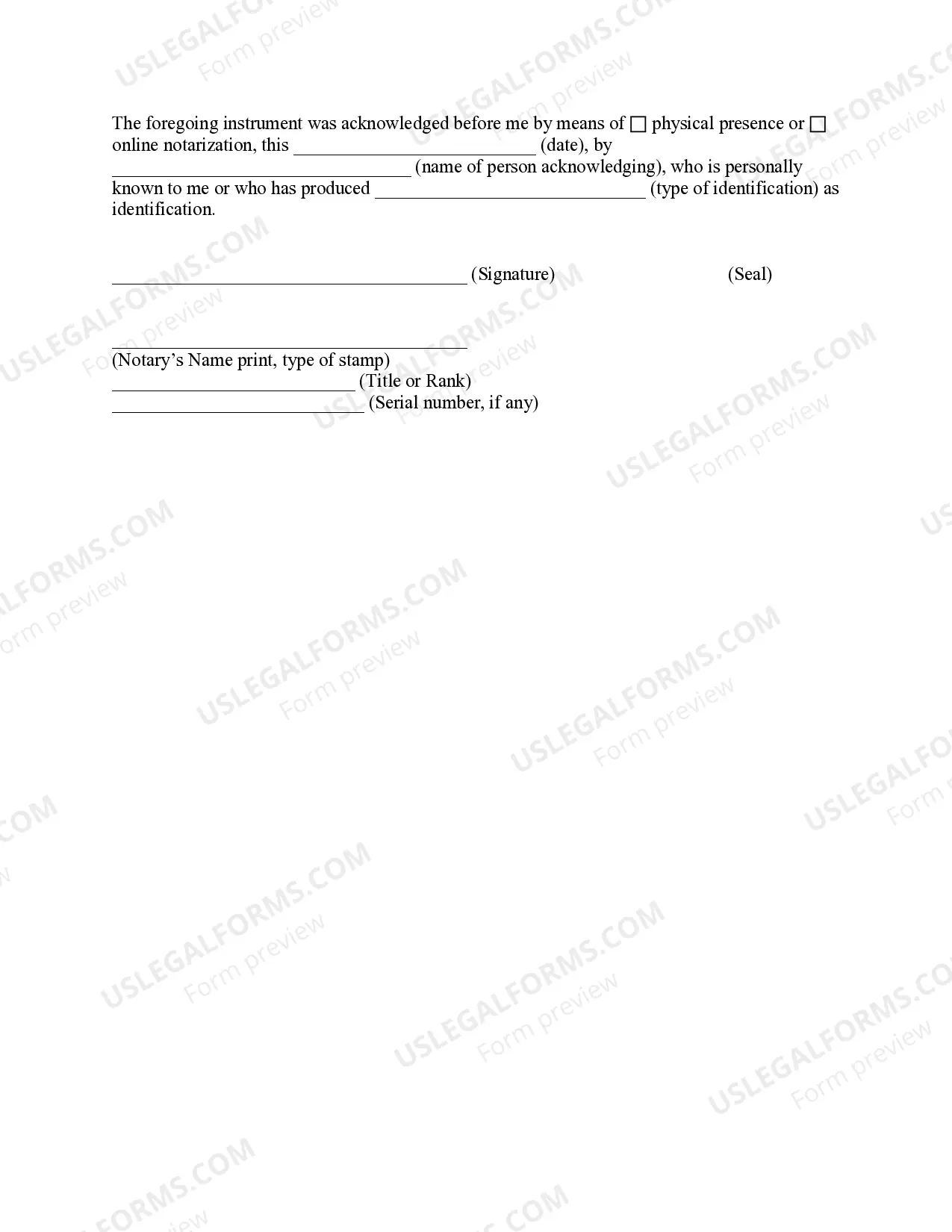

St. Petersburg Florida General Power of Attorney — Finances anPropertyrt— - Nondurable is a legally binding document that allows an individual, referred to as the principal, to designate another person, known as the attorney-in-fact, to make financial and property-related decisions on their behalf. This power of attorney is specifically applicable in St. Petersburg, Florida. In the state of Florida, there are different types of powers of attorney, including durable and nondurable. The specific focus here is on the nondurable general power of attorney for finances and property in St. Petersburg. Nondurable power of attorney provides the chosen attorney-in-fact with the authority to handle the principal's financial and property matters for a limited period. Unlike a durable power of attorney, a nondurable power of attorney expires if the principal becomes incapacitated or mentally incompetent. This legal agreement allows the attorney-in-fact to manage various financial and property-related responsibilities on behalf of the principal, including but not limited to: 1. Banking and financial transactions: With a St. Petersburg General Power of Attorney, the attorney-in-fact can handle the principal's banking activities, such as depositing or withdrawing funds, paying bills, and managing investments. 2. Real estate management: The attorney-in-fact can engage in property-related transactions, including buying, selling, or leasing real estate in St. Petersburg, Florida. 3. Contractual obligations: The attorney-in-fact can enter into contracts, negotiate terms, and handle legal agreements on behalf of the principal when it comes to financial or real estate matters. 4. Tax matters: The attorney-in-fact can file tax returns, deal with the Internal Revenue Service (IRS), and handle tax-related matters as directed by the principal. 5. Insurance management: With the power of attorney, the attorney-in-fact can manage insurance policies, submit claims, and handle any related administrative tasks. 6. Managing investments: The attorney-in-fact can make investment decisions, buy and sell stocks, bonds, or other investment vehicles, and manage the principal's portfolio, if authorized. It's important to note that even though the principal grants significant authority to the attorney-in-fact, they still retain the right to revoke or amend the general power of attorney at any time, as long as they are mentally competent. To execute a St. Petersburg Florida General Power of Attorney — Finances anPropertyrt— - Nondurable, it is advisable to consult with an experienced attorney who specializes in estate planning and understands the specific laws and regulations in St. Petersburg, Florida. The attorney will guide the principal through the process, ensuring that the power of attorney is tailored to suit their specific needs and requirements.

St. Petersburg Florida General Power of Attorney - Finances and Property - Nondurable

Category:

State:

Florida

City:

St. Petersburg

Control #:

FL-P001

Format:

Word;

Rich Text

Instant download

Description

This form is a power of attorney form that is provided by the Florida Statutes that allows you to appoint an attorney-in-fact (agent) to perform certain specified acts on your behalf. This form is a general power of attorney and grants very broad powers, including the authority to make decisions regarding property and financial matters. This Power of Attorney does NOT provide for health care services.

St. Petersburg Florida General Power of Attorney — Finances anPropertyrt— - Nondurable is a legally binding document that allows an individual, referred to as the principal, to designate another person, known as the attorney-in-fact, to make financial and property-related decisions on their behalf. This power of attorney is specifically applicable in St. Petersburg, Florida. In the state of Florida, there are different types of powers of attorney, including durable and nondurable. The specific focus here is on the nondurable general power of attorney for finances and property in St. Petersburg. Nondurable power of attorney provides the chosen attorney-in-fact with the authority to handle the principal's financial and property matters for a limited period. Unlike a durable power of attorney, a nondurable power of attorney expires if the principal becomes incapacitated or mentally incompetent. This legal agreement allows the attorney-in-fact to manage various financial and property-related responsibilities on behalf of the principal, including but not limited to: 1. Banking and financial transactions: With a St. Petersburg General Power of Attorney, the attorney-in-fact can handle the principal's banking activities, such as depositing or withdrawing funds, paying bills, and managing investments. 2. Real estate management: The attorney-in-fact can engage in property-related transactions, including buying, selling, or leasing real estate in St. Petersburg, Florida. 3. Contractual obligations: The attorney-in-fact can enter into contracts, negotiate terms, and handle legal agreements on behalf of the principal when it comes to financial or real estate matters. 4. Tax matters: The attorney-in-fact can file tax returns, deal with the Internal Revenue Service (IRS), and handle tax-related matters as directed by the principal. 5. Insurance management: With the power of attorney, the attorney-in-fact can manage insurance policies, submit claims, and handle any related administrative tasks. 6. Managing investments: The attorney-in-fact can make investment decisions, buy and sell stocks, bonds, or other investment vehicles, and manage the principal's portfolio, if authorized. It's important to note that even though the principal grants significant authority to the attorney-in-fact, they still retain the right to revoke or amend the general power of attorney at any time, as long as they are mentally competent. To execute a St. Petersburg Florida General Power of Attorney — Finances anPropertyrt— - Nondurable, it is advisable to consult with an experienced attorney who specializes in estate planning and understands the specific laws and regulations in St. Petersburg, Florida. The attorney will guide the principal through the process, ensuring that the power of attorney is tailored to suit their specific needs and requirements.

Free preview

How to fill out St. Petersburg Florida General Power Of Attorney - Finances And Property - Nondurable?

If you’ve already utilized our service before, log in to your account and download the St. Petersburg Florida General Power of Attorney - Finances and Property - Nondurable on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your St. Petersburg Florida General Power of Attorney - Finances and Property - Nondurable. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!