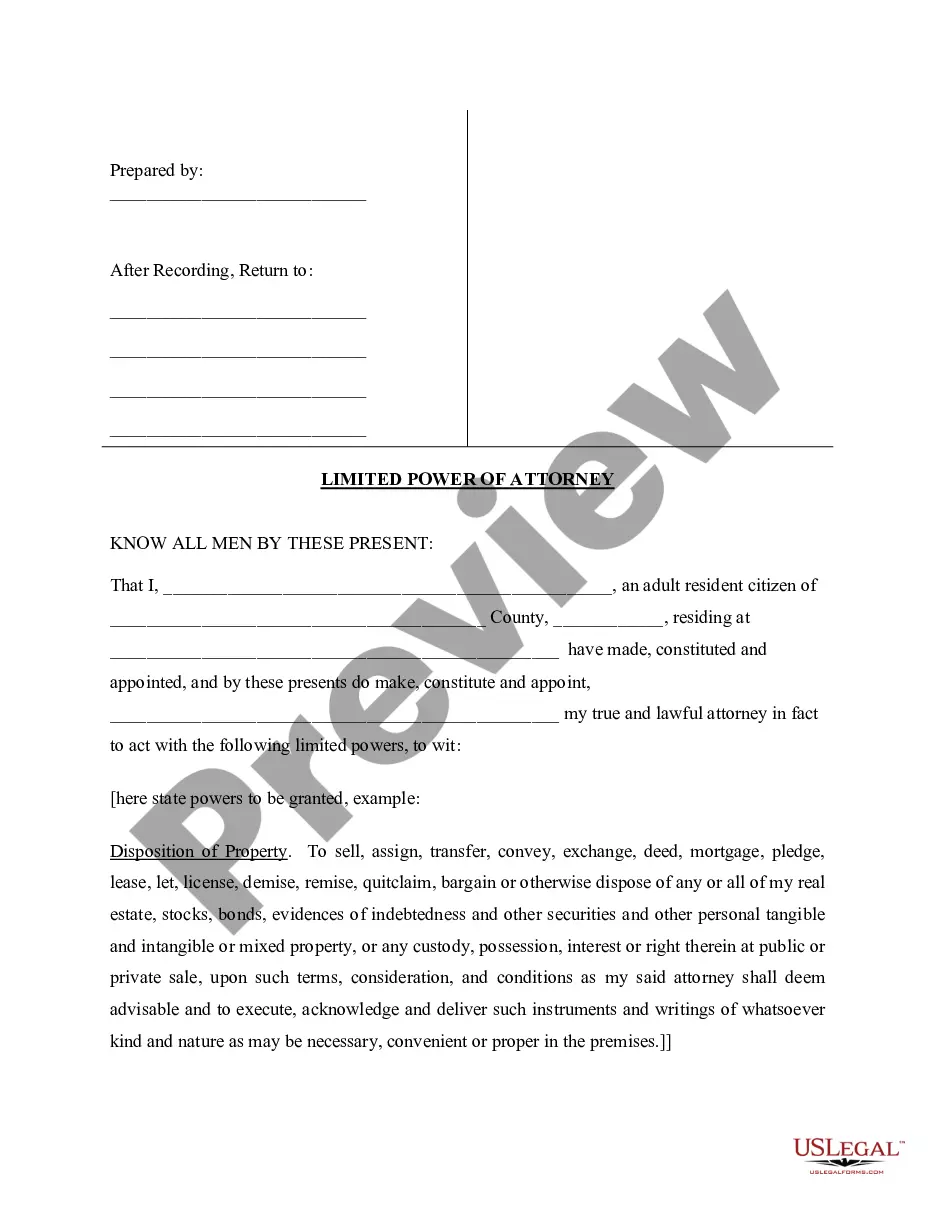

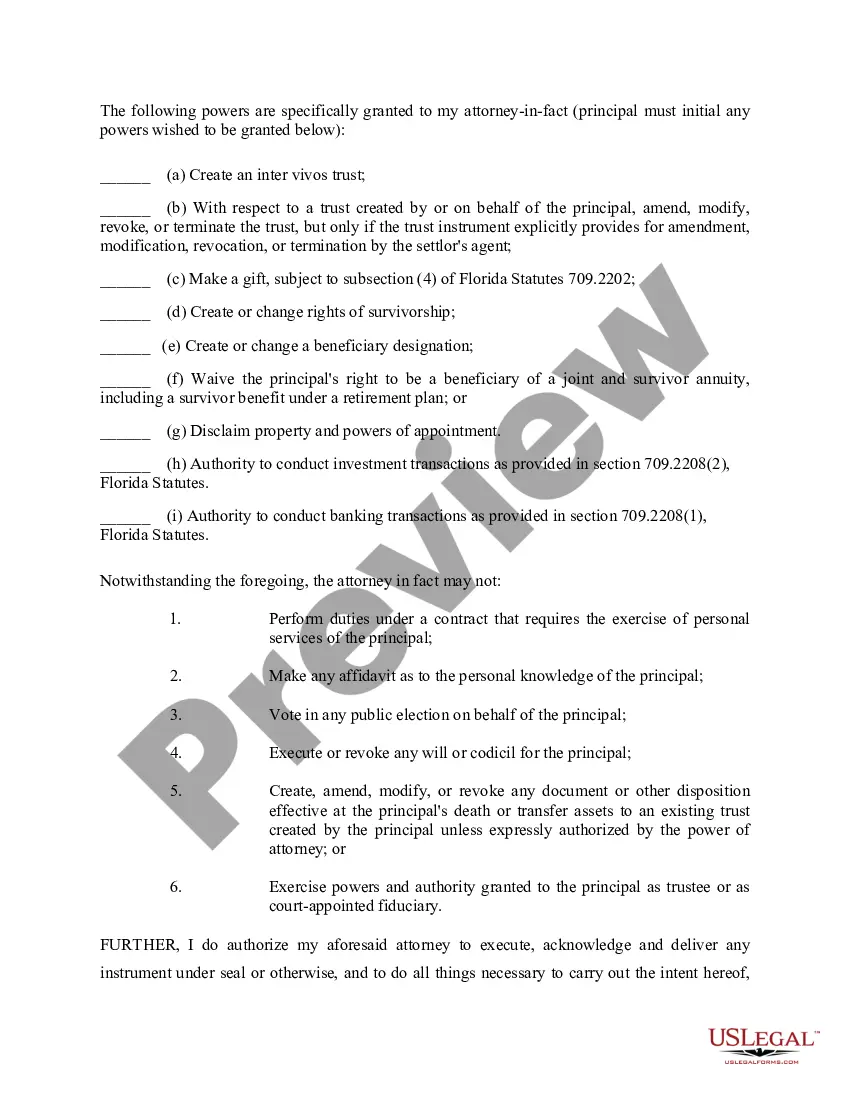

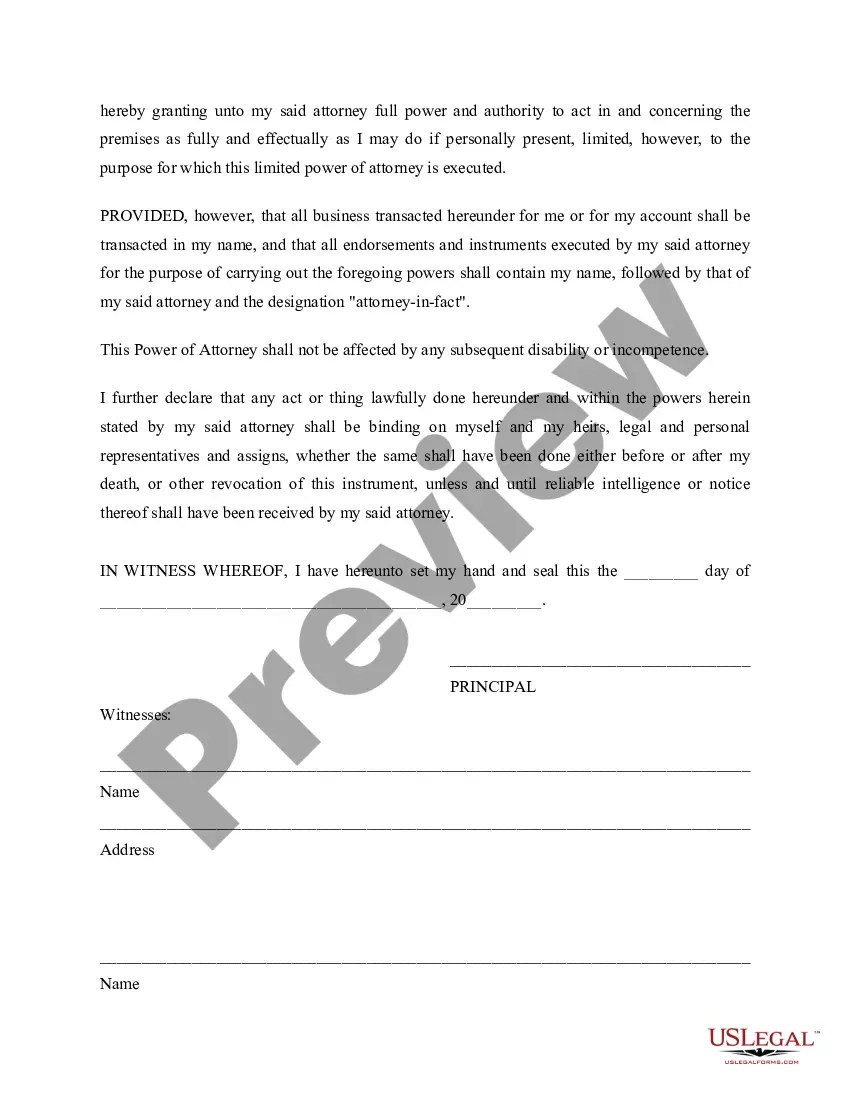

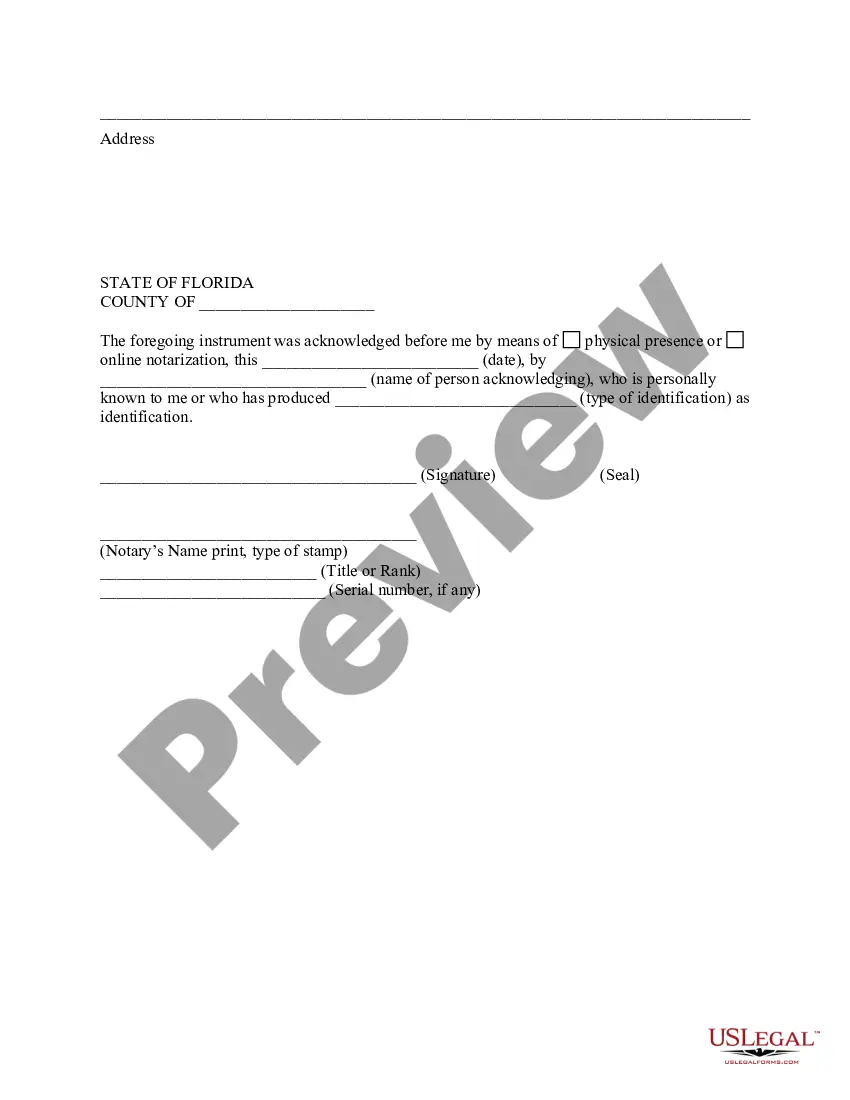

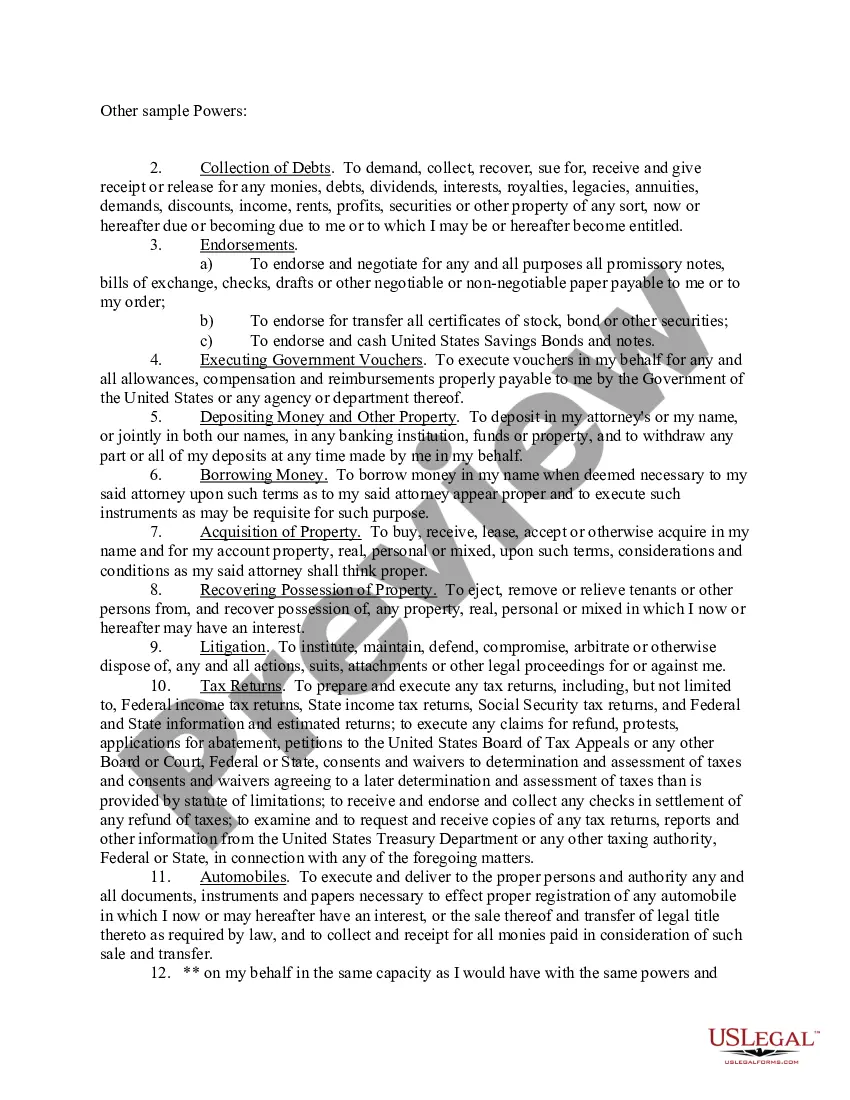

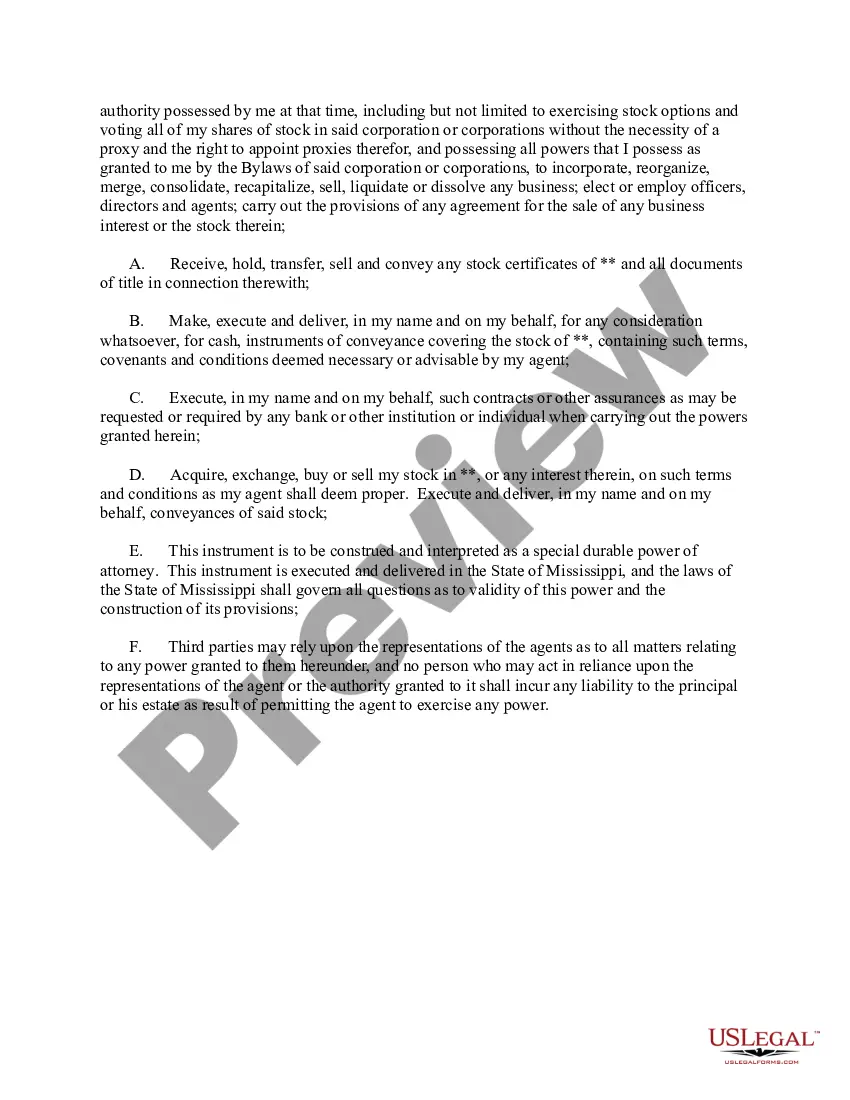

Miramar Florida Limited Power of Attorney is a legal document that grants an individual (referred to as the "agent" or "attorney-in-fact") limited powers to manage specific financial or legal matters on behalf of another person (known as the "principal"). This power of attorney is commonly used when the principal wishes to delegate specific responsibilities or tasks but still retain control over other aspects of their affairs. The limited powers granted under a Miramar Florida Limited Power of Attorney can vary based on the specific needs and preferences of the principal. Some common types of limited powers that can be granted include: 1. Financial Limited Power of Attorney: This grants the agent authority to handle the principal's financial affairs, such as managing bank accounts, paying bills, filing taxes, and making investment decisions. 2. Real Estate Limited Power of Attorney: With this type of limited power, the agent is authorized to handle the principal's real estate matters, including buying or selling property, signing leases, or managing rental properties. 3. Medical Limited Power of Attorney: This allows the agent to make medical decisions on behalf of the principal, especially in situations where the principal is unable to communicate or make informed decisions. 4. Legal Limited Power of Attorney: This grants the agent the authority to handle legal matters on behalf of the principal, such as signing contracts, initiating legal actions, or representing the principal in court. 5. Business Limited Power of Attorney: In cases where the principal owns a business, they may grant limited powers to an agent to manage certain aspects of the business, such as signing contracts, negotiating deals, or making financial decisions. It is essential to specify the scope and duration of the limited powers granted in the document to avoid any misunderstandings or misuse of authority. Miramar Florida Limited Power of Attorney — Limited Powers ensures that the principal can maintain control over their affairs while delegating specific responsibilities to a trusted individual. It is advisable to consult with an attorney to ensure the document complies with Florida law and meets the principal's objectives.

Miramar Florida Limited Power of Attorney - Limited Powers

Description

How to fill out Miramar Florida Limited Power Of Attorney - Limited Powers?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal solutions that, as a rule, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to legal counsel. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Miramar Florida Limited Power of Attorney - Limited Powers or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as easy if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Miramar Florida Limited Power of Attorney - Limited Powers adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Miramar Florida Limited Power of Attorney - Limited Powers is suitable for you, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!