Miramar Florida Durable Power of Attorney for Property, Finances, and Health Care is a legal document that allows an individual, referred to as the "Principal," to appoint a trusted person, known as the "Agent," to make decisions and act on their behalf regarding their property, finances, and health care matters in Miramar, Florida. This legal arrangement ensures that the Principal's wishes and best interests are upheld even if they become incapacitated or unable to make decisions on their own. The Durable Power of Attorney for Property and Finances grants the Agent the authority to handle various financial matters on behalf of the Principal. This may include paying bills, managing investments, buying or selling real estate, accessing bank accounts, and filing taxes. The Agent must act ethically and in the best interest of the Principal while managing their financial affairs. On the other hand, the Durable Power of Attorney for Health Care grants the Agent the authority to make decisions regarding the Principal's medical treatment, healthcare providers, and health-related matters when the Principal is incapable of doing so. The Agent is responsible for ensuring the Principal's healthcare preferences and wishes are followed, including decisions about medical treatments, surgeries, and end-of-life care if necessary. It is essential to note that the Durable Power of Attorney can have specific limitations or restrictions based on the Principal's preferences and needs. For instance, the Principal can specify that certain assets or decisions are excluded from the Agent's control, or that the Agent only holds power in case of incapacitation. These limitations can be tailored to the Principal's unique circumstances. Miramar Florida also offers specific types of Durable Power of Attorney, such as: 1. Limited Durable Power of Attorney: This form grants the Agent limited powers to handle specific financial or healthcare matters for the Principal. The Agent's authority is restricted to the specified tasks, and it terminates once the task is completed or the Principal revokes the power. 2. Springing Durable Power of Attorney: This type of power of attorney becomes effective only when specific conditions stated by the Principal are met. It may require a certification from a medical professional or a written statement verifying the Principal's incapacitation. 3. General Durable Power of Attorney: This is a comprehensive and broad power of attorney document that grants the Agent broad powers to manage the Principal's property, finances, and health care matters. It remains effective until the Principal revokes it, passes away, or becomes incapacitated. Creating a valid Miramar Florida Durable Power of Attorney for Property, Finances, and Health Care is a crucial step in estate planning. It ensures that your financial matters and health care decisions are entrusted to a trusted individual who will act in your best interests. Consulting an attorney experienced in Florida law is advisable to customize the document to your specific needs and comply with all legal requirements.

Miramar Florida Durable Power of Attorney for Property, Finances and Health Care

Description

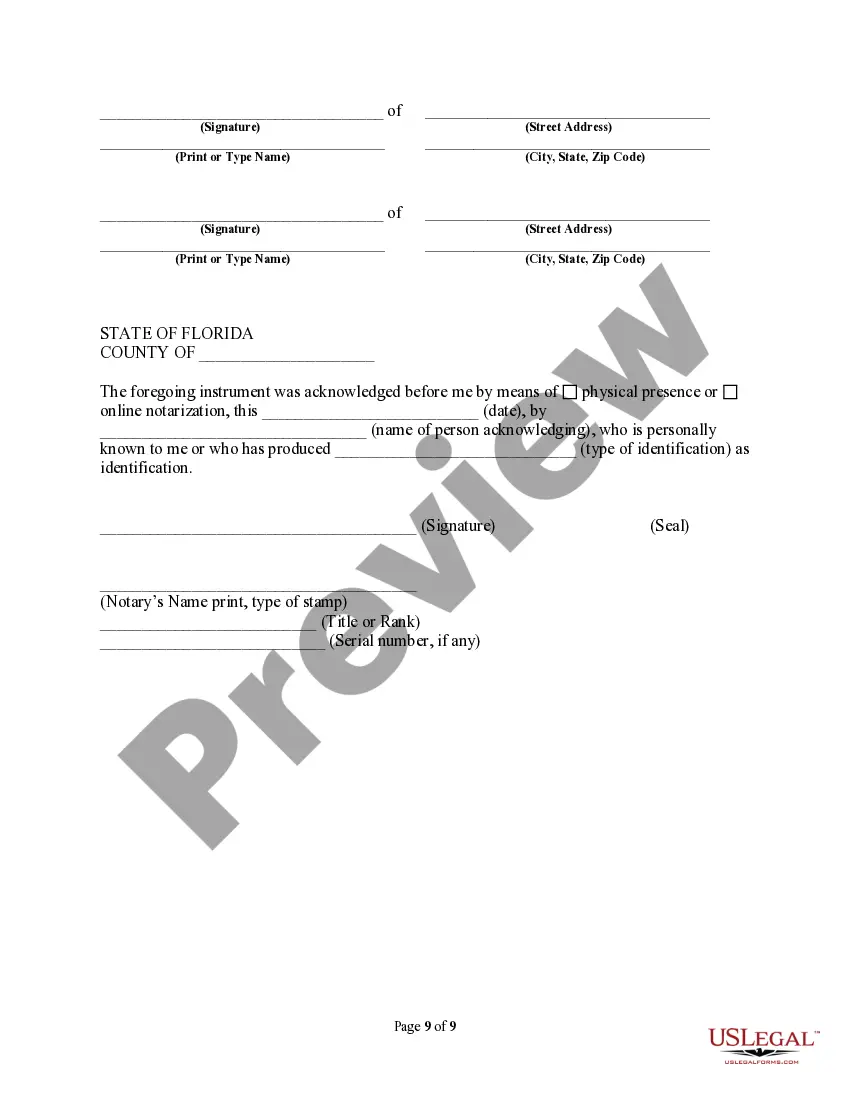

How to fill out Miramar Florida Durable Power Of Attorney For Property, Finances And Health Care?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Miramar Florida Durable Power of Attorney for Property, Finances and Health Care or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Miramar Florida Durable Power of Attorney for Property, Finances and Health Care complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Miramar Florida Durable Power of Attorney for Property, Finances and Health Care would work for you, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!